Accept a Klarna payment

Learn how to accept Klarna, a global buy now, pay later payment method.

With Klarna, customers are redirected to their Klarna account during checkout. If you don’t already have an integration with Stripe, we recommend using Stripe Checkout to create a Stripe-hosted checkout page and configure payment methods in the Dashboard.

You can also use Elements with the Checkout Sessions API to build a customized checkout page on your website or build a mobile integration to authenticate the payment in a webview.

Note

Before you start the integration, make sure your account is eligible for Klarna by going to your Payment methods settings.

Manually listing payment methods

We recommend using dynamic payment methods, where Stripe handles the logic for dynamically displaying the most relevant eligible payment methods to each customer to maximize conversion. If you choose to manually list payment methods, specify klarna in the payment_method_types list when you create a PaymentIntent.

Create a PaymentIntent

To help maximize acceptance rates and reduce disputes, pass in the following parameters when you create a PaymentIntent for Klarna payments:

- shipping: Ensure that these fields are defined and not empty:

name,address.,line1 city,country, andpostal_.code - amount_details.line_items

- payment_method_data.billing_details: Ensure these fields are defined and not empty:

name,address.,line1 city,country, andpostal_.code

Note

When you set the setup_future_usage parameter, the payment isn’t considered a one-time payment. This impacts the payment options available and prevents the Payment Method Messaging Element and Payment Element from displaying payment plans that a customer is eligible for.

Retrieve the client secret

The PaymentIntent includes a client secret that the client side uses to securely complete the payment process. You can use different approaches to pass the client secret to the client side.

Submit the payment to Stripe

In this step, you’ll complete Klarna payments on the client with Stripe.js.

Set up Stripe.js

When a customer clicks to pay with Klarna, we recommend using Stripe.js to submit the payment to Stripe. Stripe.js is our foundational JavaScript library for building payment flows. It automatically handles complexities like the redirect described below, and enables you to easily extend your integration to other payment methods in the future. Include the Stripe.js script on your checkout page by adding it to the head of your HTML file.

<head> <title>Checkout</title> <script src="https://js.stripe.com/clover/stripe.js"></script> </head>

Create an instance of Stripe.js with the following JavaScript on your checkout page.

// Set your publishable key: remember to change this to your live publishable key in production // See your keys here: https://dashboard.stripe.com/apikeys var stripe = Stripe();'pk_test_TYooMQauvdEDq54NiTphI7jx'

Rather than sending the entire PaymentIntent object to the client, use its client secret. (This is different from your API keys that authenticate Stripe API requests.)

Make sure that you handle the client secret carefully because it can complete the charge. Don’t log it, embed it in URLs, or expose it to anyone but the customer.

Use stripe.confirmKlarnaPayment to handle the redirect away from your page and to complete the payment. Add a return_url to this function to indicate where Stripe should redirect the user after they complete the payment on the Klarna website or mobile application.

On Klarna’s payments page, the customer selects among the payment options available in their market. See the table on the overview page for availability by market. You can’t limit or pre-select payment options on the Klarna payments page-deferring this choice to the consumer maximizes their opportunity to transact with you.

// Redirects away from the client const {error} = await stripe.confirmKlarnaPayment( '{{PAYMENT_INTENT_CLIENT_SECRET}}',{ return_url: 'https://example.com/checkout/complete', } ); if (error) { // Inform the customer that there was an error. }

When your customer submits a payment, Stripe redirects them to the return_ and includes the following URL query parameters. The return page can use them to get the status of the PaymentIntent so it can display the payment status to the customer.

When you specify the return_, you can also append your own query parameters for use on the return page.

| Parameter | Description |

|---|---|

payment_ | The unique identifier for the PaymentIntent. |

payment_ | The client secret of the PaymentIntent object. For subscription integrations, this client_secret is also exposed on the Invoice object through confirmation_ |

When the customer is redirected back to your site, you can use the payment_ to query for the PaymentIntent and display the transaction status to your customer.

You can find details about the Klarna payment option the customer selected on the charge in the payment_method_details property. There are four possible values: pay_, pay_, pay_, and pay_. See our Klarna overview page for more information on these options.

You can also find the locale used to localize Klarna’s payments page under the payment_method_details property.

{ "charges": { "data": [ { "payment_method_details": { "klarna": { "payment_method_category": "pay_in_installments", "preferred_locale": "en-US" }, "type": "klarna" }, "id": "src_16xhynE8WzK49JbAs9M21jaR", "object": "source", "amount": 1099, "client_secret": "src_client_secret_UfwvW2WHpZ0s3QEn9g5x7waU",

Test your integration

Below, we have specially selected test data for the currently supported customer countries. In a sandbox, Klarna approves or denies a transaction based on the supplied email address.

For production testing, you can use an amount of 3500 in your local currency to test all Klarna payment options besides Financing. For example, if you want to test “Pay in 3” in Italy, you can use a transaction of 35.00 EUR.

Two-step authentication

Any six digit number is a valid two-step authentication code. Use 999999 for authentication to fail.

