Analyse des litiges

Découvrez quel impact ont le volume de litige, le taux de litiges et l’issue des litiges sur votre entreprise.

Utilisez la page des Litiges dans le Stripe Dashboard pour comprendre et analyser le volume de litiges relatifs aux cartes, le taux de litiges et les résultats des soumissions de litiges.

Pour consulter les analyses, cliquez sur Paiements > Statistiques > Litiges dans le Dashboard. Pour répondre aux litiges, utilisez la page principale Litiges.

La page d’analyse des litiges comprend les éléments suivants pour les litiges relatifs à une carte :

- Litiges ultérieurs (plusieurs litiges sur le même paiement)

- Alertes de suspicion de fraude (EFW)

Les éléments suivants ne sont pas inclus dans la page d’analyse des litiges relatifs à la carte bancaire :

- Les moyens de paiement autres que cartes, tels que prélèvements bancaires oupaiements différés

- Demandes d’information

- Litiges cachés (litiges que Stripe traite automatiquement, de sorte qu’ils n’apparaissent pas dans votre Dashboard, souvent parce que la transaction était protégée par un transfert de responsabilité)

- RDR (Rapid Dispute Resolution, en anglais) et prévention des litiges

L’analyse des litiges vous aide à :

- Surveiller vos taux de litiges et de fraude par carte

- Analyser les litiges selon différentes catégories, par exemple en fonction de la marque de carte ou du pays

- Comprendre les motifs des litiges

- Suivre et améliorer les performances d’envoi de preuves relatives à vos litiges

Effet des litiges sur votre activité

Un suivi régulier de votre activité en matière de litiges peut vous aider à comprendre :

- L’impact financier des litiges sur votre entreprise.

- Si votre taux de litiges vous expose ou non au risque d’intégrer des programmes de surveillance gérés par des réseaux de cartes. Si vous êtes intégré à un tel programme, vous pouvez encourir des amendes mensuelles et des frais supplémentaires jusqu’à ce que vos niveaux de litiges ou de fraude aient baissé.

- Que vous souhaitiez ou non modifier votre stratégie de lutte contre la fraude. Des outils tels que Radar peuvent aider les entreprises à se protéger contre la fraude. Si vous utilisez Radar for Fraud Teams, vous pouvez envisager de personnaliser vos interventions en fonction de votre taux de fraude. Réfléchissez aux compromis en termes de prévention de la fraude tout en veillant également à ce que votre stratégie minimise l’impact sur les clients légitimes qui tentent d’effectuer un achat.

Pour en savoir plus sur les litiges, consultez la rubrique consacrée au fonctionnement des litiges.

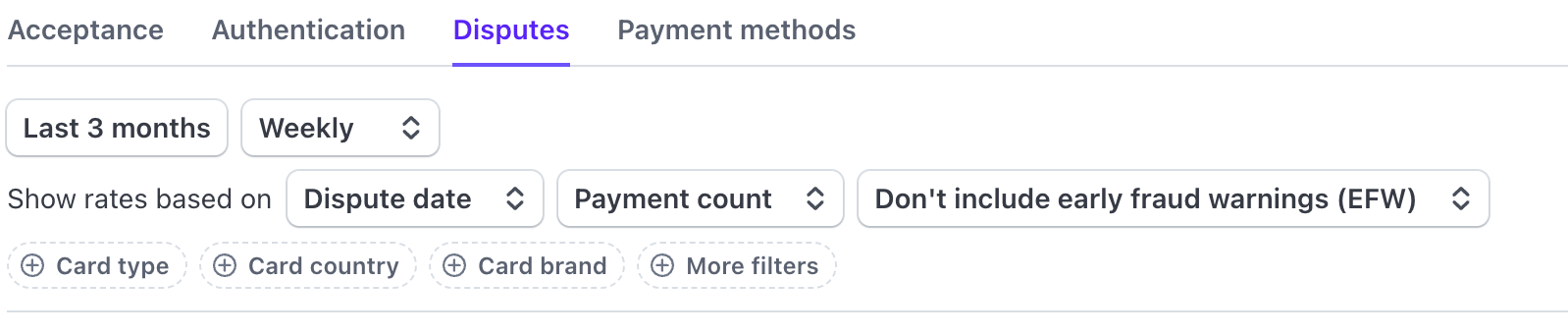

Configurer votre ensemble de données

Utilisez des filtres pour contrôler tous les indicateurs, graphiques et tableaux de cette page.

