Rapprochement

Découvrez comment le solde du client est rapproché avec les paiements et factures

Stripe propose deux comportements de rapprochement des fonds dans le solde disponible : automatic ou manual.

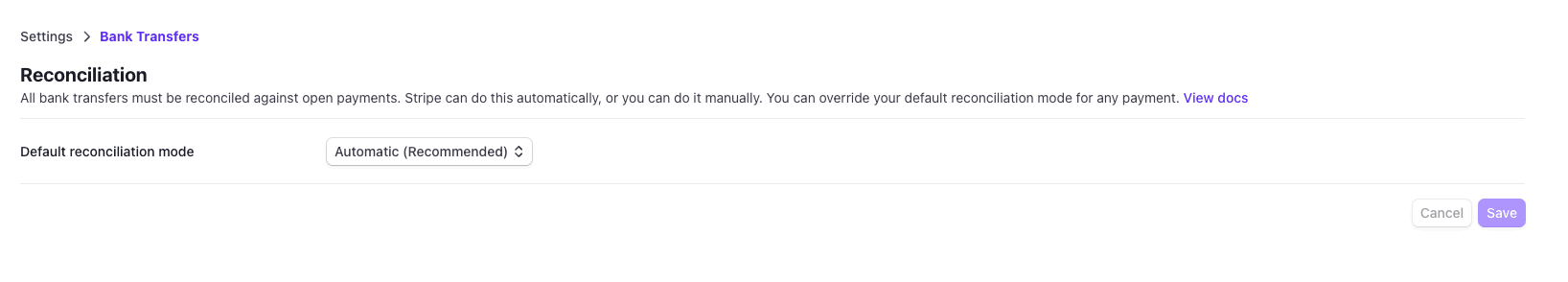

Par défaut, Stripe applique le mode de rapprochement automatique au solde disponible de tous vos clients. Rendez-vous dans les paramètres de rapprochement des virements bancaires pour modifier le comportement de rapprochement pour l’ensemble de vos clients.

Paramètres de rapprochement des virements bancaires

Modifier le comportement de rapprochement

Vous pouvez utiliser le Dashboard ou l’API pour modifier les paramètres de rapprochement des virements bancaires d’un client spécifique.

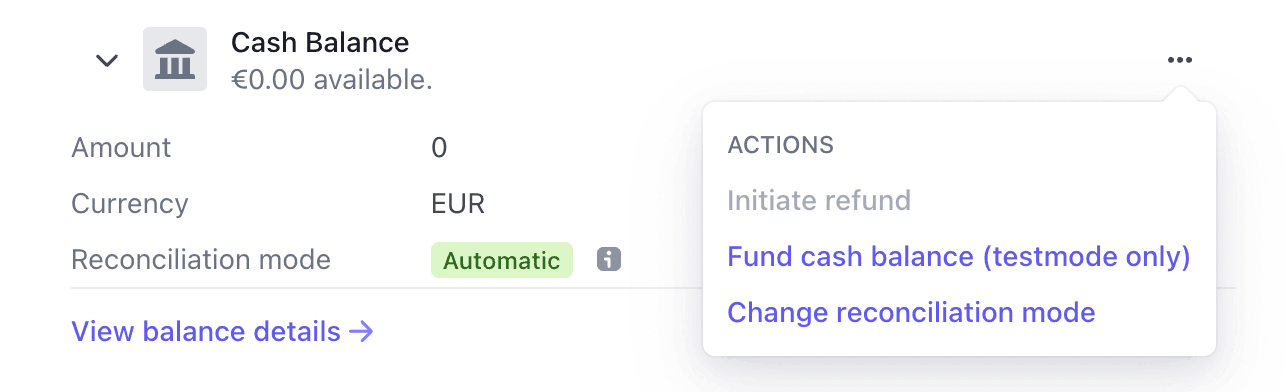

Pour modifier le comportement de rapprochement d’un client dans le Dashboard :

- Sélectionnez le client, puis recherchez Solde disponible dans la section Moyens de paiement.

