In-App-Zahlungen annehmen

Erstellen Sie mithilfe des Payment Sheet eine benutzerdefinierte Zahlungsintegration in Ihrer iOS-, Android- oder React Native-App.

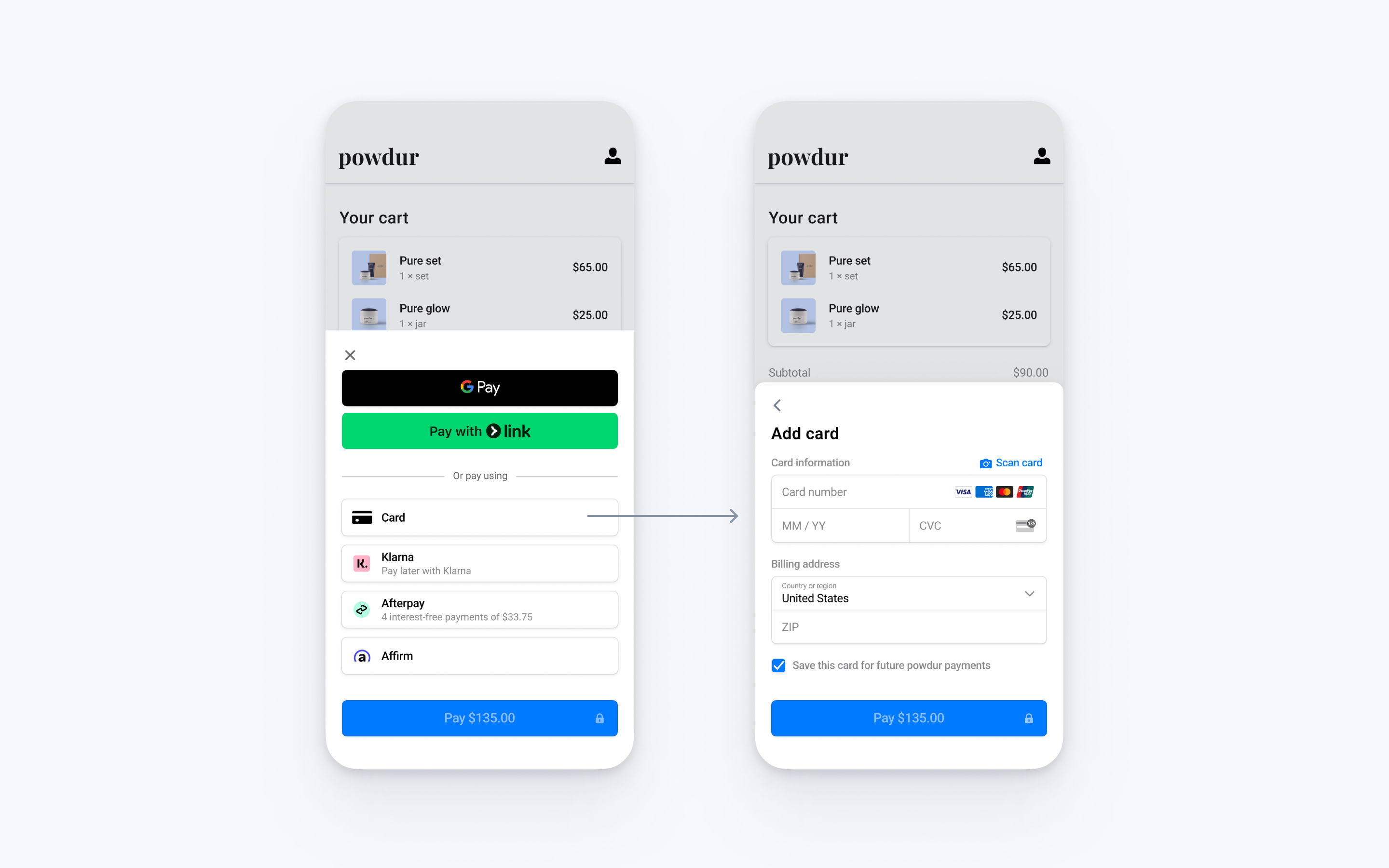

Das Payment Sheet ist eine anpassbare Komponente, die eine Liste von Zahlungsmethoden anzeigt und Zahlungsdetails in Ihrer App mithilfe eines unteren Blatts erfasst.

