Query disputes and fraud data

Use Sigma or Data Pipeline to retrieve information about disputes and fraud.

The disputes table contains data about all disputes on your account. Each row represents a Dispute object, which is created when a charge is disputed. Each dispute also includes any available data about dispute evidence that you’ve submitted.

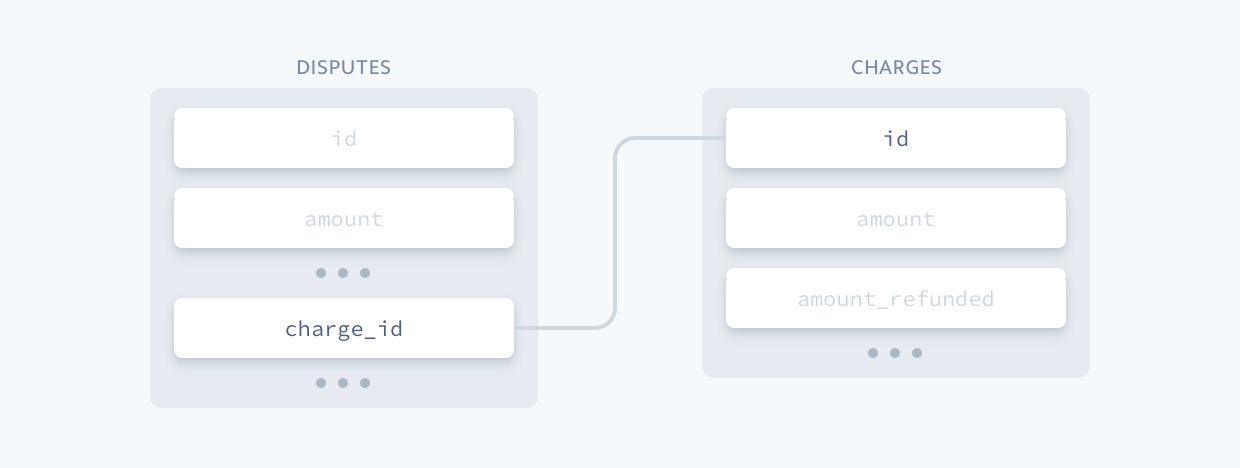

The following example provides some preliminary information about the five most recent lost disputes. It joins the disputes and charges tables together using the disputes. and charges. columns. Along with a dispute ID, each row contains an associated charge ID, the amount, and the outcome of the ZIP and CVC checks.

select date_format(date_trunc('day', disputes.created), '%m-%d-%Y') as day, disputes.id, disputes.charge_id, disputes.amount, charges.card_address_zip_check as zip, charges.card_cvc_check as cvc from disputes inner join charges on charges.id=disputes.charge_id where disputes.status = 'lost' and disputes.reason = 'fraudulent' order by day desc limit 5

| day | id | charge_id | amount | zip | cvc |

|---|---|---|---|---|---|

| dp_iyCCOL8MOXV2oP3 | ch_CYTkMuqbICCb9yR | 1,000 | pass | ||

| dp_v2N0eExDOYtQLVX | ch_oJKdEksrgIOazVW | 1,000 | pass | fail | |

| dp_on7dXRhHTzYwXIe | ch_ANxC8gs8SzM0pZu | 1,000 | fail | fail | |

| dp_hlAa3itSlfd10bd | ch_X04Grlmm4J713nx | 1,000 | pass | ||

| dp_74tnPhLqesRvGQo | ch_pCU0vGKajtVuzjP | 1,000 | pass |

Using Sigma or Data Pipeline to create reports about your disputes can help you identify fraudulent payments, which you can prevent by using Radar.

Radar for Fraud Teams Data

If you use Radar for Fraud Teams, you have a table (radar_) that contains all Radar custom rules with their action and predicate. You can use this to obtain the rule_ which you use in the rule_ table to find all charges affected by rules. This provides more information than looking at the outcome_ attribute in the charges table, as it also shows 3DS rules triggered for PaymentIntents and SetupIntents. Radar’s built-in rules have fixed rule IDs.

