Commencez à utiliser l'outil de déclaration fiscale///

Le produit de déclaration fiscale Stripe 1099 permet de créer, de modifier et d'envoyer les formulaires fiscaux de vos comptes connectés.

Stripe fournit des fonctionnalités et un Dashboard pour aider les plateformes à respecter leurs obligations de déclaration fiscale.

Connectez-vous à votre compte Stripe et servez-vous de la vue des Déclarations fiscales du Dashboard pour créer, modifier et envoyer vos formulaires fiscaux 1099 pour vos comptes connectés. Si vous utilisez une équipe, seuls les membres disposant du rôle d’utilisateur d’analyste fiscal ou d’administrateur peuvent accéder à l’ensemble des fonctionnalités relatives à la fiscalité.

Liste de vérification de la saison fiscale 2025

Suivez ce guide pour vous préparer la période fiscale.

Dates clés

- November 3 : si vous avez opté pour l’envoi électronique, Stripe commence à contacter vos comptes connectés.

- January 5 : dernier jour recommandé pour activer les communications de Stripe envoyées à vos comptes connectés afin de recueillir automatiquement leurs informations fiscales et leur consentement à l’envoi dématérialisé.

- January 12 : (provisoire) la première date à laquelle vous pouvez envoyer des formulaires fiscaux par voie électronique dans votre Dashboard Stripe.

- January 15 : dernier jour où Stripe pourrait envoyer des informations préalables à la déclaration à vos comptes connectés

- January 22 : date limite recommandée pour soumettre les formulaires fiscaux par voie électronique dans votre Dashboard Stripe, afin que le cachet de la poste soit apposé avant la date limite d’envoi imposée par l’IRS.

- January 31 : date limite de l’IRS pour envoyer les formulaires fiscaux 1099 à vos comptes connectés (le cachet de la poste faisant foi).

- February 13 : le dernier jour où les modifications relatives à l’identité seront automatiquement synchronisées sur les ébauches de formulaires fiscaux 1099 pour l’exercice fiscal 2025.

Mise en garde

Traitez les formulaires à l’état Needs attention afin d’obtenir le nom, l’adresse et le numéro fiscal (SSN ou EIN) de vos comptes connectés. Ces informations sont obligatoires pour effectuer votre déclaration.

Se préparer pour la saison fiscale

- Configurez les paramètres fiscaux de votre plateforme pour l’exercice fiscal 2025, même si vous avez déjà utilisé le produit de déclaration fiscale 1099 de Stripe.

- Commencez à vérifier vos formulaires à l’état Intervention requise pour lesquels des informations fiscales sont manquantes.

- À partir du mois de August, vous pourrez modifier vos formulaires fiscaux dans votre Dashboard ou via un fichier au format CSV.

- Fournissez toutes les informations d’identité manquantes requises pour la déclaration.

- (Facultatif) Mettez à jour les totaux de vos formulaires pour prendre en compte les transactions de paiement en dehors de Stripe.

- (Facultatif) Exportez les logs de transactions pour identifier les transactions Stripe ayant contribué au total d’un formulaire 1099.

- Si vous prévoyez d’opter pour l’envoi électronique, activez à la fois l’envoi électronique et la communication avec Stripe dans les préférences d’envoi des paramètres des formulaires fiscaux.

Se préparer à la communication entre Stripe et vos comptes connectés30 octobre

- Publiez un article du centre d’assistance expliquant le calendrier fiscal et votre partenariat avec Stripe pour la gestion des taxes. Consultez l’article d’exemple.

- Obligatoire pour l’envoi électronique :

- Identifiez les adresses e-mail manquantes à l’aide du filtre Missing Email Address dans votre Dashboard 1099, ou en exportant les formulaires fiscaux au format CSV puis en recherchant les entrées vides dans la colonne B. Ajoutez les adresses e-mail manquantes à l’aide de l’API Accounts.

- Vérifiez que vos paramètres de marque Connect et votre adresse e-mail de support sont à jour.

- Préparez vos équipes de support pour la période de déclaration fiscale 2025. Consultez des exemples de questions fréquentes que votre équipe de support est susceptible de recevoir de la part de vos comptes connectés.

- Recommandé pour l’envoi électronique :

- Informez vos comptes connectés de la date à laquelle ils recevront des communications de Stripe. Consultez l’exemple d’e-mail.

Vérifier les totaux des formulaires fiscaux et les informations d'identité31 décembre

- Stripe commencera à contacter vos comptes connectés à partir de la semaine du November 3 si vous avez opté pour l’envoi dématérialisé/la communication électronique avec Stripe. Nous vous recommandons de sélectionner cette option avant le January 5, de façon à ce que nous puissions contacter tous vos comptes d’ici le January 15. À cette date, tous les comptes doivent avoir été contactés par Stripe. Veuillez noter que nous n’envoyons d’e-mails aux comptes connectés des plateformes que 7 jours après l’activation du paramètre.

- Continuez à traiter les formulaires à l’état

Needs attentionet contactez les comptes pour lesquels des informations sont manquantes. - Vérifier les calculs des taxes de certains formulaires fiscaux 1099.

- Vérifiez vos paramètres des formulaires fiscaux afin d’être prêt à envoyer vos formulaires fiscaux 1099 au mois de janvier.

