Crea cargos Direct

Crea cargos directamente en la cuenta conectada y cobra una comisión.

Crea cargos directos cuando los clientes realicen la transacción directamente con una cuenta conectada, a menudo sin saber que existe tu plataforma. Con cargos directos:

- El pago aparece como cargo en la cuenta conectada, no en la cuenta de tu plataforma.

- El saldo de la cuenta conectada aumenta con cada pago.

- El saldo de tu cuenta aumenta con las comisiones de la aplicación recibidas de cada pago.

Este tipo de cargo es el más adecuado para las plataformas que proporcionan software como servicio. Por ejemplo, Shopify proporciona herramientas para crear tiendas en línea, y Thinkific permite a quienes ofrecen cursos de educación venderlos en línea.

Limitaciones de visibilidad de la plataforma

Los cargos Direct tienen una visibilidad limitada a nivel de plataforma. Cuando creas cargos Direct, sucede lo siguiente:

- Los objetos de transacción como

PaymentIntentsyChargesexisten en la cuenta conectada, no en la plataforma. - Para acceder a los datos de cargos Direct, debes realizar una consulta a la API de Stripe utilizando el ID de la cuenta conectada en la cabecera Stripe-Account.

Este comportamiento de alcance afecta a servicios de sincronización de datos como Fivetran, así como a otras integraciones de terceros que dependen de consultas a la API a nivel de plataforma. Para recuperar datos de cargos Direct, deben consultar la cuenta conectada, no la plataforma.

Nota

Recomendamos usar cargos directos para las cuentas conectadas que tienen acceso al Dashboard completo de Stripe.

Redirige a los usuarios a una página de pago alojada en Stripe con Stripe Checkout. Comprueba cómo esta integración se compara con los otros tipos de integración de Stripe.

Esfuerzo de integración

Tipo de integración

Redirigir a la página de pagos alojada en Stripe

Personalización de la interfaz de usuario

Primero, inscríbete para obtener una cuenta de Stripe.

Usa nuestras bibliotecas oficiales para acceder a la API de Stripe desde tu aplicación:

Crear una sesión de CheckoutLado del clienteLado del servidor

Una sesión de Checkout controla lo que tu cliente puede ver en el formulario de pago, como las partidas, el importe del pedido y la moneda. Agrega un botón de confirmación de compra a tu sitio web que llame a un punto de conexión del lado del servidor para crear una sesión de Checkout.

<html> <head> <title>Checkout</title> </head> <body> <form action="/create-checkout-session" method="POST"> <button type="submit">Checkout</button> </form> </body> </html>

En tu servidor, crea una sesión de Checkout y redirige a tu cliente a la URL que se devuelve en la respuesta.

Stripe-Account: este encabezado indica un cargo Direct para tu cuenta conectada. La imagen de marca de la cuenta conectada se utiliza en el proceso de compra, lo que permite a tus clientes sentir que están interactuando directamente con la cuenta conectada en lugar de con tu plataforma.line_: este atributo representa los artículos que tu cliente está comprando y aparece en la página de proceso de compra alojada por Stripe.items payment_: este atributo especifica el importe que tu plataforma deduce de la transacción como comisión de la plataforma. Después de que se procesa el pago en la cuenta conectada, se transfiere elintent_ data[application_ fee_ amount] application_a la plataforma. Consulta Cobra comisiones para obtener más información.fee_ amount success_: Stripe redirige al cliente a la URL de éxito después de que complete un pago y reemplace la cadenaurl {CHECKOUT_con el ID de la sesión de proceso de compra. Úsalo para recuperar la sesión de proceso de compra e inspecciona el estado para decidir qué le mostrarás a tu cliente. También puedes adjuntar tus propios parámetros de consulta, que se mantendrán durante el proceso de redireccionamiento. Consulta personalizar el comportamiento de redireccionamiento en una página alojada en Stripe para obtener más información.SESSION_ ID}

Visualiza los cargos que creas en tu cuenta conectada en tu lista de pagos. Los cargos Direct no aparecen en las exportaciones, pero puedes encontrarlos en informes, Sigma o usando la API.

