Accept in-app payments

Build a customized payments integration in your iOS, Android, or React Native app using the Payment Sheet.

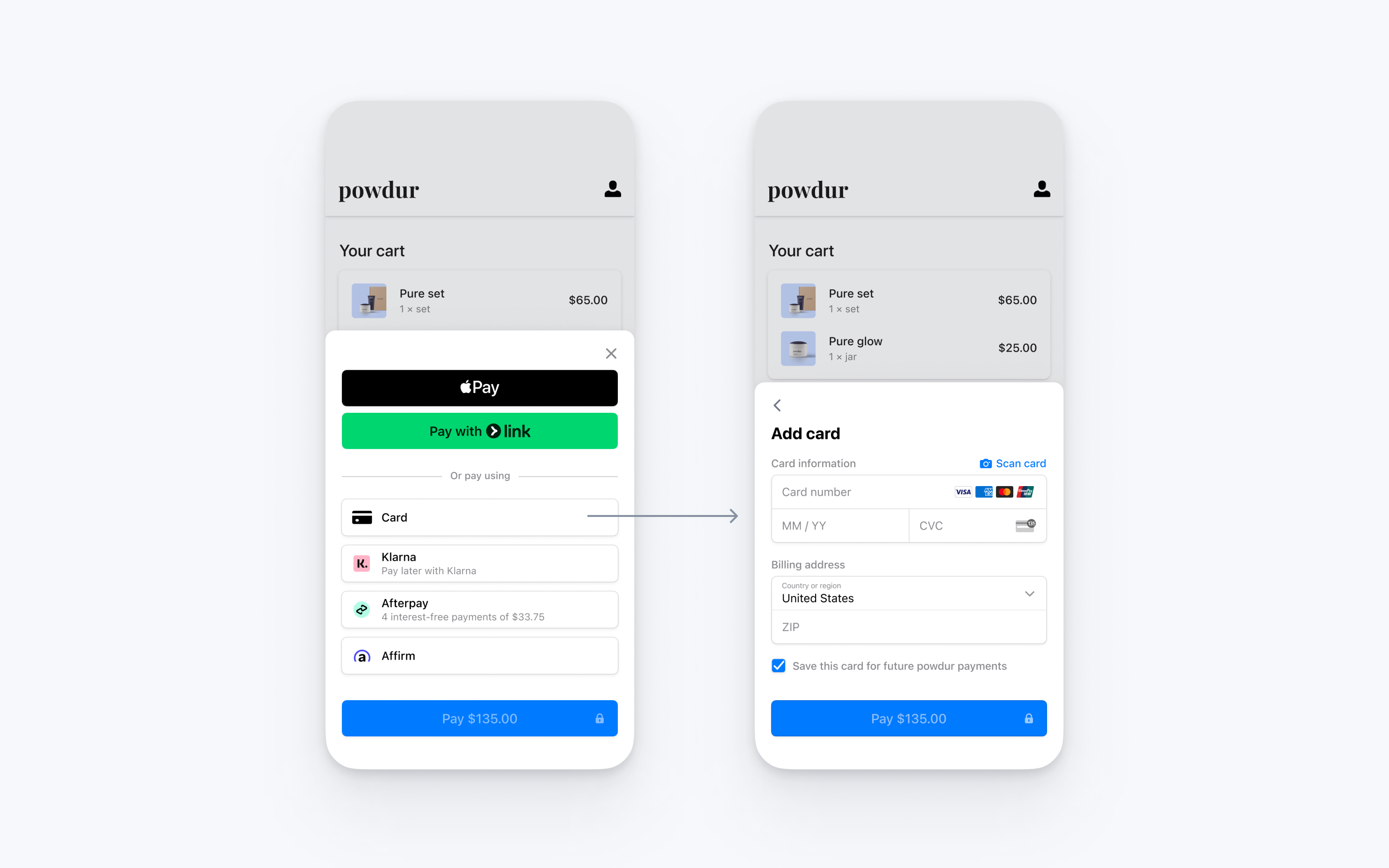

The Payment Sheet is a customizable component that displays a list of payment methods and collects payment details in your app using a bottom sheet.

Compare Customers v1 and Accounts v2 references

If your Connect platform uses customer-configured Accounts, use our guide to replace Customer and event references in your code with the equivalent Accounts v2 API references.

Use the Payment Intents API to save payment details from a purchase. There are several use cases:

- Charge a customer for an e-commerce order and store the details for future purchases.

- Initiate the first payment of a series of recurring payments.

- Charge a deposit and store the details to charge the full amount later.

Card-present transactions

Card-present transactions, such as payments through Stripe Terminal, use a different process for saving the payment method. For details, see the Terminal documentation.

Compliance

You’re responsible for your compliance with all applicable laws, regulations, and network rules when saving a customer’s payment details for future use, such as displaying a customer’s payment method to them in the checkout flow for a future purchase or charging them when they’re not actively using your website or app. Before saving or charging a customer’s payment mathod, make sure you:

- Add terms to your website or app that state how you plan to save payment method details, such as:

- The customer’s agreement allowing you to initiate a payment or a series of payments on their behalf for specified transactions.

