Künftige Zahlungen einrichten

Erfahren Sie, wie Sie Zahlungsdetails in Ihrer mobilen App speichern und später Zahlungen Ihrer Kundinnen und Kunden akzeptieren.

Mit der Setup Intents API können Sie die Zahlungsdetails Ihrer Kundinnen und Kunden ohne vorherige Zahlung speichern. Das ist hilfreich, wenn Sie das Onboarding von Kundinnen/Kunden jetzt durchführen, Zahlungen für sie einrichten, diese aber erst später durchführen möchten (wenn die Kundinnen/Kunden offline sind).

Verwenden Sie diese Integration, um wiederkehrende Zahlungen einzurichten oder einmalige Zahlungen zu erstellen, bei denen der endgültige Betrag später festgelegt wird (häufig erst nach Erhalt Ihrer Dienstleistung).

Transaktionen mit vorhandener Karte

Bei Card-Present-Transaktionen, wie z. B. bei der Erfassung von Kartendaten über Stripe Terminal, wird ein anderes Verfahren zum Speichern der Zahlungsmethode verwendet. Weitere Informationen finden Sie in der Terminal-Dokumentation.

Konformität

Sie sind dafür verantwortlich, dass Sie alle geltenden Gesetze, Vorschriften und Netzwerkregeln einhalten, wenn Sie Zahlungsdetails auf Kundenseite speichern. Diese Anforderungen gelten in der Regel, wenn Sie Zahlungsmethoden Ihrer Kundinnen und Kunden für die zukünftige Verwendung speichern möchten. Ein Beispiel wäre, wenn Sie die kundenseitig bevorzugte Zahlungsmethode im Bezahlvorgang für einen zukünftigen Kauf anzeigen oder das Kundenkonto belasten möchten, wenn Kundinnen und Kunden Ihre Website oder App zu dem Zeitpunkt nicht aktiv nutzen. Fügen Sie Nutzungsbedingungen zu Ihrer Website oder App hinzu, aus denen hervorgeht, wie Sie die Zahlungsdetails speichern möchten, und lassen Sie Kundinnen und Kunden aktiv zu diesen zustimmen.

Wenn Sie eine Zahlungsmethode speichern, können Sie diese nur für die in Ihren Konditionen vereinbarte Nutzung verwenden. Um eine Zahlungsmethode belasten zu können, wenn Kundinnen und Kunden offline sind, und diese Option auch für zukünftige Einkäufe zu speichern, müssen Sie explizit die kundenseitige Zustimmung einholen. Fügen Sie beispielsweise ein Kontrollkästchen mit dem Titel „Meine Zahlungsmethode für die zukünftige Verwendung speichern“ ein, um die Einwilligung zu erhalten.

Um Zahlungen Ihrer Kundinnen und Kunden zu akzeptieren, wenn diese offline sind, fügen Sie unbedingt Folgendes in Ihre Konditionen ein:

- Die kundenseitige Zustimmung, eine Zahlung oder mehrere Zahlungen für bestimmte Transaktionen in deren Namen einzuleiten.

- Der erwartete Zeitpunkt und die voraussichtliche Häufigkeit von Zahlungen (z. B. Zahlungen für geplante Raten- oder Abonnementzahlungen oder für außerplanmäßige Aufstockungen).

- Wie Sie den Zahlbetrag ermitteln.

- Ihre Stornorichtlinie, wenn die Zahlungsmethode für einen Abonnementdienst ist.

Dokumentieren Sie unbedingt die schriftliche Zustimmung Ihrer Kundinnen und Kunden zu diesen Bedingungen.

Hinweis

Wenn Sie die manuelle serverseitige Bestätigung verwenden müssen oder für Ihre Integration die separate Angabe von Zahlungsmethoden erforderlich ist, lesen Sie unseren alternativen Leitfaden.

