Direct Charges erstellen

Erstellen Sie Zahlungen direkt auf dem verbundenen Konto und erheben Sie Gebühren.

Erstellen Sie Direct Charges, wenn Kunden/Kundinnen direkt mit einem verbundenen Konto interagieren, während Ihre Plattform dabei im Hintergrund bleibt. Bei Direct Charges:

- Die Zahlung wird auf dem verbundenen Konto als Abbuchung ausgewiesen, nicht auf dem Konto Ihrer Plattform.

- Das Guthaben des verbundenen Kontos erhöht sich mit jeder Zahlung.

- Ihr Kontoguthaben erhöht sich mit jeder Zahlung um die Plattformgebühren.

Dieser Zahlungstyp eignet sich am besten für Plattformen, die Software as a Service anbieten. Shopify bietet beispielsweise Tools zum Erstellen von Online-Shops und Thinkific ermöglicht es Lehrkräften, Online-Kurse zu geben.

Einschränkungen der Plattformsichtbarkeit

Direct Charges sind auf Plattformebene nur eingeschränkt sichtbar. Wenn Sie Direct Charges erstellen, beachten Sie bitte Folgendes:

- Transaktionsobjekte wie

PaymentIntentsundChargessind auf dem verbundenen Konto vorhanden, nicht auf der Plattform. - Um auf Direct Charge-Daten zuzugreifen, müssen Sie die Stripe-API mit der ID des verbundenen Kontos im Stripe-Konto-Header abfragen.

Dieses Scoping-Verhalten wirkt sich auf Datensynchronisierungsdienste wie Fivetran sowie andere Integrationen von Drittanbietern aus, die auf API-Abfragen auf Plattformebene basieren. Um Direct Charge-Daten abzurufen, müssen sie das verbundene Konto abfragen, nicht die Plattform.

Hinweis

Wir empfehlen, Direct Charges für verbundene Konten zu verwenden, die Zugriff auf das vollständige Stripe haben.

Führen Sie mithilfe von Stripe Checkout eine Weiterleitung an eine von Stripe gehostete Zahlungsseite durch. Sehen Sie sich diese Integration im Vergleich zu anderen Integrationstypen von Stripe an.

Integrationsaufwand

Integrationstyp

An die von Stripe gehostete Zahlungsseite weiterleiten

Anpassung der Nutzeroberfläche

Registrieren Sie sich zunächst für ein Stripe-Konto.

Verwenden Sie unsere offiziellen Bibliotheken, um von Ihrer Anwendung aus auf die Stripe API zuzugreifen:

Checkout-Sitzung erstellenClientseitigServerseitig

Über eine Checkout-Sitzung wird gesteuert, was die Kundinnen/Kunden auf dem Zahlungsformular sehen, z. B. Posten, Bestellbetrag und Währung. Fügen Sie auf Ihrer Website eine Schaltfläche zum Bezahlen hinzu, die einen serverseitigen Endpoint aufruft, um eine Checkout-Sitzung zu erstellen.

<html> <head> <title>Checkout</title> </head> <body> <form action="/create-checkout-session" method="POST"> <button type="submit">Checkout</button> </form> </body> </html>

Erstellen Sie auf Ihrem Server eine Checkout-Sitzung und leiten Sie Ihre Kundinnen/Kunden an die in der Antwort zurückgegebene URL weiter.

Stripe-Account: Dieser Header gibt eine Direct Charge für Ihr verbundenes Konto an. In Checkout wird das Branding des verbundenen Kontos verwendet, wodurch Kundinnen und Kunden den Eindruck haben, direkt mit dem verbundenen Konto und nicht mit Ihrer Plattform zu kommunizieren.line_: Dieses Attribut stellt Artikel dar, die Ihr Kunde/Ihre Kundin kauft und wird auf der von Stripe gehosteten Checkout-Seite angezeigt.items payment_: Dieses Attribut gibt den Betrag an, den Ihre Plattform als Plattformgebühr von der Transaktion abzieht. Nachdem die Zahlung für das verbundene Konto verarbeitet wurde, wird derintent_ data[application_ fee_ amount] application_an die Plattform übertragen. Weitere Informationen finden Sie unter Gebühren erheben.fee_ amount success_– Stripe leitet die Kundin / den Kunden nach Durchführung einer Zahlung an die Bestätigungs-URL weiter und ersetzt die Zeichenfolgeurl {CHECKOUT_durch die ID der Checkout Session. Rufen Sie damit die Checkout Session ab und prüfen Sie den Status, um zu entscheiden, was Ihrem Kunden/Ihrer Kundin angezeigt werden soll. Sie können auch Ihre eigenen Abfrageparameter anhängen, die während des Weiterleitungsprozesses bestehen bleiben. Weitere Informationen finden Sie unter Anpassen des Weiterleitungsverhaltens mit einer von Stripe gehosteten Seite.SESSION_ ID}