Gestionar eventos posteriores al pagoLado del servidor

Stripe envía un evento checkout.session.completed cuando se completa el pago. Utiliza un webhook para recibir estos eventos y ejecutar acciones, como enviar un correo electrónico de confirmación del pedido a tu cliente, registrar la venta en una base de datos o iniciar el flujo de tareas para un envío.

Escucha estos eventos en lugar de esperar una devolución de llamada del cliente. De su lado, el cliente puede cerrar la ventana del navegador o salir de la aplicación antes de que se ejecute la devolución de llamada. Además, algunos métodos de pago tardan entre 2 y 14 días en confirmar el pago. Si configuras tu integración para escuchar eventos asincrónicos, podrás aceptar varios métodos de pago con una sola integración.

Stripe recomienda administrar todos los siguientes eventos al cobrar pagos con Checkout:

| Evento | Descripción | Próximos pasos |

|---|---|---|

| checkout.session.completed | Mediante el envío del formulario de Checkout, el cliente ha autorizado correctamente el pago. | Espera hasta saber si el pago se concreta o no. |

| checkout.session.async_payment_succeeded | El pago del cliente se efectuó correctamente. | Entrega los bienes o servicios comprados. |

| checkout.session.async_payment_failed | El pago se rechazó o falló por algún otro motivo. | Ponte en contacto con el cliente por correo electrónico y solicítale que haga un nuevo pedido. |

Todos estos eventos incluyen el objeto Checkout Session. Una vez que el pago se efectúa correctamente, el estado del PaymentIntent subyacente cambia de processing a succeeded o a un estado de falla.

Probar la integración

Consulta Pruebas para obtener información adicional para probar tu integración.

OpcionalHabilitar métodos de pago adicionales

Ve a Administrar métodos de pago para cuentas conectadas en el Dashboard para configurar qué métodos de pago aceptan tus cuentas conectadas. Los cambios en la configuración predeterminada se aplican a todas las cuentas conectadas nuevas y existentes.

Consulta los siguientes recursos para obtener información sobre los métodos de pago:

- Guía de métodos de pago para ayudarte a elegir los métodos de pago correctos para tu plataforma.

- Funcionalidades de cuenta para asegurarte de que los métodos de pago que elegiste funcionen en tus cuentas conectadas.

- Consulta las tablas de admisibilidad de métodos de pago y de productos para asegurarte de que los métodos de pago elegidos funcionen para tus productos y flujos de pago de Stripe.

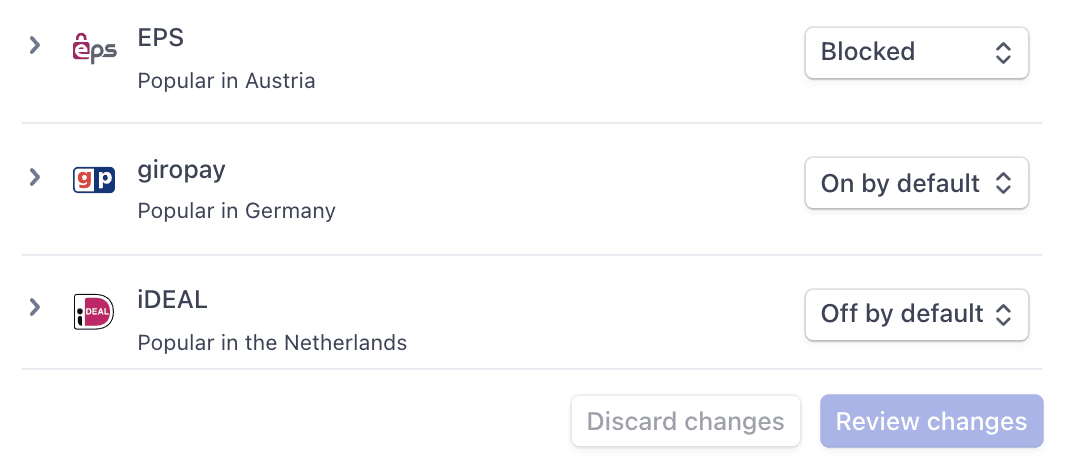

Para cada método de pago, puedes seleccionar una de las siguientes opciones desplegables:

| Activado de manera predeterminada | Tus cuentas conectadas aceptan este método de pago durante el proceso de compra. Algunos métodos de pago solo pueden estar desactivados o bloqueados. Esto se debe a que tus cuentas conectadas con acceso al Dashboard de Stripe deben activarlas en su página de configuración. |

| Desactivado de manera predeterminada | Tus cuentas conectadas no aceptan este método de pago durante el proceso de compra. Si permites que tus cuentas conectadas con acceso al Dashboard de Stripe administren sus propios métodos de pago, podrán activarlo. |

| Bloqueado | Tus cuentas conectadas no aceptan este método de pago durante el proceso de compra. Si permites que tus cuentas conectadas con acceso al Dashboard de Stripe administren sus propios métodos de pago, no tendrán la opción para activarlo. |