Filtres pour configurer vos données

Spécifier une devise

Si vous n’appliquez pas de filtre de devise, tous les paiements apparaissent dans la devise de règlement par défaut, quelle que soit la devise de paiement réelle. Si vous appliquez un filtre de devise, seuls les paiements effectués dans la devise appliquée apparaissent.

Pour modifier la devise, cliquez sur + Plus de filtres > Devise, puis sélectionnez la devise souhaitée dans la liste.

Spécifier Connect

Par défaut, les métriques incluent l’activité de paiement pour tous vos comptes connectés. Utilisez le filtre Connected accounts pour exclure les données de vos comptes connectés. Les données des comptes connectés standard ne sont visibles que si vous activez les contrôles de la plateforme.

Spécifier le calcul du taux

Vous pouvez configurer vos indicateurs et vos taux par :

- Date du litige : Date à laquelle un client a créé le litige.

- Date du paiement : La date du paiement initial.

Par défaut, les indicateurs sont calculés par date du litige. Celle-ci est systématiquement égale ou postérieure à la date de paiement, car il peut s’écouler un certain temps entre un paiement et l’ouverture d’un litige par le titulaire de la carte auprès de sa banque émettrice.

L’analyse par date du litige montre l’impact sur vos finances en fonction du moment où nous débitons les frais ou le paiement contesté de votre compte. L’analyse par date de paiement peut vous aider à évaluer l’efficacité de vos stratégies de lutte contre la fraude au moment où ces paiements ont été effectués. Les taux de litiges par date de paiement peuvent sembler plus faibles sur les derniers jours ou dernières semaines, car les clients peuvent attendre des semaines avant de déposer des litiges.

Spécifier les alertes de suspicion de fraude

Les alertes de suspicion de fraude sont des alertes envoyées par les réseaux de cartes lorsqu’ils soupçonnent un paiement d’être frauduleux. Ces avertissements proviennent des émetteurs de cartes qui analysent les rapports de paiement. Gardez à l’esprit que toutes les alertes de suspicion de fraude ne donnent pas lieu à un véritable litige pour fraude, et que toutes n’entraînent donc pas nécessairement des conséquences financières pour votre entreprise. Cependant, les alertes de suspicion de fraude qui sont prises en compte dans le programme VAMP de Visa à des fins de surveillance peuvent entraîner des amendes.

Si un avertissement se transforme en cas de fraude confirmée, il n’est plus considéré comme un EFW, mais il se transforme en un litige.

Par défaut, nous suivons les EFW dans vos indicateurs de litige, car ils peuvent vous aider à détecter les problèmes potentiels et à nous assurer que vos indicateurs de fraude reflètent fidèlement les cas confirmés.

Les EFW sont inclus dans vos calculs par défaut, mais vous pouvez choisir de les inclure ou de les exclure :

- Pour les inclure, sélectionnez Inclure les alertes de suspicion de fraude.

- Pour les exclure, sélectionnez Ne pas inclure les alertes de suspicion de fraude.

Télécharger des données

Pour télécharger ces analyses, cliquez sur Télécharger en haut de chaque graphique. Le fichier CSV que vous téléchargez correspond aux filtres que vous avez sélectionnés, ou correspond à vos valeurs par défaut si vous n’appliquez aucun filtre.