The following example shows recent payments allowed by an allow-list and their Radar score to check if potentially fraudulent payments were allowed:

select outcome_type, card_cvc_check, count(*) as cnt, avg(outcome_risk_score) as avg_risk_score from charges where outcome_rule_id = 'allow_if_in_allowlist' and created >= current_date - interval '14' day group by 1, 2

Platform data

Multiparty payment businesses such as Connect platforms have particular risk management requirements. Here’s an example of listing destination charge businesses on your platform by their dispute rate:

select m.value as merchant_external_account_id, c.destination_id, arbitrary(a.business_name) as destination_name, count(*) as cnt_charges, count_if(c.paid) as cnt_success_charges, count_if(c.paid) * 1.0 / count(*) as success_rate, if( count_if(dispute_id is not null) > 0, count_if(c.paid) * 1.0 / count_if(c.paid), 0.0 ) as dispute_rate from charges c left join charges_metadata m on m.charge_id = c.id and m.key = 'merchant_external_account_id' join connected_accounts a on a.id = c.destination_id where c.created >= current_date - interval '120' day group by 1,2 order by dispute_rate desc

3D Secure Data

Sigma and Data Pipelines contains data on 3D Secure Authentication (3DS). This more complex example shows for each 3DS Rule how many times it triggered 3DS and what the outcomes were, considering there might be more than one attempt:

select rd.rule_id, count(distinct rd.id) as cnt_rule_triggered, count(distinct rd.payment_intent_id) * 1.0 / count(distinct rd.id) * 100.0 as pct_pis, count_if(at.is_final_attempt) * 1.0 / count(distinct rd.id) * 100.0 as pct_final_attempts, count_if( at.is_final_attempt and at.threeds_outcome_result = 'authenticated' ) * 1.0 / count(distinct rd.id) * 100.0 as pct_3ds_final_authenticated, count_if( at.threeds_outcome_result = 'authenticated' and at.charge_outcome = 'authorized' ) * 1.0 / count(distinct rd.id) * 100.0 as pct_3ds_authorized from rule_decisions rd left join authentication_report_attempts at on at.intent_id = rd.payment_intent_id where action = 'request_credentials' and rd.created >= current_date - interval '30' day group by 1

All Radar Rule Attributes and Decisions

You also have access to the radar_ table. Each row contains most of the Radar rule attribute values for a single charge. You can join the radar_ and disputes tables together using the radar_ and disputes. columns, which allows you to write rules targeting your disputes and understand trends in your good and bad customers.

select card_3d_secure_support, is_3d_secure_authenticated, cvc_check, avg(risk_score) as avg_risk_score, avg(total_charges_per_card_number_all_time) as avg_total_charges_per_card_number_all_time, count(*) as cnt_disputes from radar_rule_attributes r join disputes d on r.transaction_id = d.charge_id where d.created >= current_date - interval '60' day group by 1,2,3 order by cnt_disputes desc

For more details on columns available see our guide on How to continuously improve your fraud management with Radar for Fraud Teams and Stripe Data. It explains, for instance, where to find Radar scores per Charges and so on.

Tracking Monitoring Programs

Card brand monitoring program metrics are difficult to track because rules are very specific. Some details are crucial, such as when to use volume or transaction count. Tracking them is required to estimate fraud and chargeback levels and take action promptly, because monitoring program notifications don’t happen immediately. We recommend a continous process to track and estimate chargeback and fraud metrics.

With Sigma, you can write a query to estimate fraud levels that simulate how card monitoring programs might assess your payments. The query below isn’t perfect (for example, we assume this is a US merchant where domestic and cross-border payments are counted, but you can adjust the query for your use case). Most importantly, it takes FX (currency exchange rates) into account, and applies the same method of counting payment and fraud periods independently as the monitoring programs typically do.

