Authenticate with 3D Secure

Integrate 3D Secure (3DS) into your checkout flow.

Caution

Major card brands no longer support 3D Secure 1. If your implementation uses 3D Secure 1, update it to use the Payment Intents and Setup Intents APIs. Using those APIs:

- Supports 3D Secure 2 (3DS2).

- Takes advantage of Dynamic 3D Secure.

- Complies with European Strong Customer Authentication regulations.

You can integrate 3D Secure (3DS) authentication into your checkout flow on multiple platforms, including Web, iOS, Android, and React Native. This integration runs 3D Secure 2 (3DS2) when supported by the customer’s bank and falls back to 3D Secure 1 otherwise. You can also perform 3DS authentication on Stripe while acquiring the transaction with another payment service provider (PSP) by using the Standalone 3DS product.

Control the 3DS flow

Stripe triggers 3DS automatically if mandated by regulations such as Strong Customer Authentication in Europe, industry guidelines such as the Credit Card Security Guidelines in Japan, if requested by an issuer with a soft decline code, or if certain Stripe optimisations apply.

You can also use Radar or the API to decide when to prompt users for 3DS authentication. This allows you to customise the authentication process for each user based on your chosen parameters. However, not all transactions support 3DS, for example wallets or off-session payments.

When a payment triggers 3DS, the card issuer might require the customer to authenticate to complete the payment, as long as 3DS authentication is supported for that card. While Stripe initiates the authentication request, the requirement comes from the issuer. Depending on the front end you’re using, this might require you to display the 3DS flow.

In a typical Payment Intent API flow that triggers 3DS:

