1099 Tax Support proposed communication guidelines

Review a proposed communication timeline for communicating with your connected accounts about 1099 Tax forms.

For platforms using e-delivery with Stripe Express or Connect embedded components to issue 1099 tax forms

We recommend sending a reminder (example below) to connected accounts once they’ve received their pre-filing confirmation from Stripe. Notifying your connected accounts about outreach from Stripe helps to make a smoother user experience during tax season. We’ll send you a heads up email once we start sending pre-filing confirmation emails to your connected accounts.

| Who sends? | Email to connected accounts | Date |

|---|---|---|

| Stripe | Get your [Platform_Name] 2025 tax forms faster by enabling e-delivery | Starting the week of November 3, 2025 |

| Platform | Email template: Post-Stripe email | Any time after Stripe has sent the initial pre-filing confirmation email and before filing your 1099s. |

| Stripe | Your [Platform_Name] 1099 tax form is ready | When your platform files in the Stripe dashboard (must be before January 22, 2026) |

| Platform | Email template: E-delivery follow up email | Anytime after you file your 1099s in the Stripe dashboard. |

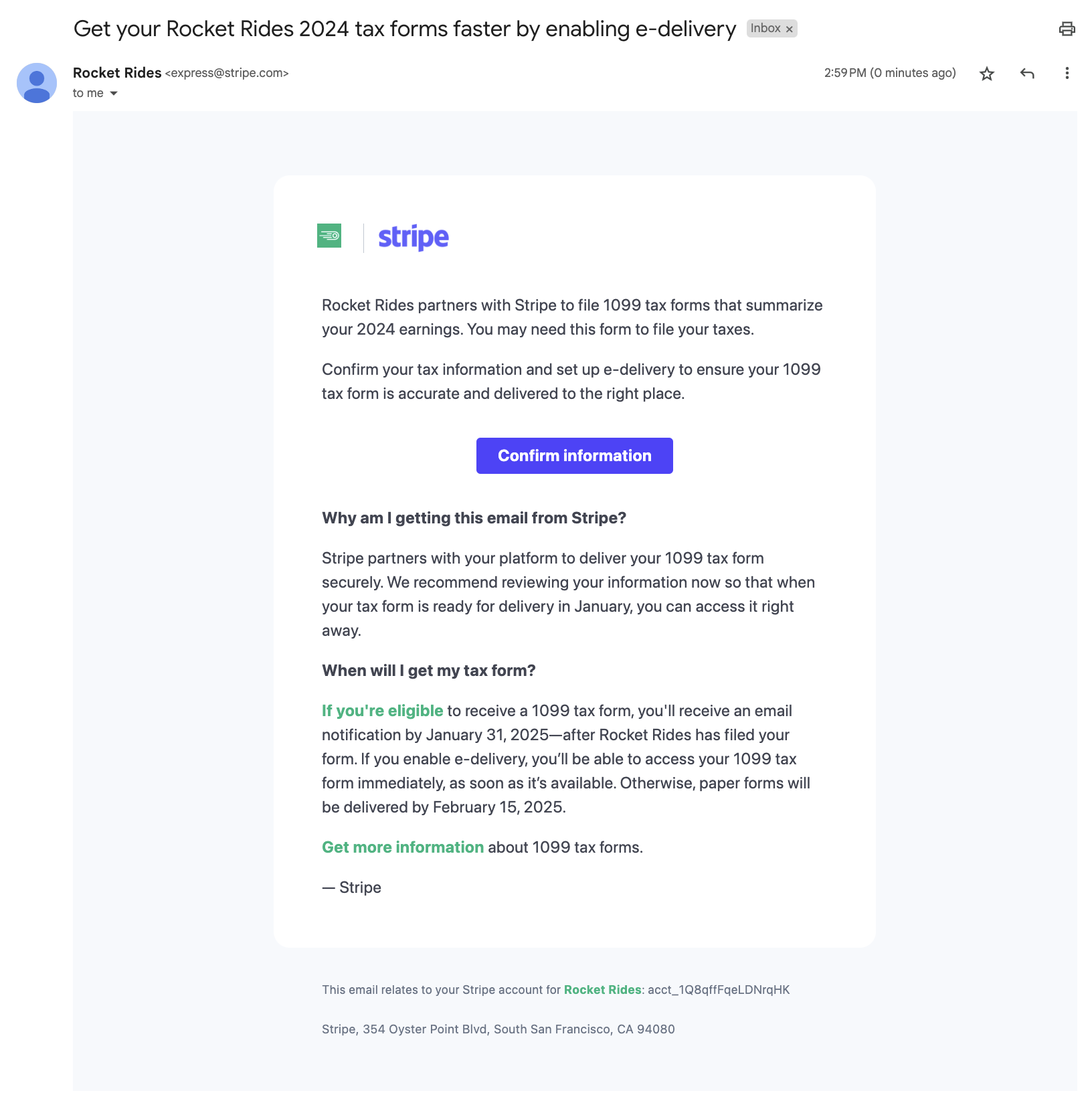

Stripe email to connected accounts: Get your [Platform_Name] 2025 tax forms faster by enabling e-delivery

Stripe will send a version of these communications starting the week of November 3, 2025.

An example email from Stripe to a connected account to review draft 1099 tax forms.

Email template: Post-Stripe email

We recommend letting your connected accounts know that they should’ve received information about their 1099 tax forms from Stripe. This is a proposed email template you can customize for your platform, based on the interface you’ve selected for e-delivery: Stripe Express or Connect embedded components.

Reply-to: [Platform’s preferred email]

Subject: Confirm your tax information in your account