Zeigen Sie Zahlungen, die Sie auf Ihrem verbundenen Konto erstellen, in Ihrer Zahlungsliste an. Direct Charges werden in Exporten nicht angezeigt, aber Sie finden sie in Berichten, Sigma oder über die API.

Ereignisse nach Zahlung verarbeitenServerseitig

Stripe übermittelt ein checkout.session.completed-Ereignis, wenn die Zahlung abgeschlossen ist. Verwenden Sie einen Webhook, um diese Ereignisse zu empfangen und Aktionen auszuführen (Versenden einer Bestellbestätigung per E-Mail an die Kundinnen/Kunden, Erfassen des Verkaufs in einer Datenbank oder Einleiten des Versandablaufs).

Überwachen Sie diese Ereignisse, anstatt auf einen Callback vom Client zu warten. Auf dem Client könnten die Kundinnen und Kunden das Browserfenster schließen oder die App beenden, bevor der Callback erfolgt ist. Einige Zahlungsmethoden benötigen auch 2 bis 14 Tage bis zur Zahlungsbestätigung. Wenn Sie Ihre Integration so einrichten, dass sie asynchrone Ereignisse überwacht, können Sie mehrere Zahlungsmethoden mit einer einzelnen Integration akzeptieren.

Stripe empfiehlt, alle folgenden Ereignisse zu verarbeiten, wenn Zahlungen mit Checkout eingezogen werden:

| Ereignis | Beschreibung | Nächste Schritte |

|---|---|---|

| checkout.session.completed | Der Kunde/die Kundin hat die Zahlung nach der Übermittlung des Checkout-Formulars erfolgreich autorisiert. | Warten Sie, bis die Zahlung erfolgt ist oder fehlschlägt. |

| checkout.session.async_payment_succeeded | Die Kundenzahlung war erfolgreich. | Führen Sie die Bestellung der gekauften Waren oder Dienstleistungen aus. |

| checkout.session.async_payment_failed | Die Zahlung wurde abgelehnt oder ist aus einem anderen Grund fehlgeschlagen. | Kontaktieren Sie den Kunden/die Kundin per E-Mail und fordern Sie eine neue Bestellung von ihm/ihr an. |

Diese Ereignisse beinhalten alle das Checkout-Sitzungsobjekt. Nach erfolgreicher Zahlung ändert sich der Status des zugrunde liegenden PaymentIntent von processing in succeeded oder in einen Fehlerstatus.

Integration testen

Hier finden Sie weitere Informationen zum Testen Ihrer Integration.

OptionalWeitere Zahlungsmethoden aktivieren

Navigieren Sie im Dashboard zu Zahlungsmethoden für Ihre verbundenen Konten verwalten, um zu konfigurieren, welche Zahlungsmethoden Ihre verbundenen Konten akzeptieren. Änderungen an den Standardeinstellungen gelten für alle neuen und bestehenden verbundenen Konten.

Informationen zu den Zahlungsmethoden finden Sie in den folgenden Ressourcen:

- Ein Leitfaden zu Zahlungsmethoden, der Ihnen bei der Auswahl der richtigen Zahlungsmethoden für Ihre Plattform hilft.

- Kontofunktionen, um sicherzustellen, dass die gewählten Zahlungsmethoden für Ihre verbundenen Konten funktionieren.

- Zahlungsmethode und Produktsupport, um sicherzustellen, dass die gewählten Zahlungsmethoden für Ihre Stripe-Produkte und Zahlungsabläufe geeignet sind.