Préparer, remplir et envoyer les formulaires fiscaux 1099January 22

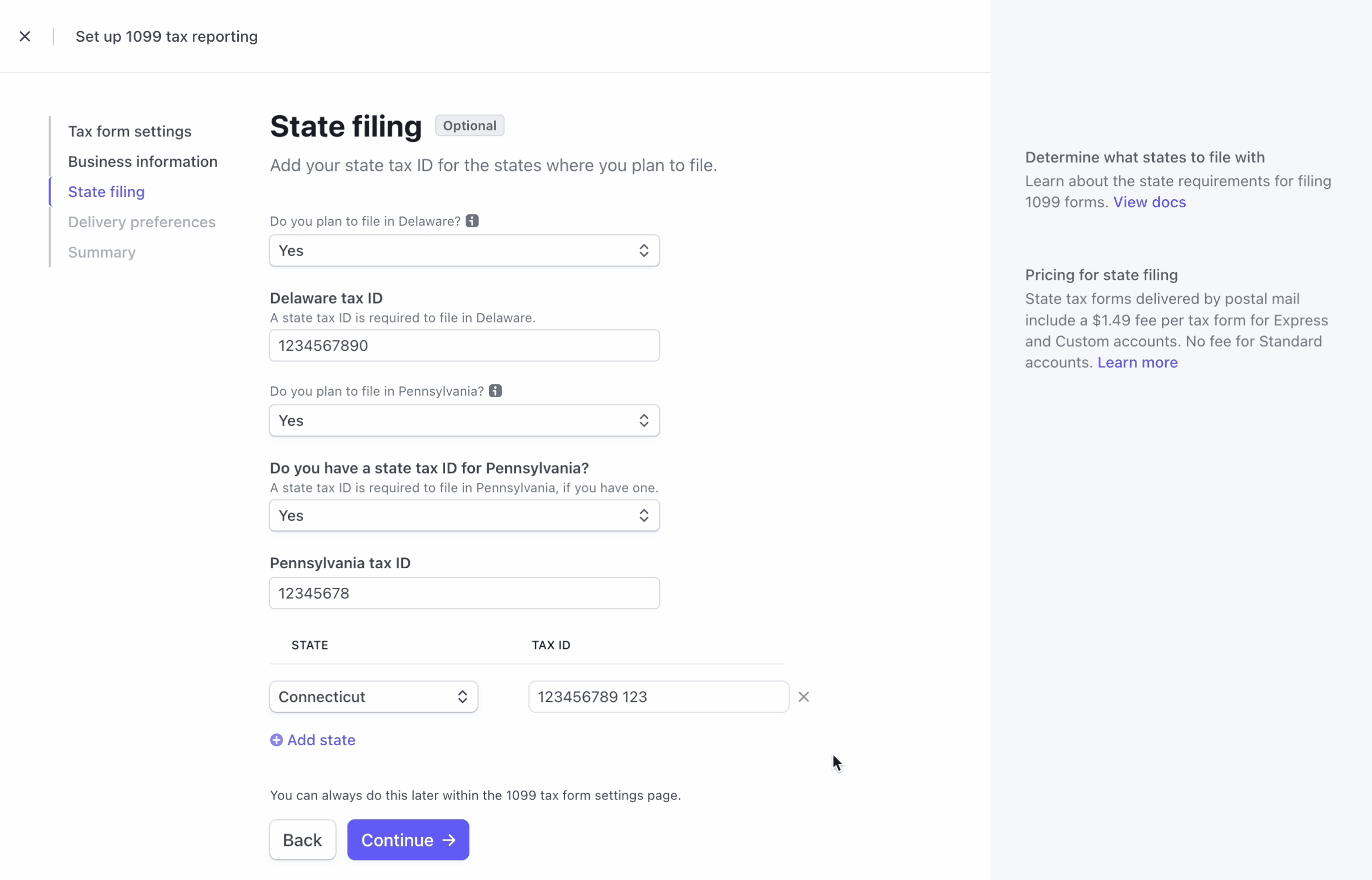

- Input State Tax Registration or withholding numbers for all states where you plan to file.

- File tax forms in your Stripe Dashboard no later than January 22. You can begin filing forms on January 12.

- When you press ‘File’ Stripe files any forms in a ‘Ready’ or ‘Ready!’ state.

- If you have forms in a ‘Needs Attention’ state and wish to file them, you need to explicitly update the filing requirement for these forms before filing.

- When you press ‘File’ Stripe files any forms in a ‘Ready’ or ‘Ready!’ state.

- Stripe e-delivers or postmarks tax forms for postal delivery by January 31.

- After February 13, payee identity updates (name, TIN, address) stop flowing onto the 1099 tax forms that haven’t been filed yet. This doesn’t impact forms that you already filed by February 13.