Opciones de métodos de pago

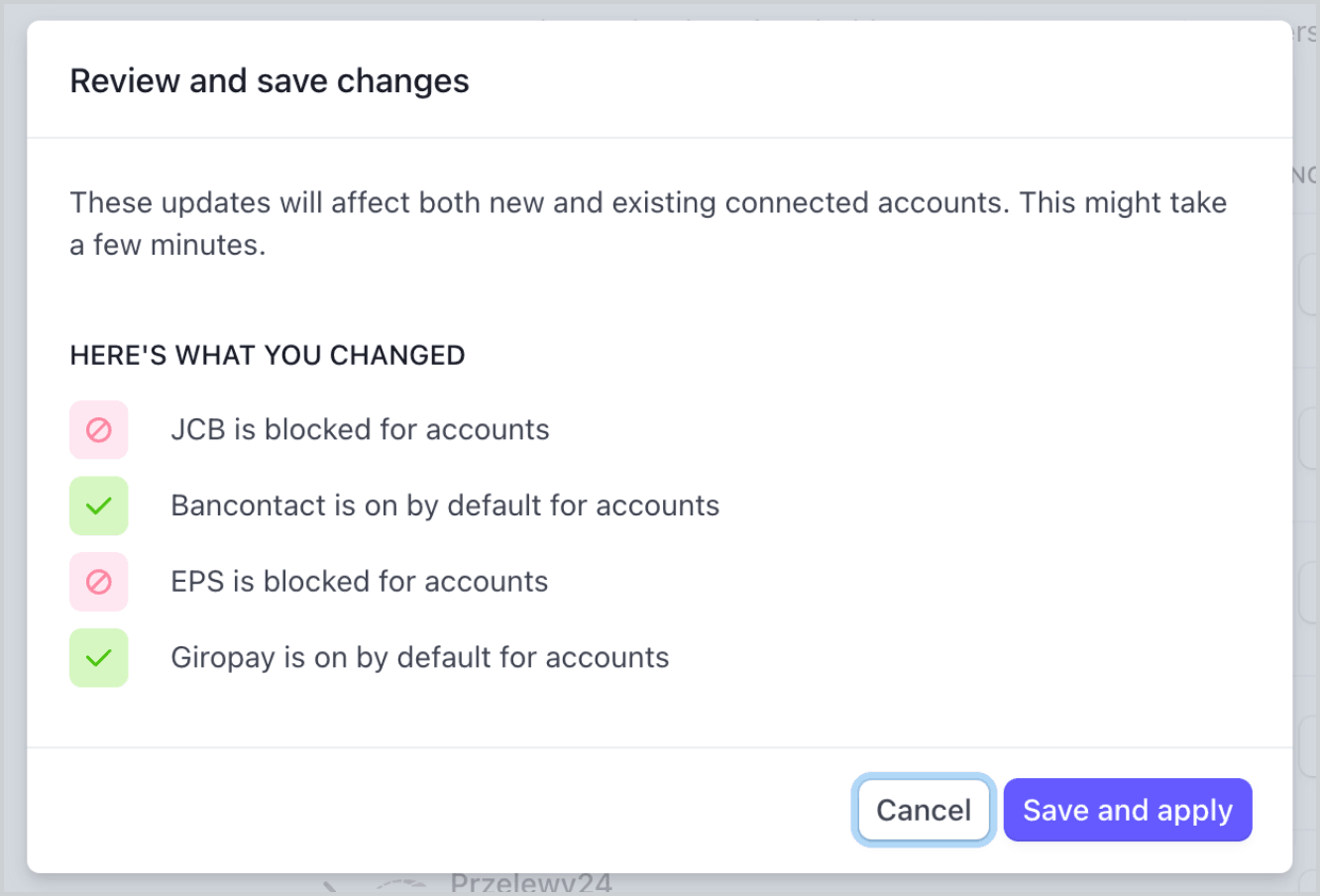

Si realizas un cambio en un método de pago, debes hacer clic en Revisar cambios en la barra inferior de la pantalla y en Guardar y aplicar para actualizar tus cuentas conectadas.