Repayment method

Inside the Klarna flow, you can use the following test values to try various repayment types:

| Type | Value |

|---|---|

| Direct Debit | DE11520513735120710131 |

| Bank transfer | Demo Bank |

| Credit Card |

|

| Debit Card |

|

Failed payments

Klarna takes into account multiple factors when deciding to accept or decline a transaction (for example, length of time buyer has been using Klarna, outstanding amount customer has to repay, value of the current order).

When the customer selects a deferred payment method, Klarna performs a risk assessment before accepting the transaction. Klarna might decline the transaction due to unsatisfactory risk assessment result, the transaction amount involved, or the customer having a large outstanding debt. As such, we recommend that you present additional payment options such as card in your checkout flow. In these cases, the PaymentMethod is detached and the PaymentIntent object’s status automatically transitions to requires_.

Customers are expected to complete the payment within 48 hours after they’re redirected to the Klarna site. If no action is taken after 48 hours, the PaymentMethod is detached and the PaymentIntent object’s status automatically transitions from requires_ to requires_.

In these cases, inform your customer to try again with a different payment option presented in your checkout flow.

Klarna rate limits

API requests to Klarna are subject to additional rate limits beyond Stripe’s API-wide rate limits. These limits can differ depending on the shape of the API requests that you make. In general, if you make more than 50 requests per second, you might see rate limiting in the form of responses with HTTP status code 400 or 402. Contact us using the form at Stripe support if you’re concerned that your usage might reach these levels, because Klarna might be able to increase these limits on a case-by-case basis.

Error messaging

Failed Klarna payments normally return one of the following failure codes. These codes show in the last_payment_error API object.

Caution

Before the 2023-08-16 API version, every Klarna error reported as payment_intent_authentication_failure. Make sure your API version is up to date to see the detailed errors listed below.

| Failure code | Explanation |

|---|---|

| payment_method_customer_decline | The customer cancelled the checkout on Klarna’s page |

| payment_method_provider_decline | Klarna declined the customer’s payment |

| payment_intent_payment_attempt_expired | The customer never completed the checkout on Klarna’s page, and the payment session has expired |

| payment_method_not_available | An unexpected error occurred when trying to use Klarna |

Optional customizations

You can optionally implement several different customizations for Klarna payment flows (such as separating the authorization and capture of funds) and customer interactions (such as handling redirects).

Separate authorization and capture

Klarna supports separate authorization and capture. If there’s a delay between the payment and delivering the goods to your customer, authorize the payment first and capture it later. At the point of capture, Klarna sends a statement to the customer and initiates the due dates on any subsequent payments that they must make. An authorized Klarna payment must be captured within 28 days of the authorization. Otherwise, the authorization automatically cancels and you can no longer capture the payment.

Tell Stripe to authorize only

To indicate that you want separate authorization and capture, set capture_method to

manualwhen creating the PaymentIntent. This parameter instructs Stripe to only authorize the amount on the customer’s Klarna account.Capture the funds

After the authorization succeeds, the PaymentIntent status transitions to

requires_. To capture the authorized funds, make a PaymentIntent capture request. The total authorized amount is captured by default—you can’t capture more than this, but you can capture less.capture Optional Cancel the authorization

Klarna counts any authorized payments against the customer’s total purchasing power within Klarna. Make sure that you actively cancel any authorized payments that you can’t fulfill (for example, the goods can’t be shipped) as soon as this becomes apparent.

Handle the Klarna redirect manually

We recommend relying on Stripe.js to handle Klarna redirects and payments client-side with confirmKlarnaPayment. Using Stripe.js helps extend your integration to other payment methods. However, you can also manually redirect your customers on your server by following these steps:

Create and confirm a PaymentIntent of type

klarna. You must provide the post-payment redirect URL for your customer in thereturn_field. You can provide your own query parameters in this URL, and the redirect flow’s final URL will include them.url The created

PaymentIntenthas a status ofrequires_and the type foraction next_isaction redirect_.to_ url { "status": "requires_action", "next_action": { "type": "redirect_to_url", "redirect_to_url": { "url": "https://hooks.stripe.com/...", "return_url": "https://example.com/checkout/complete" } }, "id": "pi_1G1sgdKi6xqXeNtkldRRE6HT", "object": "payment_intent", "amount": 1099,Redirect the customer to the URL provided in the

next_property. The code example here is approximate—the redirect method may be different in your web framework.action. redirect_ to_ url. url

When the customer finishes the payment process, they’re sent to the return_ configured in step 1. The payment_ and payment_ URL query parameters are included. If return_ already included query parameters, they’re preserved too.

We recommend that you rely on webhooks to confirm the status of a payment.

Handle post-payment events

Stripe sends a payment_intent.succeeded event when the payment completes. Use the Dashboard, a custom webhook, or a partner solution to receive these events and run actions, like sending an order confirmation email to your customer, logging the sale in a database, or starting a shipping workflow.

Listen for these events rather than waiting on a callback from the client. On the client, the customer could close the browser window or quit the app before the callback executes, and malicious clients could manipulate the response. Setting up your integration to listen for asynchronous events also helps you accept more payment methods in the future. Learn about the differences between all supported payment methods.

