Accept in-app payments

Build a customized payments integration in your iOS, Android, or React Native app using the Payment Sheet.

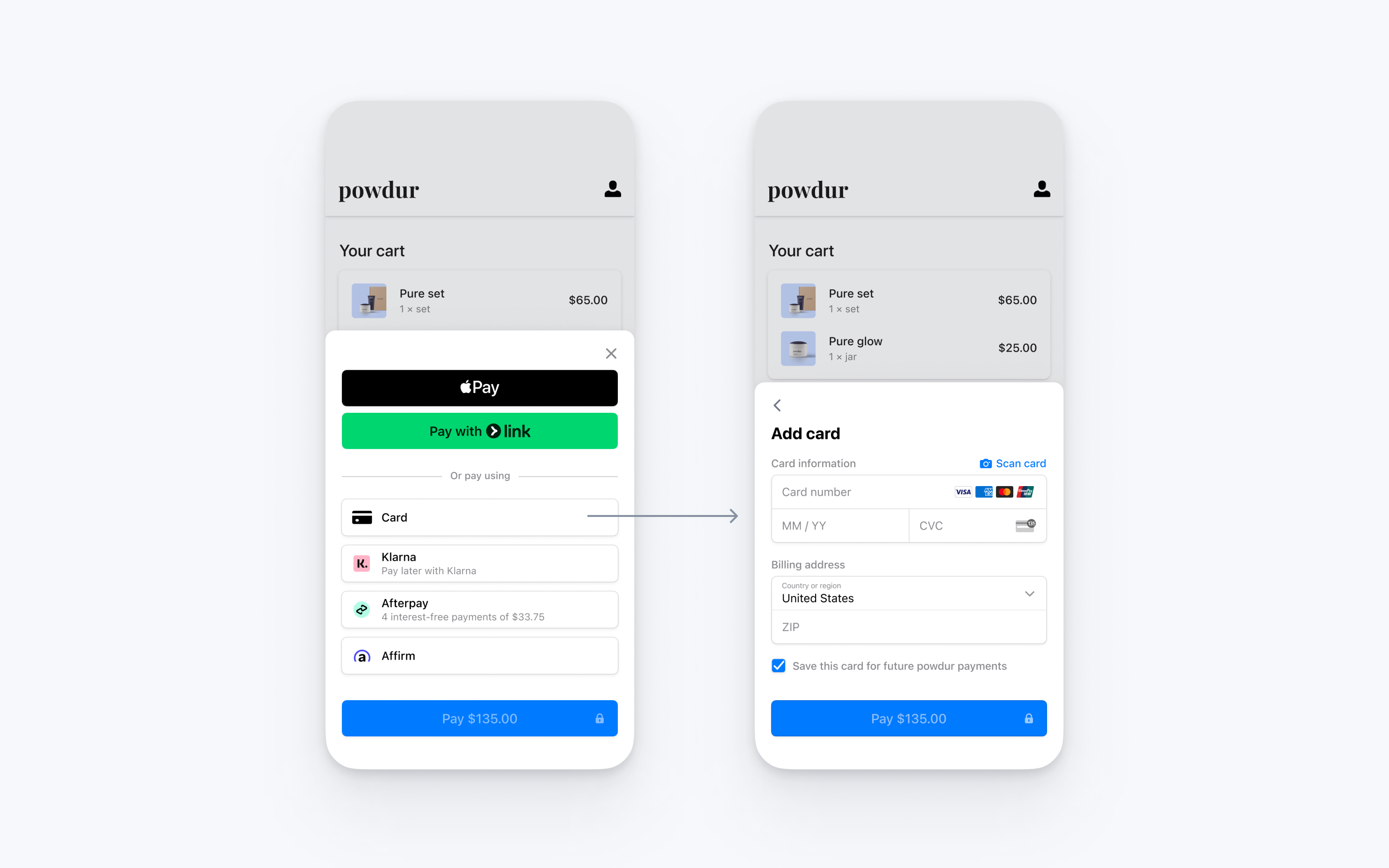

The Payment Sheet is a customizable component that displays a list of payment methods and collects payment details in your app using a bottom sheet.

A SetupIntent flow allows you to collect payment method details and save them for future payments without creating a charge. In this integration, you build a custom flow where you render the Payment Element, create the SetupIntent, and confirm saving the payment method in your app.

Set up StripeServer-sideClient-side

Server-side

This integration requires endpoints on your server that talk to the Stripe API. Use our official libraries for access to the Stripe API from your server:

Client-side

The React Native SDK is open source and fully documented. Internally, it uses the native iOS and Android SDKs. To install Stripe’s React Native SDK, run one of the following commands in your project’s directory (depending on which package manager you use):

Next, install some other necessary dependencies:

- For iOS, go to the ios directory and run

pod installto ensure that you also install the required native dependencies. - For Android, there are no more dependencies to install.

Note

We recommend following the official TypeScript guide to add TypeScript support.

