Create direct charges

Create charges directly on the connected account and collect fees.

Create direct charges when customers transact directly with a connected account, often unaware of your platform’s existence. With direct charges:

- The payment appears as a charge on the connected account, not your platform’s account.

- The connected account’s balance increases with every charge.

- Your account balance increases with application fees from every charge.

This charge type is best suited for platforms providing software as a service. For example, Shopify provides tools for building online storefronts, and Thinkific enables educators to sell online courses.

Platform visibility limitations

Direct charges have limited visibility at the platform level. When you create direct charges:

- Transaction objects such as

PaymentIntentsandChargesexist on the connected account, not on the platform. - To access direct charge data, you must query the Stripe API using the connected account ID in the Stripe-Account header.

This scoping behavior affects data synchronization services like Fivetran, as well as other third-party integrations that rely on platform-level API queries. To retrieve direct charge data, they must query the connected account, not the platform.

Note

We recommend using direct charges for connected accounts that have access to the full Stripe Dashboard.

Integrate Stripe’s prebuilt payment UI into the checkout of your iOS app with the PaymentSheet class. See our sample integration on GitHub.

Set up StripeServer-sideClient-side

First, you need a Stripe account. Register now.

Server-side

This integration requires endpoints on your server that talk to the Stripe API. Use our official libraries for access to the Stripe API from your server:

Client-side

The Stripe iOS SDK is open source, fully documented, and compatible with apps supporting iOS 13 or above.

Note

For details on the latest SDK release and past versions, see the Releases page on GitHub. To receive notifications when a new release is published, watch releases for the repository.

Configure the SDK with your Stripe publishable key on app start. This enables your app to make requests to the Stripe API.

Add an endpointServer-side

Note

To display the PaymentSheet before you create a PaymentIntent, see Collect payment details before creating an Intent.

This integration uses three Stripe API objects:

PaymentIntent: Stripe uses this to represent your intent to collect payment from a customer, tracking your charge attempts and payment state changes throughout the process.

(Optional) Customer: To set up a payment method for future payments, you must attach it to a Customer. Create a Customer object when your customer creates an account with your business. If your customer is making a payment as a guest, you can create a Customer object before payment and associate it with your own internal representation of the customer’s account later.

(Optional) Customer Ephemeral Key: Information on the Customer object is sensitive, and can’t be retrieved directly from an app. An Ephemeral Key grants the SDK temporary access to the Customer.

Note

If you never save cards to a Customer and don’t allow returning Customers to reuse saved cards, you can omit the Customer and Customer Ephemeral Key objects from your integration.

For security reasons, your app can’t create these objects. Instead, add an endpoint on your server that:

- Retrieves the Customer, or creates a new one.

- Creates an Ephemeral Key for the Customer.

- Creates a PaymentIntent with the amount, currency, and customer. You can also optionally include the

automatic_parameter. Stripe enables its functionality by default in the latest version of the API.payment_ methods - Returns the Payment Intent’s client secret, the Ephemeral Key’s

secret, the Customer’s id, and your publishable key to your app.

The payment methods shown to customers during the checkout process are also included on the PaymentIntent. You can let Stripe pull payment methods from your Dashboard settings or you can list them manually. Regardless of the option you choose, know that the currency passed in the PaymentIntent filters the payment methods shown to the customer. For example, if you pass eur on the PaymentIntent and have OXXO enabled in the Dashboard, OXXO won’t be shown to the customer because OXXO doesn’t support eur payments.

Unless your integration requires a code-based option for offering payment methods, Stripe recommends the automated option. This is because Stripe evaluates the currency, payment method restrictions, and other parameters to determine the list of supported payment methods. Payment methods that increase conversion and that are most relevant to the currency and customer’s location are prioritized.

