Deliver your 1099 tax forms

Learn about 1099 form delivery requirements and how to deliver your tax forms, including e-delivery and postal delivery.

Getting your 1099 Forms

If you work for a platform that pays you through Stripe and want to learn about your 1099 forms and how to get them, see 1099 tax forms on the Stripe Support site.

Revenue authorities (such as the IRS) typically require that you deliver a copy of the tax form to the payee, in addition to filing the tax form. Per IRS recommendations, the tax form you deliver is a “Copy B” with the payee taxpayer identification number (TIN) redacted to the last four digits.

The IRS requires you to provide tax forms to payees using postal mail unless you’ve obtained consent from the payee to only deliver the forms electronically. If you don’t obtain consent for e-delivery, you can still e-deliver as long as you also mail the copy of the tax form to the payee. For more information, see the IRS Requirements for Furnishing Information Returns Electronically.

You must deliver tax forms by the first business day on or after January 31. For postal delivery, tax forms must be postmarked by this date.

Tax forms are always delivered to payees the first time they’re filed with a revenue authority. This includes e-filing with the IRS as well as states. If a tax form is both e-filed with the IRS and to a state, it’s only delivered on the first of these events.

Delivery options

There are three options for delivering tax forms:

- E-delivery with a Stripe-built product: Use the Stripe Dashboard, Stripe Express Dashboard, or Stripe Embedded Components to collect e-delivery consent and deliver tax forms.

- E-delivery with Tax Forms API Preview: Use the Tax Forms API to directly control and manage the entire e-delivery flow.

- Postal delivery: Use Stripe to send tax forms using postal delivery.

E-delivery with interfaces built by Stripe

Your connected accounts can access their e-delivered tax forms through an interface built by Stripe. If you implemented Stripe Embedded Components, the link directs your connected account to the Embedded Component. Otherwise, they can access the tax forms through the interface that they typically use for non-tax reporting interactions. For instance:

- If a connected account views their payments through the Stripe Dashboard, their 1099 forms are e-delivered there.

- If a connected account views their payments through the Stripe Express Dashboard, their 1099 forms are e-delivered there. If you handle the complete onboarding and management process for your connected accounts and didn’t configure Embedded Components for tax reporting, the Express Dashboard is accessible.

Despite your platform’s eligibility, some connected accounts might not qualify for e-delivery through an interface built by Stripe. The following connected accounts aren’t eligible for e-delivery:

- Multi-user accounts

- Vendors without a Stripe account

- Users who have multiple accounts on your platform with the same email address To view a full list of the types of connected accounts that aren’t eligible for e-delivery through an interface built by Stripe, see Which accounts get access to e-delivery.

Connected account users must provide e-delivery consent to view and download their forms online. The e-delivery consent is applicable to all future electronic deliveries. Enable postal delivery to make sure that eligible accounts receive their tax forms. Consult your tax advisors if you want to completely opt out of paper delivery.

Prerequisites for using tax form e-delivery

Make sure that the email address is available and current for the connected accounts on your platform where you own the user experience. You can confirm that an email address for an account is available. Use the following command to view the email address for a connected account:

Turn on e-delivery

To turn on e-delivery for your account, open the Tax forms settings page in the Dashboard, then choose Optimize for e-delivery in the Delivery settings section.

Additionally, you can select the Have Stripe collect tax information automatically option to have Stripe email your connected accounts and ask them to update their tax information and delivery preferences. Learn more about e-delivery for connected accounts.

File and deliver 1099 forms with a Stripe-hosted Dashboard

Stripe-hosted Dashboards are surfaces where eligible Connect platforms can deliver 1099s to their users.

- Express Dashboard: Only connected accounts who have access to the Express Dashboard for non-tax reporting purposes and connected accounts where you own the full onboarding and management process can have their 1099 forms delivered to this Dashboard.

- Stripe Dashboard: Only connected accounts who have access to the Stripe Dashboard for non-tax reporting purposes can have their 1099 forms delivered to this Dashboard.

Toward the end of January, when you click File, your finalized tax forms are automatically sent out to your connected accounts. They receive another email notifying them that their tax forms are ready, with a link to download the forms directly from the Tax Forms tab in the Stripe-hosted Dashboard. If a connected account user later consents to e-delivery, it applies only to future years because paper forms were already sent for the current year.