- The anticipated timing and frequency of payments (for example, if the charges are for scheduled installments, subscription payments, or unscheduled top-ups).

- How you determine the payment amount.

- Your cancellation policy, if the payment method is for a subscription service.

- Use a saved payment method for only the purpose stated in your terms.

- Collect explicit consent from the customer for this specific use. For example, include a “Save my payment method for future checkbox.

- Keep a record of your customer’s written agreement to your terms.

Set up StripeServer-sideClient-side

Server-side

This integration requires endpoints on your server that talk to the Stripe API. Use our official libraries for access to the Stripe API from your server:

Client-side

The Stripe iOS SDK is open source, fully documented, and compatible with apps supporting iOS 13 or above.

Note

For details on the latest SDK release and past versions, see the Releases page on GitHub. To receive notifications when a new release is published, watch releases for the repository.

You also need to set your publishable key so that the SDK can make API calls to Stripe. To get started, you can hardcode the publishable key on the client while you’re integrating, but fetch the publishable key from your server in production.

// Set your publishable key: remember to change this to your live publishable key in production // See your keys here: https://dashboard.stripe.com/apikeys STPAPIClient.shared.publishableKey ="pk_test_TYooMQauvdEDq54NiTphI7jx"

Enable payment methods

View your payment methods settings and enable the payment methods you want to support. You need at least one payment method enabled to create a PaymentIntent.

By default, Stripe enables cards and other prevalent payment methods that can help you reach more customers, but we recommend turning on additional payment methods that are relevant for your business and customers. See Payment method support for product and payment method support, and our pricing page for fees.

Set up a return URLClient-side

The customer might navigate away from your app to authenticate (for example, in Safari or their banking app). To allow them to automatically return to your app after authenticating, configure a custom URL scheme and set up your app delegate to forward the URL to the SDK. Stripe doesn’t support universal links.

Additionally, set the returnURL on your PaymentSheet.Configuration object to the URL for your app.

var configuration = PaymentSheet.Configuration() configuration.returnURL = "your-app://stripe-redirect"

Create a CustomerServer-side

To set up a payment method for future payments, you must attach it to a Customer. Create a Customer object when your customer creates an account with your business. Customer objects allow for reusing payment methods and tracking across multiple payments.

Compare Customers v1 and Accounts v2 references

If your Connect platform uses customer-configured Accounts, use our guide to replace Customer and event references in your code with the equivalent Accounts v2 API references.

Collect payment detailsClient-side

We offer two styles of integration. Choose one to continue.

| PaymentSheet | PaymentSheet.FlowController |

|---|---|

|  |

| Displays a sheet to collect payment details and complete the payment. The sheet contains a *Pay button with the amount and currency, and completes the payment. | Displays a sheet to collect payment details only. The button in the sheet says Continue and returns the customer to your app, where your own button completes payment. |

Create a PaymentIntentServer-side

On your server, create a PaymentIntent with an amount and currency. You can manage payment methods from the Dashboard. Stripe handles the return of eligible payment methods based on factors such as the transaction’s amount, currency, and payment flow. To prevent malicious customers from choosing their own prices, always decide how much to charge on the server-side (a trusted environment) and not the client.

If the call succeeds, return the PaymentIntent client secret. If the call fails, handle the error and return an error message with a brief explanation for your customer.

Note

Verify that all IntentConfiguration properties match your PaymentIntent (for example, setup_, amount, and currency).

Handle post-payment eventsServer-side

Stripe sends a payment_intent.succeeded event when the payment completes. Use the Dashboard webhook tool or follow the webhook guide to receive these events and run actions, such as sending an order confirmation email to your customer, logging the sale in a database, or starting a shipping workflow.

Listen for these events rather than waiting on a callback from the client. On the client, the customer could close the browser window or quit the app before the callback executes, and malicious clients could manipulate the response. Setting up your integration to listen for asynchronous events is what enables you to accept different types of payment methods with a single integration.

In addition to handling the payment_ event, we recommend handling these other events when collecting payments with the Payment Element:

| Event | Description | Action |

|---|---|---|

| payment_intent.succeeded | Sent when a customer successfully completes a payment. | Send the customer an order confirmation and fulfill their order. |

| payment_intent.processing | Sent when a customer successfully initiates a payment, but the payment has yet to complete. This event is most commonly sent when the customer initiates a bank debit. It’s followed by either a payment_ or payment_ event in the future. | Send the customer an order confirmation that indicates their payment is pending. For digital goods, you might want to fulfill the order before waiting for payment to complete. |

| payment_intent.payment_failed | Sent when a customer attempts a payment, but the payment fails. | If a payment transitions from processing to payment_, offer the customer another attempt to pay. |

Charge the saved payment method laterServer-side

Warning

bancontact and ideal are one-time payment methods by default. When set up for future usage, they generate a sepa_ reusable payment method type so you need to use sepa_ to query for saved payment methods.

