Correct tax forms

File corrections to tax forms.

Getting your 1099 forms

If you work for a platform that pays you using Stripe, learn how to get your 1099 tax forms.

In some cases, you need to correct the values in a 1099 tax form after you’ve filed it. If you try to update a tax form that you already filed, you see a Correct button instead of an Edit button in the form.

Correction Reasons

You might need to issue a correction for several reasons:

- To change the identity data of your connected account. For example, users might request changes to their name, address, or tax identification information

- To change form totals

- To handle forms with a

Rejectedstate filing status. If you have forms with federal filing status ofRejected, contact Stripe support.

Rejection reasons

Here are the most common rejection reasons:

| Attribute | Example rejection reasons |

|---|---|

| TIN | Missing, invalid, mismatched with IRS records |

| Address | Non-English characters, malformed zip codes, missing fields (for example, city, empty Line 1 address) |

| Name | Missing, non-English or non-alphabetical characters |

The Rejected status implies that the form was either rejected by the IRS or state after submission, or that the state refused to accept the information during submission.

You can file a correction to update information on a form that has been rejected by a state (if federal filing status shows up as Rejected, contact Stripe support). Stripe 1099 intelligently files corrections if the form was initially accepted, or replacements if it was rejected.

Delivery failures

If the delivery status is Failed, that means we couldn’t deliver the tax form to the mailing address on file. There could be two reasons for this:

- Misconfigured address: The address is missing or invalid. For example, it includes non-English characters, the zip code doesn’t have the correct number of digits, or the city is missing.

- Non-deliverable address: The address doesn’t exist and our delivery partners can’t use it to deliver first-class mail.

Supported corrections

You can correct most boxes on a tax form. Depending on when you submit a correction and what you’re correcting, penalties might apply.

The IRS generally allows you to correct totals or payee information.

When you correct totals, a single form replaces the original and includes the original payee information, new totals, and a checked Corrected checkbox.

When you correct payee information, two forms replace the original:

- The first form includes the original payee information, zeros for all totals, and a checked Corrected checkbox.

- The second form includes the new payee information, original totals, and an unchecked Corrected checkbox (because this is the first form received by the new payee).

The IRS imposes certain requirements on tax form corrections.

You can’t correct:

- The payee name and form totals in the same form

- The payee tax identification number and form totals in the same form

- Tax forms that the IRS hasn’t accepted

- The form type (for example, 1099-MISC to 1099-NEC)

Create a correction

You can only correct tax forms that the IRS and State have accepted. There are a few ways to start corrections, each of which results in a corrected form that shows up as a Ready Correction.

Note

If you want to update information for the connected account permanently, make the changes programmatically using the Accounts API or the Connected Accounts details page and you can then use Quick Correct as shown below. Without doing this first, you’ll be updating the information only on the tax form. This doesn’t persist onto the connected account details and you’ll have to re-enter this information next tax season.

Use the Tax form editor

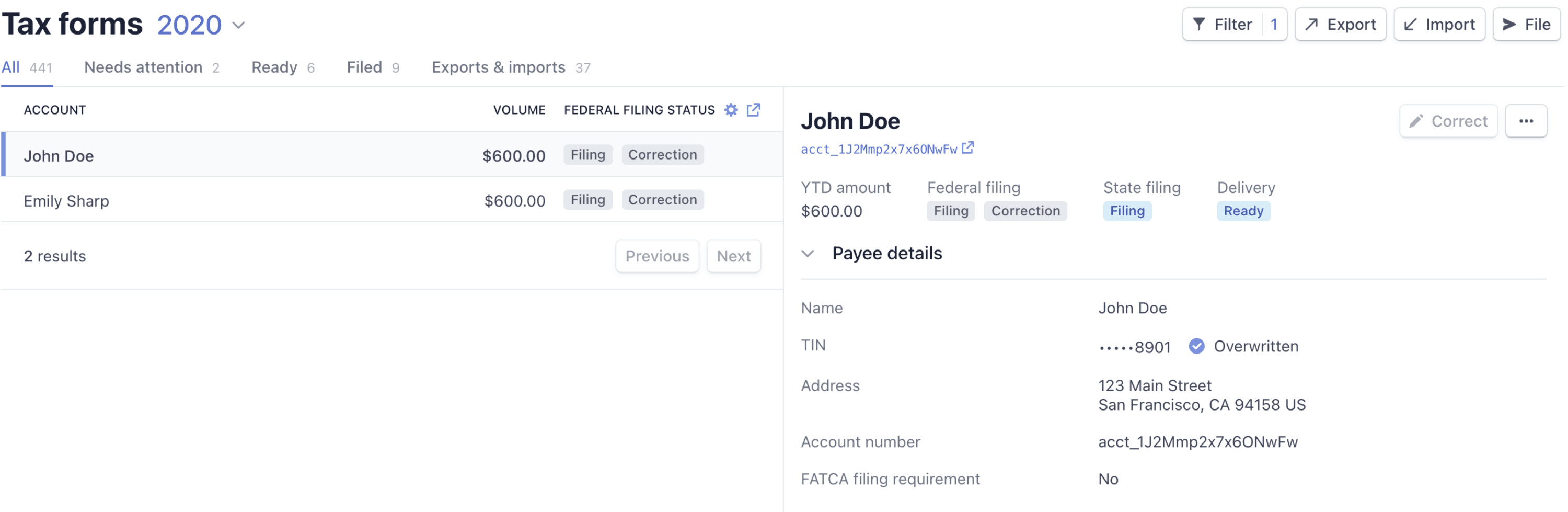

- Select the form on the Tax reporting page.

- Click Correct to create a correction.

- Make the necessary changes.

- Save the changes.

Use a CSV import

- Select the form and export it as a CSV.

- Open the CSV in a compatible tool to make and save the necessary changes.

- Import the updated CSV using the import mode Correct.

Corrections use the same CSV schema as updates and are filed regardless of filing threshold. This allows you to zero out a tax form that was accidentally filed or to correct a tax form to have a lower volume. The Filing_requirement allows you to specify whether or not to file a correction.

Use Quick Correct

If the identity (name, address, TIN) of the connected account has been updated in Stripe and now differs from what’s on the filed form, a pencil icon appears next to the “Payee details” for platform admin accounts. Hovering over the pencil and clicking Correct generates a corrected form to match the identity values of the connected account.

When you click Correct to update the values in the tax form, it updates all values that are different in the connected account than the tax form. You can’t choose which fields to update values for. Verify all changes before filing the updated forms. For example, if a connected account user made a typo in their address, the incorrect address updates in the corrected form.

To list the forms with identity values that differ between the connected account and the tax form to find potential corrections, add a

Payee detailsfilter with a value of “Payee has updated identity info”.

View or cancel a correction

Tax form corrections have a Correction badge in the tax forms list and on the details pane in the Dashboard. You can download previous versions of a tax form from the details pane. To cancel a correction before filing, click Cancel correction from the menu on the details pane.

File a correction

After you successfully create a correction through one of the methods above, the corrected form moves to the Ready column of your Tax Forms page after a page refresh regardless of whether the form is above the filing threshold.

If you want to file the correction, select the correction and click File. If you want to skip filing one of the corrections, set the filing requirement to NOT_ in the Tax Form Editor or import a CSV file.

If you selected to e-deliver your tax forms through an interface built by Stripe, your connected account receives an email notifying them that the corrected form is available within the interface.