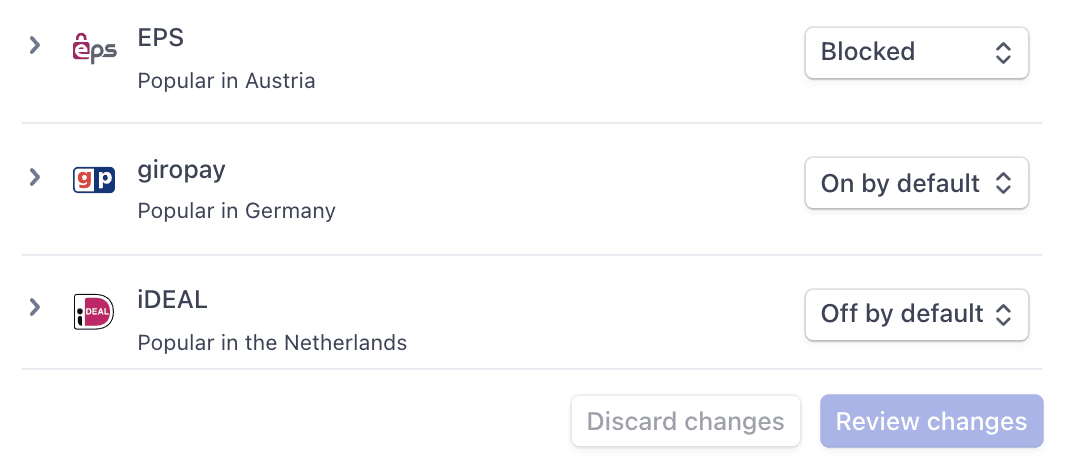

Für jede Zahlungsmethode können Sie eine der folgenden Dropdown-Optionen wählen:

| Standardmäßig aktiviert | Ihre verbundenen Konten akzeptieren diese Zahlungsmethode beim Bezahlvorgang. Einige Zahlungsmethoden können nur deaktiviert oder gesperrt werden. Dies liegt daran, dass Ihre verbundenen Konten mit Zugriff auf das Stripe-Dashboard sie auf ihrer Seite mit Einstellungen aktivieren müssen. |

| Standardmäßig deaktiviert | Ihre verbundenen Konten akzeptieren diese Zahlungsmethode beim Bezahlvorgang nicht. Wenn Sie Ihren verbundenen Konten mit Zugriff auf das Stripe-Dashboard erlauben, ihre eigenen Zahlungsmethoden zu verwalten, haben sie die Möglichkeit, sie zu aktivieren. |

| Blockiert | Ihre verbundenen Konten akzeptieren diese Zahlungsmethode beim Bezahlvorgang nicht. Wenn Sie Ihren verbundenen Konten mit Zugriff auf das Stripe-Dashboard erlauben, ihre eigenen Zahlungsmethoden zu verwalten, haben sie nicht die Möglichkeit, sie zu aktivieren. |

