1099 Tax Reporting embedded components walkthrough

Manage 1099 Tax forms for connected accounts using embedded components.

This page outlines an example of the typical product flow that your connected accounts can encounter when you, as the platform, have implemented Connect embedded components. This is useful for you and your support teams to understand the overall user journey of your connected accounts. If you have any questions, contact Stripe Support.

Connect embedded components

You can give your connected accounts access to components for managing tax information and receiving 1099s electronically, all embedded within your platform. Integrate and configure Connect embedded components, and enable e-delivery.

Stripe can send pre-filing confirmation emails to collect tax information and paperless delivery consent directly from your connected accounts. We email your eligible connected accounts starting the week of November 3. You can select this option when you configure your tax form settings.

1099 tax reporting lifecycle

The following sections describe what the process looks like after you set up Connect embedded components and enable e-delivery.

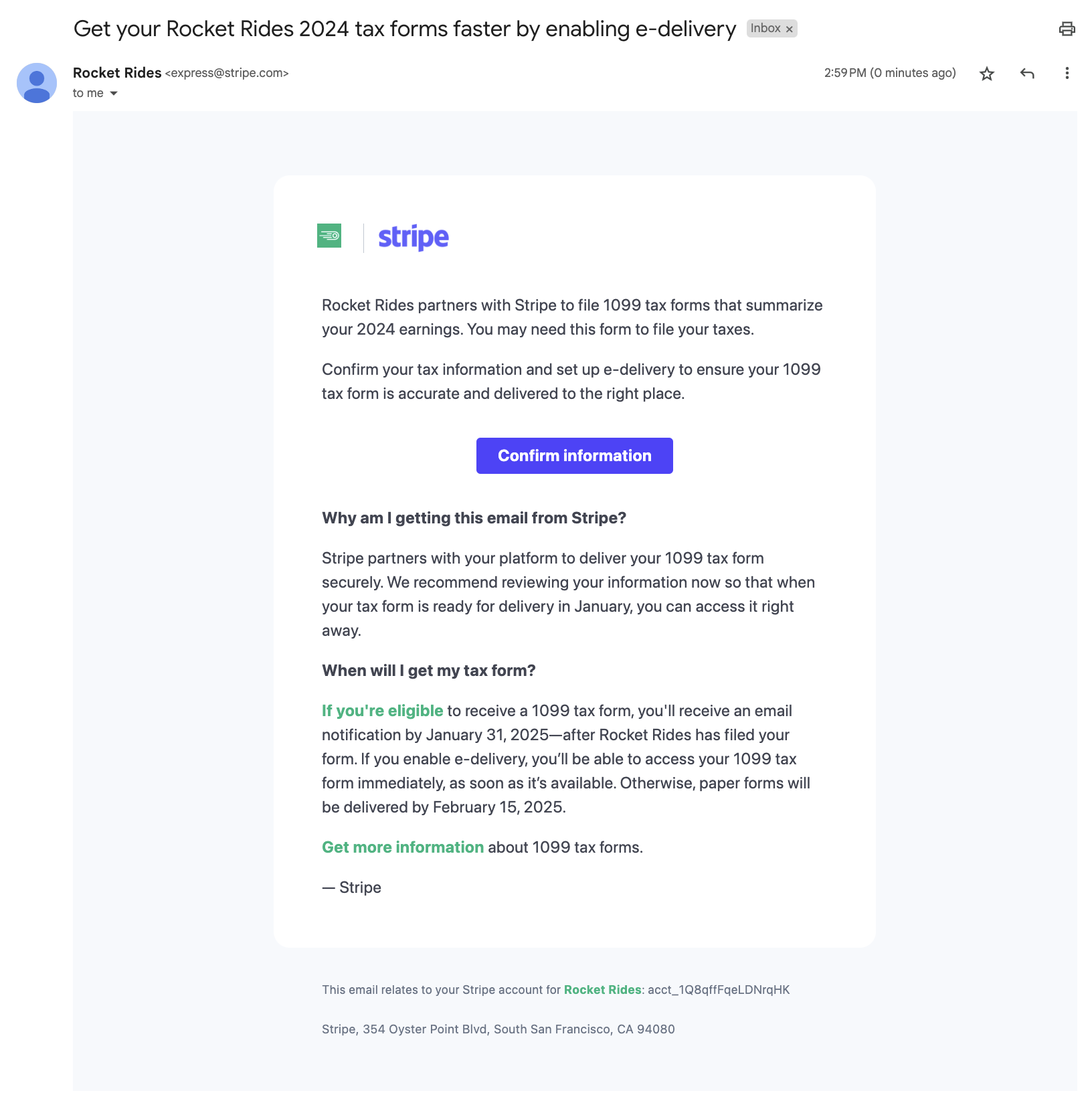

Your connected account receives a pre-filing confirmation email from Stripe

Your connected account receives an email from Stripe asking them to confirm their tax information and update their delivery preferences. The subject line reads ‘Get your [Platform_Name] 2025 tax forms faster by enabling e-delivery.’