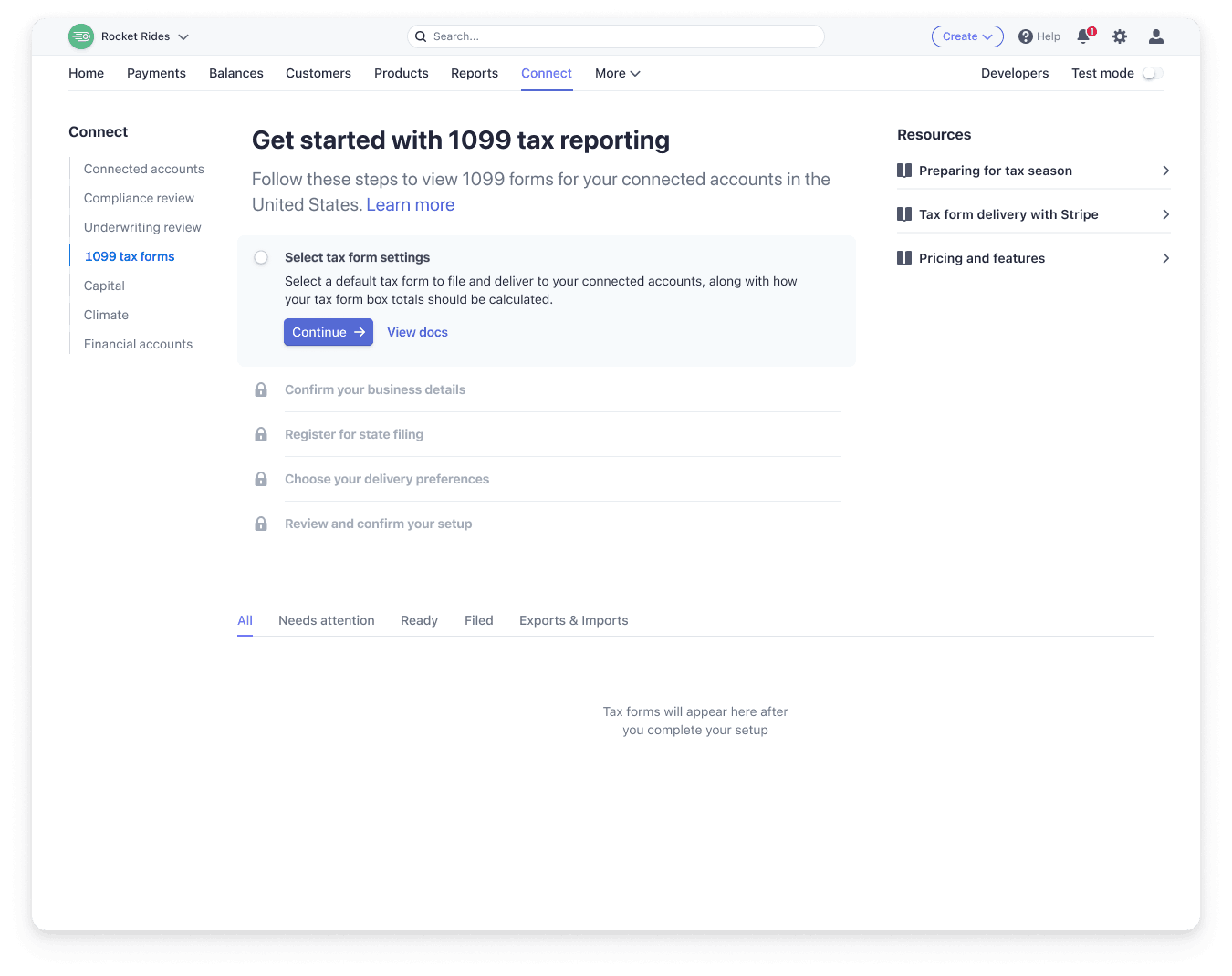

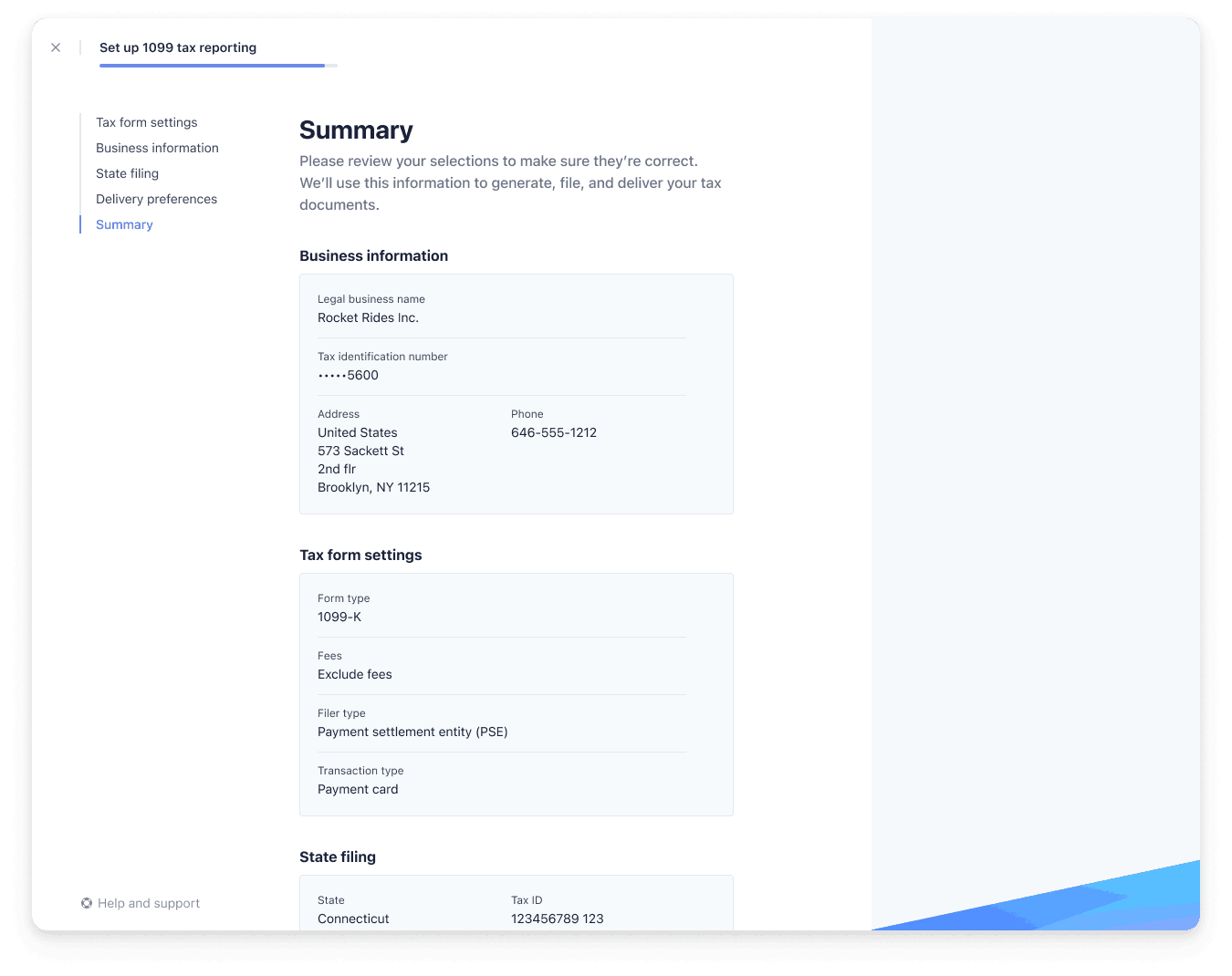

Set tax form default settings

To configure the settings for tax forms in your account you must log in as the account owner. If you use a team, any user that has the Administrator user role for your account can configure settings. To get started with generating your tax forms for 2025, open the Tax reporting page of the Dashboard, and then click Get started.