Optionen für Zahlungsmethoden

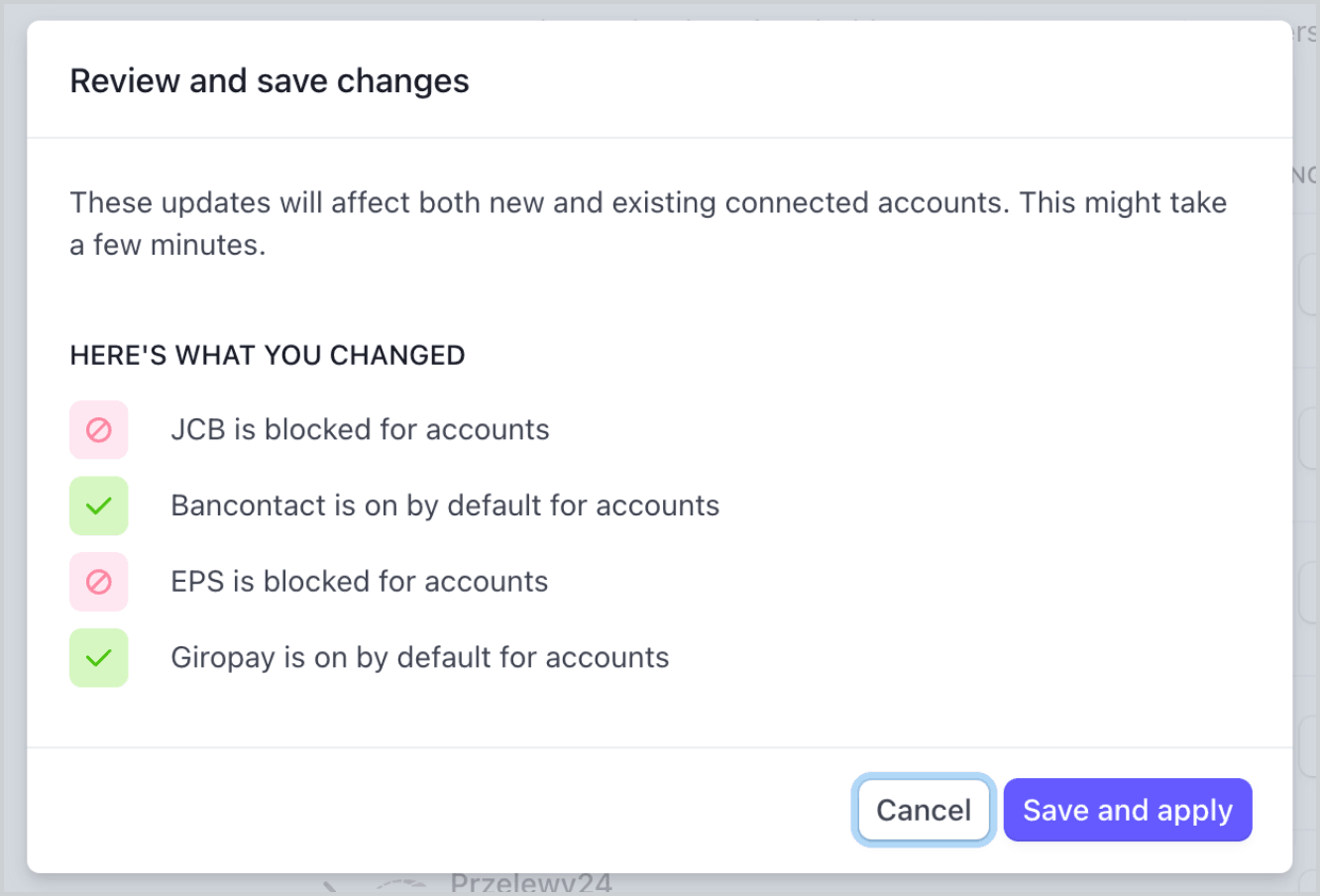

Wenn Sie eine Änderung an einer Zahlungsmethode vornehmen, müssen Sie auf Änderungen überprüfen in der Leiste unten im Bildschirm klicken und auf Speichern und anwenden, um Ihre verbundenen Konten zu aktualisieren.

Dialogfeld „Speichern“

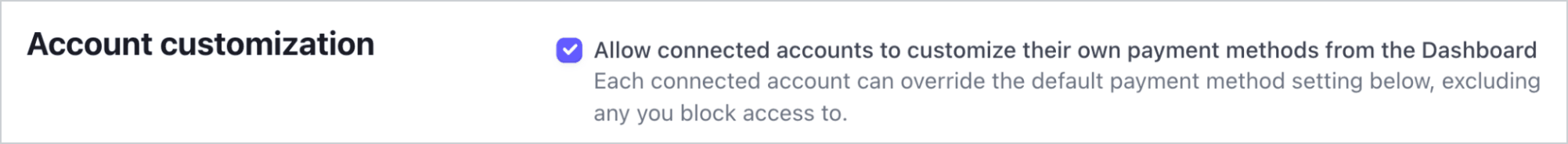

Verbundenen Konten die Verwaltung von Zahlungsmethoden gestatten

Stripe empfiehlt, dass Sie Ihren verbundenen Konten erlauben, ihre eigenen Zahlungsmethoden anzupassen. Diese Option ermöglicht jedem verbundenen Konto mit Zugriff auf das Stripe-Dashboard, seine Seite mit den Zahlungsmethoden anzuzeigen und zu aktualisieren. Nur Inhaber/innen der verbundenen Konten können ihre Zahlungsmethoden anpassen. Das Stripe-Dashboard zeigt die Standard-Zahlungsmethoden an, die Sie auf alle neuen und bestehenden verbundenen Konten angewendet haben. Ihre verbundenen Konten können diese Standardeinstellungen außer Kraft setzen, mit Ausnahme der von Ihnen blockierten Zahlungsmethoden.