Pre-filing confirmation email from Stripe

Your connected account is directed to your platform

During pre-filing confirmation, your connected account is directed to the Account Management embedded component, where they can confirm their account information and agree to paperless delivery of their 1099 tax form. They can also edit information other than tax information in the Account Management component.

Your accounts could get blocked if you’ve applied 1099 capabilities and the connected account updates their value to a name and TIN combination that doesn’t match against IRS records. Similarly, if Stripe is unable to complete KYC requirements on them based on the information they provided, their account payouts are blocked until they correct their information.

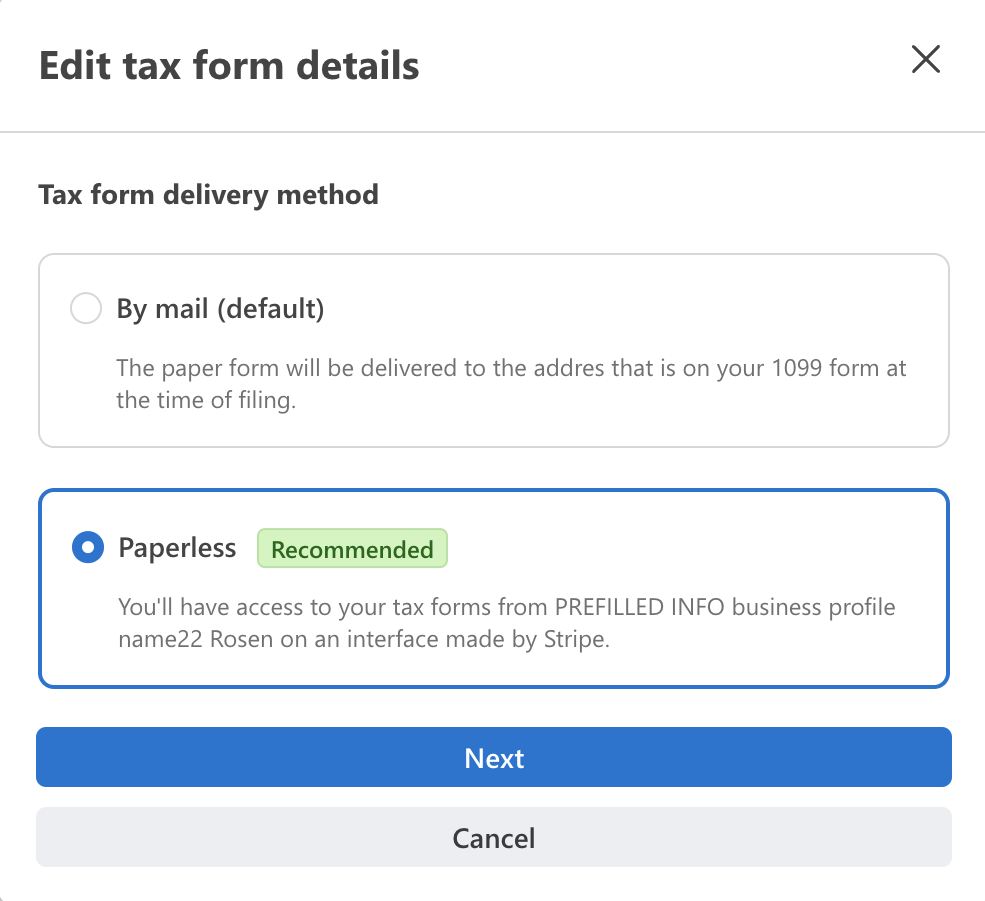

Connected account owners agree to paperless delivery

When your connected account edits their tax form delivery method, they can agree to paperless delivery.

The dialog to consent to paperless delivery of tax forms.

Currently, connected accounts can’t request a paper copy in addition to the e-delivery of the tax form.