with exchange_rates as ( select date, currency, rate from exchange_rates_from_usd cross join unnest ( cast( json_parse(buy_currency_exchange_rates) as map(varchar, double) ) ) as t(currency, rate) where date = ( select max(date) from exchange_rates_from_usd ) -- note the calculation for jpy is decimal and may look off ), payments as ( select -- technically these values are calculated per statement descriptor for CNP but we assume this equals merchant date_format(p.captured_at, '%Y-%m-01') as start_of_month, if( p.card_brand = 'Visa' or p.card_brand = 'MasterCard', p.card_brand, 'Other' ) as network, arbitrary(date_trunc('month', p.captured_at)) as month_datetime, count(*) as sales_count, -- For US, both Cross-Border and Domestic charges are counted -- we can ignore this in CBMP but show it here just to get a magnitude count_if(p.card_country != 'US') as sales_count_crossborder, count_if(pmd.card_3ds_succeeded) as sales_count_3ds, sum(p.amount / fx.rate / 100.0) as sales_volume_usd, sum( if( p.card_country != 'US', p.amount / fx.rate / 100.0 ) ) as sales_volume_crossborder_usd, sum( if( p.card_country = 'US' and pmd.card_3ds_succeeded, p.amount / fx.rate / 100.0 ) ) as sales_volume_3ds_us_usd from charges p join exchange_rates fx on p.currency = fx.currency left join payment_method_details pmd on pmd.charge_id = p.id -- for more information you may use -- left join authentication_report_attempts aa on attempt_id intent_id where p.captured_at >= date_trunc('month', current_date - interval '150' day) -- CBMPs only consider cleared amounts; refunds still count in the volume unless reversed and p.status = 'succeeded' and p.payment_method_type = 'card' group by 1, 2 ), efw as ( select date_format(e.created, '%Y-%m-01') as start_of_month, if( c.card_brand = 'Visa' or c.card_brand = 'MasterCard', c.card_brand, 'Other' ) as network, -- For US, both Cross-Border and Domestic charges are counted -- count_if(card_country != 'US') as efw_count_crossborder count(distinct c.id) as efw_count, count(distinct if(pmd.card_3ds_succeeded, c.id)) as efw_count_3ds, sum(c.amount / fx.rate / 100.0) as efw_volume_usd, sum( if( pmd.card_3ds_succeeded, c.amount / fx.rate / 100.0 ) ) as efw_volume_3ds_usd, -- for VFMP-3DS sum( if( c.card_country = 'US' and pmd.card_3ds_succeeded, c.amount / fx.rate / 100.0 ) ) as efw_volume_3ds_us_usd from early_fraud_warnings e join charges c on e.charge_id = c.id join exchange_rates fx on c.currency = fx.currency left join payment_method_details pmd on pmd.charge_id = c.id where e.created >= date_trunc('month', current_date - interval '150' day) group by 1, 2 -- used for VAMP and ECM/ECP ), disputes as ( select date_format(d.created, '%Y-%m-01') as start_of_month, if( c.card_brand = 'Visa' or c.card_brand = 'MasterCard', c.card_brand, 'Other' ) as network, -- For US, both Cross-Border and Domestic charges are counted -- count_if(card_country != 'US') as dispute_count_crossborder -- Because a payment can have multiple disputes, we count the disputes here count(distinct d.id) as dispute_count_all, count(distinct if(d.reason != 'fraudulent', d.id)) as non_fraud_dispute_count_all, count(distinct if(d.reason = 'fraudulent', d.id)) as fraud_dispute_count_all, count( distinct if( d.network_details_visa_rapid_dispute_resolution, d.id ) ) as dispute_count_rdr, count( distinct if( d.network_details_visa_rapid_dispute_resolution is null or not d.network_details_visa_rapid_dispute_resolution, d.id ) ) as dispute_count_exrdr, count(distinct if(pmd.card_3ds_succeeded, d.id)) as dispute_count_3ds, count( distinct if( d.reason = 'fraudulent' and pmd.card_3ds_succeeded, d.id ) ) as fraud_dispute_count_3ds, count( distinct if( d.reason = 'fraudulent' and ( d.network_details_visa_rapid_dispute_resolution is null or not d.network_details_visa_rapid_dispute_resolution ), d.id ) ) as fraud_dispute_count_exrdr, count_if(d.status = 'won') * 1.0 / count_if( d.status = 'won' or d.status = 'lost' ) as