1099 Tax Reporting Express Dashboard walkthrough

Learn how to manage 1099 tax forms for connected accounts that use the Express Dashboard.

The images in this section describe an example of the product flow that connected accounts can encounter when using the Express Dashboard. We provide these images to help give you and your support teams an idea of the overall user experience. If you have any questions, contact Stripe Support.

The Stripe Express Dashboard

For your connected accounts not using Connect embedded components, enabling e-delivery for tax year 2025 gives them access to the Stripe Express Tax Forms page. That page is a pre-built web and mobile dashboard for managing their tax information and receiving their 1099s electronically.

As you configure your tax form settings, you can also choose to have Stripe send pre-filing confirmation emails to collect tax information and paperless delivery consent directly from your connected accounts. We’ll email your eligible connected accounts starting the week of November 3.

The Stripe Express Dashboard where payees can grant e-delivery consent, download their 1099 tax forms, and update their tax information.

Connected accounts can also use the Express Dashboard to view their available balance, see upcoming payouts, and track their earnings in real time.

Note

To prevent accounts that don’t normally access the Express Dashboard from using it, or if you don’t want Stripe to email your connected accounts, select postal delivery and disable electronic delivery in your tax form settings.

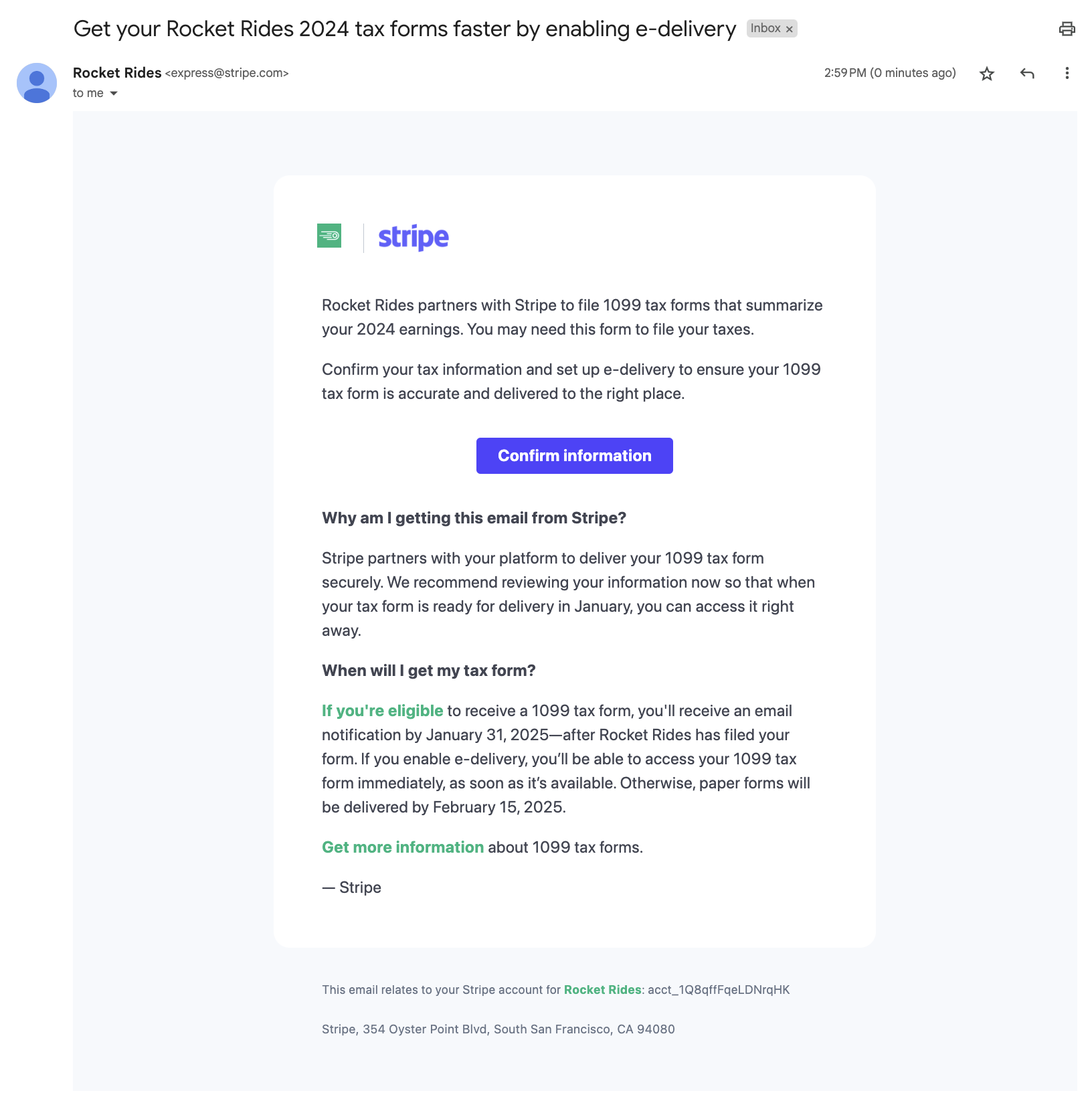

Your connected account receives an email from Stripe

Your connected account receives an email from Stripe asking them to confirm their tax information and update their delivery preferences. The subject line reads ‘Get your [Platform_Name] 2025 tax forms faster by enabling e-delivery.’ The following image displays the content of the email.

Pre-filing confirmation email from Stripe

Connected Accounts are prompted to claim their account on Stripe Express

For connected accounts without existing access to the Express Dashboard, clicking the Get Started button in Stripe’s email takes them to this screen.

For connected accounts that can access the Express Dashboard but aren’t logged in, the button opens a login screen. Authenticated accounts with Express Dashboard access proceed directly to the next step.

The Stripe Express page to create an account

Connected account owners with existing accounts are presented with phone number verification