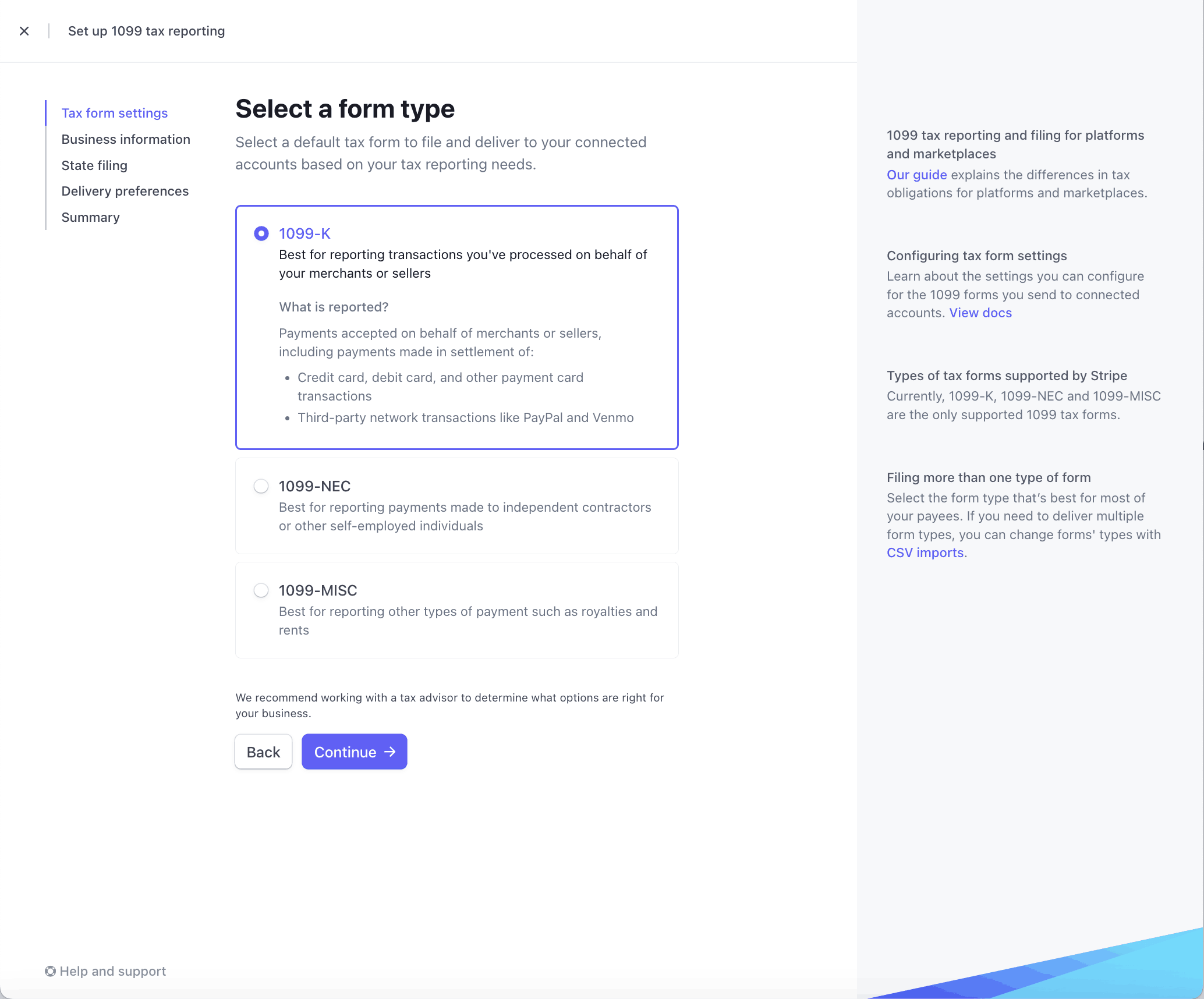

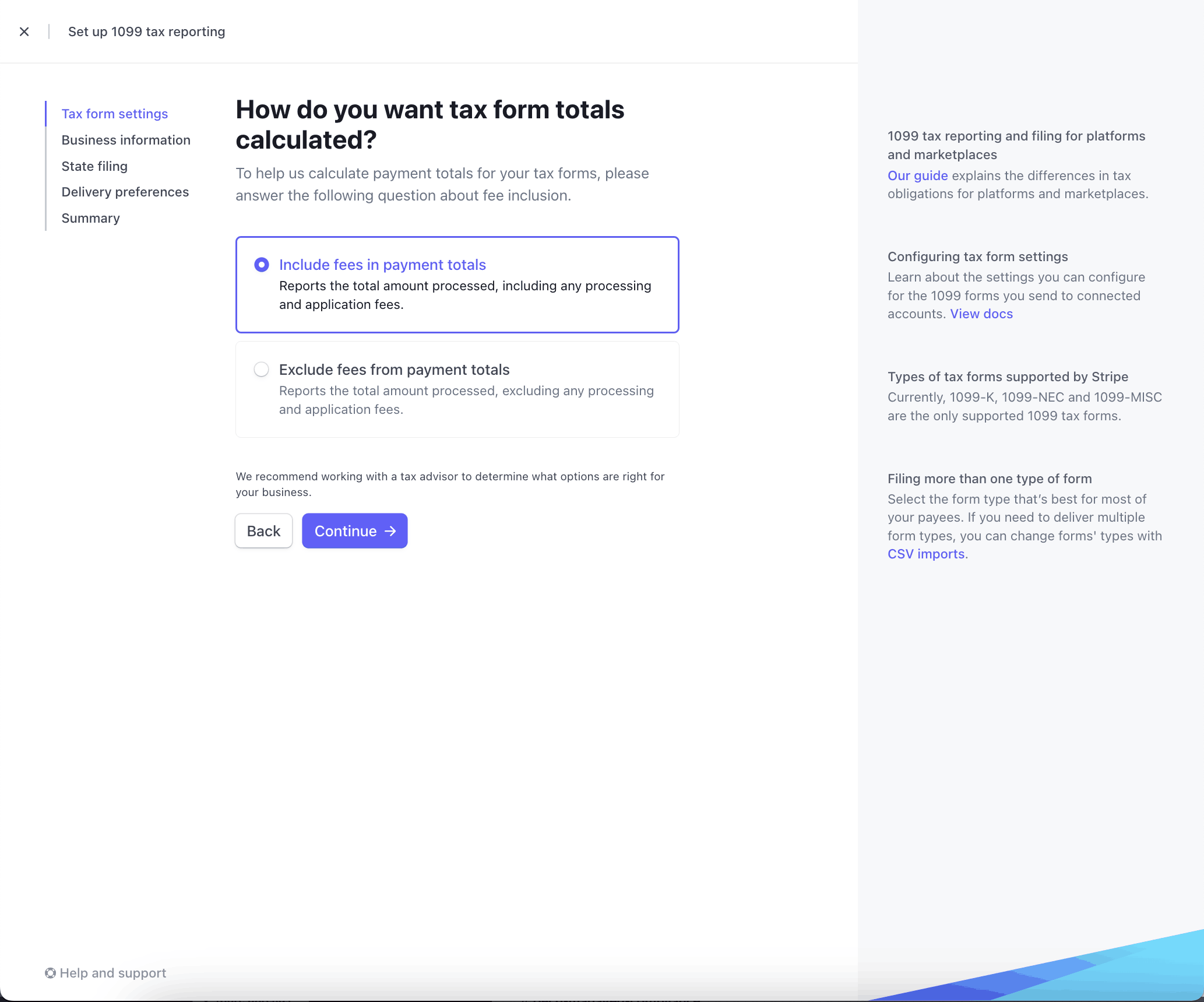

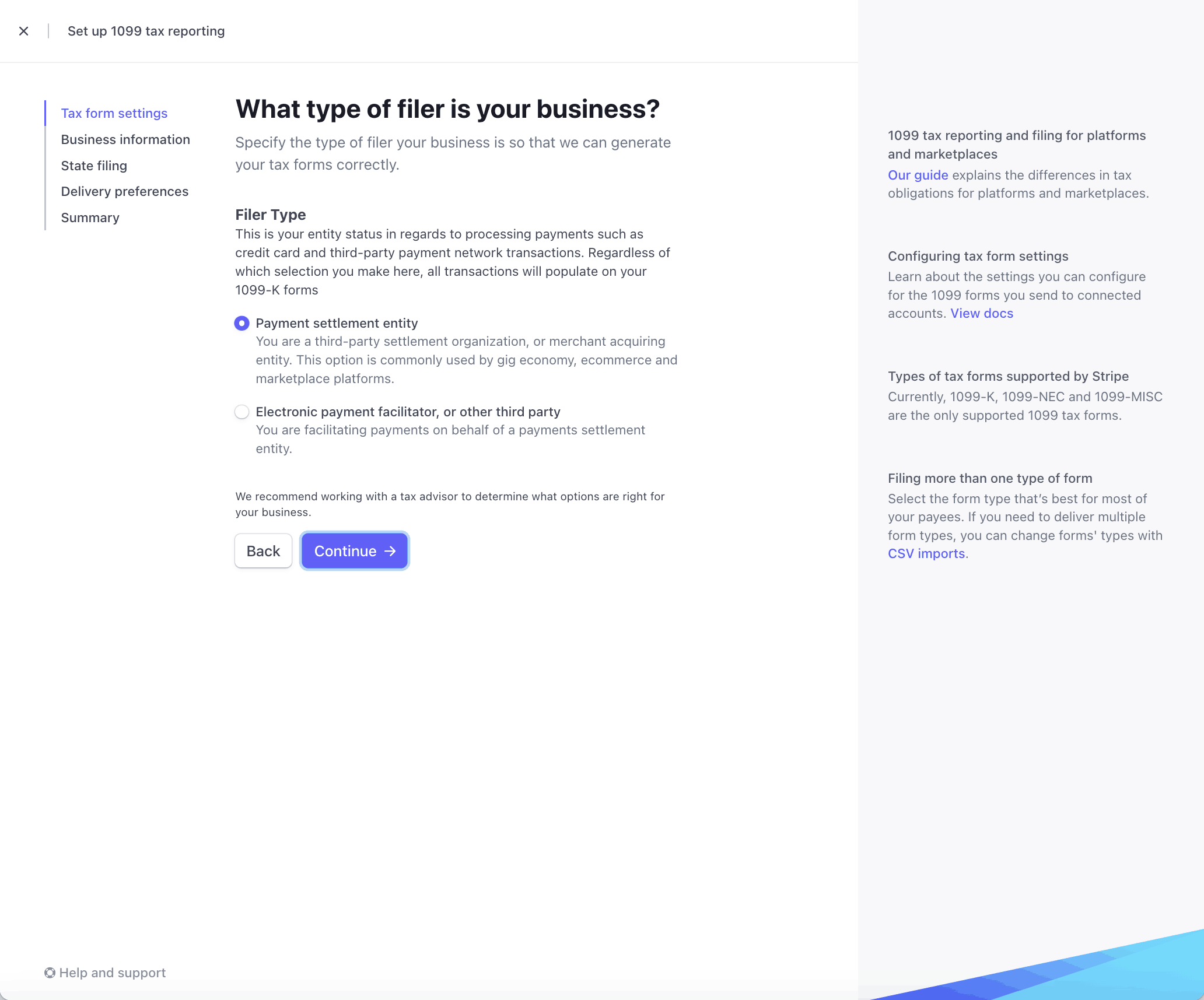

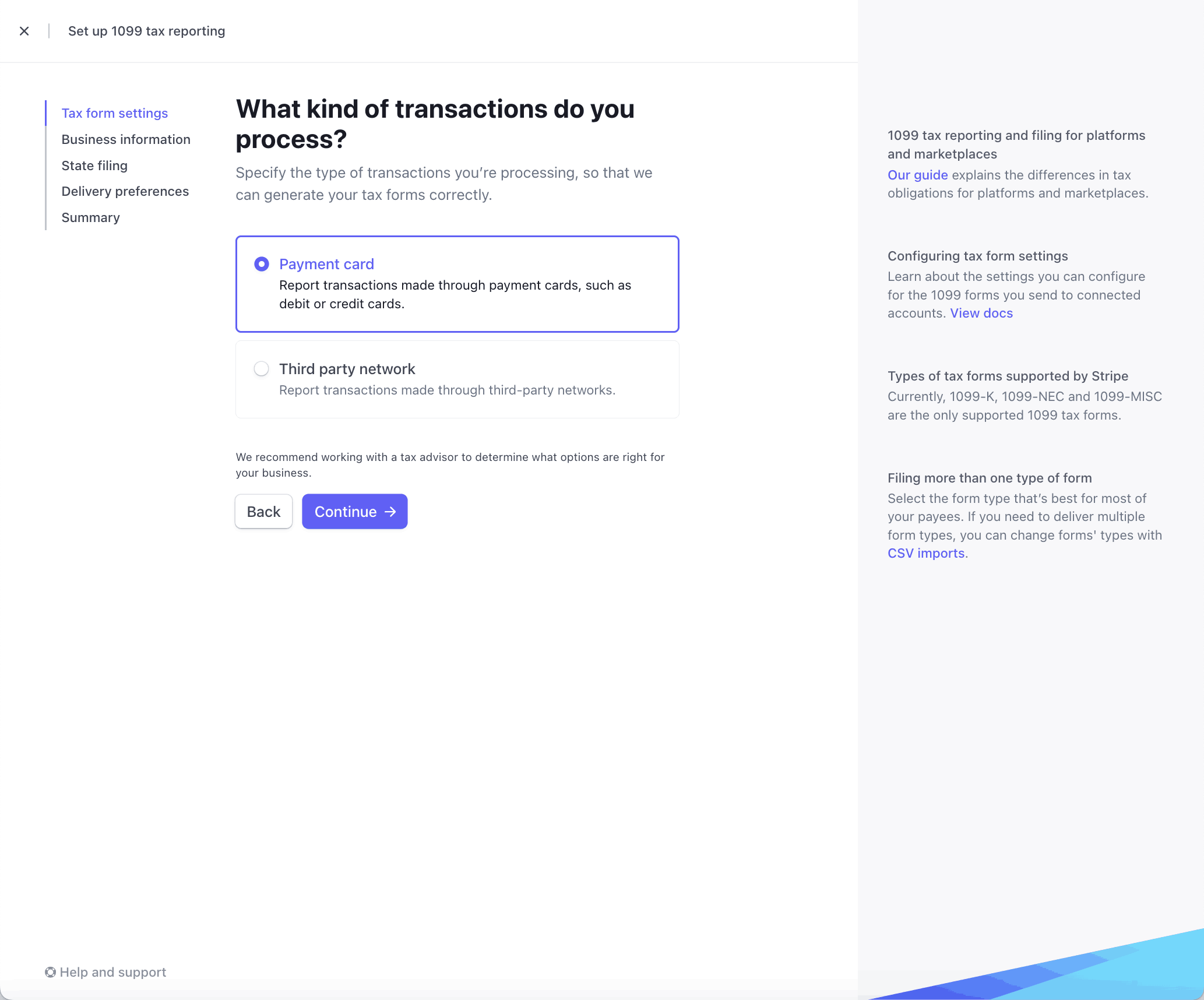

Choose the default tax form to generate for your connected accounts, the calculation method to use for your tax form totals, the type of filer for your business, and the kind of transactions you process. We recommend that