win_rate, -- The sum of disputes should match and can't exceed the payment sum(d.amount / fx.rate / 100.0) as dispute_volume_usd_all, sum( if( reason = 'fraudulent', d.amount / fx.rate / 100.0 ) ) as fraud_dispute_volume_usd_all, sum( if( ( d.network_details_visa_rapid_dispute_resolution is null or not d.network_details_visa_rapid_dispute_resolution ), d.amount / fx.rate / 100.0 ) ) as dispute_volume_usd_exrdr, sum( if( d.reason = 'fraudulent' and ( d.network_details_visa_rapid_dispute_resolution is null or not d.network_details_visa_rapid_dispute_resolution ), d.amount / fx.rate / 100.0 ) ) as fraud_dispute_volume_usd_exrdr from disputes d join charges c on d.charge_id = c.id join exchange_rates fx on c.currency = fx.currency left join payment_method_details pmd on pmd.charge_id = c.id where -- current month data will usually be off due to dispute delays, -- we still show it as an indicator but it's better tracked weekly d.created >= date_trunc('month', current_date - interval '150' day) group by 1, 2 ) select -- theoretically this might cause gaps if there is a month -- without payments but a helper table with continuous dates would complicate this example query p.start_of_month, -- Visa deprecated VDMP and VFMP in April 2025 replacing it with VAMP p.month_datetime >= date '2025-04-01' as use_vamp_over_vdmpvfmp, p.network, -- Used for VAMP/VDMP/ECP/ECM/HEC p.sales_count, lag(p.sales_count, 1) over ( order by p.network, p.start_of_month ) as sales_count_prior_month, p.sales_count_crossborder, p.sales_count_3ds, -- Used for VFMP round(p.sales_volume_usd, 2) as sales_volume_usd, round(p.sales_volume_crossborder_usd, 2) as sales_volume_crossborder_usd, round(p.sales_volume_3ds_us_usd, 2) as sales_volume_3ds_us_usd, e.efw_count, e.efw_count_3ds, -- Used for VFMP round(e.efw_volume_usd, 2) as efw_volume_usd, round(e.efw_volume_3ds_usd, 2) as efw_volume_3ds_usd, -- Used for VFMP-3DS round(e.efw_volume_3ds_us_usd, 2) as efw_volume_3ds_us_usd, -- Used for VAMP/VDMP/ECP/ECM/HEC d.dispute_count_all, d.dispute_count_rdr, d.non_fraud_dispute_count_all, d.fraud_dispute_count_all, d.dispute_count_exrdr, d.dispute_count_3ds, d.fraud_dispute_count_3ds, d.fraud_dispute_count_exrdr, round(d.dispute_volume_usd_all, 2) as dispute_volume_usd_all, -- Used for EFM round(d.fraud_dispute_volume_usd_all, 2) as fraud_dispute_volume_usd_all, round(d.dispute_volume_usd_exrdr, 2) as dispute_volume_usd_exrdr, round(d.fraud_dispute_volume_usd_exrdr, 2) as fraud_dispute_volume_usd_exrdr, d.win_rate, -- we show all the values below for all networks for comparison but they're only relevant for the indicated ones -- VDMP deducting RDR actuals (until Apr '25) if( p.network = 'visa', d.dispute_count_exrdr, d.dispute_count_all ) * 1.0 / p.sales_count as rdr_chargeback_ratio_for_visa, -- ECP/ECM/HECM based on prior month sales d.dispute_count_all * 1.0 / lag(p.sales_count, 1) over ( order by p.network, p.start_of_month ) as all_chargeback_ratio_for_mastercard, -- VDMP ignoring RDR and ECP/ECM/HECM for crosscheck (until Apr '25) d.dispute_count_all * 1.0 / p.sales_count as all_chargeback_ratio_for_visa_and_mastercard, -- VFMP (until Apr '25) e.efw_volume_usd * 1.0 / p.sales_volume_usd as fraud_ratio_for_visa, -- VFMP-3DS (until Apr '25) e.efw_volume_3ds_us_usd * 1.0 / p.sales_volume_3ds_us_usd as fraud_ratio_for_visa_3ds, -- VAMP (from Apr '25), RDR counts (d.non_fraud_dispute_count_all + e.efw_count) * 1.0 / p.sales_count as vamp_chargeback_ratio_for_visa, -- EFM based on prior month sales -- Note different limits for Australia and 3DS regulations are not reflected here d.fraud_dispute_count_all * 1.0 / lag(p.sales_count, 1) over ( order by p.network, p.start_of_month ) as fraud_ratio_for_mastercard from payments p left join efw e on p.start_of_month = e.start_of_month and p.network = e.network left join disputes d on p.start_of_month = d.start_of_month and p.network = d.network order by start_of_month desc, network;