This screen requests a code sent to the phone number associated with the connected account.

The Stripe Express account phone number verification window.

After passing phone number verification, accounts new to Express are asked to verify their identity

This step applies only to connected accounts that claimed Express Dashboard access in the earlier step and haven’t onboarded to Stripe Express. Other accounts proceed to the next step.

Stripe provides the connected account with prompts to verify their identity by providing details matching their account information. If, after a few attempts, they’re unable to enter matching details, we prompt them to confirm their details with you, the platform. The error message reads “One of the fields didn’t match the information we received from [Platform_Name]. You can try again, or check that your information with [Platform_Name] is up to date.”

The Stripe Express account Verify your identity dialog.

After verifying their identity, connected accounts are taken to the Tax forms page of Stripe Express

After the connected account’s details are verified, they’re taken to the Tax forms page in Stripe Express where they can confirm their tax information they have on file for their account and agree to paperless delivery of their 1099 tax form.

The Tax forms page of the Express Dashboard.

They’re prompted to confirm tax information but can choose to skip temporarily if they want to leave their information as is. Your accounts could get blocked if you’ve applied 1099 capabilities and the connected account updates their value to a name and TIN combination that doesn’t match against IRS records. If the connected account is verified and then changes their name or TIN, they’re asked to re-sign a new Stripe Terms Of Service Agreement. Similarly, if Stripe is unable to complete KYC requirements on them based on the information they provided, their account payouts are blocked until they log back in to Stripe Express and correct their information.

The window displayed to users to confirm their information.

Connected account owners agree to paperless delivery

After the tax information is confirmed, Stripe prompts the connected account to agree to paperless delivery.

The window to consent to paperless delivery of tax forms.

If you’ve enabled optional postal delivery, after agreeing to paperless delivery consent, your connected accounts can choose to request a paper copy in addition to the e-delivery of the tax form.