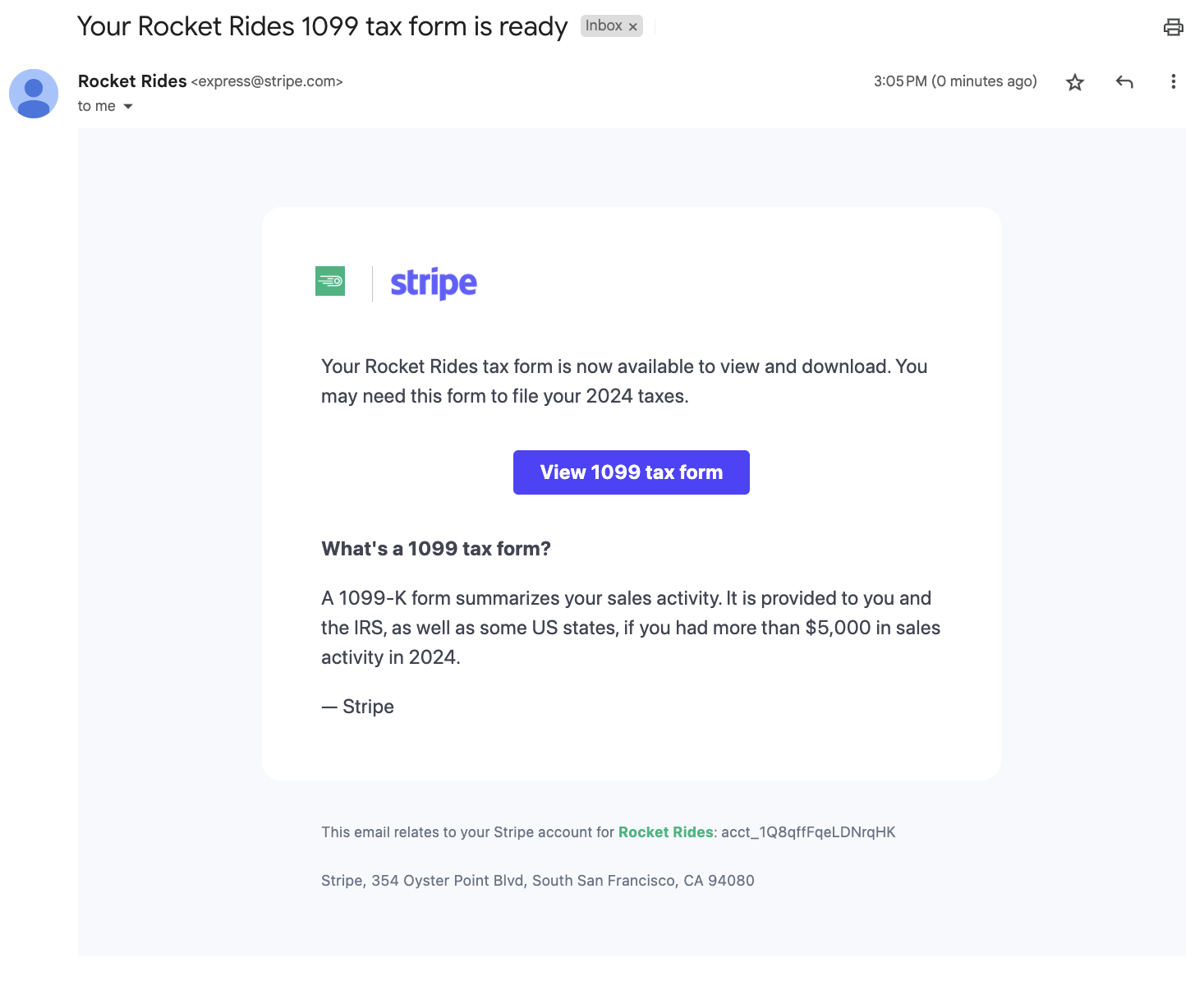

Your connected account receives the e-delivery email from Stripe

After you file 1099 tax forms in your platform’s Stripe Dashboard, your connected account receives an email from Stripe to view their tax form electronically. The subject line reads “Your [Platform_Name] 1099 tax form is ready.”

Connected accounts download their tax forms

Note

Past forms will be visible ahead of 1099 tax form filing in January 2025, and new forms will appear after they’re filed.

Your connected account can download their form after your platform makes it available through the Documents Embedded Component. Tax invoices and other documents are also available through this component.

Most connected accounts are prompted to enter the last four digits of the TIN on their 1099 tax form before being able to download a copy of the form.