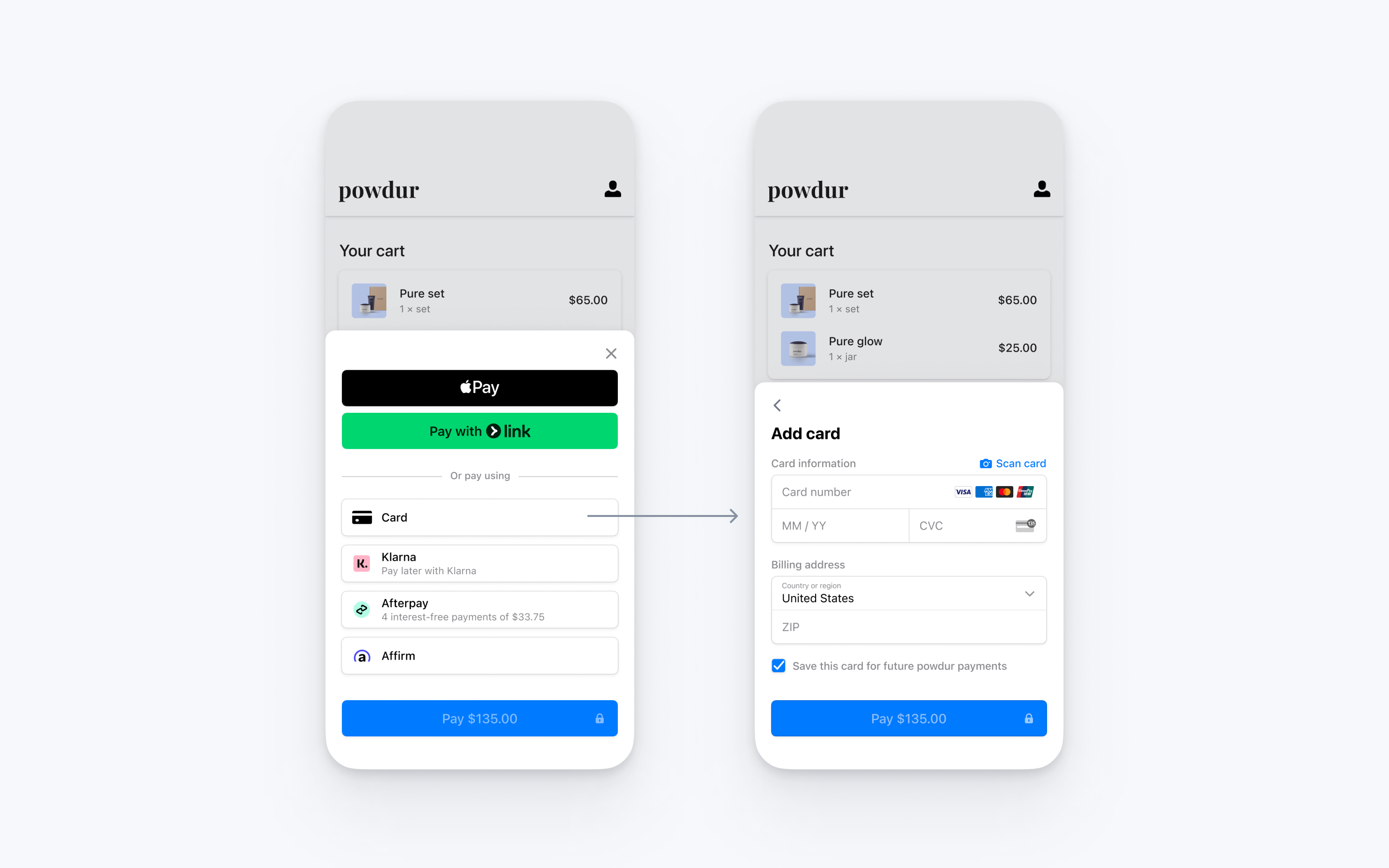

Integrate the payment sheetClient-side

To display the mobile Payment Element on your checkout screen, make sure you:

- Display the products the customer is purchasing along with the total amount

- Use the Address Element to collect any required shipping information from the customer

- Add a checkout button to display Stripe’s UI

If PaymentSheetResult is ., inform the user (for example, by displaying an order confirmation screen).

Setting allowsDelayedPaymentMethods to true allows delayed notification payment methods like US bank accounts. For these payment methods, the final payment status isn’t known when the PaymentSheet completes, and instead succeeds or fails later. If you support these types of payment methods, inform the customer their order is confirmed and only fulfill their order (for example, ship their product) when the payment is successful.

Set up a return URLClient-side

The customer might navigate away from your app to authenticate (for example, in Safari or their banking app). To allow them to automatically return to your app after authenticating, configure a custom URL scheme and set up your app delegate to forward the URL to the SDK. Stripe doesn’t support universal links.