Handle events manually in the Dashboard

Use the Dashboard to View your test payments in the Dashboard, send email receipts, handle payouts, or retry failed payments.

Build a custom webhook

Build a custom webhook handler to listen for events and build custom asynchronous payment flows. Test and debug your webhook integration locally with the Stripe CLI.

Integrate a prebuilt app

Handle common business events, such as automation or marketing and sales, by integrating a partner application.

Customize the Klarna payment page

Prefill the Klarna form

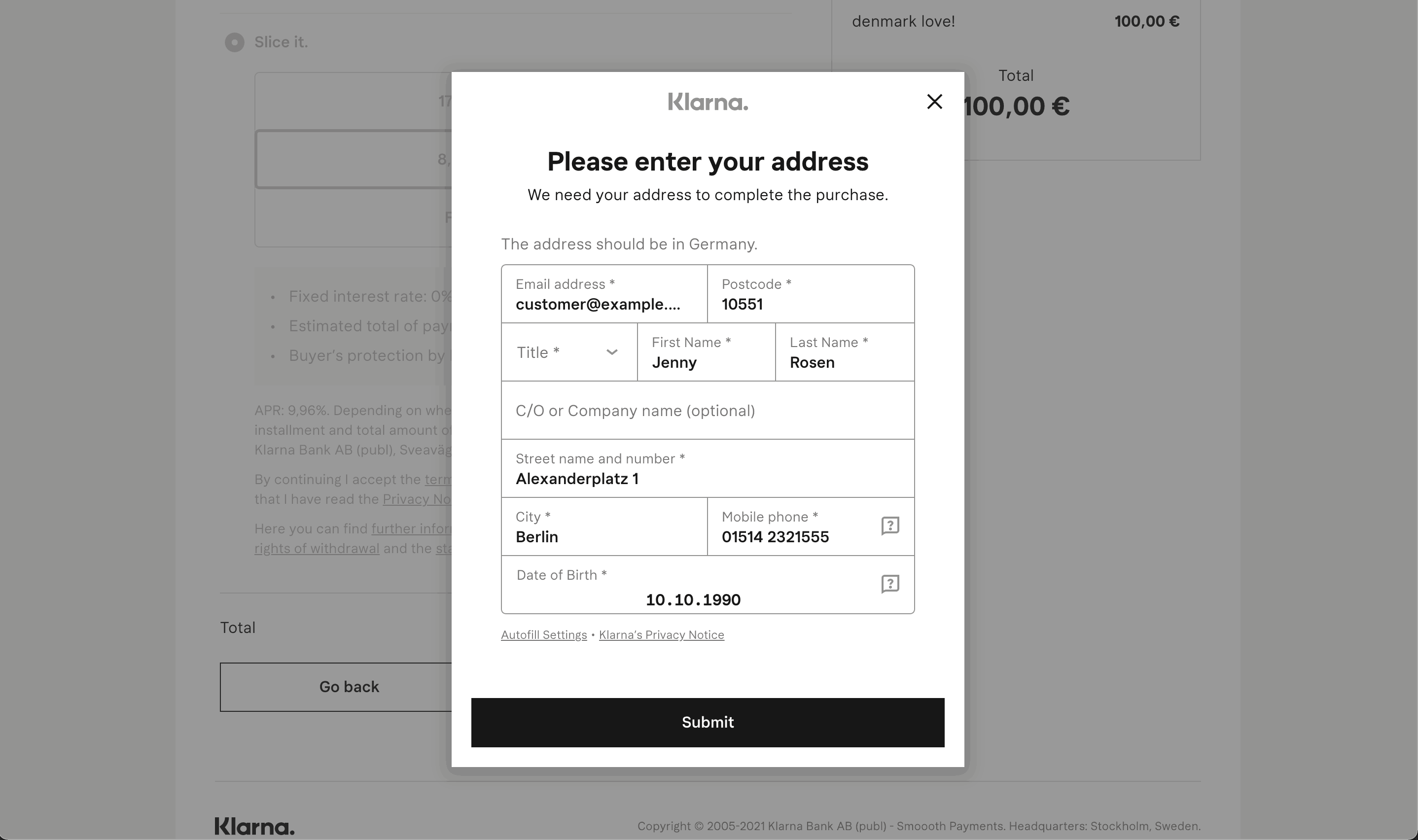

When the customer chooses to pay Klarna with a deferred payment option (pay later, installments, and financing), Klarna collects enough information for risk assessment and approval. The type of information depends on the country of the customer. For most countries in Europe, it’s the full billing details and date of birth. You can pass this information through the API, and the form will be prefilled when your customer arrives on the page.

A Klarna payment page prefilled with billing details from the API and customized to render in English for a customer in Germany

Add line items to the PaymentIntent

Unified line items with Klarna

To optimize approval rates when you integrate with Klarna, include line_ data to represent what’s in a shopper’s cart. For early access, see Payments line items.

Display payment method messaging on your website

The Payment Method Messaging Element is an embeddable UI component that helps your customers know which buy now, pay later payment options they have at checkout directly from your product, cart, or payment pages.

To add the Payment Method Messaging Element to your website, see Display payment method messaging.