Save details for future payments with New Zealand BECS Direct Debits

Learn how to save payment method details for future New Zealand bank account debit payments.

You can use the Setup Intents API to collect payment method details in advance, with the final amount or payment date determined later. This is useful for:

- Saving payment methods to a wallet to streamline future purchases

- Collecting surcharges after fulfilling a service

- Starting a free trial for a subscription

Set up StripeServer-side

First, you need a Stripe account. Register now.

Use our official libraries for access to the Stripe API from your application:

Create or retrieve a CustomerServer-side

To reuse a bank account for future payments, attach it to a Customer.

Create a Customer object when your customer creates an account with your business. Associating the ID of the Customer object with your own internal representation of a customer enables you to retrieve and use the stored payment method details later. If your customer hasn’t created an account, you can still create a Customer object now and associate it with your internal representation of the customer’s account later.

Create a new Customer or retrieve an existing Customer to associate with these payment details. Include the following code on your server to create a new Customer.

Create a SetupIntentServer-side

A SetupIntent is an object that represents your intent to set up a customer’s payment method for future payments. The SetupIntent tracks the steps of this set-up process.

Create a SetupIntent on your server with payment_method_types set to nz_ and specify the Customer’s id.

Retrieve the client secret

The SetupIntent includes a client secret that the client side uses to securely complete the payment process. You can use different approaches to pass the client secret to the client side.

Collect payment method details and mandate acknowledgementClient-side

Set up Stripe Elements

Include the Stripe.js script on your checkout page by adding it to the head of your HTML file. Always load Stripe.js directly from js.stripe.com. Don’t include the script in a bundle or host a copy of it yourself.

<head> <title>Checkout</title> <script src="https://js.stripe.com/clover/stripe.js"></script> </head>

Create an instance of the Stripe object by providing your publishable API key:

// Set your publishable key: remember to change this to your live publishable key in production // See your keys here: https://dashboard.stripe.com/apikeys const stripe = Stripe();'pk_test_TYooMQauvdEDq54NiTphI7jx'

Add the Payment Element to your checkout page

On your checkout page, create an empty DOM node with a unique ID for the Payment Element to render into.

<form id="payment-form"> <h3>Payment</h3> <div id="payment-element"></div> <button id="submit">Submit</button> </form>