Handle post-payment eventsServer-side

Stripe sends a payment_intent.succeeded event when the payment completes. Use the Dashboard webhook tool or follow the webhook guide to receive these events and run actions, such as sending an order confirmation email to your customer, logging the sale in a database, or starting a shipping workflow.

Listen for these events rather than waiting on a callback from the client. On the client, the customer could close the browser window or quit the app before the callback executes, and malicious clients could manipulate the response. Setting up your integration to listen for asynchronous events is what enables you to accept different types of payment methods with a single integration.

In addition to handling the payment_ event, we recommend handling these other events when collecting payments with the Payment Element:

| Event | Description | Action |

|---|---|---|

| payment_intent.succeeded | Sent when a customer successfully completes a payment. | Send the customer an order confirmation and fulfill their order. |

| payment_intent.processing | Sent when a customer successfully initiates a payment, but the payment has yet to complete. This event is most commonly sent when the customer initiates a bank debit. It’s followed by either a payment_ or payment_ event in the future. | Send the customer an order confirmation that indicates their payment is pending. For digital goods, you might want to fulfill the order before waiting for payment to complete. |

| payment_intent.payment_failed | Sent when a customer attempts a payment, but the payment fails. | If a payment transitions from processing to payment_, offer the customer another attempt to pay. |

Test the integration

See Testing for additional information to test your integration.

OptionalEnable Apple Pay

Note

If your checkout screen has a dedicated Apple Pay button, follow the Apple Pay guide and use ApplePayContext to collect payment from your Apple Pay button. You can use PaymentSheet to handle other payment method types.

Register for an Apple Merchant ID

Obtain an Apple Merchant ID by registering for a new identifier on the Apple Developer website.

Fill out the form with a description and identifier. Your description is for your own records and you can modify it in the future. Stripe recommends using the name of your app as the identifier (for example, merchant.).

Create a new Apple Pay certificate

Create a certificate for your app to encrypt payment data.

Go to the iOS Certificate Settings in the Dashboard, click Add new application, and follow the guide.

Download a Certificate Signing Request (CSR) file to get a secure certificate from Apple that allows you to use Apple Pay.

One CSR file must be used to issue exactly one certificate. If you switch your Apple Merchant ID, you must go to the iOS Certificate Settings in the Dashboard to obtain a new CSR and certificate.