Stripe initialization

To initialize Stripe in your React Native app, either wrap your payment screen with the StripeProvider component, or use the initStripe initialization method. Only the API publishable key in publishableKey is required. The following example shows how to initialize Stripe using the StripeProvider component.

import { useState, useEffect } from 'react'; import { StripeProvider } from '@stripe/stripe-react-native'; function App() { const [publishableKey, setPublishableKey] = useState(''); const fetchPublishableKey = async () => { const key = await fetchKey(); // fetch key from your server here setPublishableKey(key); }; useEffect(() => { fetchPublishableKey(); }, []); return ( <StripeProvider publishableKey={publishableKey} merchantIdentifier="merchant.identifier" // required for Apple Pay urlScheme="your-url-scheme" // required for 3D Secure and bank redirects > {/* Your app code here */} </StripeProvider> ); }

Enable payment methods

Note

When used with a SetupIntent, PaymentSheet supports cards and PayPal.

View your payment methods settings and enable the payment methods you want to support. You need at least one payment method enabled to create a SetupIntent.

By default, Stripe enables cards and other prevalent payment methods that can help you reach more customers, but we recommend turning on additional payment methods that are relevant for your business and customers. See Payment method support for product and payment method support, and our pricing page for fees.

Set up a return URLClient-side

When a customer exits your app (for example to authenticate in Safari or their banking app), provide a way for them to automatically return to your app. Many payment method types require a return URL. If you don’t provide one, we can’t present payment methods that require a return URL to your users, even if you’ve enabled them.

To provide a return URL:

- Register a custom URL. Universal links aren’t supported.

- Configure your custom URL.

- Set up your root component to forward the URL to the Stripe SDK as shown below.

Note

If you’re using Expo, set your scheme in the app. file.

import { useEffect, useCallback } from 'react'; import { Linking } from 'react-native'; import { useStripe } from '@stripe/stripe-react-native'; export default function MyApp() { const { handleURLCallback } = useStripe(); const handleDeepLink = useCallback( async (url: string | null) => { if (url) { const stripeHandled = await handleURLCallback(url); if (stripeHandled) { // This was a Stripe URL - you can return or add extra handling here as you see fit } else { // This was NOT a Stripe URL – handle as you normally would } } }, [handleURLCallback] ); useEffect(() => { const getUrlAsync = async () => { const initialUrl = await Linking.getInitialURL(); handleDeepLink(initialUrl); }; getUrlAsync(); const deepLinkListener = Linking.addEventListener( 'url', (event: { url: string }) => { handleDeepLink(event.url); } ); return () => deepLinkListener.remove(); }, [handleDeepLink]); return ( <View> <AwesomeAppComponent /> </View> ); }

Additionally, set the returnURL when you call the initPaymentSheet method:

await initPaymentSheet({ ... returnURL: 'your-app://stripe-redirect', ... });

For more information on native URL schemes, refer to the Android and iOS docs.

Create a CustomerServer-side

To set up a payment method for future payments, you must attach it to a Customer. Create a Customer object when your customer creates an account with your business. Customer objects allow for reusing payment methods and tracking across multiple payments.

Collect payment detailsClient-side

The integration can use the default payment flow or a custom flow.

| Default | Custom flow |

|---|---|

|  |

| Displays a sheet to collect payment details and complete the setup. The button in the sheet says Set up and sets up the payment method. | Displays a sheet to collect payment details only. The button in the sheet says Continue and returns the customer to your app, where your own button completes the setup. |

Create a SetupIntentServer-side

On your server, create a SetupIntent. You can manage payment methods from the Dashboard. Stripe evaluates payment method restrictions and other parameters to determine the list of supported payment methods.

If the call succeeds, return the SetupIntent client secret. If the call fails, handle the error and return an error message with a brief explanation for your customer.

Note

Verify that all IntentConfiguration properties match your SetupIntent (for example, usage).

Charge the saved payment method laterServer-side

Warning

When you save a bancontact or ideal payment method, it generates and saves a sepa_ reusable payment method instead of the original method. To query for the saved method, you need to use sepa_, not bancontact or ideal.

Compliance

You’re responsible for your compliance with all applicable laws, regulations, and network rules when saving a customer’s payment details. When rendering past payment methods to your end customer for future purchases, make sure you’re listing payment methods where you’ve collected consent from the customer to save the payment method details for this specific future use. To differentiate between payment methods attached to customers that can and can’t be presented to your end customer as a saved payment method for future purchases, use the allow_redisplay parameter.

When you’re ready to charge your customer off-session, use the Customer and PaymentMethod IDs to create a PaymentIntent. To find a payment method to charge, list the payment methods associated with your customer. This example lists cards but you can list any supported type.

When you have the Customer and PaymentMethod IDs, create a PaymentIntent with the amount and currency of the payment. Set a few other parameters to make the off-session payment:

- Set off_session to

trueto indicate that the customer isn’t in your checkout flow during a payment attempt and can’t fulfill an authentication request made by a partner, such as a card issuer, bank, or other payment institution. If, during your checkout flow, a partner requests authentication, Stripe requests exemptions using customer information from a previous on-session transaction. If the conditions for exemption aren’t met, the PaymentIntent might throw an error. - Set the value of the PaymentIntent’s confirm property to

true, which causes confirmation to occur immediately when the PaymentIntent is created. - Set payment_method to the ID of the PaymentMethod and customer to the ID of the Customer.

Test the integration

See Testing for additional information to test your integration.