Aktivieren Sie das Kontrollkästchen Anpassung des Kontos, um diese Option zu aktivieren. Sie müssen auf Änderungen überprüfen in der Leiste unten im Bildschirm klicken und dann Speichern und übernehmen auswählen, um diese Einstellung zu aktualisieren.

Kontrollkästchen „Anpassung des Kontos“

Funktionen der Zahlungsmethode

Damit Ihre verbundenen Konten zusätzliche Zahlungsmethoden akzeptieren können, müssen deren Accounts über aktive Zahlungsmethoden verfügen.

Wenn Sie unter Zahlungsmethoden für Ihre verbundenen Konten verwalten die Option „Standardmäßig aktiviert“ für eine Zahlungsmethode ausgewählt haben, fordert Stripe automatisch die erforderliche Funktion für neue und bestehende verbundene Konten an, sofern diese die Verifizierungsanforderungen erfüllen. Wenn das verbundene Konto die Anforderungen nicht erfüllt oder Sie die direkte Kontrolle behalten möchten, können Sie die Funktion manuell im Dashboard oder über die API anfordern.

Die meisten Zahlungsmethoden haben die gleichen Verifizierungsanforderungen wie die card_-Funktion, mit einigen Einschränkungen und Ausnahmen. Die Tabelle der Zahlungsmethodenfunktionen führt die Zahlungsmethoden auf, die eine zusätzliche Verifizierung erfordern.

Gebühren einziehen

Wenn eine Zahlung verarbeitet wird, kann Ihre Plattform einen Teil der Transaktion in Form von Plattformgebühren übernehmen. Sie können die Preise für die Plattformgebühr auf zwei Arten festlegen:

- Mit dem Plattform-Preistool können Sie Preisregeln festlegen und testen. Diese No-Code-Funktion im Stripe-Dashboard ist derzeit nur für Plattformen verfügbar, die für die Zahlung von Stripe-Gebühren verantwortlich sind.

- Legen Sie Ihre Preisregeln intern fest und geben Sie die Plattformgebühren direkt in einem PaymentIntent an. Die mit dieser Methode festgelegten Gebühren überschreiben die im Plattform-Preistool angegebene Preislogik.

Ihre Plattform kann eine Plattformgebühr unter Berücksichtigung der folgenden Einschränkungen erheben:

- Der Wert von

application_muss positiv und kleiner als der Betrag der Zahlung sein. Die erhobene Plattformgebühr wird auf den Betrag der Zahlung begrenzt.fee_ amount - Es fallen keine zusätzlichen Stripe-Gebühren für die Plattformgebühr selbst an.

- In Übereinstimmung mit gesetzlich vorgeschriebenen und Compliance-Anforderungen in Brasilien können Plattformen mit Sitz außerhalb Brasiliens und mit brasilianischen verbundenen Konten keine Plattformgebühren über Stripe einziehen.

- Die Währung des

application_hängt von einigen Faktoren für mehrere Währungen ab.fee_ amount

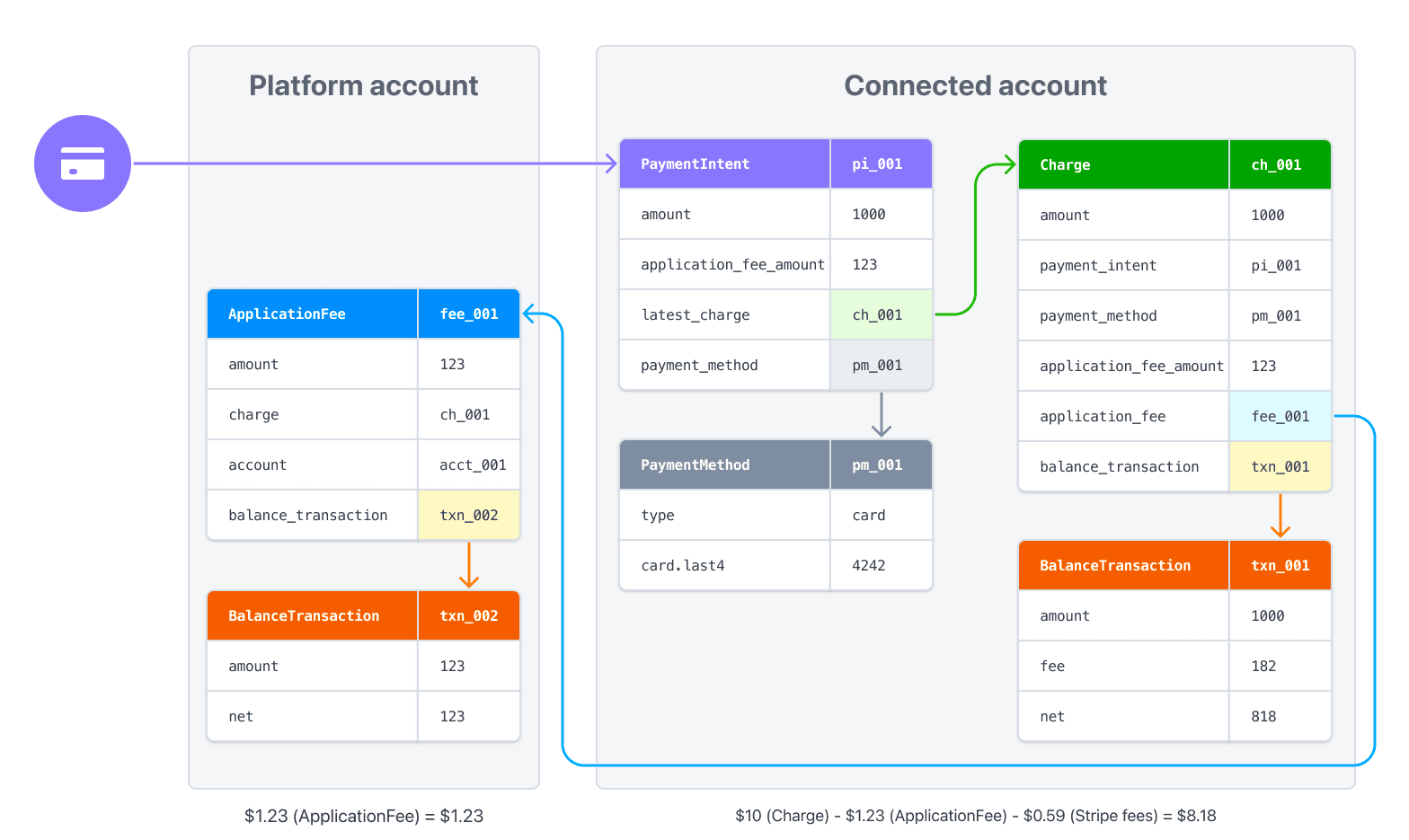

Die Saldo-Transaktion der sich ergebenden Zahlung beinhaltet eine detaillierte Gebührenaufschlüsselung sowohl der Stripe-Gebühren als auch der Plattformgebühren. Um eine bessere Berichterstellung zu ermöglichen, wird ein Plattformgebühr-Objekt erstellt, sobald die Gebühr eingezogen wurde. Verwenden Sie die Eigenschaft amount des Plattformgebühren-Objekts für die Berichterstellung. Anschließend können Sie mit dem Endpoint für Plattformgebühren auf diese Objekte zugreifen.

Erhaltene Plattformgebühren werden Ihrem verfügbaren Kontosaldo nach demselben Zeitplan hinzugefügt wie Gelder aus regulären Stripe-Zahlungen. Plattformgebühren können im Abschnitt Erhobene Gebühren des Dashboards angezeigt werden.

Vorsicht

Plattformgebühren für Direct Charges werden standardmäßig asynchron erstellt. Wenn Sie das application_-Objekt in einer Zahlungserstellungsanfrage erweitern, wird die Plattformgebühr synchron als Teil dieser Anfrage erstellt. Erweitern Sie das application_-Objekt nur bei Bedarf, da dies die Latenz der Anfrage erhöht.

Um auf die Plattformgebührenobjekte für Plattformgebühren, die asynchron erstellt werden, zuzugreifen, überwachen Sie das Webhook-Ereignis application_fee.created.