Cuadro de diálogo Guardar

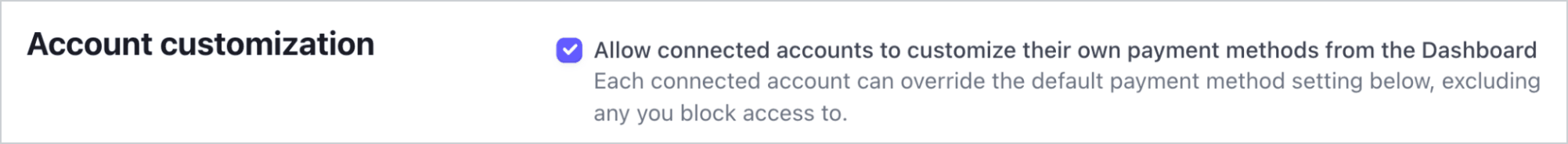

Permite que las cuentas conectadas gestionen los métodos de pago

Stripe recomienda permitir que tus cuentas conectadas personalicen sus propios métodos de pago. Esta opción le permite a cada cuenta conectada con acceso al Dashboard de Stripe ver y actualizar página Métodos de pago. Solo los propietarios de las cuentas conectadas pueden personalizar sus métodos de pago. El Dashboard de Stripe muestra el conjunto de métodos de pago predeterminados que aplicaste a todas las cuentas conectadas nuevas y existentes. Tus cuentas conectadas pueden anular estos valores predeterminados, excluyendo los métodos de pago que hayas bloqueado.

Marca la casilla de verificación Personalización de la cuenta para habilitar esta opción. Debes hacer clic en Revisar cambios en la barra inferior de la pantalla y luego seleccionar Guardar y aplicar para actualizar esta configuración.

Casilla de verificación de personalización de la cuenta

Capacidades de métodos de pago

Para permitir que tus cuentas conectadas acepten métodos de pago adicionales, sus cuentas deben tener funcionalidades de métodos de pago activos.

Si seleccionaste la opción “Activado por defecto” para un método de pago en Gestionar métodos de pago para tus cuentas conectadas, Stripe solicita automáticamente la funcionalidad necesaria para las cuentas conectadas nuevas y las existentes si cumplen con los requisitos de verificación. Si la cuenta conectada no cumple con los requisitos o si quieres tener control directo, puedes solicitar de forma manual la funcionalidad en el dashboard o con la API.

La mayoría de los métodos de pago tienen los mismos requisitos de verificación que la funcionalidad card_, con algunas restricciones y excepciones. En el cuadro figuran las funcionalidades de métodos de pago que requieren verificación adicional.

Cobra comisiones

Cuando se procesa un pago, tu plataforma puede tomar una parte de la transacción en forma de comisiones de la plataforma. Puedes establecer los precios de la comisión de la plataforma de dos maneras:

- Utiliza la herramienta de tarifas de la plataforma para establecer y probar las reglas de tarifas. Esta función que no requiere programación del Dashboard de Stripe solo está disponible actualmente para plataformas responsables de pagar las comisiones de Stripe.

- Define las reglas de precios internamente, especificando las comisiones de la aplicación directamente en un PaymentIntent. Las comisiones establecidas con este método anulan la lógica de tarifas especificada en la herramienta de tarifas de la plataforma.

Tu plataforma puede cobrar una comisión de la plataforma con las siguientes limitaciones:

- El valor del importe de la comisión de la aplicación (

application_) debe ser positivo e inferior al importe del cargo. El importe del cargo es el tope de la comisión de la plataforma que se puede cobrar.fee_ amount - No se aplican comisiones adicionales de Stripe a la comisión de la plataforma en sí.