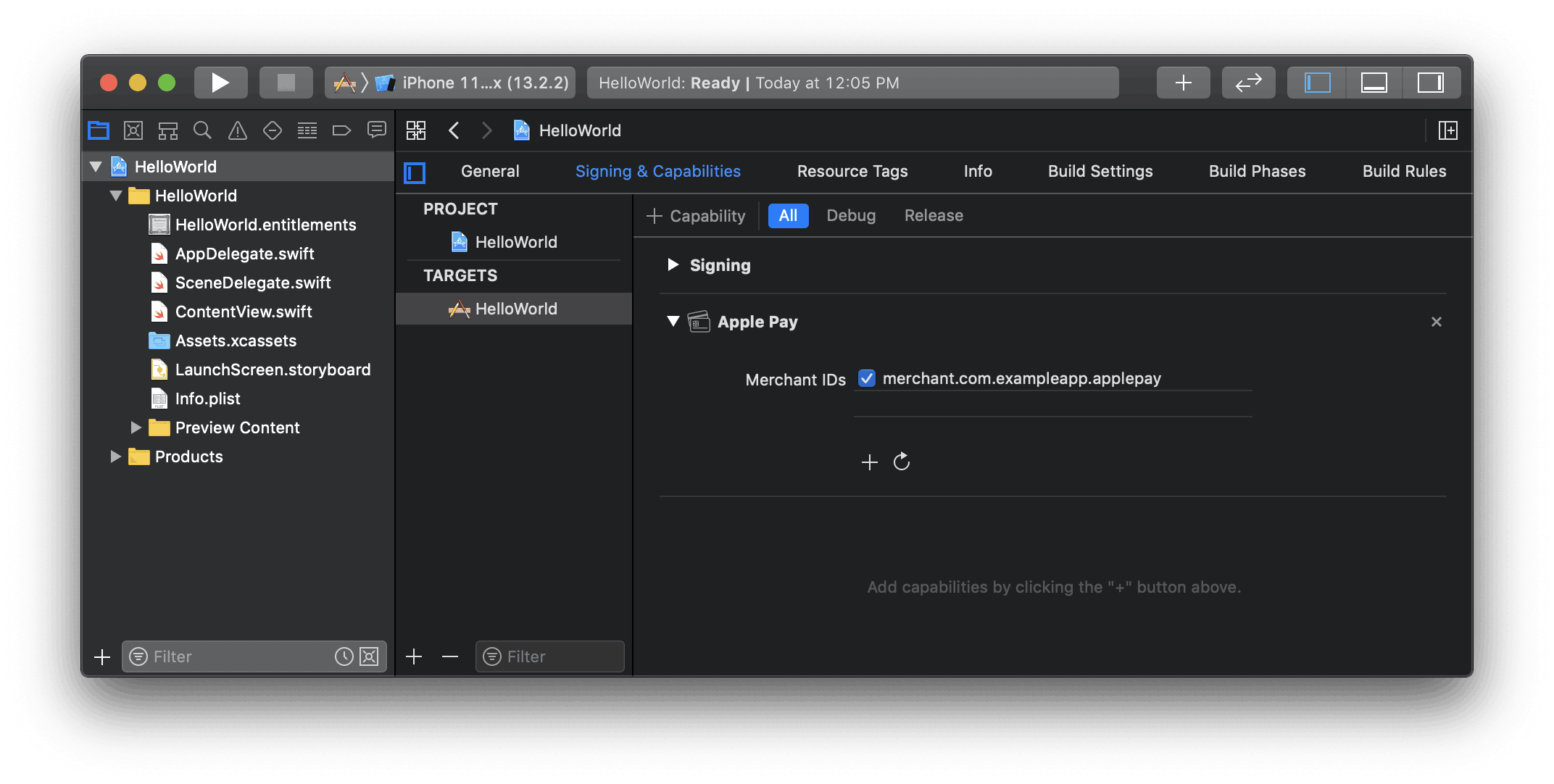

Integrate with Xcode

Add the Apple Pay capability to your app. In Xcode, open your project settings, click the Signing & Capabilities tab, and add the Apple Pay capability. You might be prompted to log in to your developer account at this point. Select the merchant ID you created earlier, and your app is ready to accept Apple Pay.

Enable the Apple Pay capability in Xcode

Add Apple Pay

Order tracking

To add order tracking information in iOS 16 or later, configure an authorizationResultHandler in your PaymentSheet.. Stripe calls your implementation after the payment is complete, but before iOS dismisses the Apple Pay sheet.

In your authorizationResultHandler implementation, fetch the order details from your server for the completed order. Add the details to the provided PKPaymentAuthorizationResult and call the provided completion handler.

To learn more about order tracking, see Apple’s Wallet Orders documentation.

let customHandlers = PaymentSheet.ApplePayConfiguration.Handlers( authorizationResultHandler: { result, completion in // Fetch the order details from your service MyAPIClient.shared.fetchOrderDetails(orderID: orderID) { myOrderDetails result.orderDetails = PKPaymentOrderDetails( orderTypeIdentifier: myOrderDetails.orderTypeIdentifier, // "com.myapp.order" orderIdentifier: myOrderDetails.orderIdentifier, // "ABC123-AAAA-1111" webServiceURL: myOrderDetails.webServiceURL, // "https://my-backend.example.com/apple-order-tracking-backend" authenticationToken: myOrderDetails.authenticationToken) // "abc123" // Call the completion block on the main queue with your modified PKPaymentAuthorizationResult completion(result) } } ) var configuration = PaymentSheet.Configuration() configuration.applePay = .init(merchantId: "merchant.com.your_app_name", merchantCountryCode: "US", customHandlers: customHandlers)

OptionalEnable card scanning

To enable card scanning support, set the NSCameraUsageDescription (Privacy - Camera Usage Description) in the Info.plist of your application, and provide a reason for accessing the camera (for example, “To scan cards”). Devices with iOS 13 or higher support card scanning.

OptionalCustomize the sheet

All customization is configured through the PaymentSheet.Configuration object.

Appearance

Customize colors, fonts, and so on to match the look and feel of your app by using the appearance API.

Payment method layout

Configure the layout of payment methods in the sheet using paymentMethodLayout. You can display them horizontally, vertically, or let Stripe optimize the layout automatically.

var configuration = PaymentSheet.Configuration() configuration.paymentMethodLayout = .automatic

Collect users addresses

Collect local and international shipping or billing addresses from your customers using the Address Element.