- Développez le menu déroulant () en regard des détails du solde disponible.

- Dans les options qui s’affichent, sélectionnez Modifier le mode de rapprochement. Cela affiche une fenêtre modale qui vous permet de modifier le comportement de rapprochement pour le client.

La section Solde disponible sur la page Client

Pour modifier le comportement de rapprochement d’un client à l’aide de l’API, définissez le mode de rapprochement du client sur manual.

Vous pouvez rétablir le mode de rapprochement par défaut d’un client dans le Dashboard. Vous pouvez également utiliser l’API pour définir le mode de rapprochement du client sur merchant_.

Rapprochement automatique du solde disponible

Rapprochement manuel du solde disponible

Lorsque le rapprochement manuel est activé pour un client, Stripe n’applique pas automatiquement les fonds du solde du client.

Vous pouvez appliquer manuellement des fonds à partir du solde du client à l’aide de l’API ou du Dashboard.

Vous pouvez appliquer des fonds à un PaymentIntent incomplet, partiellement financé ou à une facture ouverte à l’aide de l’API ou du Dashboard. Vous pouvez également payer des factures encore ouvertes, mais marquées comme étant en retard à l’aide de cette méthode.

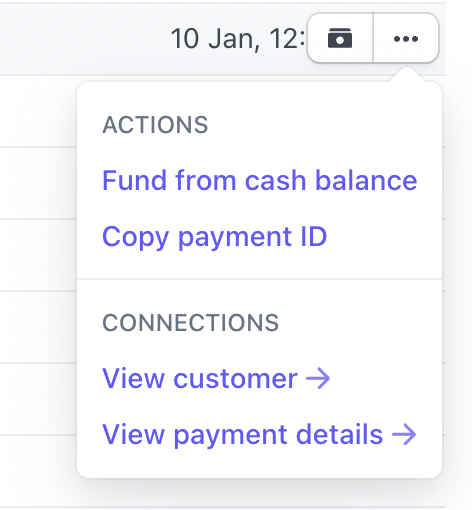

Dans le Dashboard, vous pouvez appliquer des fonds à un PaymentIntent sur la page Paiements ou sur la page du paiement en question.

Pour régler un PaymentIntent depuis la page Paiements, recherchez le paiement que vous souhaitez effectuer, cliquez sur le menu déroulant (), puis sur Payer à partir du solde de trésorerie.

Pour régler un PaymentIntent à partir de la page du paiement en question, cliquez sur le bouton Payer à partir du solde de trésorerie.

Dans les deux cas, la sélection du bouton Fonds à partir du solde de trésorerie vous invite à confirmer le paiement. Ce bouton n’apparaît sur aucune des pages si le client ne dispose pas de fonds disponibles sur son solde.

Pour appliquer des fonds à une facture, accédez à la page Facture, cliquez sur le bouton Débiter le client, puis sélectionnez Solde de disponible comme moyen de paiement.

Vous pouvez financer partiellement ou totalement une facture à l’aide du Dashboard. Cette option vous permet de payer une partie de la facture, si le client ne dispose pas de fonds suffisants sur son solde disponible pour payer l’intégralité de la facture.

Pour appliquer des fonds à l’aide de l’API :

Le montant est facultatif. Si vous l’omettez, le montant sera défini par défaut sur le montant restant demandé sur le PaymentIntent.

Le code suivant est un exemple d’une passe complète de rapprochement manuel. Vous recevez le webhook cash_, trouvez les PaymentIntents en attente de paiement et utilisez les fonds disponibles pour rapprocher les PaymentIntents ouverts.

L’objet envoyé dans le message cash_ contient toujours une représentation du solde de trésorerie du client dans son entièreté, quel que soit l’événement ayant déclenché le webhook. Cela signifie que le solde de trésorerie du client peut contenir des fonds ajoutés auparavant, en plus de ceux ajoutés juste avant l’événement déclencheur.