Mesures clés

Ces indicateurs montrent la fréquence à laquelle votre entreprise est confrontée à des litiges concernant des paiements par carte. Les termes les plus courants pour désigner les litiges sont les suivants :

| Terme | Définition |

|---|---|

| Litiges | Nombre total de litiges liés aux paiements par carte |

| Volume de litiges | Montant total des litiges liés aux paiements par carte (exprimé dans votre devise de règlement par défaut) |

| Taux de litiges | Pourcentage des paiements par carte ayant donné lieu à un litige, sur l’ensemble des paiements par carte acceptés |

| Taux de fraude | Pourcentage de paiements par carte identifiés comme frauduleux, sur l’ensemble des paiements acceptés. Les litiges pour fraude sont un sous-ensemble des litiges |

Rapport détaillé des litiges

Le rapport de répartition des litiges vous permet d’afficher les indicateurs des litiges pour plusieurs catégories de cartes courantes.

Cliquez sur le menu déroulant pour sélectionner différentes catégories :

- Motif du litige

- Pays de la carte bancaire

- Marque de la carte

- Type de carte bancaire

- Méthode de saisie

- Devise

Sous la liste déroulante, cliquez sur les onglets pour comparer :

- Ventilation par nombre de litiges (en nombres absolus ou en pourcentage des litiges)

- Volume total de litiges

- Taux de litiges

Ce rapport vous aide à comprendre où et à quelle fréquence les litiges de votre entreprise se produisent, afin de vous permettre d’identifier les tendances et de vous aider à résoudre les problèmes.

Motifs des litiges

La consultation des données par motif de litige vous aide à comprendre vos cinq principales catégories de litiges. Pour afficher tous les motifs de litige dans le Dashboard, cliquez sur le menu déroulant Tous les motifs.

Performance mensuelle des envois de preuves

Mise en garde

Les configurations d’indicateurs ou dates choisies n’affectent pas le rapport mensuel sur les performances des envois de preuves. Vous verrez toujours s’afficher les indicateurs correspondant à une période de 12 mois, agrégés mensuellement et basés sur la date du litige plutôt que sur la date du paiement. Toutefois, les filtres que vous avez sélectionnés s’appliquent toujours aux indicateurs du rapport mensuel sur les performances des envois de preuves.

Le graphique de performance des envois de preuves comporte les onglets suivants :

- Smart Disputes : Compare le total des fonds recouvrés sur les litiges remportés après envoi manuel de preuves à ceux recouvrés grâce à Smart Disputes, le système automatisé de Stripe.

- Taux de réussite : La fréquence à laquelle vous remportez des litiges contestés avec envoi de preuves (inclut les litiges remportés grâce à Smart Disputes).

- Taux d’envoi de preuves : La fréquence à laquelle vous contestez les litiges en soumettant des preuves à la banque émettrice de la carte (y compris les litiges contestés à l’aide de Smart Disputes).

Smart Disputes

Ce graphique vous indique le montant des revenus que vous récupérez sur les litiges que vous avez remportés grâce à Smart Disputes.

Smart Disputes utilise un moteur de règles alimenté par l’IA pour analyser les litiges entrants. Il extrait les preuves pertinentes des nombreuses données internes à Stripe, de vos données de transaction et des données des titulaires de cartes. Le système compile les preuves à envoyer en fonction du code de motif du litige et des éventuelles preuves convaincantes dont Stripe a connaissance. L’admissibilité à Smart Disputes dépend de plusieurs facteurs, dont le code de motif du litige, le moyen de paiement, la disponibilité des preuves, leur pertinence et le coût.

Lorsque vous recevez un litige éligible à Smart Disputes, Stripe vous en informe par e-mail et dans le Dashboard. Si vous n’agissez pas, Smart Disputes envoie automatiquement le paquet de preuves prérempli juste avant l’expiration du litige. Cela vous permet de ne manquer aucune échéance. Si vous ne souhaitez pas utiliser Smart Disputes, vous pouvez réfuter un litige manuellement ou l’accepter avant la date limite.