- En concordancia con los requisitos reglamentarios y de cumplimiento de la normativa de Brasil, las plataformas establecidas fuera de Brasil con cuentas conectadas brasileñas no pueden cobrar comisiones de la plataforma a través de Stripe.

- La moneda de

application_depende de algunos factores de varias monedas.fee_ amount

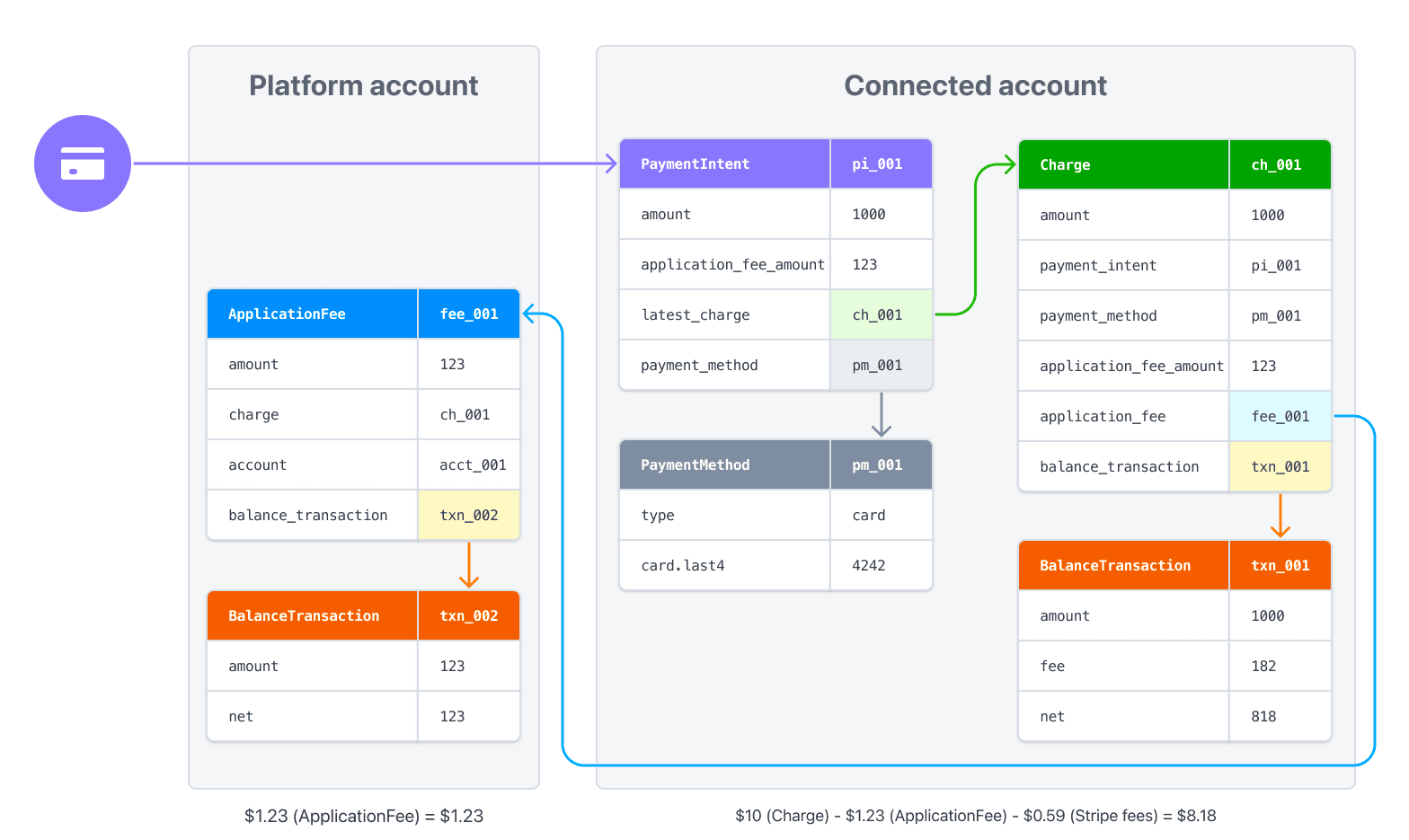

La transacción de saldo del cargo resultante incluye un desglose detallado de las comisiones de Stripe y de la plataforma. Para brindar una mejor experiencia a la hora de elaborar informes, se crea un objeto Application Fee después del cobro de la comisión. Utiliza la propiedad amount en el objeto Application Fee para la elaboración de informes. También puedes acceder a estos objetos usando el punto de conexión de las Comisiones de la aplicación.