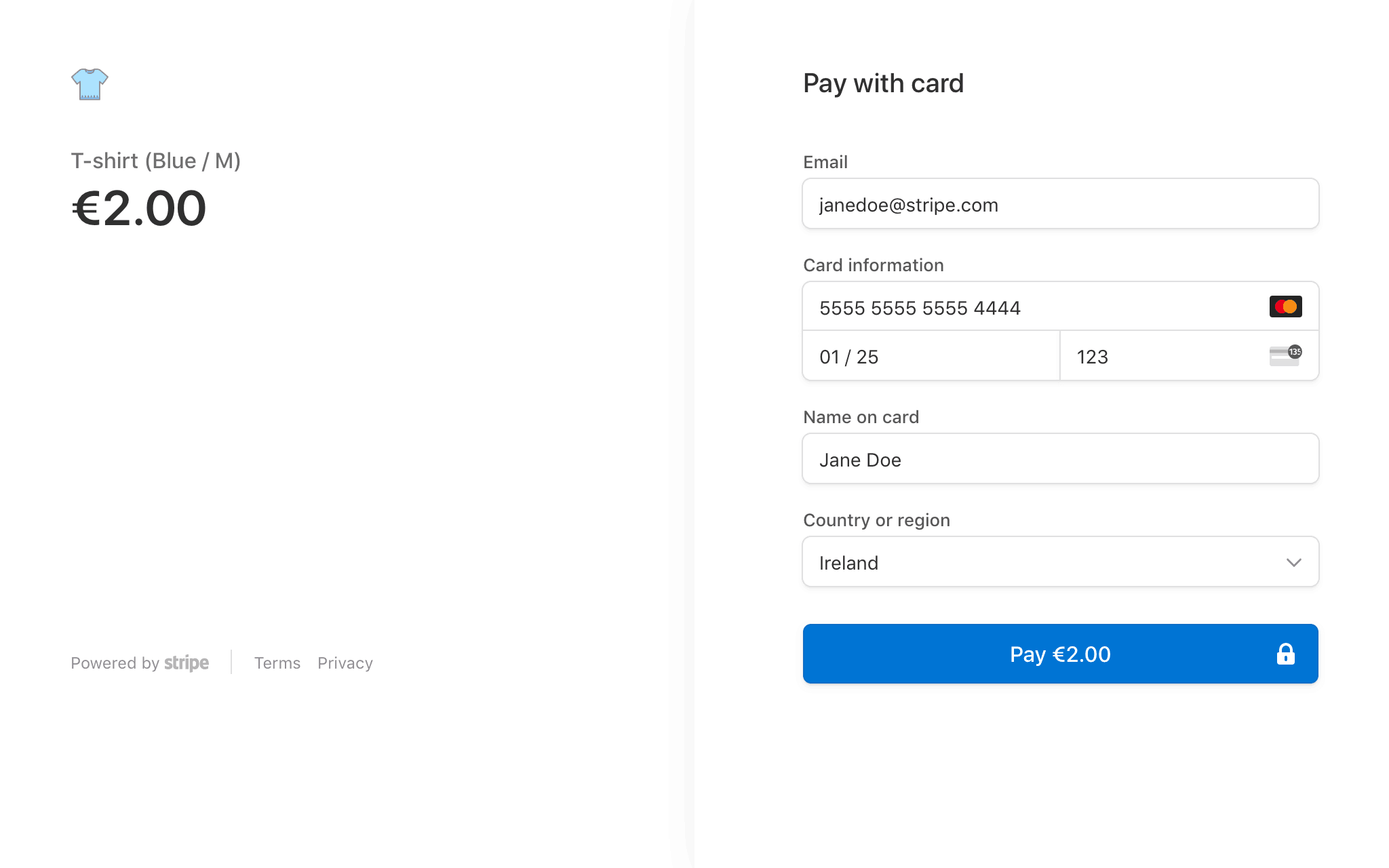

- The user enters their payment information, which confirms a PaymentIntent, SetupIntent, or attaches a PaymentMethod to a Customer.

- Stripe assesses if the transaction supports and requires 3DS based on regulatory mandates, Radar rules, manual API requests, issuer soft declines, and other criteria.

- If 3DS is:

- Not required: For example, because of an exemption, Stripe attempts the charge. The PaymentIntent transitions to a status of

processing. If requested by the issuer with a soft decline, we automatically reattempt and continue as if required. - Not supported: The PaymentIntent transitions to a status of

requires_. Depending on the reason 3DS was triggered, it might be permissible to continue to the authorisation step for the charge. In that case, the PaymentIntent transitions to a status ofpayment_ method processing. - Required: Stripe starts the 3DS authentication flow by contacting the card issuer’s 3DS Access Control Server (ACS) and starting the 3DS flow.

- Not required: For example, because of an exemption, Stripe attempts the charge. The PaymentIntent transitions to a status of

- When 3DS flow information is received from the issuer, Stripe submits the request for the issuer to authenticate the cardholder. The PaymentIntent transitions to a status of