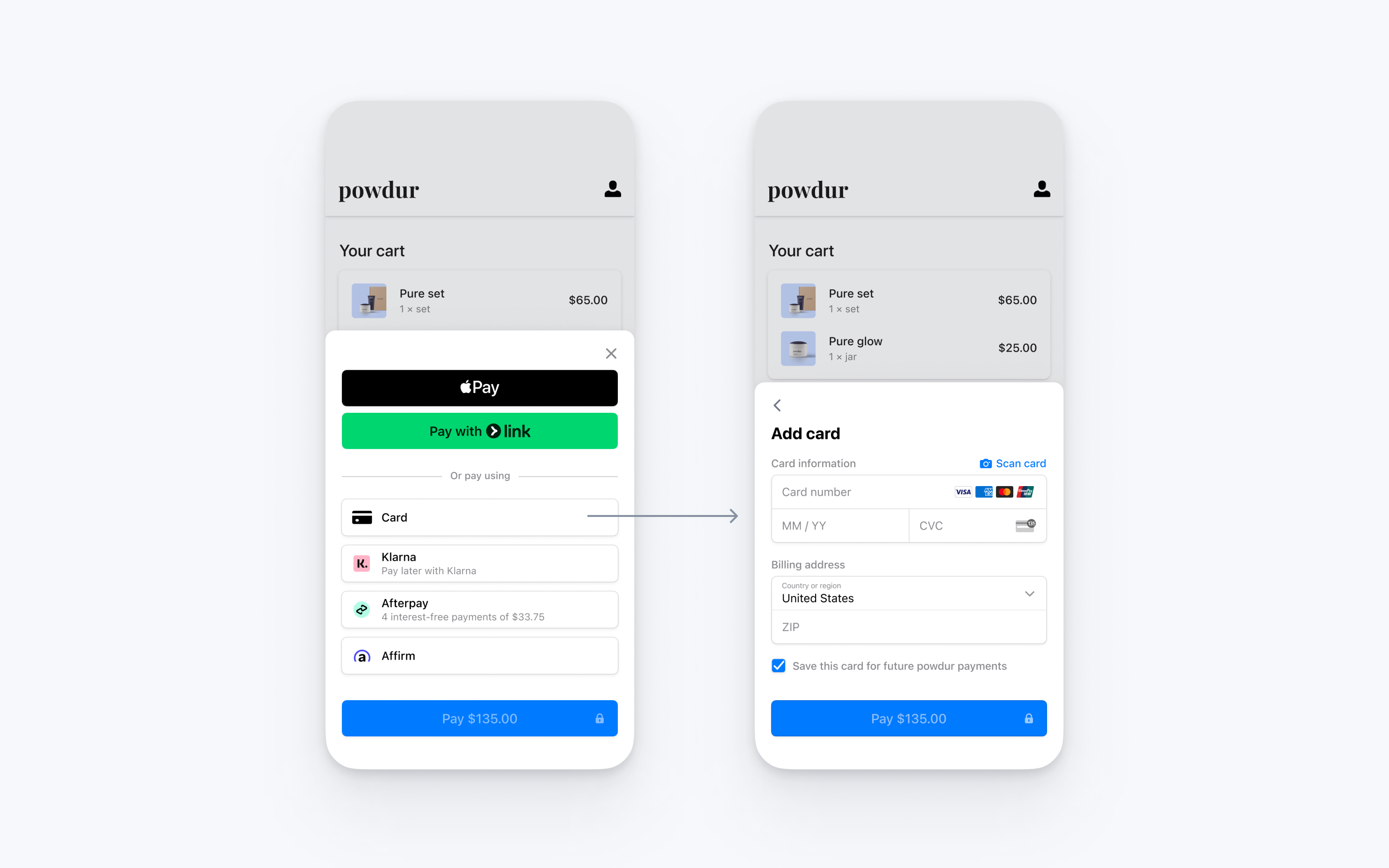

Integrieren Sie die vorgefertigte Zahlungs-UI von Stripe in den Bezahlvorgang Ihrer iOS app mit der PaymentSheet-Klasse. Sehen Sie sich unsere Beispielintegration auf GitHub an.

Stripe einrichtenServerseitigClientseitig

Zunächst benötigen Sie ein Stripe-Konto. Jetzt regristrieren.