Las comisiones ganadas se agregan al saldo disponible de tu cuenta según el mismo calendario que se aplica a los fondos provenientes de cargos normales de Stripe. Las comisiones de la aplicación se pueden ver en la sección Comisiones cobradas del Dashboard.

Precaución

De manera predeterminada, las comisiones de la plataforma para cargos directos se crean de forma asincrónica. Si expandes el objeto application_ en una solicitud de creación de cargo, la comisión de la plataforma se crea sincrónicamente como parte de esa solicitud. Solo expande el objeto application_ si es necesario, ya que aumenta la latencia de la solicitud.

Para acceder a los objetos Application Fee por las comisiones de la aplicación que se crearon de forma asíncrona, escucha el evento de webhook application_fee.created.

Flujo de fondos con comisiones

Cuando especificas una comisión de aplicación en un cargo, el monto de la comisión se transfiere a la cuenta de Stripe de tu plataforma. Al procesar un cargo directamente en la cuenta conectada, el monto del cargo, menos las comisiones de Stripe y la comisión de la aplicación, se deposita en la cuenta conectada.

Por ejemplo, si efectúas un cargo de USD 10 con una comisión de la aplicación de USD 1.23 (como en el ejemplo anterior), se transfieren USD 1.23 a la cuenta de la plataforma. La cuenta conectada obtiene un importe neto de USD 8.18 (USD 10 - USD 0.59 - USD 1.23) (con las comisiones estándar de Stripe en Estados Unidos).

Si procesas pagos en varias monedas, lee cómo se administran las monedas en Connect.

Personaliza la imagen de marca

Tu plataforma y las cuentas conectadas pueden usar la Configuración de imagen de marca en el Dashboard para personalizar la imagen de marca en la página de pagos. Para los cargos directos, Checkout utiliza la configuración de imagen de marca de la cuenta conectada.

También puedes usar la API para actualizar la configuración de imagen de marca:

icon: aparece junto al nombre de la empresa en el encabezado de la página de Checkout.logo: se utiliza en lugar del ícono y el nombre de la empresa en el encabezado de la página de Checkout.primary_: se utiliza como color de fondo en la página de Checkout.color secondary_: se utiliza como color del botón en la página de Checkout.color

Emitir rembolsos

De la misma manera que las plataformas pueden crear cargos en las cuentas conectadas, también pueden crear reembolsos de cargos en las cuentas conectadas. Crea un reembolso con la clave secreta de tu plataforma estando autenticado como cuenta conectada.

Las comisiones de la aplicación no se reembolsan automáticamente al emitir el reembolso. Tu plataforma debe reembolsar expresamente la comisión de la aplicación, o la cuenta conectada (la cuenta en la que se creó el cargo) perderá ese importe. Puedes reembolsar la comisión de la aplicación pasando el valor refund_ de true en la solicitud de reembolso:

De forma predeterminada, se reembolsa el total del cargo, pero puedes crear un reembolso parcial estableciendo un valor de amount como un número entero positivo. Si el reembolso implica que se reembolsa el total del cargo, se reembolsa el total de la comisión de la plataforma. De lo contrario, se reembolsa un importe proporcional de la comisión de la plataforma. Como alternativa, puedes proporcionar un valor de refund_ de false y reembolsar la comisión de la plataforma por separado.

Componentes integrados de Connect

Los componentes integrados de Connect admiten cargos directos. Cuando usas el componente integrado de pagos, puedes permitir que tus cuentas conectadas vean la información de pago, capturen cargos y gestionen disputas desde tu sitio.

Los siguientes componentes muestran información para cargos directos:

Componente de pago: muestra todos los pagos y las disputas de una cuenta.

Detalles de pagos: Muestra información para un pago específico.

Componente de lista de disputas: muestra todas las disputas de una cuenta.

Disputas para un componente de pago: muestra las disputas para un solo pago especificado. Puedes usarlo para incluir funcionalidades para gestionar disputas en una página con tu interfaz de usuario (IU) de pagos.