Merchant display name

Specify a customer-facing business name by setting merchantDisplayName. By default, this is your app’s name.

var configuration = PaymentSheet.Configuration() configuration.merchantDisplayName = "My app, Inc."

Dark mode

PaymentSheet automatically adapts to the user’s system-wide appearance settings (light and dark mode). If your app doesn’t support dark mode, you can set style to alwaysLight or alwaysDark mode.

var configuration = PaymentSheet.Configuration() configuration.style = .alwaysLight

Default billing details

To set default values for billing details collected in the payment sheet, configure the defaultBillingDetails property. The PaymentSheet pre-populates its fields with the values that you provide.

var configuration = PaymentSheet.Configuration() configuration.defaultBillingDetails.address.country = "US" configuration.defaultBillingDetails.email = "foo@bar.com"

Billing details collection

Use billingDetailsCollectionConfiguration to specify how you want to collect billing details in the payment sheet.

You can collect your customer’s name, email, phone number, and address.

If you only want to billing details required by the payment method, set billingDetailsCollectionConfiguration. to true. In that case, the PaymentSheet. are set as the payment method’s billing details.

If you want to collect additional billing details that aren’t necessarily required by the payment method, set billingDetailsCollectionConfiguration. to false. In that case, the billing details collected through the PaymentSheet are set as the payment method’s billing details.

var configuration = PaymentSheet.Configuration() configuration.defaultBillingDetails.email = "foo@bar.com" configuration.billingDetailsCollectionConfiguration.name = .always configuration.billingDetailsCollectionConfiguration.email = .never configuration.billingDetailsCollectionConfiguration.address = .full configuration.billingDetailsCollectionConfiguration.attachDefaultsToPaymentMethod = true

Note

Consult with your legal counsel regarding laws that apply to collecting information. Only collect phone numbers if you need them for the transaction.

OptionalComplete payment in your UI

You can present the Payment Sheet to only collect payment method details and then later call a confirm method to complete payment in your app’s UI. This is useful if you have a custom buy button or require additional steps after you collect payment details.

Complete the payment in your app’s UI

If PaymentSheetResult is ., inform the user (for example, by displaying an order confirmation screen).

Setting allowsDelayedPaymentMethods to true allows delayed notification payment methods like US bank accounts. For these payment methods, the final payment status isn’t known when the PaymentSheet completes, and instead succeeds or fails later. If you support these types of payment methods, inform the customer their order is confirmed and only fulfill their order (for example, ship their product) when the payment is successful.

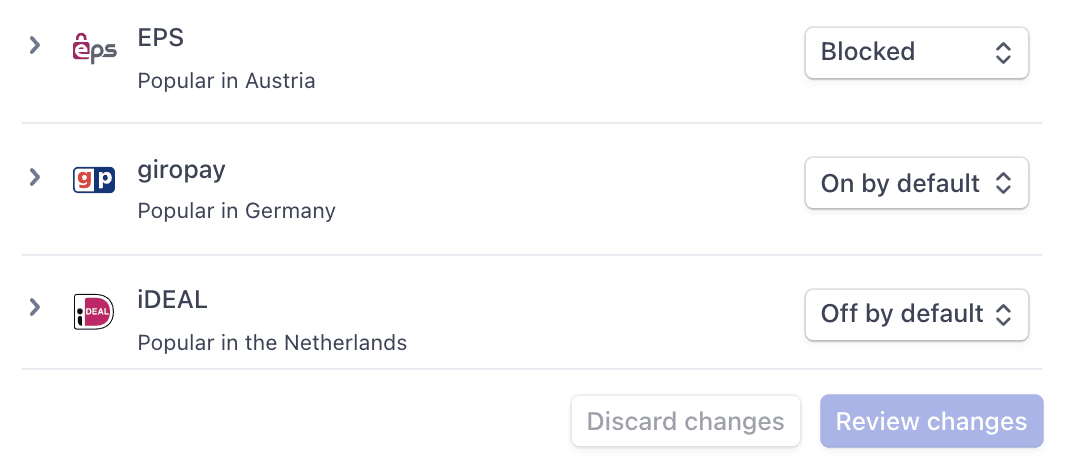

OptionalEnable additional payment methods

Navigate to Manage payment methods for your connected accounts in the Dashboard to configure which payment methods your connected accounts accept. Changes to default settings apply to all new and existing connected accounts.