Serverseitig

Diese Integration erfordert Endpoints auf Ihrem Server, die mit der Stripe API kommunizieren können. Nutzen Sie unsere offiziellen Bibliotheken für den Zugriff auf die Stripe API von Ihrem Server aus:

Clientseitig

Das Stripe iOS SDK ist Open Source, vollständig dokumentiert und kompatibel mit Apps, die iOS 13 oder höher unterstützen.

Hinweis

Details zur aktuellen SDK-Version und zu vorherigen Versionen finden Sie auf der Seite Releases auf GitHub. Um bei Veröffentlichung einer neuen Version eine Benachrichtigung zu erhalten, achten Sie auf die Releases zum jeweiligen Repository.

Endpoint hinzufügenServerseitig

Hinweis

Das mobile Payment Element unterstützt nur SetupIntents mit Karten, Bancontact, iDEAL, Link, SEPA-Lastschrift, Sofort und US-Bankkonten.

Diese Integration verwendet drei Stripe-API-Objekte:

Ein SetupIntent ist ein Objekt, das Ihre Absicht darstellt, die Zahlungsmethode eines Kunden/einer Kundin für zukünftige Zahlungen einzurichten. Die Zahlungsmethoden, die dem Kunden/der Kundin während des Bezahlvorgangs angezeigt werden, sind ebenfalls im SetupIntent enthalten. Sie können Stripe automatisch Zahlungsmethoden aus Ihren Dashboard-Einstellungen abrufen lassen oder sie manuell auflisten.

Ein/e Kund/in. Um eine Zahlungsmethode für zukünftige Zahlungen einzurichten, muss diese einem/einer Kund/in zugeordnet werden. Erstellen Sie ein Customer-Objekt, wenn Ihre Kundin/Ihr Kunde ein Konto bei Ihrem Unternehmen anlegt. Wenn eine Zahlung als Gast durchgeführt wird, können Sie vor der Zahlung ein Customer-Objekt erstellen und es zu einem späteren Zeitpunkt mit Ihrer eigenen internen Darstellung des Kundenkontos verknüpfen.

Ein temporärer Kundenschlüssel (optional). Informationen zum Kundenobjekt sind vertraulich und können nicht direkt über die App abgerufen werden. Ein temporärer Schlüssel gewährt dem SDK vorübergehenden Zugriff auf den Kunden/die Kundin.

Aus Sicherheitsgründen kann Ihre App diese Objekte nicht erstellen. Fügen Sie stattdessen einen Endpoint auf Ihrem Server hinzu, der:

- Ruft den/die Kund/in ab oder erstellt eine/n neue/n.

- Erstellt einen temporären Schlüssel für den/die Kund/in.

- Erstellt eine SetupIntent mit der Customer-ID.

- Gibt das Client-Geheimnis des PaymentIntent, das

secretdes temporären Schlüssels, die ID des Customer-Objekts und Ihren veröffentlichbaren Schlüssel an Ihre App zurück.

Die Zahlungsmethoden, die Kund/innen während des Bezahlvorgangs angezeigt werden, sind ebenfalls in der SetupIntent enthalten. Sie können Stripe Zahlungsmethoden automatisch aus Ihren Dashboard-Einstellungen abrufen lassen oder sie manuell auflisten.

Zahlungsdaten erfassenClientseitig

Um das mobile Zahlung Element auf Ihrer Zahlungsseite anzuzeigen, müssen Sie eine Zahlungsschaltfläche hinzufügen, die die Nutzeroberfläche von Stripe anzeigt.

Wenn das Ergebnis von PaymentSheetResult . lautet, informieren Sie den/die Nutzer/in, (zum Beispiel durch die Anzeige einer Bestellbestätigung).

Wenn Sie allowsDelayedPaymentMethods auf true festlegen, werden Zahlungsmethoden mit verzögerter Benachrichtigung wie US-Bankkonten zugelassen. Für diese Zahlungsmethoden ist der endgültige Zahlungsstatus nicht bekannt, wenn das PaymentSheet abgeschlossen wird. Stattdessen ist sie erfolgreich oder schlägt fehl. Wenn Sie diese Art von Zahlungsmethoden unterstützen, informieren Sie den Kunden/die Kundin darüber, dass seine/ihre Bestellung bestätigt ist, und führen seine/ihre Bestellung erst aus (z. B. das Produkt versenden), wenn die Zahlung erfolgreich ist.

Rückgabe-URL einrichtenServerseitig

Der Kunde/Die Kundin verlässt ggf. Ihre App, um sich zu authentifizieren (z. B. in Safari oder einer Banking-App). Damit sie nach der Authentifizierung automatisch zu Ihrer App zurückkehren können, konfigurieren Sie ein benutzerdefiniertes URL-Schema und richten Sie Ihren App-Delegate so ein, dass die URL an das SDK weitergeleitet wird. Stripe unterstützt keine universellen Links.

Legen Sie zusätzlich die returnURL in Ihrem PaymentSheet.Configuration-Objekt auf die URL für Ihre App fest.

var configuration = PaymentSheet.Configuration() configuration.returnURL = "your-app://stripe-redirect"

Die gespeicherte Zahlungsmethode später belastenServerseitig

Compliance

Sie sind für die Einhaltung aller geltenden Gesetze, Vorschriften und Netzwerkregeln verantwortlich, wenn Sie die Zahlungsdaten von Kundinnen und Kunden speichern. Wenn Sie Ihren Endkundinnen und Endkunden zuvor genutzte Zahlungsmethoden für zukünftige Einkäufe anzeigen, dürfen Sie nur Zahlungsmethoden auflisten, für die Sie bereits eine kundenseitige Zustimmung eingeholt haben, dank der Sie die Details der Zahlungsmethode für diese spezifische zukünftige Verwendung speichern können. Verwenden Sie den Parameter allow_redisplay, um zwischen Zahlungsmethoden zu unterscheiden, die mit Kundinnen und Kunden verknüpft sind und Ihren Endkundinnen und Endkunden als gespeicherte Zahlungsmethode für zukünftige Einkäufe angezeigt werden können oder nicht.

Wenn Sie eine Kundenzahlung per Off-Session vornehmen möchten, erstellen Sie anhand der Kunden-ID und der PaymentMethod-ID einen PaymentIntent. Um eine geeignete Zahlungsmethode zu finden, listen Sie die mit Ihrer Kundin/Ihrem Kunden verbundenen Zahlungsmethoden auf. In diesem Beispiel sind Karten aufgeführt, Sie können aber auch alle anderen unterstützten Zahlungsmethoden verwenden.

Wenn Ihnen die Kunden-ID und die PaymentMethod-ID vorliegen, erstellen Sie eine PaymentIntent mit dem Betrag und der Währung der Zahlung. Legen Sie einige weitere Parameter fest, um die Off-Session-Zahlung durchzuführen:

- Legen Sie off_session auf

truefest, um anzugeben, dass die Kundin/der Kunde sich während eines Zahlungsversuchs nicht in Ihrem Bezahlvorgang befindet und somit eine Authentifizierungsanfrage eines Partners, wie z. B. eines Kartenausstellers, einer Bank oder eines anderen Zahlungsinstituts nicht erfüllen kann. Wenn ein Partner während Ihres Bezahlvorgangs eine Authentifizierung anfordert, fordert Stripe Ausnahmen unter Verwendung von Kundeninformationen aus einer vorherigen On-Session-Transaktion an. Wenn die Bedingungen für eine Ausnahme nicht erfüllt sind, gibt der PaymentIntent möglicherweise einen Fehler zurück. - Legen Sie den Wert der Eigenschaft confirm des PaymentIntent auf

truefest. Dadurch erfolgt die Bestätigung sofort, wenn der PaymentIntent erstellt wird. - Setzen Sie payment_method auf die ID der PaymentMethod und Kunde/Kundin auf die ID des Kunden/der Kundin.

OptionalApple Pay aktivieren

Hinweis

Wenn Ihr Zahlungsbildschirm eine spezielle Apple Pay-Schaltfläche enthält, folgen Sie dem Apple Pay-Leitfaden und verwenden Sie ApplePayContext, um Zahlungen über Ihre Apple Pay-Schaltfläche einzuziehen. Sie können PaymentSheet verwenden, um andere Arten von Zahlungsmethoden zu verarbeiten.

Für eine Apple-Händler-ID registrieren

Beantragen Sie eine Apple-Händler-ID, indem Sie sich auf der Apple Developer-Website für eine neue Kennung registrieren.

Tragen Sie eine Beschreibung und eine Kennung in das Formular ein. Die Beschreibung ist nur für Ihre internen Zwecke bestimmt und kann später geändert werden. Stripe empfiehlt, dass Sie den Namen Ihrer App als Kennung verwenden, zum Beispiel merchant..

Neues Apple Pay-Zertifikat erstellen

Erstellen Sie ein Zertifikat für Ihre App, um Zahlungsdaten zu verschlüsseln.

Gehen Sie zu den iOS-Zertifikateinstellungen im Dashboard, klicken Sie auf Neue Anwendung hinzufügen und befolgen Sie die Anleitung.

Laden Sie eine Certificate Signing Request (CSR)-Datei herunter, um ein sicheres Zertifikat von Apple zu erhalten, mit dem Sie Apple Pay verwenden können.

Eine CSR-Datei muss verwendet werden, um genau ein Zertifikat auszustellen. Wenn Sie Ihre Apple-Händler-ID wechseln, müssen Sie zu den iOS-Zertifikateinstellungen im Dashboard gehen, um eine neue CSR und ein Zertifikat zu erhalten.