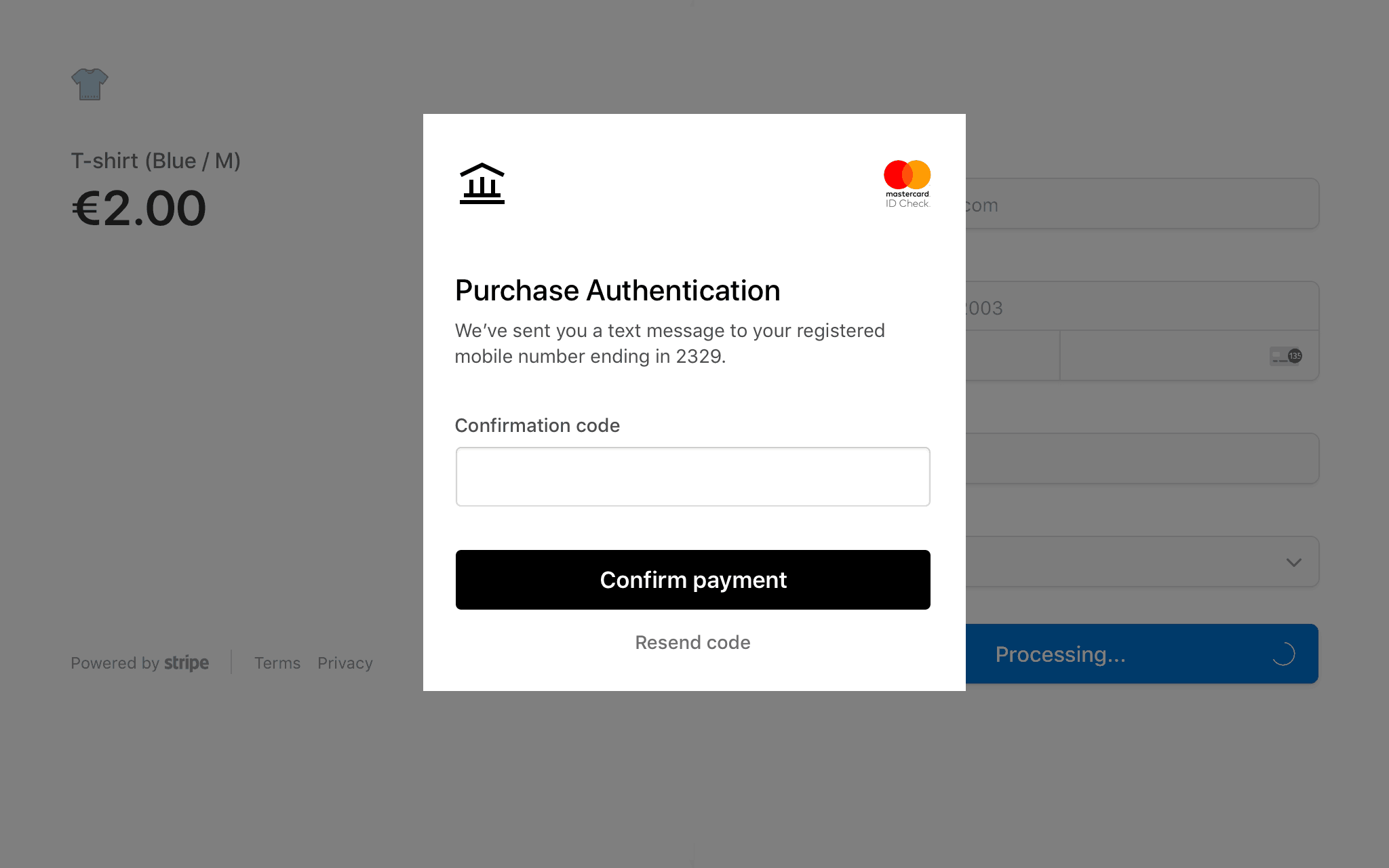

requires_:action - See below for how to display the required 3DS action. Issuers might request different 3DS flow action types, which might not always result in visibly displaying a 3DS challenge (for example, a frictionless flow).

- If the issuer doesn’t support 3DS at all or has an outage, Stripe might attempt to complete the payment without authentication if permissible.

- Data for 3DS authentication requests is typically provided by the customer at the time of the transaction. To reduce friction and the possibility of failed authentication, we might complete these requests with data we infer from other sources such as data collected from your customer during the payment flow, records related to your customer’s past transactions with you, or relevant information available from the customer’s card or issuers.

- If Stripe already has access to all the required 3DS data elements, our optimised 3DS server might attempt to complete the authentication request for you while confirming the PaymentIntent. This can result in the PaymentIntent directly transitioning to a status of

processingif the 3DS flow succeeds, or to a status ofrequires_if additional steps or data elements are required to complete the 3DS flow.action

- Depending on the 3DS authentication result:

- Authenticated: Stripe attempts the charge and the PaymentIntent transitions to a status of

processing. - Failure: The PaymentIntent transitions to a status of

requires_, indicating that you need to try a different payment method, or you can retry 3DS by reconfirming.payment_ method - Other scenarios: Depending on the reason the payment triggered 3DS, it might be permissible to continue authorisation for the charge in edge cases. For example, a result of

attempt_leads to a charge and the PaymentIntent transitions to a status ofacknowledged processing.- An exception is when creating Indian e-mandates for recurring payments. Anything but an

authenticatedresult is treated as failure.

- An exception is when creating Indian e-mandates for recurring payments. Anything but an

- Authenticated: Stripe attempts the charge and the PaymentIntent transitions to a status of

- The PaymentIntent transitions to one of the following statuses, depending on the outcome of the payment:

succeeded,requires_, orcapture requires_.payment_ method

To track whether 3DS was supported and attempted on a card payment, read the three_d_secure property on the card information in the Charge’s payment_. Stripe populates the three_ property when the customer attempts to authenticate the card – three_ indicates the authentication outcome.

Use Radar rules in the Dashboard

Stripe provides fraud controls to dynamically request 3DS when creating or confirming a PaymentIntent or SetupIntent. You can configure these rules in your Dashboard.

If you have Radar for Fraud Teams, you can add custom 3DS rules.

Manually request 3DS with the API

The default method to trigger 3DS is using Radar to dynamically request 3D Secure based on risk level and other requirements. Triggering 3DS manually is for advanced users integrating Stripe with their own fraud engine.

To trigger 3DS manually, set payment_ depending on what you want to optimise for when either creating or confirming a PaymentIntent or SetupIntent, or creating a Checkout Session. This process is the same for one-off payments or when setting up a payment method for future payments. When you provide this parameter, Stripe attempts to perform 3DS and overrides any dynamic 3D Secure Radar rules on the PaymentIntent, SetupIntent, or Checkout Session.

When to provide this parameter depends on when your fraud engine detects risk. For example, if your fraud engine only inspects card details, you know whether to request 3DS before you create the PaymentIntent or SetupIntent. If your fraud engine inspects both card and transaction details, provide the parameter during confirmation – when you have more information. Then pass the resulting PaymentIntent or SetupIntent to your client to complete the process.

Explore the request_ parameter’s usage for each case in the API reference:

- Create a PaymentIntent

- Confirm a PaymentIntent

- Create a SetupIntent

- Confirm a SetupIntent

- Create a Checkout Session

Set request_ to any to manually request 3DS with a preference for a frictionless flow, increasing the likelihood of the authentication being completed without any additional input from the customer.