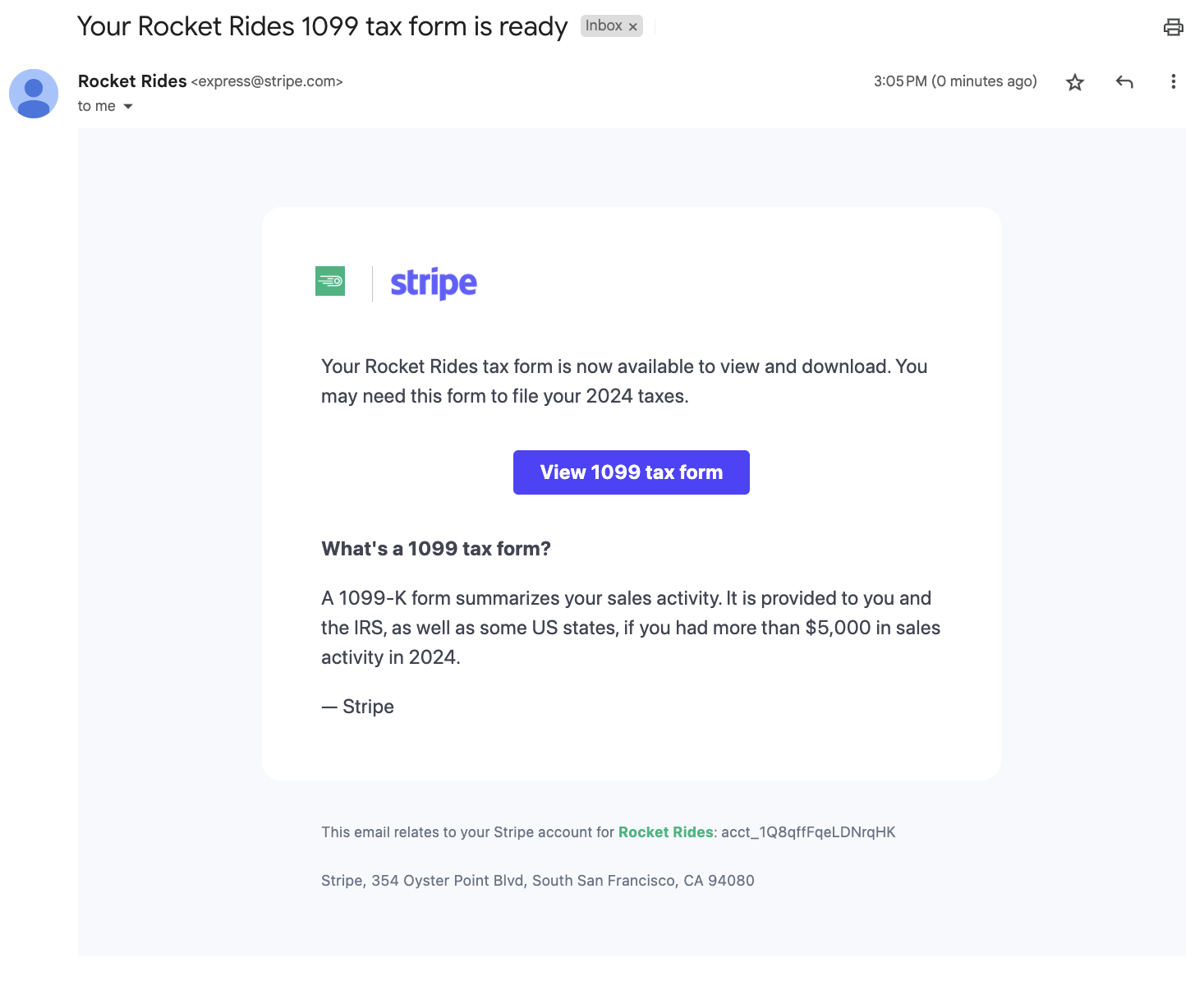

Your connected account receives an email from Stripe

After filing 1099 tax forms in your Stripe dashboard, your connected account receives an email from Stripe to view their tax form electronically. The subject line reads ‘Your [Platform_Name] 1099 tax form is ready’. The following image displays the content of the email.

Connected account owners can download their tax forms

After a connected account agrees to the e-delivery terms, they can download their form when your platform makes it available.

The dashboard where payees can download their 1099 tax forms.

Most connected account owners are prompted to enter the last four digits of the TIN on their 1099 tax form before being able to download a copy of the form. Downloads aren’t available for 24 hours after an update has been made to any personal identity information including name, address, business type, or TIN.

Caution

Connected accounts that do not agree to paperless delivery are unable to download their 1099 tax forms and resolve the call to action in their dashboard. Turn on paper delivery in your Stripe Tax form settings to make sure that recipients who don’t consent to e-delivery still receive paper forms.