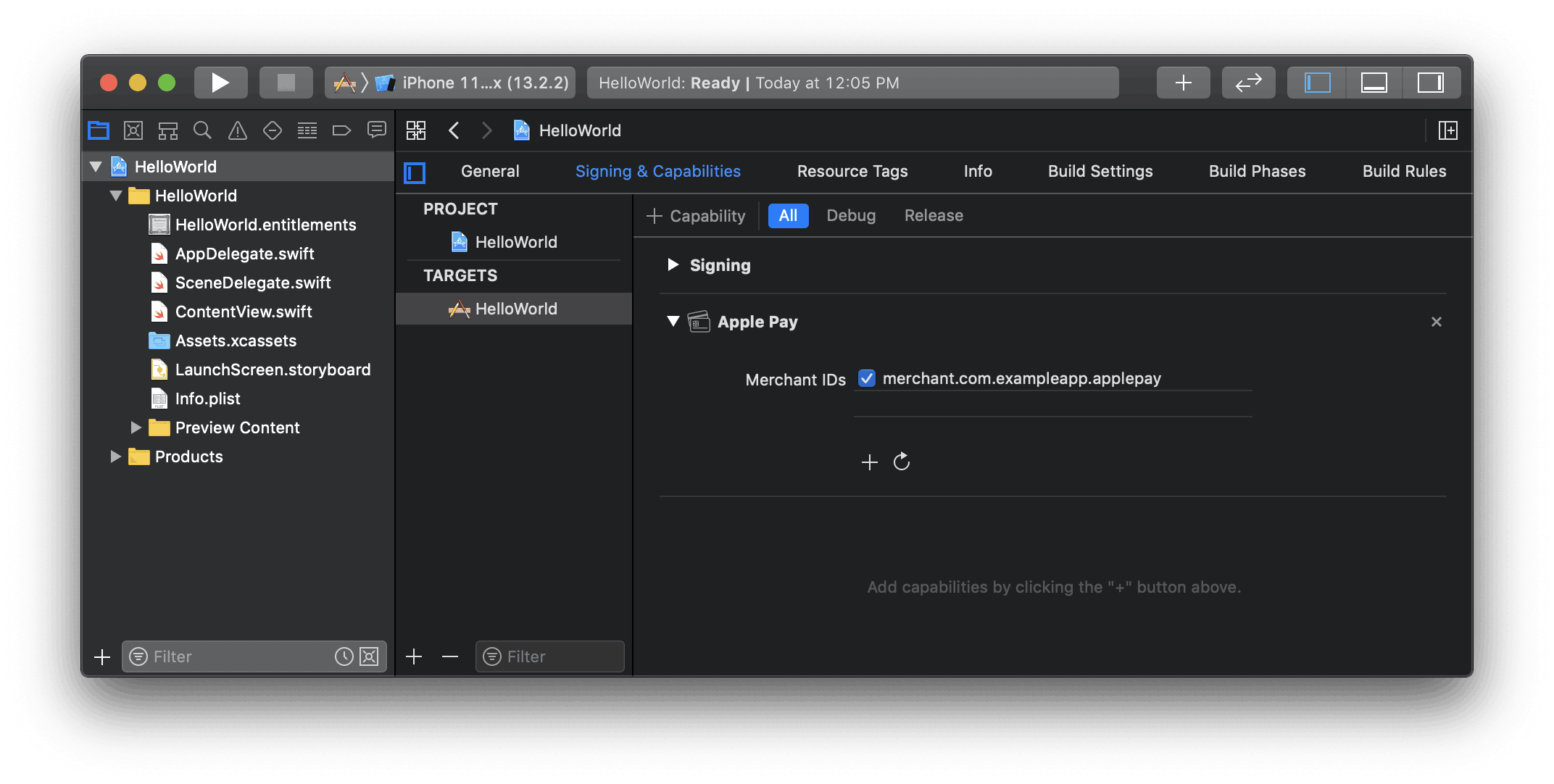

Mit Xcode integrieren

Fügen Sie Ihrer App die Apple Pay-Funktion hinzu. Öffnen Sie in Xcode Ihre Projekteinstellungen, klicken Sie auf die Registerkarte Signing & Capabilities (Anmeldung und Funktionen) und fügen Sie die Apple Pay-Funktion hinzu. Möglicherweise werden Sie an dieser Stelle aufgefordert, sich bei Ihrem Entwicklerkonto anzumelden. Wählen Sie die zuvor erstellte Händler-ID aus. Ihre App sollte nun Apple Pay unterstützen.

Apple Pay-Funktion in Xcode aktivieren

Apple Pay hinzufügen

Bestellverfolgung

Um Informationen zur Bestellverfolgung in iOS 16 oder höher hinzuzufügen, konfigurieren Sie einen authorizationResultHandler in Ihren PaymentSheet.. Stripe ruft Ihre Implementierung auf, nachdem die Zahlung durchgeführt wurde, aber bevor iOS das Apple Pay-Formular schließt.

Rufen Sie in Ihrer Implementierung von authorizationResultHandler die Bestelldetails für die abgeschlossene Bestellung von Ihrem Server ab. Fügen Sie die Details dem bereitgestellten PKPaymentAuthorizationResult hinzu und geben Sie das geänderte Ergebnis zurück.

Weitere Informationen zur Bestellverfolgung finden Sie in der Dokumentation zu Wallet-Bestellungen von Apple.

let customHandlers = PaymentSheet.ApplePayConfiguration.Handlers( authorizationResultHandler: { result in do { // Fetch the order details from your service let myOrderDetails = try await MyAPIClient.shared.fetchOrderDetails(orderID: orderID) result.orderDetails = PKPaymentOrderDetails( orderTypeIdentifier: myOrderDetails.orderTypeIdentifier, // "com.myapp.order" orderIdentifier: myOrderDetails.orderIdentifier, // "ABC123-AAAA-1111" webServiceURL: myOrderDetails.webServiceURL, // "https://my-backend.example.com/apple-order-tracking-backend" authenticationToken: myOrderDetails.authenticationToken) // "abc123" // Return your modified PKPaymentAuthorizationResult return result } catch { return PKPaymentAuthorizationResult(status: .failure, errors: [error]) } } ) var configuration = PaymentSheet.Configuration() configuration.applePay = .init(merchantId: "merchant.com.your_app_name", merchantCountryCode: "US", customHandlers: customHandlers)

OptionalFormular anpassen

Alle Anpassungen werden mithilfe des PaymentSheet.Configuration-Objekts konfiguriert.