Taux de litiges remportés

Un litige remporté est un litige reçu d’un client, que vous avez ensuite réfuté et pour lequel l’institution financière émettrice a tranché en votre faveur. Le taux de litiges remportés est toujours calculé d’après la date du litige (la date à laquelle le litige a été créé). De plus, lorsque vous remportez une contestation de litige, Stripe attribue le litige won à la date de création du litige, plutôt qu’à la date d’envoi des preuves ou à la date de résultat de la contestation.

Le nombre de litiges remportés (won) peut sembler plus faible au cours des derniers mois, car les banques émettrices de cartes ont besoin de temps pour traiter les contestations de litige. Une fois que vous avez contesté le litige (en soumettant des preuves), l’émetteur de la carte évalue les preuves et décide de l’issue du litige, ce qui peut prendre de 60 à 75 jours, selon le réseau de cartes.

Tous les litiges que vous contestez sont pris en compte dans le calcul du taux de litiges remportés dès que vous les soumettez à la banque émettrice de la carte. Comme les décisions peuvent prendre du temps, le taux peut sembler plus faible pendant que les banques traitent les contestations. Le taux de litiges remportés exclut les litiges qui n’ont jamais été contestés.

Taux d’envoi de preuves

Le taux d’envoi de preuves correspond au nombre de litiges pour lesquels des preuves ont été soumises, divisé par le nombre total de litiges créés au cours d’un mois donné. Le taux est calculé en fonction de la date du litige, et non de la date d’envoi des preuves. Par exemple, si vous recevez un litige en avril et que vous envoyez des preuves en mai (dans la période de contestation de 7 à 21 jours), l’envoi de preuves affecte votre taux d’avril, et non celui de mai.

Résultats mensuels des litiges

Mise en garde

Vos choix de date et de configuration des indicateurs n’affectent pas le rapport mensuel sur l’issue des litiges. Ce rapport affiche toujours des indicateurs :

- Sur une période de 12 mois

- Agrégation mensuelle

- En fonction de la date du litige plutôt que de la date de paiement

- En fonction du nombre de paiements plutôt que du volume de paiements

Toutefois, les filtres que vous avez sélectionnés s’appliquent toujours aux indicateurs figurant dans le rapport mensuel sur l’issue des litiges.

Le graphique des résultats d’envoi des preuves comporte les onglets suivants :

| Onglet | Définition |

|---|---|

| Litiges | Affiche le nombre total de litiges que vous avez reçus de vos clients par dernier état de soumission des preuves (à savoir les états Needs response, Under review, Won et Lost) |

| Pourcentage de litiges | Présente les litiges par dernier état de soumission des preuves en indiquant pour chacun le pourcentage du nombre total de litiges |

| Volume de litiges | Affiche la valeur monétaire totale des litiges par dernier état de soumission des preuves |

Le tableau suivant présente des exemples de valeurs pour les litiges au cours du cycle de vie de réfutation des litiges :

| Valeur | Définition |

|---|---|

Needs response | Litige que vous n’avez pas encore contesté ni accepté, et auquel vous avez encore la possibilité de répondre |

Under review | Litige que vous avez contesté preuves à l’appui, mais pour lequel Stripe n’a pas encore reçu de réponse de la banque émettrice de la carte |

Won | Litige que la banque émettrice du titulaire de la carte a tranché en votre faveur |

Protected | Litige que Stripe a peut-être contesté en votre nom et dont elle a assumé la responsabilité des pertes dans le cadre de Chargeback Protection, une fonctionnalité Stripe désormais obsolète |

Lost | Litige que vous avez contesté, et pour lequel l’établissement financier émetteur de la carte a tranché en faveur du titulaire de la carte. Ou un litige que vous n’avez pas réfuté avant la date limite d’envoi des preuves |