Pre-header: Please verify your tax information is up to date

Email Copy:

[Platform_Name] partners with Stripe to file 1099 tax forms that report your earnings or sales activity. You should have received an email from Stripe ([check domain in your communication settings]) with instructions about how to confirm your tax information and delivery preference to ensure your 1099 tax form is sent to the right place.

Please confirm your information using the link provided in the email from Stripe. You’ll need to confirm your information is up-to-date to receive your 1099 form for the 2025 tax year. You may be asked a series of security questions to verify your identity.

If you have any questions, visit [https://support.stripe.com/express or https://support.stripe.com/embedded-connect/topics/1099].

What’s a 1099 form? A 1099-NEC/1099-MISC form summarizes your earnings as an independent contractor or service provider. It’s provided to you and the IRS, as well as some US states, if you earned $600 or more in 2025.

The 1099-K form summarizes the sales activity of your account. It will be provided to you and the IRS, as well as some US states, if you processed more than $20,000 and had more than 200 transactions in 2025.

Why do I need to verify my information? We want to ensure that information like your name, address, and Taxpayer Identification Number are up to date so that your 1099 tax form is accurate and sent to the right place.

I didn’t receive an email from Stripe—what should I do? Please double check your spam or junk mail folder for an email with the subject line “Get your [Platform_Name] 2025 tax forms faster by enabling e-delivery.” If you haven’t received this email from Stripe, please reach out to [Platform email].

When and where can I expect my 1099 tax form? 1099 tax forms are typically finalized in January. If you meet the income thresholds above, Stripe will send you an email to access your 1099 tax form (or mail a paper form if you prefer).

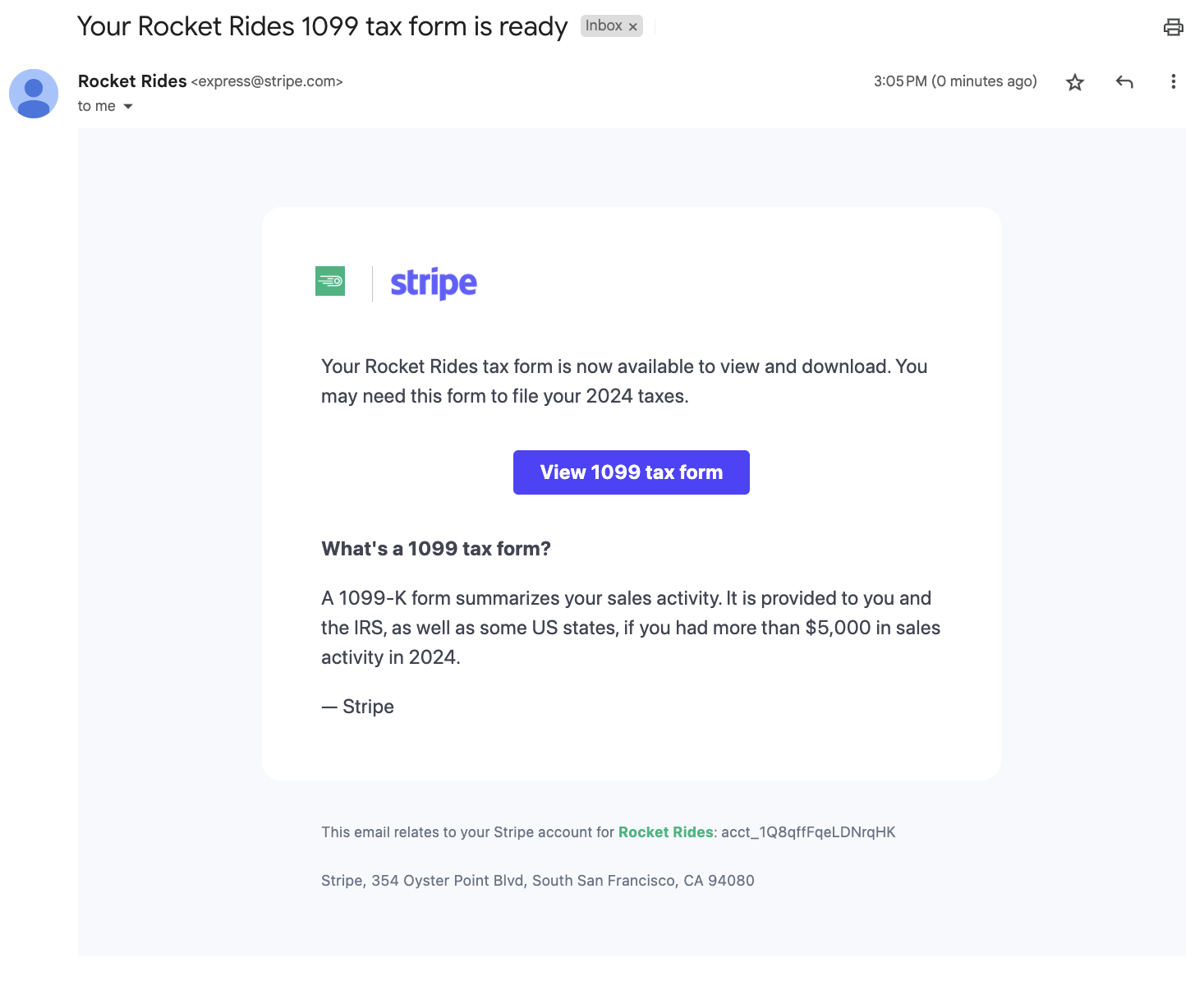

Stripe email to connected accounts: Your [Platform_Name] 1099 tax form is ready

Stripe sends a version of this email to your connected accounts after you file your tax forms in the Connect Dashboard.

An example email from Stripe to a connected account to view their 1099 tax form.

The copy changes slightly if the platform issues a 1099-MISC or 1099-NEC.

Email template: E-delivery follow up email

We recommend letting your connected accounts know that they should file and deliver their 1099 after you’ve filed all your 1099 tax forms. This is a proposed email template you can customize for your platform, based on the interface you’ve selected for e-delivery: Stripe Express or Connect embedded components.

Email Copy:

Hi there,

[Platform_Name] partners with Stripe to file 1099 tax forms that report your earnings or sales activity. You should have received an email from Stripe ([check domain in your communication settings]) to notify you that your 1099 tax form has been filed with the IRS and/or state tax authorities. Look for an email with the subject line, “Your [Platform_Name] 1099 tax form is ready.”

Please follow the instructions in the email to view and download your 1099 tax form. It’s not too late to agree to paperless delivery—just follow the prompts in your account to opt into paperless delivery. This will allow you to be able to view and download your 1099 tax form directly from your account.

If you have any questions, visit [https://support.stripe.com/express or https://support.stripe.com/embedded-connect/topics/1099].

FAQ

What’s a 1099 form? A 1099-NEC/1099-MISC form summarizes your earnings as an independent contractor or service provider. It’s provided to you and the IRS, as well as some US states, if you earned $600 or more in 2025.

The 1099-K form summarizes the sales activity of your account. It will be provided to you and the IRS, as well as some US states, if you processed more than $20,000 and had more than 200 transactions in 2025.

I didn’t receive an email from Stripe—what should I do? Please double check your spam or junk mail folder for an email with the subject line “Your [Platform_Name] 1099 tax form is ready” If you haven’t received this email from Stripe, please reach out to [Platform’s preferred email].