Erscheinungsbild

Passen Sie mit der Appearance API Farben, Schriftarten und mehr an das Erscheinungsbild Ihrer App an.

Layout der Zahlungsmethode

Konfigurieren Sie das Layout der Zahlungsmethoden im Formular mit paymentMethodLayout. Sie können sie horizontal oder vertikal anzeigen oder das Layout von Stripe automatisch optimieren lassen.

var configuration = PaymentSheet.Configuration() configuration.paymentMethodLayout = .automatic

Adressen der Nutzer/innen erfassen

Erfassen Sie lokale und internationale Versand- und Rechnungsadressen von Ihren Kundinnen und Kunden mithilfe des Address Element.

Anzeigename des Händlers

Geben Sie einen kundenorientierten Unternehmensnamen an, indem Sie merchantDisplayName festlegen. Standardmäßig handelt es sich dabei um den Namen Ihrer App.

var configuration = PaymentSheet.Configuration() configuration.merchantDisplayName = "My app, Inc."

Dunkelmodus

PaymentSheet passt sich automatisch an die systemweiten Erscheinungsbildeinstellungen des Nutzers/der Nutzerin an (heller und dunkler Modus). Wenn Ihre App den Dunkelmodus nicht unterstützt, können Sie den Stil auf den Modus alwaysLight oder alwaysDark einstellen.

var configuration = PaymentSheet.Configuration() configuration.style = .alwaysLight

Standardabrechnungsdetails

Um Standardwerte für die im Zahlungsformular erfassten Rechnungsdetails festzulegen, konfigurieren Sie die Eigenschaft defaultBillingDetails. Die Felder von PaymentSheet werden vorab mit den von Ihnen angegebenen Werten ausgefüllt.

var configuration = PaymentSheet.Configuration() configuration.defaultBillingDetails.address.country = "US" configuration.defaultBillingDetails.email = "foo@bar.com"

Erfassung der Rechnungsdetails

Verwenden Sie billingDetailsCollectionConfiguration, um anzugeben, wie Sie Rechnungsdetails im Zahlungsformular erfassen möchten.

Sie können den Namen, die E-Mail-Adresse, die Telefonnummer und die Adresse Ihrer Kundinnen und Kunden erfassen.

Wenn Sie nur die für die Zahlungsmethode erforderlichen Rechnungsdetails angeben möchten, legen Sie billingDetailsCollectionConfiguration. auf „true“ fest. In diesem Fall werden PaymentSheet. als Abrechnungsdetails der Zahlungsmethode festgelegt.

Wenn Sie zusätzliche Rechnungsdetails erfassen möchten, die für die Zahlungsmethode nicht unbedingt erforderlich sind, legen Sie billingDetailsCollectionConfiguration. auf „false“ fest. In diesem Fall werden die über das PaymentSheet erfassten Rechnungsdetails als Rechnungsdetails der Zahlungsmethode festgelegt.

var configuration = PaymentSheet.Configuration() configuration.defaultBillingDetails.email = "foo@bar.com" configuration.billingDetailsCollectionConfiguration.name = .always configuration.billingDetailsCollectionConfiguration.email = .never configuration.billingDetailsCollectionConfiguration.address = .full configuration.billingDetailsCollectionConfiguration.attachDefaultsToPaymentMethod = true

Hinweis

Wenden Sie sich an Ihren Rechtsbeistand bezüglich der Gesetze, die für das Erfassen von Informationen gelten. Erfassen Sie Telefonnummern nur, wenn Sie sie für die Transaktion benötigen.

OptionalZahlung in Ihrer Nutzeroberfläche abschließen

Sie können das Zahlungsformular anzeigen, um nur die Details einer Zahlungsmethode zu erfassen, und später eine confirm-Methode aufrufen, um die Zahlung in der Nutzeroberfläche Ihrer App abzuschließen. Dies ist nützlich, wenn Sie eine nutzerspezifische Kaufschaltfläche haben oder zusätzliche Schritte erforderlich sind, nachdem Sie die Zahlungsdetails erfasst haben.

Schließen Sie die Zahlung über die Nutzeroberfläche Ihrer App ab