Swish paymentsVersion bêta privée

Learn about Swish, a popular payment method in Sweden.

Swish is a single-use payment method used in Sweden. It allows customers to authenticate and approve payments using the Swish mobile app and the Swedish BankID mobile app.

You get immediate notification on whether the payment succeeded or failed.

Payment flows

Customers pay with Swish by using one of the following methods:

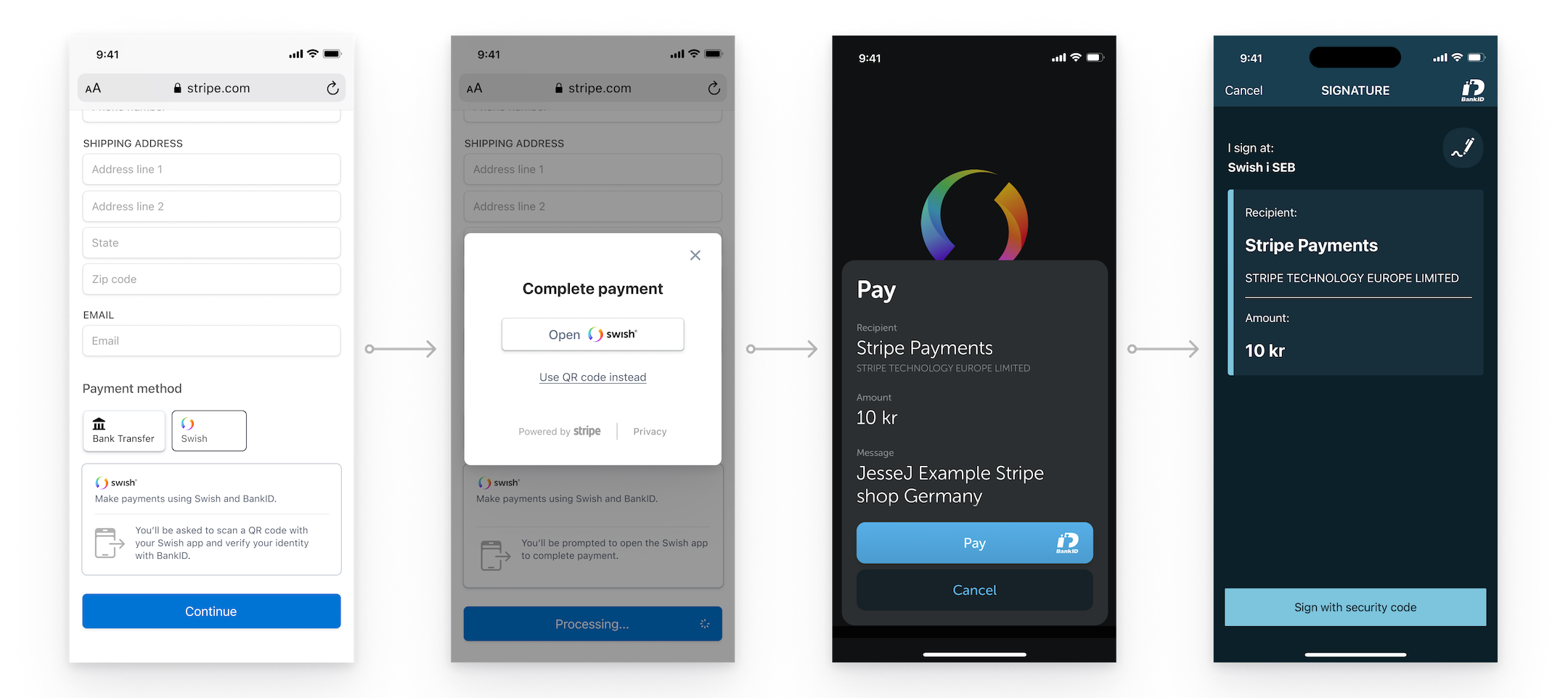

Mobile: Customers follow a mobile redirect from your website or mobile app to the Swish app, where they authorize the payment, then return to your website or mobile app.

Desktop: Customers scan a QR code you present on your website using the Swish app, which allows them to authorize the payment.

Get started

Learn how to manually configure Swish as a payment method.

You don’t have to integrate Swish and other payment methods individually. If you use our front-end products, Stripe automatically determines the most relevant payment methods to display. Go to the Stripe Dashboard and enable Swish. To get started with one of our hosted UIs, follow a quickstart:

Other payment products

The following Stripe products also let you add Swish from the Dashboard:

Merchant of record

For Swish payments, Stripe operates as the merchant of record. Therefore, Stripe’s name appears as the recipient of payments in the Swish app and as the statement descriptor in the customer’s bank statements. Your business name appears in the message field in the Swish app. The factoring addendum in the Swish terms applies.

Prohibited business categories

In addition to the industry and business categories listed in Prohibited and Restricted Businesses, the following categories aren’t allowed to use Swish:

- Precious stones and metals, watches and jewelry

- Digital wallet top-ups

For more information about Swish eligibility for your account, go to your Payment methods settings.

Refunds

You can refund Swish charges up to 365 days after the payment completes. Refunds usually take a few minutes to complete. Swish supports full and partial refunds. You can also issue multiple partial refunds up to the amount of the original charge.

Connect

You can use Stripe Connect with Swish to process payments on behalf of a connected account. Connect users can use Swish with the following charge types: