Accept in-app payments

Build a customized payments integration in your iOS, Android, or React Native app using the Payment Element.

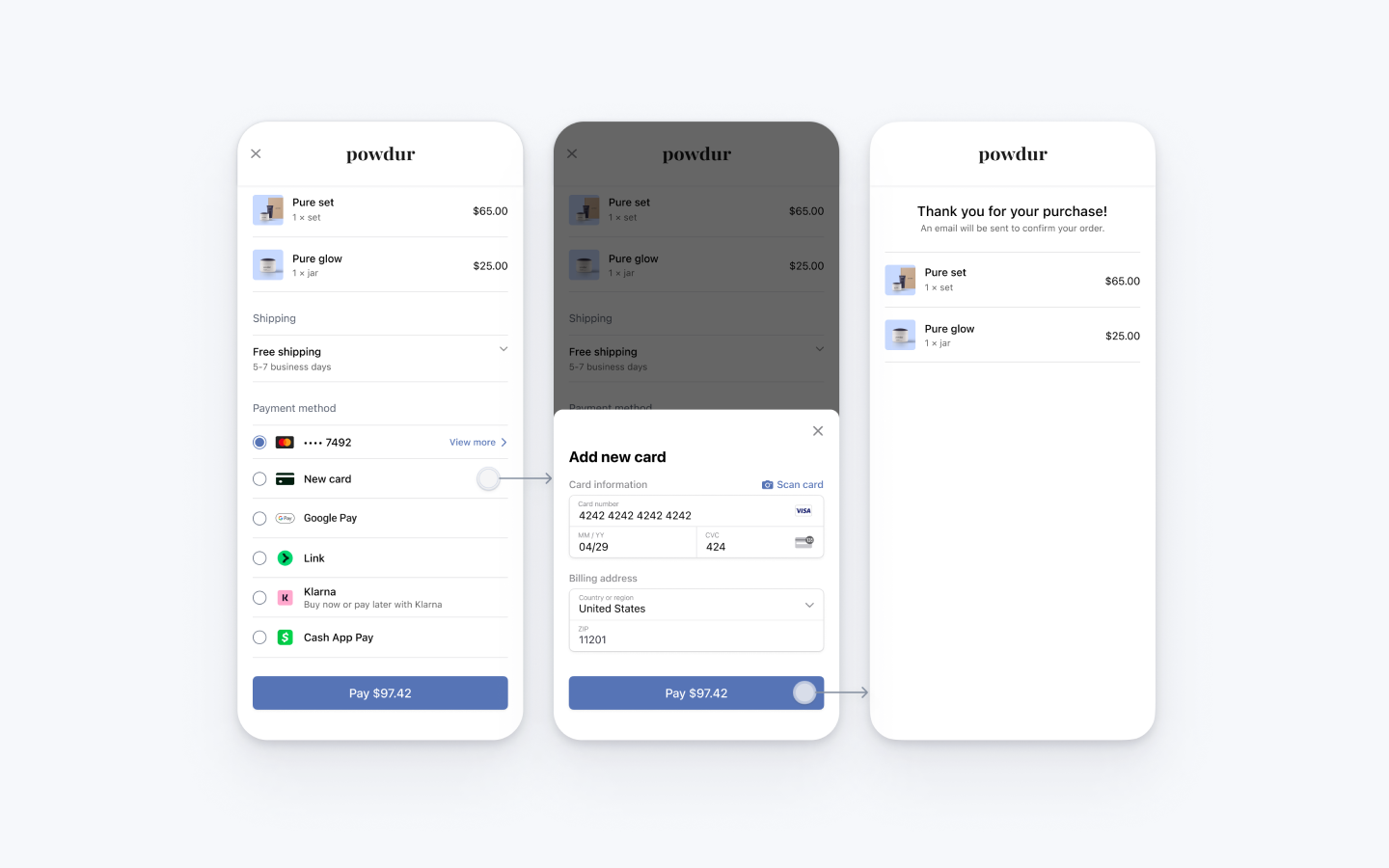

The Payment Element is a customizable component that renders a list of payment methods that you can add into any screen in your app. When customers interact with payment methods in the list, the component opens individual bottom sheets to collect payment details.

The Payment Element allows you to accept multiple payment methods using a single integration. In this integration, you build a custom payment flow where you render the Payment Element, create the PaymentIntent, and confirm the payment in your app.

Set up StripeServer-sideClient-side

First, you need a Stripe account. Register now.

Server-side

This integration requires endpoints on your server that talk to the Stripe API. Use the official libraries for access to the Stripe API from your server:

Client-side

The Stripe Android SDK is open source and fully documented.

To install the SDK, add stripe-android to the dependencies block of your app/build.gradle file:

Note

For details on the latest SDK release and past versions, see the Releases page on GitHub. To receive notifications when a new release is published, watch releases for the repository.

You also need to set your publishable key so that the SDK can make API calls to Stripe. To get started quickly, you can hardcode this on the client while you’re integrating, but fetch the publishable key from your server in production.

// Set your publishable key: remember to change this to your live publishable key in production // See your keys here: https://dashboard.stripe.com/apikeys PaymentConfiguration.init(context, publishableKey =)"pk_test_TYooMQauvdEDq54NiTphI7jx"

Enable payment methods

View your payment methods settings and enable the payment methods you want to support. You need at least one payment method enabled to create a PaymentIntent.

By default, Stripe enables cards and other prevalent payment methods that can help you reach more customers, but we recommend turning on additional payment methods that are relevant for your business and customers. See Payment method support for product and payment method support, and our pricing page for fees.

Collect payment detailsClient-side

The Embedded Mobile Payment Element is designed for use on the checkout page of your native mobile app. The element displays a list of payment methods, and you can customize it to match your app’s look and feel.

When the customer taps the Card row, a sheet opens where they can enter their payment method details. The button in the sheet says Continue by default and dismisses the sheet when tapped, which lets your customer finish payment in your checkout.

Alternatively, you can configure the button to immediately complete payment instead of continuing. To do so, complete this step after following the guide.

Initialize the Embedded Payment Element

Configure the Embedded Payment Element

The Builder object contains callbacks necessary for instantiating EmbeddedPaymentElement, including the CreateIntentCallback. For now, leave its implementation empty.

After instantiating, call configure with an EmbeddedPaymentElement. and PaymentSheet.. The Configuration object contains general configuration options for EmbeddedPaymentElement that don’t change between payments. The IntentConfiguration object contains details about the specific payment, such as the amount and currency.

import com.stripe.android.paymentsheet.PaymentSheet @Composable fun CheckoutScreen() { val embeddedBuilder = .... val embeddedPaymentElement = rememberEmbeddedPaymentElement(embeddedBuilder) LaunchedEffect(embeddedPaymentElement) { embeddedPaymentElement.configure( intentConfiguration = PaymentSheet.IntentConfiguration( mode = PaymentSheet.IntentConfiguration.Mode.Payment( amount = 1099, currency = "USD", ), // Optional intent configuration options... ), configuration = EmbeddedPaymentElement.Configuration.Builder("Powdur").build() ) } }

Add the Embedded Payment Element view

After the EmbeddedPaymentElement has successfully initialized, put its @Composable Content in your checkout UI.

Note

The content must be in a scrollable container, because its height can change after it’s initially rendered.

@Composable fun CheckoutScreen() { val embeddedBuilder = .... val embeddedPaymentElement = rememberEmbeddedPaymentElement(embeddedBuilder) ..... val scrollState = rememberScrollState() Column( modifier = Modifier .fillMaxSize() .verticalScroll(scrollState) .padding(16.dp) ) { embeddedPaymentElement.Content() } }

At this point, you can run your app and see the Embedded Mobile Payment Element.

Optional Update payment details

If a customer changes the payment details (for example, by applying a discount code), update the EmbeddedPaymentElement instance. When you call the configure method again, the new values synchronize and display in the UI.

Note

Some payment methods, like Google Pay, show the amount in the UI. If a customer changes the payment and you don’t update the EmbeddedPaymentElement, the UI displays incorrect values.

When the configure call completes, the @Composable Content and the paymentOption automatically update with the new values provided to the configure call.

val intentConfiguration = PaymentSheet.IntentConfiguration( // Update the amount to reflect the price after applying the discount code mode = PaymentSheet.IntentConfiguration.Mode.Payment( amount = 999, currency = "USD", ), ) val configuration = EmbeddedPaymentElement.Configuration.Builder("Powdur") .build() LaunchedEffect(embeddedPaymentElement) { embeddedPaymentElement.configure( intentConfiguration = intentConfiguration, configuration = configuration, ) }

Optional Display the selected payment option

You can display payment option details (such as the last 4 digits, a card logo, or billing information) by accessing the observable Flow property in the Embedded Payment Element’s paymentOption. When a customer selects a payment method that opens a form sheet, the payment option updates after they tap Continue in the sheet.

val selectedPaymentOption by embeddedPaymentElement.paymentOption.collectAsState() selectedPaymentOption?.let { paymentOption -> Row( verticalAlignment = Alignment.CenterVertically, modifier = Modifier .clickable( onClick = { }, ) .semantics { text = AnnotatedString(paymentOption.label) }, ) { Icon( painter = paymentOption.iconPainter, contentDescription = null, // decorative element modifier = Modifier.padding(horizontal = 4.dp), tint = Color.Unspecified, ) Text(text = paymentOption.label) } }

Confirm the payment

When the customer taps the checkout button, initiate the payment by calling embeddedPaymentElement.. Be sure to disable user interaction during confirmation.

When a form is presented, the EmbeddedPaymentElement calls confirm when the user clicks Call to action. If the selected payment method doesn’t have any form fields, call confirm when the user clicks Call to action below the @Composable Content.

Button( onClick = { embeddedPaymentElement.confirm() } ) { Text("Confirm payment") }

Next, implement the createIntentCallback callback you passed to EmbeddedPaymentElement. earlier to send a request to your server. Your server creates a PaymentIntent and returns its client secret, explained in Create a PaymentIntent.

When you receive the request, return the result of the Intent creation using CreateIntentResult with your server response’s client secret or an error. The EmbeddedPaymentElement confirms the PaymentIntent using the client secret or displays the localized error message in its UI.

import com.stripe.android.paymentsheet.CreateIntentResult val embeddedBuilder = remember { val embeddedBuilder = EmbeddedPaymentElement.Builder( createIntentCallback = { confirmationToken -> // Make a request to your own server and receive a client secret or an error. val networkResult = ... if (networkResult.isSuccess) { CreateIntentResult.Success(networkResult.clientSecret) } else { CreateIntentResult.Failure(networkResult.exception) } }, resultCallback = { result -> when (result) { is EmbeddedPaymentElement.Result.Completed -> { // Payment completed - show a confirmation screen. } is EmbeddedPaymentElement.Result.Failed -> { // Encountered an unrecoverable error. You can display the error to the user, log it, and so on } is EmbeddedPaymentElement.Result.Canceled -> { // Customer canceled - you should probably do nothing. } } }, ) }

OptionalClear the selected payment option

If you have payment options external to EmbeddedPaymentElement, you might need to clear the selected payment option. To do so, use the clearPaymentOption API to deselect the selected payment option.

@Composable fun CheckoutScreen() { val embeddedPaymentElementBuilder = .... val embeddedPaymentElement = rememberEmbeddedPaymentElement(embeddedPaymentElementBuilder) .... Button( onClick = embeddedPaymentElement::clearPaymentOption ) { Text("Select external payment option") } }

OptionalDisplay the mandate yourself

To ensure regulatory compliance, the Embedded Mobile Payment Element displays mandates and legal disclaimers by default. This text must be located close to your Buy button. If you disable the default display of this text in the view, you must display it yourself.

Warning

To be compliant, your integration must display the mandate text accurately. If you display it yourself, make sure that any URLs are rendered correctly by including the text in a Text composable.

val configuration = EmbeddedPaymentElement.Configuration.Builder("Merchant, Inc") .embeddedViewDisplaysMandateText(false) .build() .... val selectedPaymentOption by embeddedPaymentElement.paymentOption.collectAsState() selectedPaymentOption?.mandateText?.let { mandateText -> Text(mandateText) }

OptionalLet the customer pay immediately in the sheet

To configure the button in the form sheet to immediately confirm payment, set formSheetAction on your EmbeddedPaymentElement. object.

The completion block executes with the result of the payment after the sheet dismisses. The embedded UI isn’t usable after payment completes, so we recommend that your implementation directs the user to a different screen, such as a receipt screen.

@Composable fun CheckoutScreen() { val embeddedBuilder = .... val embeddedPaymentElement = rememberEmbeddedPaymentElement(embeddedBuilder) LaunchedEffect(embeddedPaymentElement) { embeddedPaymentElement.configure( intentConfiguration = ...., configuration = EmbeddedPaymentElement.Configuration.Builder("Powdur") .formSheetAction(EmbeddedPaymentElement.FormSheetAction.Confirm) .build() ) } }

Create a PaymentIntentServer-side

On your server, create a PaymentIntent with an amount and currency. You can manage payment methods from the Dashboard. Stripe handles the return of eligible payment methods based on factors such as the transaction’s amount, currency, and payment flow. To prevent malicious customers from choosing their own prices, always decide how much to charge on the server-side (a trusted environment) and not the client.

If the call succeeds, return the PaymentIntent client secret. If the call fails, handle the error and return an error message with a brief explanation for your customer.

Note

Verify that all IntentConfiguration properties match your PaymentIntent (for example, setup_, amount, and currency).

Handle post-payment eventsServer-side

Stripe sends a payment_intent.succeeded event when the payment completes. Use the Dashboard webhook tool or follow the webhook guide to receive these events and run actions, such as sending an order confirmation email to your customer, logging the sale in a database, or starting a shipping workflow.

Listen for these events rather than waiting on a callback from the client. On the client, the customer could close the browser window or quit the app before the callback executes, and malicious clients could manipulate the response. Setting up your integration to listen for asynchronous events is what enables you to accept different types of payment methods with a single integration.

In addition to handling the payment_ event, we recommend handling these other events when collecting payments with the Payment Element:

| Event | Description | Action |

|---|---|---|

| payment_intent.succeeded | Sent when a customer successfully completes a payment. | Send the customer an order confirmation and fulfill their order. |

| payment_intent.processing | Sent when a customer successfully initiates a payment, but the payment has yet to complete. This event is most commonly sent when the customer initiates a bank debit. It’s followed by either a payment_ or payment_ event in the future. | Send the customer an order confirmation that indicates their payment is pending. For digital goods, you might want to fulfill the order before waiting for payment to complete. |

| payment_intent.payment_failed | Sent when a customer attempts a payment, but the payment fails. | If a payment transitions from processing to payment_, offer the customer another attempt to pay. |

Test the integration

See Testing for additional information to test your integration.

OptionalEnable saved cardsServer-sideClient-side

EmbeddedPaymentElement can allow the customer to save their card and can include the customer’s saved cards in available payment methods. The customer must have an associated Customer object on your server. To enable a checkbox that allows the customer to save their card, create a CustomerSession, with payment_ set to enabled.

const stripe = require("stripe")(); const express = require('express'); const app = express(); app.set('trust proxy', true); app.use(express.json()); app.post('/payment-sheet', async (req, res) => { // Use an existing Customer ID if this is a returning customer. const customer = await stripe.customers.create(); const customerSession = await stripe.customerSessions.create({ customer: customer.id, components: { mobile_payment_element: { enabled: true, features: { payment_method_save: 'enabled', payment_method_redisplay: 'enabled', payment_method_remove: 'enabled' } }, }, }); res.json({ customerSessionClientSecret: customerSession.client_secret, customer: customer.id, }); });"sk_test_BQokikJOvBiI2HlWgH4olfQ2"

Next, configure EmbeddedPaymentElement with the Customer’s ID and the CustomerSession client secret.

val configuration = EmbeddedPaymentElement.Configuration.Builder(merchantDisplayName = "Powdur") .customer( PaymentSheet.CustomerConfiguration.createWithCustomerSession( id = customerId, clientSecret = customerSessionClientSecret, ) ) .build() embeddedPaymentElement.configure( intentConfiguration = // ... , configuration = configuration, )

OptionalAllow delayed payment methodsClient-side

Delayed payment methods don’t guarantee that you’ll receive funds from your customer at the end of checkout, either because they take time to settle (for example, US Bank Accounts, SEPA Debit, iDEAL, Bancontact, and Sofort) or because they require customer action to complete (for example, OXXO, Konbini, and Boleto).

By default, EmbeddedPaymentElement doesn’t display delayed payment methods, even if you accept them. To display the delayed payment methods that you’ve enabled, set allowsDelayedPaymentMethods to true in your EmbeddedPaymentElement..

val configuration = EmbeddedPaymentElement.Configuration.Builder(merchantDisplayName = "Powdur") .allowsDelayedPaymentMethods(true) .build()

If the customer successfully uses a delayed payment method in an EmbeddedPaymentElement, the payment result returned is EmbeddedPaymentElement..

OptionalEnable Google Pay

Note

If your checkout screen has a dedicated Google Pay button, follow the Google Pay guide. You can use Embedded Payment Element to handle other payment method types.

Set up your integration

To use Google Pay, first enable the Google Pay API by adding the following to the <application> tag of your AndroidManifest.xml:

<application> ... <meta-data android:name="com.google.android.gms.wallet.api.enabled" android:value="true" /> </application>

For more details, see Google Pay’s Set up Google Pay API for Android.

Add Google Pay

To add Google Pay to your integration, pass a PaymentSheet.GooglePayConfiguration with your Google Pay environment (production or test) and the country code of your business when initializing EmbeddedPaymentElement..

val googlePayConfiguration = PaymentSheet.GooglePayConfiguration( environment = PaymentSheet.GooglePayConfiguration.Environment.Test, countryCode = "US", currencyCode = "USD" // Required for Setup Intents, optional for Payment Intents ) val configuration = EmbeddedPaymentElement.Configuration.Builder("Merchant, Inc.") .googlePay(googlePayConfiguration) .build()

Test Google Pay

Google allows you to make test payments through their Test card suite. The test suite supports using Stripe test cards.

You must test Google Pay using a physical Android device instead of a simulated device, in a country where Google Pay is supported. Log in to a Google account on your test device with a real card saved to Google Wallet.

OptionalEnable card scanning

To enable card scanning support, request production access to the Google Pay API from the Google Pay and Wallet Console.

- If you’ve enabled Google Pay, the card scanning feature is automatically available in our UI on eligible devices. To learn more about eligible devices, see the Google Pay API constraints

- Important: The card scanning feature only appears in builds signed with the same signing key registered in the Google Pay & Wallet Console. Test or debug builds using different signing keys (for example, builds distributed through Firebase App Tester) won’t show the Scan card option. To test card scanning in pre-release builds, you must either:

- Sign your test builds with your production signing key

- Add your test signing key fingerprint to the Google Pay and Wallet Console

OptionalCustomize the sheet

All customization is configured through the EmbeddedPaymentElement. object.

Appearance

Customize colors, fonts, and so on to match the look and feel of your app by using the appearance API.

Collect customer addresses

Collect shipping and billing addresses from your customers using the Address Element.

Customize the displayed business name

Specify a customer-facing business name by setting merchantDisplayName. If you don’t specify a name, the default value is your app’s name.

val configuration = EmbeddedPaymentElement.Configuration.Builder(merchantDisplayName = "Merchant, Inc.") .build()

Specify default billing details

To set default values for billing details collected in EmbeddedPaymentElement, configure the defaultBillingDetails property. The EmbeddedPaymentElement pre-populates its fields with the values that you provide.

val configuration = EmbeddedPaymentElement.Configuration.Builder(merchantDisplayName = "Merchant, Inc.") .defaultBillingDetails( PaymentSheet.BillingDetails( address = PaymentSheet.Address( country = "US", ), email = "foo@bar.com" ) ) .build()

Configure collection of billing details

Use BillingDetailsCollectionConfiguration to specify how you want to collect billing details in the EmbeddedPaymentElement.

You can collect your customer’s name, email, phone number, and address.

If you want to attach default billing details to the PaymentMethod object even when those fields aren’t collected in the UI, set billingDetailsCollectionConfiguration. to true.

import com.stripe.android.paymentsheet.PaymentSheet.BillingDetailsCollectionConfiguration val billingDetails = PaymentSheet.BillingDetails( email = "foo@bar.com" ) val billingDetailsCollectionConfiguration = BillingDetailsCollectionConfiguration( attachDefaultsToPaymentMethod = true, name = BillingDetailsCollectionConfiguration.CollectionMode.Always, email = BillingDetailsCollectionConfiguration.CollectionMode.Never, address = BillingDetailsCollectionConfiguration.AddressCollectionMode.Full, ) val configuration = EmbeddedPaymentElement.Configuration.Builder(merchantDisplayName = "Merchant, Inc.") .defaultBillingDetails(billingDetails) .billingDetailsCollectionConfiguration(billingDetailsCollectionConfiguration) .build()

Note

Consult with your legal counsel regarding laws that apply to collecting information. Only collect phone numbers if you need them for the transaction.

OptionalEnable CVC recollection on confirmation

To re-collect the CVC of a saved card during PaymentIntent confirmation, your integration must collect payment details before creating a PaymentIntent.

Update the intent configuration

PaymentSheet. accepts an optional parameter that controls when to re-collect CVC for a saved card.

val intentConfig = PaymentSheet.IntentConfiguration( mode = PaymentSheet.IntentConfiguration.Mode.Payment( amount = 1099, currency = "usd", ), requireCvcRecollection = true, )

Update parameters of the intent creation

To re-collect the CVC when confirming payment, include both the customerId and require_ parameters during the creation of the PaymentIntent.