Consult the following resources for payment method information:

- A guide to payment methods to help you choose the correct payment methods for your platform.

- Account capabilities to make sure your chosen payment methods work for your connected accounts.

- Payment method and product support tables to make sure your chosen payment methods work for your Stripe products and payments flows.

For each payment method, you can select one of the following dropdown options:

| On by default | Your connected accounts accept this payment method during checkout. Some payment methods can only be off or blocked. This is because your connected accounts with access to the Stripe Dashboard must activate them in their settings page. |

| Off by default | Your connected accounts don’t accept this payment method during checkout. If you allow your connected accounts with access to the Stripe Dashboard to manage their own payment methods, they have the ability to turn it on. |

| Blocked | Your connected accounts don’t accept this payment method during checkout. If you allow your connected accounts with access to the Stripe Dashboard to manage their own payment methods, they don’t have the option to turn it on. |

Payment method options

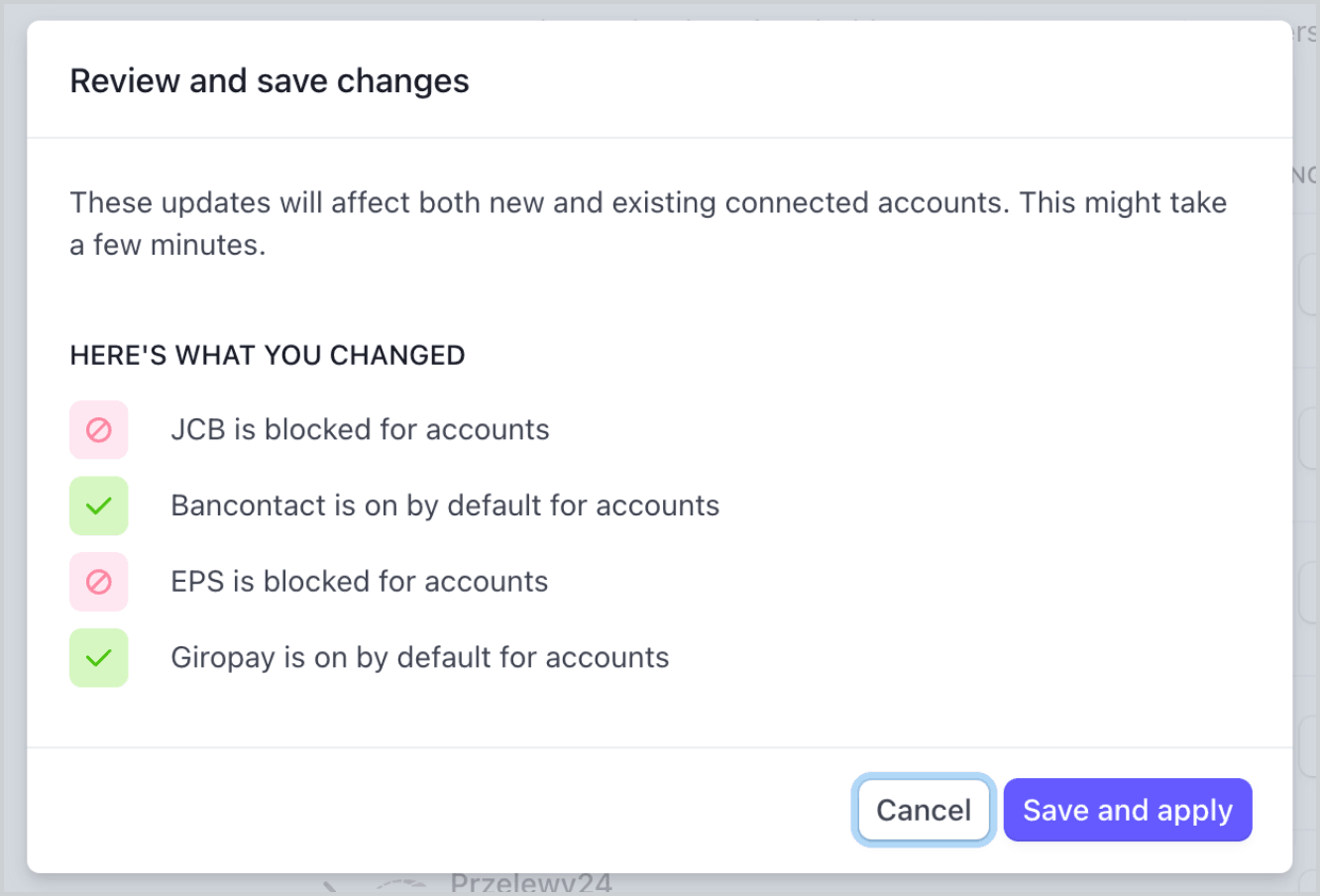

If you make a change to a payment method, you must click Review changes in the bottom bar of your screen and Save and apply to update your connected accounts.

Save dialog

Allow connected accounts to manage payment methods

Stripe recommends allowing your connected accounts to customize their own payment methods. This option allows each connected account with access to the Stripe Dashboard to view and update their Payment methods page. Only owners of the connected accounts can customize their payment methods. The Stripe Dashboard displays the set of payment method defaults you applied to all new and existing connected accounts. Your connected accounts can override these defaults, excluding payment methods you have blocked.

Check the Account customization checkbox to enable this option. You must click Review changes in the bottom bar of your screen and then select Save and apply to update this setting.

Account customization checkbox

Payment method capabilities

To allow your connected accounts to accept additional payment methods, you must make sure their connected accounts have active capabilities for each payment method. Most payment methods have the same verification requirements as the card_ capability, with some restrictions and exceptions. The payment method capabilities table lists the payment methods that require additional verification over cards.

Collect fees

When a payment is processed, your platform can take a portion of the transaction in the form of application fees. You can set application fee pricing in two ways:

- Use the Platform Pricing Tool to set and test pricing rules. This no-code feature in the Stripe Dashboard is currently only available for platforms responsible for paying Stripe fees.

- Set your pricing rules in-house, specifying application fees directly in a PaymentIntent. Fees set with this method override the pricing logic specified in the Platform Pricing Tool.

Your platform can take an application fee with the following limitations:

- The value of

application_must be positive and less than the amount of the charge. The application fee collected is capped at the captured amount of the charge.fee_ amount - There are no additional Stripe fees on the application fee itself.

- In line with Brazilian regulatory and compliance requirements, platforms based outside of Brazil, with Brazilian connected accounts can’t collect application fees through Stripe.