you use a tax advisor to determine which options are right for your business. You can change almost all tax form settings at any time for the forms that you haven’t filed.

Select a form type

Select tax calculation

Select type of filer

Select types of transactions processed

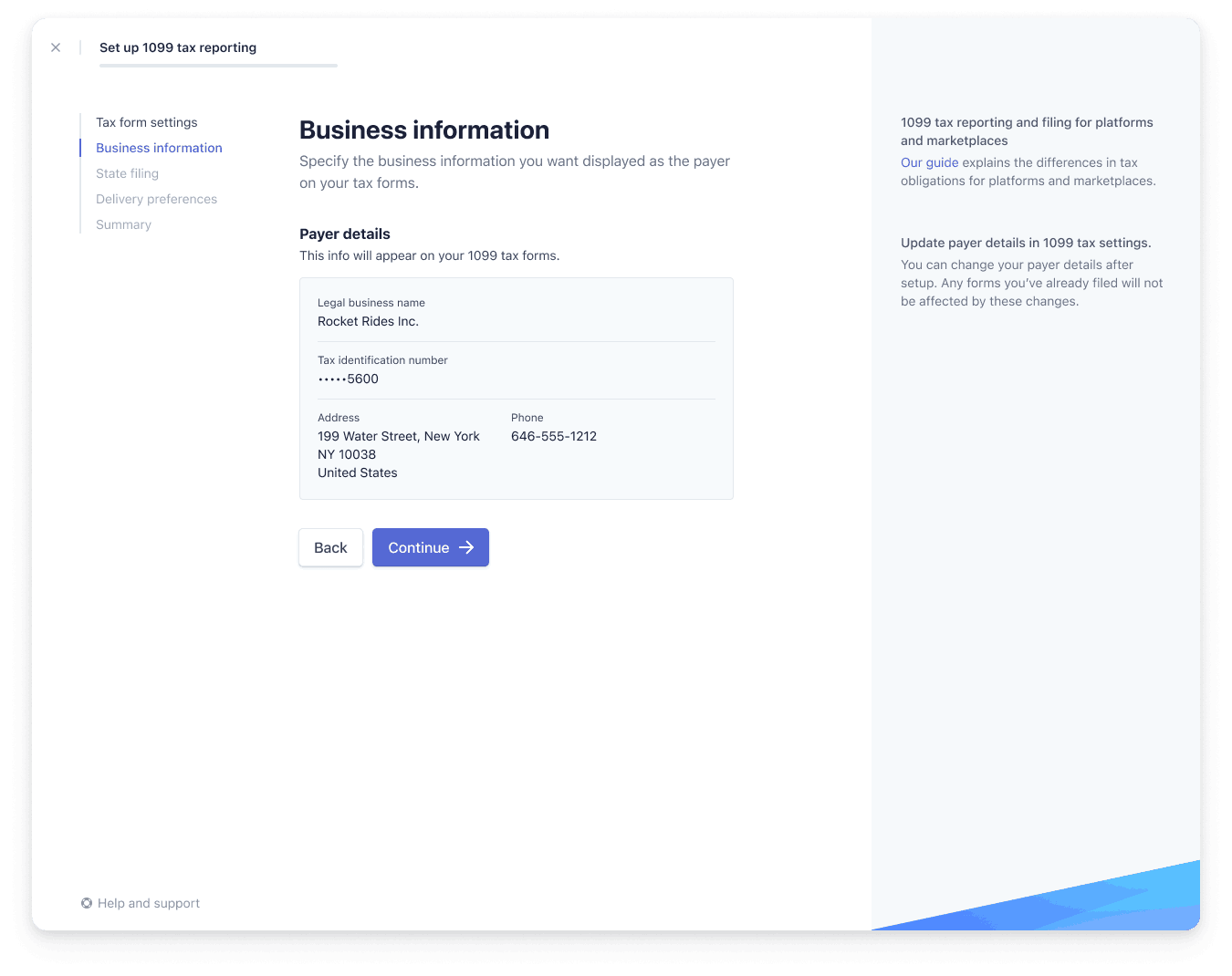

Next, confirm the business information that displays as the Payer details on all of your tax forms. Make any necessary changes, then click Continue.

Next, add state registration or withholding IDs for the states you plan to file with. You can enter these at any time in the future through tax form settings. If you intend to file in either Delaware and Pennsylvania, include your state IDs during this step to prevent possible rejection of your filings.

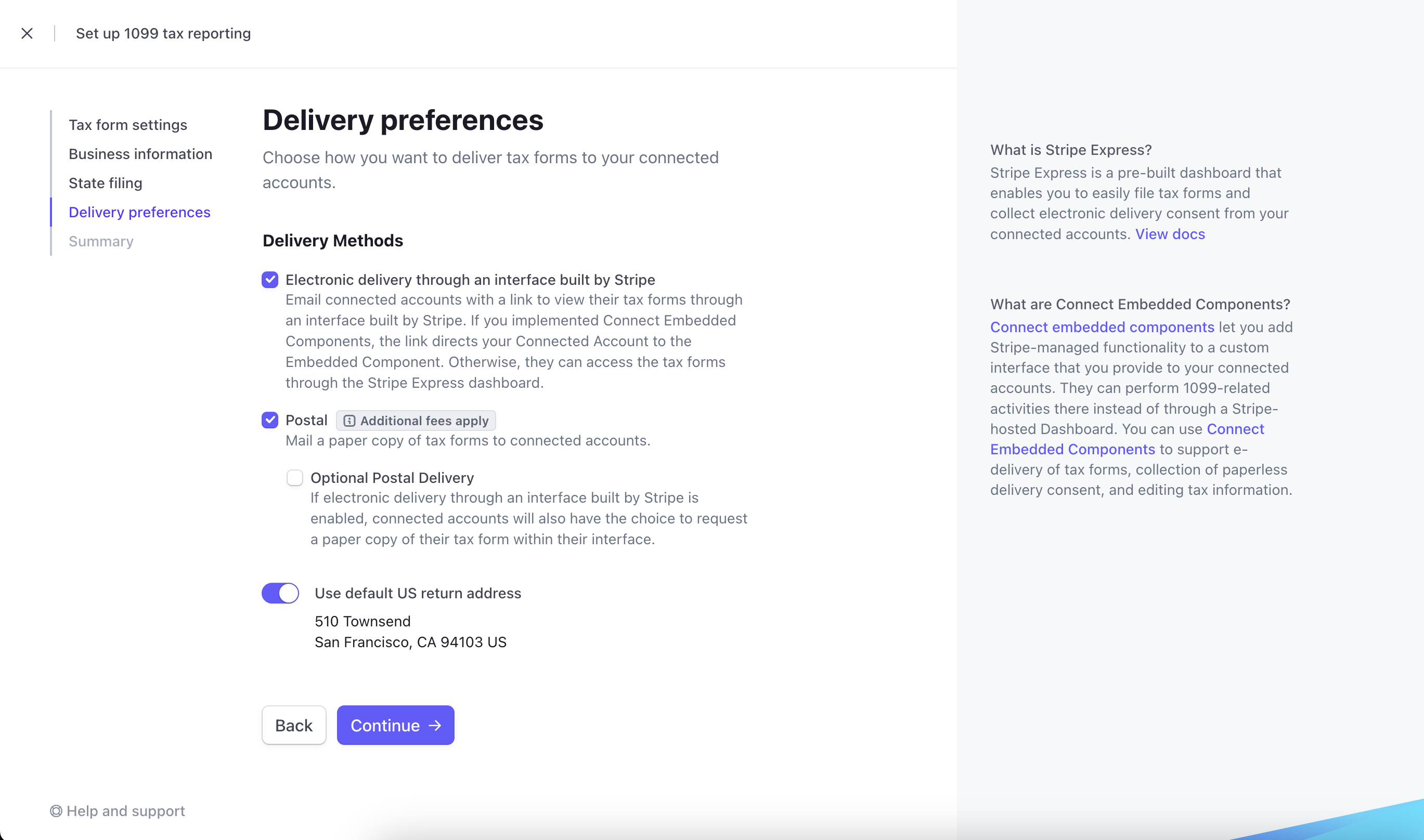

The next step involves choosing your delivery preferences to meet IRS obligations around delivering 1099 forms to payees. We offer two forms of delivery:

E-delivery through an interface built by Stripe: Owners of eligible connected accounts receive an electronic copy of the 1099 form through their Stripe interface. If the connected account previously did not have access to a Stripe interface, the Stripe Express Dashboard or Stripe Embedded Components may be used. Stripe sends an email invite to the connected account owners to confirm their tax details, collect their consent, and provide access to the electronic copy of the form. Read more about how e-delivery works.

Paper delivery through postal mail: Stripe delivers the 1099 forms to the owners of eligible connected accounts through postal mail based on the address on the tax form. If e-delivery is enabled, but the connected account hasn’t provided e-delivery consent at the time of filing, we fall back on postal delivery to meet IRS obligations.

As a final step, you can view a summary of your tax form settings to confirm your choices. After you confirm your settings, the tax forms dashboard opens, where you can view all of your tax forms for 2025.

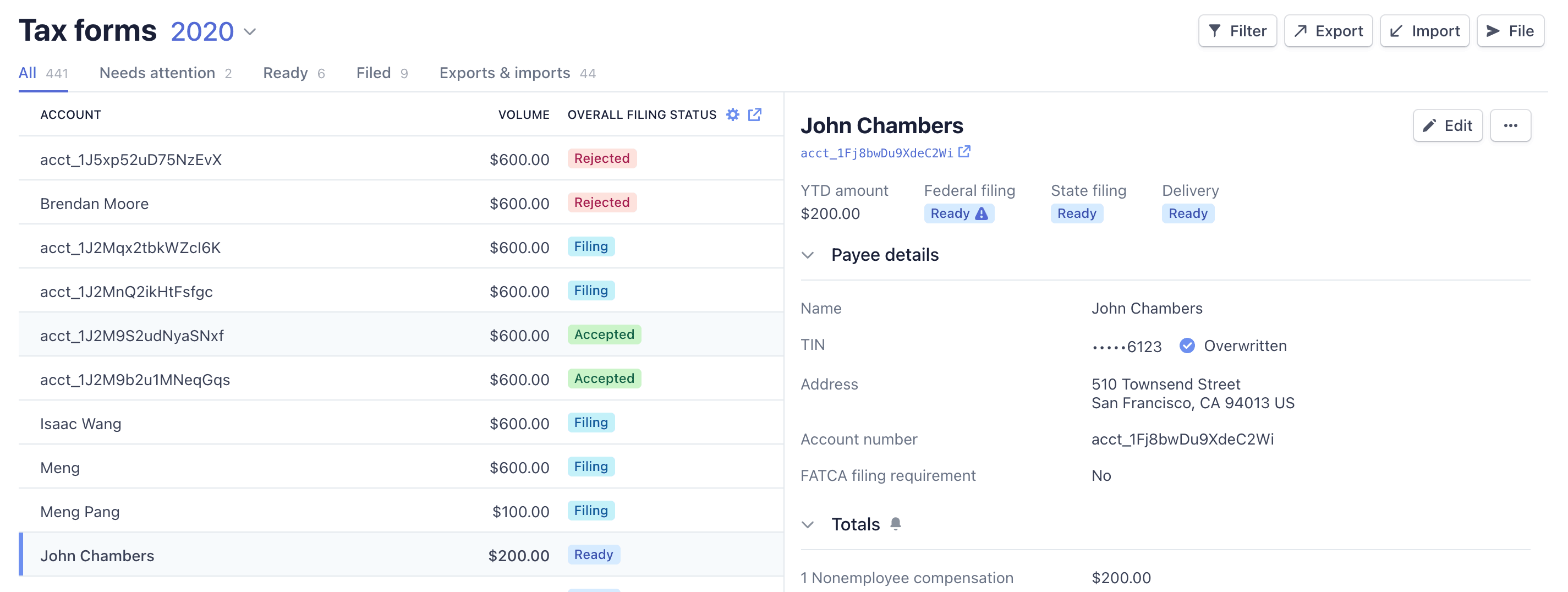

View and filter tax forms

You can view all of the tax forms for your connected account using the Tax reporting dashboard. Click the appropriate tab to filter the forms displayed. To display the State filing status, Federal filing status, or Delivery filing status instead of Overall filing status, click the gear icon to the right of the column heading and select the status to display.

You can apply any of the existing filters to limit the results to only those records that match the filter criteria. For example, to display only records for a specific payee, choose the Payee name filter and then enter all or part of a name to match. The records displayed include only the records for payees with Payee names that match the string you used for the filter.

You can use the following filters to display tax forms:

| Filter name | Filter values |

|---|---|

| Type | Type of tax form: 1099-K, 1099-MISC, or 1099-NEC |

| Overall filing status | Overall status of tax form: Will not file, Needs attention, Ready, Filing, Accepted, or Rejected |

| Federal filing status | Status of the Federal tax form: Will not file, Needs attention, Ready, Filing, Accepted, or Rejected |

| State filing status | Status of the State tax form: Will not file, Needs attention, Ready, Filing, Accepted, or Rejected |

| Delivery status | Delivery status of the tax form: Will not deliver, Needs attention, Ready, Scheduled, Delivering, Delivered, Failed |

| Postal delivery status | Postal delivery status of the tax form: Will not deliver, Needs attention, Ready, Scheduled, Delivering, Delivered, Failed |

| Electronic delivery status | Electronic delivery status of the tax form: Will not deliver, Needs attention, Ready, Scheduled, Delivering, Delivered, Failed |

| Pre-filing confirmation status | Status of Stripe’s pre-filing outreach: Not eligible, Queued, Sent |

| Stripe merchant ID | Tax forms for the specified merchant ID |

| Forms grouped with | Tax forms grouped with the specified tax form ID |

| Payee name | Tax forms for the payee |

| Payee state | Tax forms for the payee’s state |

| Needs attention | Needs attention status: Any reason, Address, Business name, TIN - Any reason, TIN - Missing, TIN - Mismatch |

| YTD volume | Tax forms with the specified year-to-date volume |

| Correction | Correction status: Correction, Original |

| Threshold | State or federal threshold status: Meets federal threshold, Meets state threshold, Meets any threshold, Meets state and federal threshold, Meets neither state nor federal thresholds |

| Email address | Tax forms with the specified email address |

| Missing email address | Filter for tax forms that either have or don’t have email addresses: True, False |

| Delta values | Filter for tax forms with delta values: With delta values, Without delta values |

| Standalone forms | Filter for standalone tax forms: All standalone forms, No standalone forms |

| Paperless delivery consent | Status of paperless delivery (e-delivery) consent collection: Provided, Not provided, Revoked |

| Grouped TIN | Tax forms that have grouped TINs: Grouped forms only, No grouped forms |

Understand tax form status

Stripe automatically calculates the overall status for each tax form, and allows you to apply filing requirements for each form as appropriate. The filing requirement appears as a visual indicator in the tax form status. You can view the status for both State and Federal tax forms.

| Status | Description | Next steps |

|---|---|---|

| Accepted | The IRS or state accepted the tax form. | No further action required. |

| Filing | The tax form has been queued for transmission to the IRS or state, and will be sent shortly. | No further action required. |

| Filed | The tax form was sent to the IRS or state, but hasn’t been accepted yet. | No further action required. |

| Exported | The tax form was included in a state filing export, which you can find on the bulk jobs listing. | You must download the export and manually submit these to the appropriate state reporting agency. |

| Needs attention | The tax form is above the IRS or state threshold, but requires additional information before filing. | Most tax forms require additional information before filing. You can update the form or update the connected account. If you determine that you shouldn’t file the tax form, or you want to file with incomplete information, you can update the filing requirement. |

| Ready | The tax form is above the IRS or state threshold and ready to file. | File most tax forms. If you determine that you shouldn’t file the tax form, you can update the filing requirement. |

| Rejected | The IRS or state rejected the tax form. | Review the IRS information return penalties, and your connected accounts’ tax forms for incorrect names or tax identification numbers. You have 60 days from the initial submission to file corrected tax forms to the IRS. Learn more about handling rejections. |

| Will not file | The tax form is below the IRS or state threshold, or was overridden and won’t be filed. | Most tax forms don’t require further action. If you determine that you should file the tax form, (for example, if the connected account has withholding data), you can update the form. |

Understand tax form TIN status

Platforms need valid TINs on the tax forms to ensure that the IRS and/or state accepts the forms, and Stripe displays the status of the TIN in the Tax Form Editor as follows:

| Status | Description | Next steps |

|---|---|---|

| Verified | Name & TIN are verified | No further action required. |

| Mismatch | Name + TIN didn’t match the records in IRS and need to be resolved before filing | Follow up with the account to get a name + TIN that matches IRS records. If you still want to file the form in this state, change the Filing requirement to Required even if incomplete. |

| Overwritten | Platform has overwritten the Name and/or TIN | Verify the name + TIN directly with the IRS and/or use a third party TIN verification tool. You can still file this form in this status. |

| Provided | Name and TIN were inherited from Connect Settings, but Stripe didn’t verify. | Verify the name + TIN directly with the IRS and/or use a third party TIN verification tool. You can still file this form in this status. |

| Missing | Name or TIN not provided and needs to be resolved before filing | Follow up with the account to get a name + TIN that matches IRS records. If you still want to file the form in this state, change the Filing requirement to Required even if incomplete. |

Understand tax form delivery status

Stripe sends your tax forms using the delivery method you set for your account, either mail or e-delivery. The Tax reporting page shows the delivery status for your tax forms. The following table describes each possible delivery status.

| Status | Description | Next steps |

|---|---|---|

| Delivered | The forms were successfully delivered. | No further action required. |

| Delivering | The forms were sent, but haven’t been received. | No further action required. |

| Failed | The forms were not successfully delivered. | No further action required. |

| Needs attention | The forms are ready to send, but require additional information. | Most tax forms require additional information before delivering. You can update the form or update the user information for the connected account. |

| Ready | These forms are sent when the forms are filed. | No further action required. |

| Scheduled | The forms are scheduled for delivery. | No further action required. |

| Will not deliver | The forms won’t be delivered. | No further action required. |

Updating tax forms

You can Update 1099 tax forms for the current year and choose whether or not to include tax identification numbers (TIN).