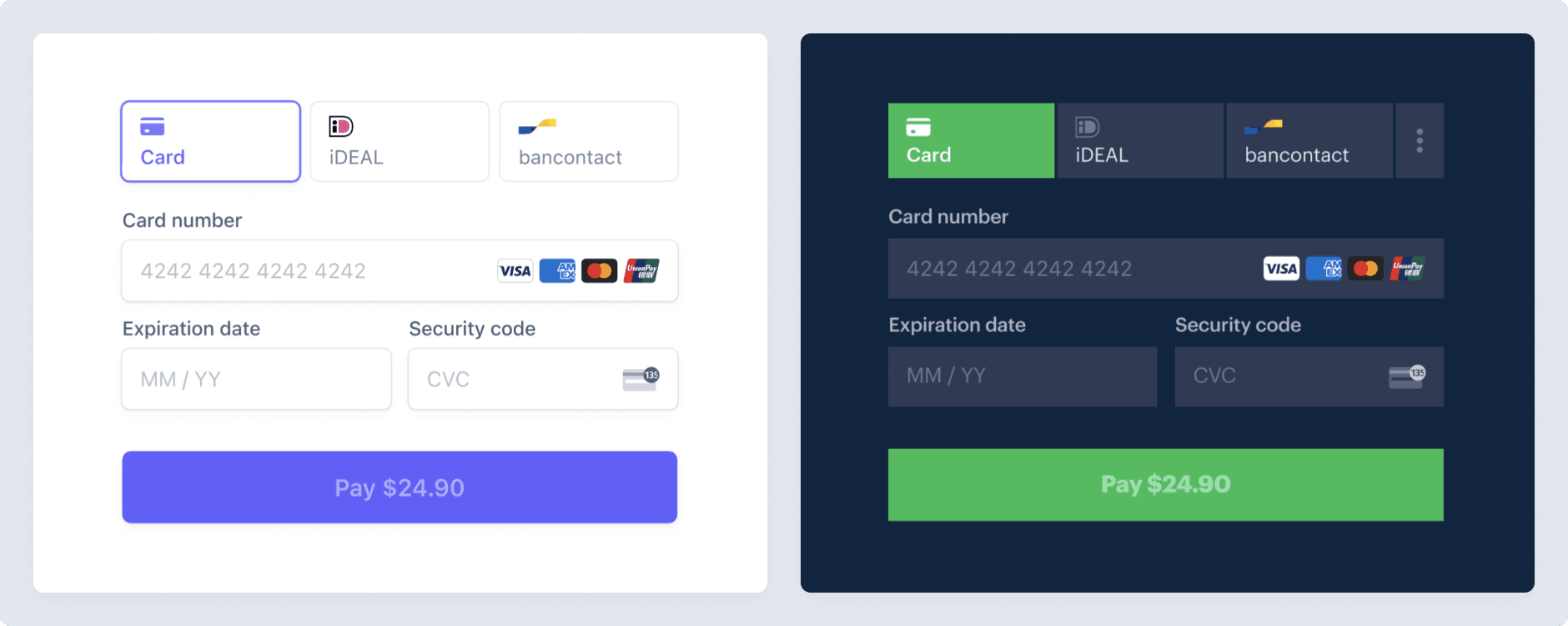

When the form above finishes loading, create a new Elements group, passing the client secret from the previous step as configuration. You can also pass in the appearance option, customising the Elements to match the design of your site.

Then, create an instance of the Payment Element and mount it to its corresponding DOM node:

// Customize the appearance of Elements using the Appearance API. const appearance = { /* ... */ }; // Create an elements group from the Stripe instance, passing the clientSecret (obtained in step 2) and appearance (optional). const elements = stripe.elements({clientSecret, appearance}); // Create Payment Element instance. const paymentElement = elements.create("payment"); // Mount the Payment Element to its corresponding DOM node. paymentElement.mount("#payment-element");

The Payment Element renders a dynamic form that allows your customer to pick a payment method type. The form automatically collects all necessary payments details for the payment method type that they select. For New Zealand BECS Diret Debit payments, that includes the customer’s name, email address, and bank account number.

Mandate acknowledgement

The Payment Element also displays the New Zealand BECS Direct Debit Service Terms and Conditions to your customer and collects their agreement with those terms. You’re not required to do anything else.

If you don’t use the Payment Element, you must separately display these terms and conditions to your customer and confirm their acceptance.

Note

By providing your bank account details and confirming this payment, you authorise Stripe New Zealand Limited (authorisation code 3143978), to debit your account with the amounts of direct debits payable to Rocket Rides (“we”, “us” or “Merchant”) in accordance with this authority.

You agree that this authority is subject to:

- your bank’s terms and conditions that relate to your account, and

- the Direct Debit Service Terms and Conditions

You certify that you are either the sole account holder on the bank account listed above or that you are an authorised signatory on, and have authority to operate, this bank account severally.

We will send you an email confirmation no later than 5 business days after your confirmation of this Direct Debit Authority.

If we request you to do so, you must promptly provide Stripe with a record of the mandates.

OptionalCustomize the appearanceClient-side

Now that you’ve added these Elements to your page, you can customize everything about their appearance to make them fit with the design of the rest of your page:

Submit the payment method details to StripeClient-side

Use stripe.confirmSetup to collect bank account details, create a PaymentMethod, and attach that PaymentMethod to the SetupIntent.

For some other payment method types, your customer might be first redirected to an intermediate site, like a bank authorisation page, before being redirected to the return_. Provide a return_url to this function to indicate where Stripe should redirect the customer after they complete the payment.

Since New Zealand BECS Direct Debits don’t require a redirect, you can also set redirect to if_ in place of providing a return_. A return_ will only be required if you add another redirect-based payment method later.

confirmationForm.addEventListener('submit', (ev) => { ev.preventDefault(); stripe.confirmSetup({elements, redirect: "if_required"}) .then(({setupIntent, error}) => { if (error) { console.error(error.message); // The confirmation failed for some reason. } else if (setupIntent.status === "requires_payment_method") { // Confirmation failed. Attempt again with a different payment method. } else if (setupIntent.status === "succeeded") { // Confirmation succeeded! The account is now saved. // Display a message to the customer. } }); });

If successful, Stripe returns a SetupIntent object with the status succeeded. The attached PaymentMethod is now ready to be used for future payments.

Customer notification emails

You must send an email confirmation of the mandate and collected bank account details to your customer after successfully confirming the SetupIntent.

In addition, for every payment collected, you must send your customer an email notification of the debit date and amount at latest on the day the debit takes place.

Stripe handles sending these emails for you by default, but you can choose to send custom notifications.

Accepting future paymentsServer-side

When the SetupIntent succeeds, it creates a new PaymentMethod attached to a Customer. You can use these to initiate future payments without having to prompt the customer for their bank account a second time.