Mit dem Payment Element können Sie mehrere Zahlungsmethoden über eine einzige Integration akzeptieren. Bei dieser Integration erstellen Sie einen benutzerdefinierten Zahlungsablauf, bei dem Sie das Payment Element rendern, den PaymentIntent erstellen und die Zahlung in Ihrer App bestätigen. Informationen dazu, wie Sie die Zahlung stattdessen auf dem Server bestätigen, finden Sie unter Zahlungen auf dem Server finalisieren.

Stripe einrichtenServerseitigClientseitig

Zunächst benötigen Sie ein Stripe-Konto. Registrieren Sie sich jetzt.

Serverseitig

Für diese Integration sind Endpoints auf Ihrem Server erforderlich, die mit der Stripe-API kommunizieren können. Nutzen Sie diese offiziellen Bibliotheken für den Zugriff auf die Stripe-API von Ihrem Server aus:

Client-seitig

Das Stripe Android SDK ist Open Source und vollständig dokumentiert.

Um das SDK zu installieren, fügen Sie stripe-android in den Block dependencies Ihrer app/build.gradle-Datei ein:

Notiz

Details zur aktuellen SDK-Version und zu vorherigen Versionen finden Sie auf der Seite Releases auf GitHub. Um bei Veröffentlichung eines neuen Release eine Benachrichtigung zu erhalten, beobachten Sie Veröffentlichungen für das jeweilige Repository.

Sie müssen auch Ihren veröffentlichbaren Schlüssel festlegen, damit das SDK API Aufrufe an Stripe tätigen kann. Um schnell loszulegen, können Sie dies während der Integration auf dem Client fest codieren, aber den veröffentlichbaren Schlüssel von Ihrem Server in der Produktionsumgebung abrufen.

// Set your publishable key: remember to change this to your live publishable key in production // See your keys here: https://dashboard.stripe.com/apikeys PaymentConfiguration.init(context, publishableKey =)"pk_test_TYooMQauvdEDq54NiTphI7jx"

Zahlungsmethoden aktivieren

Zeigen Sie Ihre Einstellungen für Zahlungsmethoden an und aktivieren Sie die Zahlungsmethoden, die Sie unterstützen möchten. Sie müssen mindestens eine Zahlungsmethode aktiviert haben, um einen PaymentIntent zu erstellen.

Standardmäßig aktiviert Stripe Karten und andere gängige Zahlungsmethoden, mit denen Sie mehr Kundinnen und Kunden erreichen können. Wir empfehlen jedoch, zusätzliche Zahlungsmethoden zu aktivieren, die für Ihr Unternehmen und Ihre Kundschaft relevant sind. Weitere Informationen zur Unterstützung von Produkten und Zahlungsmethoden finden Sie auf der Seite Unterstützte Zahlungsmethoden und der Preisseite für Gebühren.

Zahlungsdetails erfassenClientseitig

Wir bieten zwei Arten der Integration an.

| PaymentSheet | PaymentSheet.FlowController |

|---|---|

|  |

| Zeigt ein Formular an, um die Zahlungsdetails zu erfassen und die Zahlung abzuschließen. Die Beschriftung der Schaltfläche lautet Bezahlen und sie enthält den Betrag. Durch Klicken auf die Schaltfläche wird die Zahlung abgeschlossen. | Zeigt ein Formular an, um nur Zahlungsdetails zu erfassen. Die Beschriftung der Schaltfläche lautet Weiter. Durch Klicken auf die Schaltfläche kehrt der Kunde/die Kundin zu Ihrer App zurück, in der die Zahlung über Ihre eigene Schaltfläche abgeschlossen wird. |