Geldbewegungen mit Gebühren

Wenn Sie eine Plattformgebühr für eine Zahlung angeben, wird der Gebührenbetrag auf das Stripe-Konto Ihrer Plattform übertragen. Wird eine Zahlung direkt über das verbundene Konto abgewickelt, wird der Zahlungsbetrag – abzüglich der Stripe-Gebühren und der Plattformgebühr – in das verbundene Konto eingezahlt.

Wenn Sie beispielsweise eine Zahlung in Höhe von 10 USD mit einer Plattformgebühr von 1,23 USD vornehmen (wie im vorherigen Beispiel), werden 1,23 USD auf Ihr Plattformkonto überwiesen. 8,18 USD (10 USD – 0,59 USD – 1,23 USD) werden im verbundenen Konto verrechnet (wobei standardmäßig US-Stripe-Gebühren angenommen werden).

Wenn Sie Zahlungen in mehreren Währungen abwickeln, lesen Sie die Informationen zur Handhabung von Währungen in Connect.

Branding anpassen

Ihre Plattform und verbundene Konten können die Branding-Einstellungen im Dashboard verwenden, um das Branding auf der Zahlungsseite anzupassen. Für Direct Charges verwendet Checkout die Markeneinstellungen des verbundenen Kontos.

Sie können die API auch verwenden, um die Branding-Einstellungen zu aktualisieren:

icon– Wird neben dem Unternehmensnamen in der Kopfzeile der Checkout-Seite angezeigt.logo– Wird anstelle des Symbols und des Unternehmensnamens in der Kopfzeile der Checkout-Seite verwendet.primary_– Wird als Hintergrundfarbe auf der Checkout-Seite verwendet.color secondary_– Wird als Farbe für Schaltflächen auf der Checkout-Seite verwendet.color

Rückerstattungen ausstellen

Ebenso wie Plattformen Zahlungen für verbundene Konten erstellen können, können sie auch Rückerstattungen von Zahlungen für verbundene Konten erstellen. Erstellen Sie eine Rückerstattung mit dem Geheimschlüssel Ihrer Plattform, während Sie als das verbundene Konto authentifiziert sind.

Plattformgebühren werden bei Ausstellung einer Rückerstattung nicht automatisch zurückerstattet. Ihre Plattform muss die Plattformgebühr explizit zurückerstatten. Andernfalls büßt das verbundene Konto, d. h. das Konto, auf dem die Zahlung erstellt wurde, diesen Betrag ein. Sie können eine Plattformgebühr zurückerstatten, indem Sie in der Erstattungsanfrage für den Wert refund_ true angeben:

Standardmäßig wird die gesamte Zahlung zurückerstattet. Sie können jedoch auch eine Teilerstattung erstellen, indem Sie den Wert amount als positive ganze Zahl festlegen. Wenn die Erstattung zu einer Rückerstattung der gesamten Zahlung führt, wird die gesamte Plattformgebühr zurückerstattet. Andernfalls wird ein anteiliger Betrag der Plattformgebühr zurückerstattet. Alternativ können Sie den Wert refund_ als false angeben und die Plattformgebühr getrennt erstatten.

In Connect eingebettete Komponenten

In Connect eingebettete Komponenten unterstützt Direct Charges. Mithilfe der eingebetteten Zahlungskomponente können Sie Ihren verbundenen Konten innerhalb Ihrer Website die Möglichkeit geben, Zahlungsinformationen einzusehen, Gebühren zu erfassen und Zahlungsanfechtungen zu verwalten.

Die folgenden Komponenten zeigen Informationen für Direct Charges an:

Payments-Komponente: Zeigt alle Zahlungen und Zahlungsanfechtungen eines Kontos an.

Zahlungsdetails: Zeigt Informationen für eine bestimmte Zahlung an.

Komponente „Zahlungsanfechtungen“: Zeigt alle Zahlungsanfechtungen eines Kontos an.

Komponente „Zahlungsanfechtungen für eine Zahlung“: Zeigt die Zahlungsanfechtungen für eine einzelne angegebene Zahlung an. Sie können damit Funktionen zum Management von Zahlungsanfechtungen in eine Seite Ihrer Zahlungs-Nutzeroberfläche integrieren.