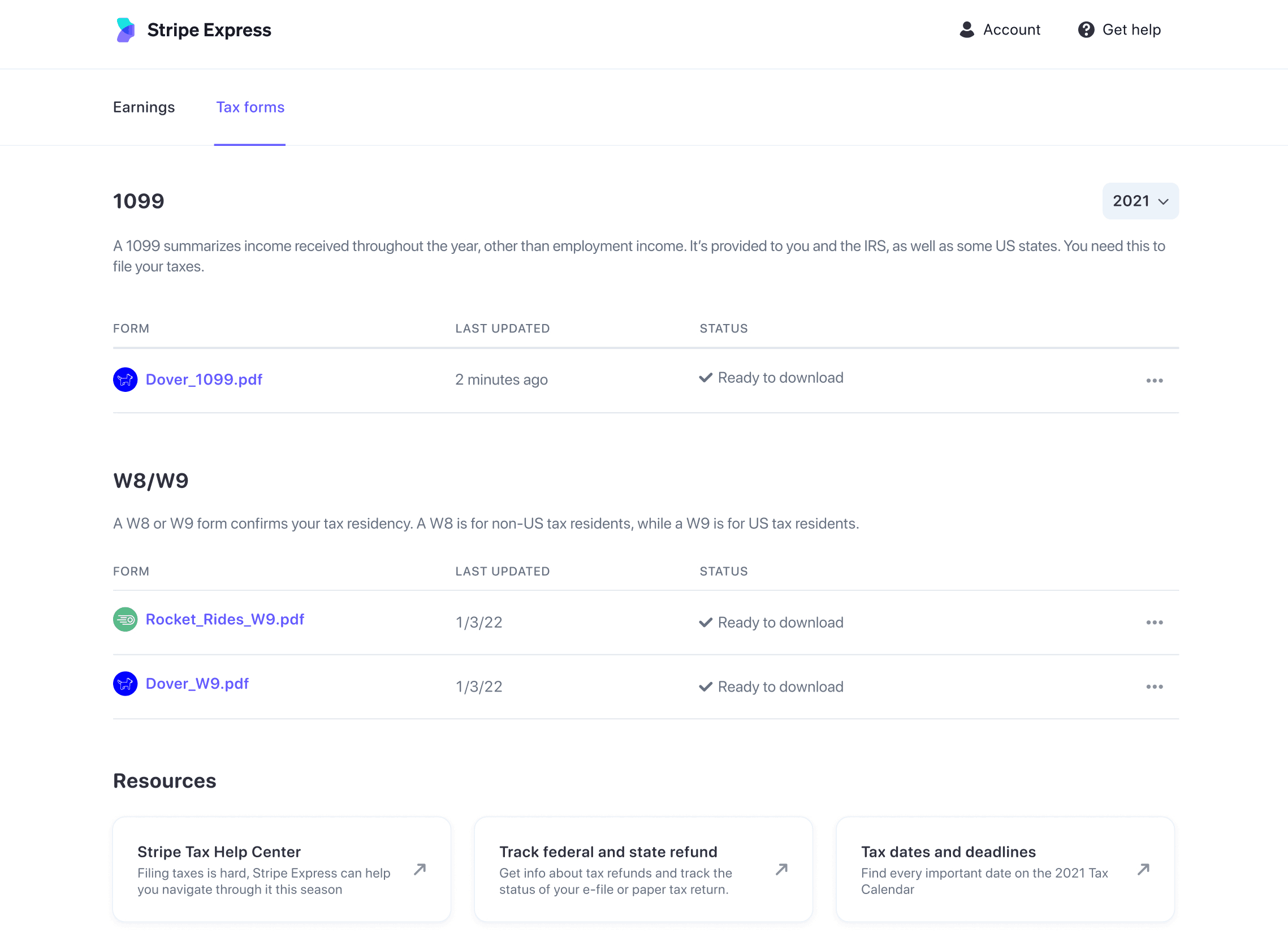

The Connect tax forms page in the Express Dashboard

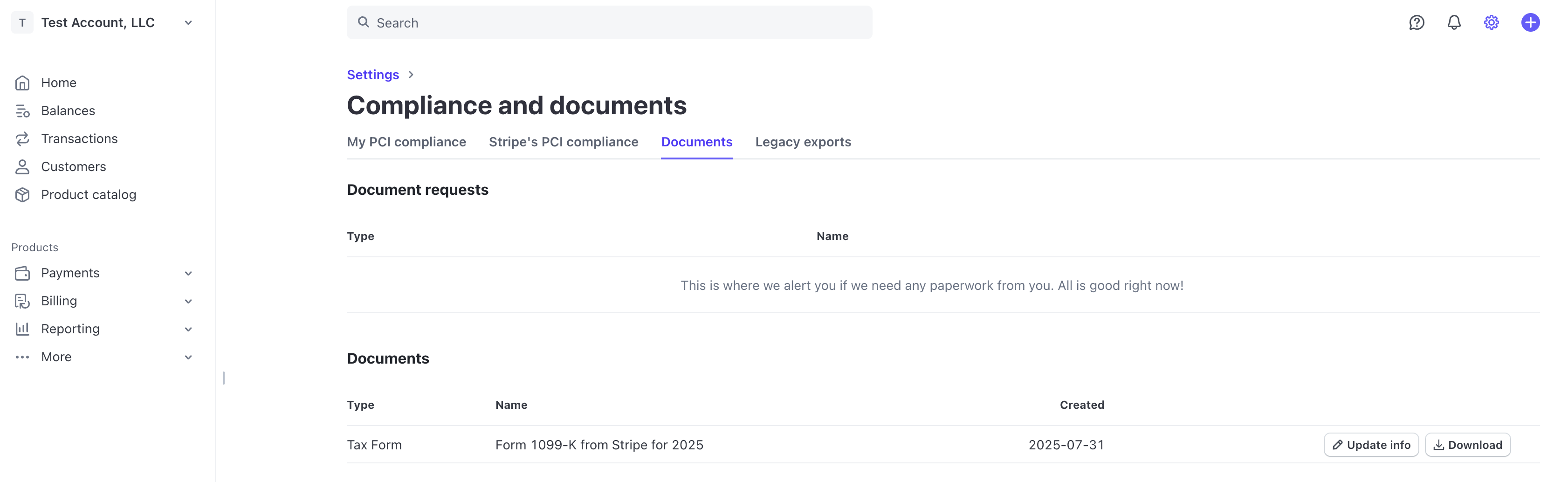

The Stripe dashboard page to download tax documents

File and deliver 1099 forms with Stripe Embedded Components

If your connected accounts currently interact with Stripe Embedded Components or you own the full onboarding and management process for your connected accounts, you can deliver 1099 forms with Stripe Embedded Components.

You need to implement the Documents component for your Connected Account to access their 1099 Tax Forms. You should also implement the Account management component to collect paperless delivery consent, and allow your connected accounts to make any necessary edits to their account information.

You must update your Connect settings with the URLs where you’ve embedded the Account management and Documents components for the pre-verification and 1099 delivery emails to link to those components.

Note

E-delivery consent appears only if the connected account has a populated email address. For connected accounts where you’re responsible for requirement collection, including custom accounts, Stripe doesn’t set the email field. You can update the connected account’s email address in the Dashboard.

E-delivery with Tax Forms API

Private preview

The Tax Forms API is available in limited preview.

You can use the Tax Forms API to deliver forms to your users directly. With the API, you build and brand the e-delivery flow in your platform and Stripe doesn’t interact with your users directly. You also need to manage the collection of e-delivery consent, how your users access the e-delivered forms, and any user identity changes or corrections that go through your platform.

Postal delivery

If you want to mail your tax forms, you must file by January 22, 2026 to guarantee the tax forms are postmarked by January 31, 2026. You must also provide a valid US return address to comply with USPS guidelines.

You can use postal delivery for any deliverable address, including PO boxes. For compliance reasons, Stripe doesn’t allow you to set a PO box as the address for a connected account; however, you can use Tax form editor or CSV import to modify the address on the tax form.

You may have connected accounts that are only eligible for state filing and not with the IRS. When you use Stripe to file your forms with the IRS and states, Forms 1099 for the state are mailed to these connected accounts after you finish filing.

If you use CSV import to override the default delivery method, this also affects the state mailing. For example, if you set postal_delivery to false, Stripe doesn’t mail the 1099 form to the connected account for state reporting.