PaymentIntent erstellenServerseitig

Erstellen Sie auf Ihrem Server a PaymentIntent durch Angabe eines Betrags und einer Währung. Sie können Zahlungsmethoden über das Dashboard verwalten. Stripe handhabt die Rückgabe geeigneter Zahlungsmethoden basierend auf Faktoren wie Betrag, Währung und Zahlungsablauf der Transaktion. Um zu verhindern, dass böswillige Kundinnen und Kunden ihre eigenen Preise wählen, sollten Sie den Preis immer auf der Serverseite (einer vertrauenswürdigen Umgebung) festlegen und nicht auf dem Client.

Wenn der Aufruf erfolgreich ist, geben Sie den PaymentIntent das Client-Geheimnis zurück. Wenn der Aufruf fehlschlägt, beheben Sie den Fehler und geben eine Fehlermeldung mit einer kurzen Erklärung an Ihre Kundin/Ihren Kunden zurück.

Notiz

Überprüfen Sie, ob alle IntentConfiguration-Eigenschaften mit Ihrem PaymentIntent (zum Beispiel setup_, amount und currency) übereinstimmen.

Ereignisse nach Zahlung verarbeitenServerseitig

Stripe sendet ein payment_intent.succeeded-Ereignis, wenn die Zahlung abgeschlossen ist. Verwenden Sie Webhook-Tool im Dashboard oder folgen Sie der Webhook-Anleitung, um diese Ereignisse zu empfangen und führen Sie Aktionen aus, wie beispielsweise das Senden einer Bestellbestätigung per E-Mail, das Protokollieren des Verkaufs in der Datenbank oder das Starten eines Versand-Workflows.

Überwachen Sie diese Ereignisse, statt auf einen Callback vom Client zu warten. Auf dem Client könnten die Kund/innen das Browserfenster schließen oder die App beenden, bevor der Callback erfolgt ist. Bösartige Clients könnten dann die Antwort manipulieren. Wenn Sie Ihre Integration so einrichten, dass sie asynchrone Ereignisse überwacht, können Sie verschiedene Arten von Zahlungsmethoden mit einer einzelnen Integration akzeptieren.

Neben der Abwicklung des payment_-Ereignisses empfehlen wir die Abwicklung von diesen weiteren Ereignissen, wenn Sie Zahlungen mit dem Payment Element erfassen:

| Ereignis | Beschreibung | Aktion |

|---|---|---|

| payment_intent.succeeded | Wird gesendet, wenn Kundinnen und Kunden eine Zahlung erfolgreich abgeschlossen haben. | Senden Sie den Kund/innen eine Auftragsbestätigung und wickeln Sie die Bestellung ab. |

| payment_intent.processing | Wird gesendet, wenn eine/e Kund/in eine Zahlung erfolgreich veranlasst hat, die Zahlung aber noch nicht abgeschlossen ist. Dieses Ereignis wird am häufigsten gesendet, wenn der Kunde/die Kundin eine Bankabbuchung veranlasst. In Zukunft folgt darauf entweder ein payment_- oder ein payment_-Ereignis. | Senden Sie eine Bestellbestätigung an die Kund/innen, in der angegeben ist, dass die Zahlung noch aussteht. Bei digitalen Waren können Sie die Bestellung abwickeln, bevor Sie darauf warten, dass die Zahlung erfolgt. |

| payment_intent.payment_failed | Wird gesendet, wenn ein Kunde/eine Kundin einen Zahlungsversuch durchführt, die Zahlung jedoch fehlschlägt. | Wenn eine Zahlung von processing zu payment_ übergeht, bieten Sie der Kundin/dem Kunden einen weiteren Zahlungsversuch an. |

Integration testen

Hier finden Sie weitere Informationen zum Testen Ihrer Integration.