Fonds du solde disponible non rapprochés

Parfois, les fonds du solde disponible restent non rapprochés. Par exemple, lorsqu’un client a envoyé trop d’argent et que vous n’avez pas créé de PaymentIntents ou factures supplémentaires pour ce client.

Pour rapprocher les fonds restants sur le solde disponible du client, vous pouvez créer un nouveau PaymentIntent ou une nouvelle facture, ou renvoyer les fonds au client.

Mise en garde

Vous devez vérifier que les soldes disponibles sont rapprochés rapidement et sans erreur. Rapprochez rapidement les soldes restants des clients, plutôt que de les laisser sur votre compte durant une longue période.

Stripe envoie régulièrement des e-mails de rappel si votre compte comporte des soldes non rapprochés, afin que vous puissiez examiner ces fonds. Si le solde d’un client reste non rapproché pendant 75 jours, Stripe tente automatiquement de renvoyer les fonds vers le compte bancaire du client. Si Stripe ne dispose pas des informations sur le compte du client, elle peut contacter directement ce dernier pour initier le remboursement des fonds non rapprochés. Si Stripe ne trouve pas les informations de compte du client au bout de 90 jours, les fonds non rapprochés sont transférés sur le solde de votre compte Stripe. Contactez directement le client pour vous assurer qu’il reçoive les fonds restitués.

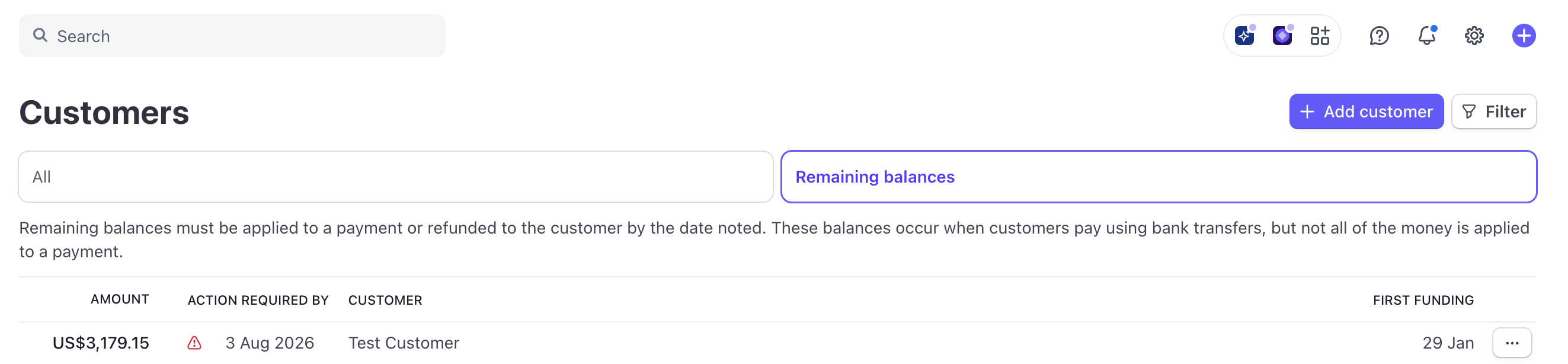

Vous pouvez consulter la liste complète des clients qui ont des soldes disponibles non rapprochés et la date à laquelle nous les rembourserons au client dans votre Dashboard.

Filtre des soldes restants du client

Solde créditeur

La gestion du solde créditeur est différente de celle du solde de trésorerie. Le solde créditeur du client est une fonctionnalité uniquement destinée aux factures qui représente une responsabilité entre vous et le client. Lorsqu’une facture est finalisée, le solde créditeur du client est appliqué à la facture, réduisant ainsi le montant dû.

En savoir plus sur les soldes créditeurs.