Set request_ to challenge to request 3DS with a preference for a challenge flow, where the customer must respond to a prompt for active authentication.

Stripe can’t guarantee your preference because the issuer determines the ultimate authentication flow. You can find out what the ultimate authentication flow was by inspecting the authentication_ on the three_ property of the Charge or SetupAttempt. To learn more about 3DS flows, read our guide.

Caution

Stripe only prompts your customer to perform authentication if 3DS authentication is available for a card. If it’s not available for the given card or if an error occurred during the authentication process, the payment proceeds normally.

Stripe’s mandatory authentication rules run automatically, regardless of whether or not you manually request 3DS. Any 3DS requests from you are additional to those required for SCA.

Display the 3DS flow

Test the 3DS flow

Use a Stripe test card with any CVC, postal code, and future expiry date to trigger 3DS authentication challenge flows while in a sandbox.

When you build an integration with your test API keys, the authentication process displays a mock authentication page. On that page, you can either authorise or cancel the payment. Authorising the payment simulates successful authentication and redirects you to the specified return URL. Clicking the Failure button simulates an unsuccessful attempt at authentication.

All other Visa and Mastercard test cards don’t require authentication from the customer’s card issuer.

You can write custom Radar rules in a test environment to trigger authentication on test cards. Learn more about testing your Radar rules.

Disputes and liability shift

The liability shift rule typically applies to payments successfully authenticated using 3DS. In some cases, liability shift applies with equivalent cryptograms, such as Apple Pay or Google Pay. If a cardholder disputes a 3DS payment as fraudulent, the liability typically shifts from you to the card issuer.

If a card doesn’t support 3DS or an error occurs during the authentication process, the payment proceeds normally. When this occurs, liability doesn’t generally shift to the issuer, because a successful 3DS authentication hasn’t taken place.

In practice, this means you typically won’t receive disputes marked as fraudulent if the payment is covered by the liability shift rule, but you might still receive an Early Fraud Warning. You might still receive a low percentage of fraudulent disputes, and we list a few cases below where the liability shift rule might not apply.

You might receive a dispute enquiry on a successfully authenticated payment using 3DS. This type of dispute doesn’t precipitate a chargeback because it’s only a request for information.

If you receive an enquiry for a 3D-Secure-authenticated charge, you must respond. If you don’t, the cardholder’s bank can initiate a financial chargeback known as a “no-reply” chargeback that could invalidate the liability shift. To prevent no-reply chargebacks on 3DS charges, submit sufficient information about the charge. Include information about what was ordered, how it was delivered, and who it was delivered to (whether it was physical or electronic goods, or services).

Note

If a customer disputes a payment for any other reason (for example, product not received), then the standard dispute process applies. Make informed decisions about your business management, especially in handling and completely avoiding disputes.

Liability shift might also occur when the card network requires 3DS, but it isn’t available for the card or issuer. This can happen if the issuer’s 3DS provider is down or if the issuer doesn’t support it, despite the card network requiring support. During the payment process, the cardholder isn’t prompted to complete 3DS authentication, because the card isn’t enrolled. Although the cardholder didn’t complete 3DS authentication, liability can still shift to the issuer.

Stripe returns the requested Electronic Commerce Indicator (ECI) in the electronic_ of the 3DS authentication outcome. This indicator can aid in determining whether a charge should adhere to the liability shift rule. As 3DS occurs subsequent to the initial payment intent response, you typically get this from a charge. event that’s sent to one of your configured webhook endpoints or other event destinations. A requested ECI might be degraded in the issuer response, which we don’t reveal.

Caution

Sometimes payments that are successfully authenticated using 3DS don’t fall under liability shift. This is rare and can happen, for example, if you have an excessive level of fraud on your account and are enrolled in a fraud monitoring programme. Certain networks have also exempted some industries from liability shift. For example, Visa doesn’t support liability shift for businesses engaging in wire transfer or money orders, non-financial institutions offering foreign or non-fiat currency, or stored-value card purchase or load.

It’s also possible for liability shift to get downgraded post-authorisation, or the card network’s dispute rejection system might fail to catch liability shift for a transaction. In these cases, if you counter the dispute, Stripe automatically adds the requested ECI and the 3DS authentication outcome of the payment to your evidence details, but we recommend you also include additional details to increase your chance of winning the dispute.

Custom Radar rules for 3DS and liability shift

If you have Radar for Fraud Teams, you can customise your rules to control when to request 3DS and how to handle each specific authentication outcome and liability shift. The Stripe Strong Customer Authentication (SCA) rules run automatically and independently of custom Radar rules, and block unauthenticated payments unless exempted.