- The currency of

application_depends upon a few multiple currency factors.fee_ amount

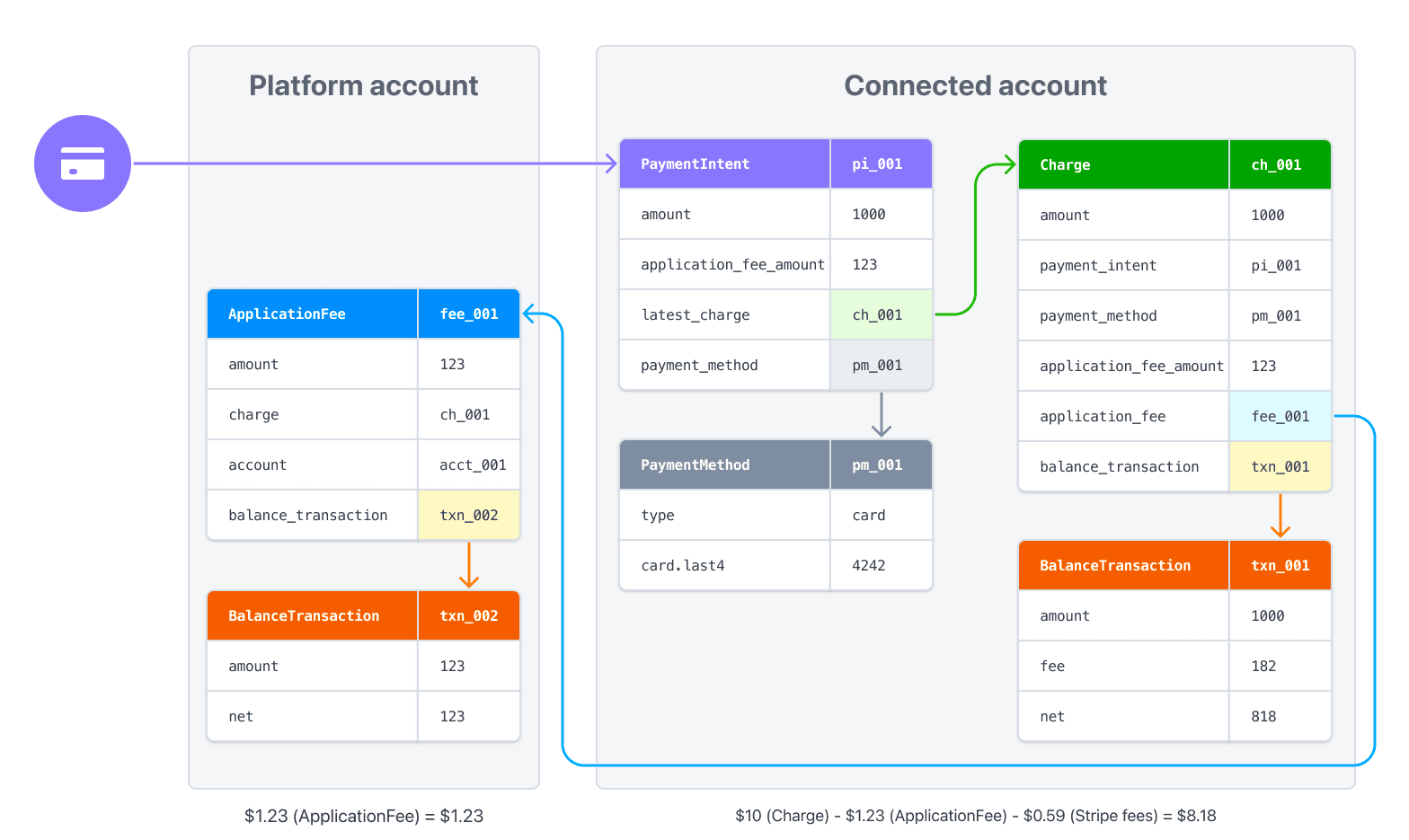

The resulting charge’s balance transaction includes a detailed fee breakdown of both the Stripe and application fees. To provide a better reporting experience, an Application Fee is created after the fee is collected. Use the amount property on the application fee object for reporting. You can then access these objects with the Application Fees endpoint.

Earned application fees are added to your available account balance on the same schedule as funds from regular Stripe charges. Application fees are viewable in the Collected fees section of the Dashboard.

Caution

Application fees for direct charges are created asynchronously by default. If you expand the application_ object in a charge creation request, the application fee is created synchronously as part of that request. Only expand the application_ object if you must, because it increases the latency of the request.

To access the application fee objects for application fees that are created asynchronously, listen for the application_fee.created webhook event.

Flow of funds with fees

When you specify an application fee on a charge, the fee amount is transferred to your platform’s Stripe account. When processing a charge directly on the connected account, the charge amount—less the Stripe fees and application fee—is deposited into the connected account.

For example, if you make a charge of 10 USD with a 1.23 USD application fee (like in the previous example), 1.23 USD is transferred to your platform account. 8.18 USD (10 USD - 0.59 USD - 1.23 USD) is netted in the connected account (assuming standard US Stripe fees).

If you process payments in multiple currencies, read how currencies are handled in Connect.

Issue refunds

Just as platforms can create charges on connected accounts, they can also create refunds of charges on connected accounts. Create a refund using your platform’s secret key while authenticated as the connected account.

Application fees are not automatically refunded when issuing a refund. Your platform must explicitly refund the application fee or the connected account—the account on which the charge was created—loses that amount. You can refund an application fee by passing a refund_ value of true in the refund request:

By default, the entire charge is refunded, but you can create a partial refund by setting an amount value as a positive integer. If the refund results in the entire charge being refunded, the entire application fee is refunded. Otherwise, a proportional amount of the application fee is refunded. Alternatively, you can provide a refund_ value of false and refund the application fee separately.

Connect embedded components

Connect embedded components support direct charges. By using the payments embedded component, you can let your connected accounts view payment information, capture charges, and manage disputes from within your site.

The following components display information for direct charges:

Payments component: Displays all of an account’s payments and disputes.

Payments details: Displays information for a specific payment.

Disputes list component: Displays all of an account’s disputes.

Disputes for a payment component: Displays the disputes for a single specified payment. You can use it to include dispute management functionality on a page with your payments UI.