Compliance

You’re responsible for your compliance with all applicable laws, regulations, and network rules when saving a customer’s payment details. When rendering past payment methods to your end customer for future purchases, make sure you’re listing payment methods where you’ve collected consent from the customer to save the payment method details for this specific future use. To differentiate between payment methods attached to customers that can and can’t be presented to your end customer as a saved payment method for future purchases, use the allow_redisplay parameter.

When you’re ready to charge your customer off-session, use the Customer and PaymentMethod IDs to create a PaymentIntent. To find a payment method to charge, list the payment methods associated with your customer. This example lists cards but you can list any supported type.

When you have the Customer and PaymentMethod IDs, create a PaymentIntent with the amount and currency of the payment. Set a few other parameters to make the off-session payment:

- Set off_session to

trueto indicate that the customer isn’t in your checkout flow during a payment attempt and can’t fulfill an authentication request made by a partner, such as a card issuer, bank, or other payment institution. If, during your checkout flow, a partner requests authentication, Stripe requests exemptions using customer information from a previous on-session transaction. If the conditions for exemption aren’t met, the PaymentIntent might throw an error. - Set the value of the PaymentIntent’s confirm property to

true, which causes confirmation to occur immediately when the PaymentIntent is created. - Set payment_method to the ID of the PaymentMethod and customer to the ID of the Customer.

Test the integration

See Testing for additional information to test your integration.

OptionalSet SetupFutureUsage on individual payment methodsPreviewServer-sideClient-side

For more granularity, set setupFutureUsage for specific payment methods with PaymentSheet.IntentConfiguration.Mode.PaymentMethodOptions.

Learn more about the setupFutureUsage values that are supported for each payment method.

Next, make sure your server doesn’t set setup_ or payment_ on the PaymentIntent. The SDK automatically handles setting it based on the IntentConfiguration.

Enable card scanning

To enable card scanning support for iOS, set the NSCameraUsageDescription (Privacy - Camera Usage Description) in the Info. of your application, and provide a reason for accessing the camera (for example, “To scan cards”).

OptionalEnable saved cardsServer-sideClient-side

PaymentSheet can display a Save this card for future use checkbox that saves the customer’s card, and display the customer’s saved cards. To enable this checkbox, create a Customer object on your server and an associated CustomerSession, with payment_ set to enabled.

Compare Customers v1 and Accounts v2 references

If your Connect platform uses customer-configured Accounts, use our guide to replace Customer and event references in your code with the equivalent Accounts v2 API references.

const stripe = require('stripe')('sk_test_your_secret_key'); app.post('/mobile-payment-element', async (req, res) => { // Use an existing Customer ID if this is a returning customer. const customer = await stripe.customers.create(); const customerSession = await stripe.customerSessions.create({ customer: customer.id, components: { mobile_payment_element: { enabled: true, features: { payment_method_save: 'enabled', payment_method_redisplay: 'enabled', payment_method_remove: 'enabled' } }, }, }); res.json({ customerSessionClientSecret: customerSession.client_secret, customer: customer.id, }); });

Next, configure PaymentSheet with the Customer’s ID and the CustomerSession client secret.

@_spi(CustomerSessionBetaAccess) import StripePaymentSheet var configuration = PaymentSheet.Configuration() configuration.customer = .init(id: customerId, customerSessionClientSecret: customerSessionClientSecret) self.paymentSheet = PaymentSheet(..., configuration: configuration)

OptionalAllow delayed payment methodsClient-side

Delayed payment methods don’t guarantee that you’ll receive funds from your customer at the end of the checkout either because they take time to settle (for example, US Bank Accounts, SEPA Debit, iDEAL, and Bancontact) or because they require customer action to complete (for example, OXXO, Konbini, and Boleto).

By default, PaymentSheet doesn’t display delayed payment methods. To opt in, set allowsDelayedPaymentMethods to true in your PaymentSheet.. This step alone doesn’t activate any specific payment methods; rather, it indicates that your app is able to handle them. For example, although OXXO isn’t supported by PaymentSheet, if it becomes supported and you’ve updated to the latest SDK version, your app will be able to display OXXO as a payment option without additional integration changes.

var configuration = PaymentSheet.Configuration() configuration.allowsDelayedPaymentMethods = true self.paymentSheet = PaymentSheet(..., configuration: configuration)

If the customer successfully uses one of these delayed payment methods in PaymentSheet, the payment result returned is ..

OptionalEnable Apple Pay

Note

If your checkout screen has a dedicated Apple Pay button, follow the Apple Pay guide and use ApplePayContext to collect payment from your Apple Pay button. You can use PaymentSheet to handle other payment method types.

Register for an Apple Merchant ID

Obtain an Apple Merchant ID by registering for a new identifier on the Apple Developer website.

Fill out the form with a description and identifier. Your description is for your own records and you can modify it in the future. Stripe recommends using the name of your app as the identifier (for example, merchant.).

Create a new Apple Pay certificate

Create a certificate for your app to encrypt payment data.

Go to the iOS Certificate Settings in the Dashboard, click Add new application, and follow the guide.

Download a Certificate Signing Request (CSR) file to get a secure certificate from Apple that allows you to use Apple Pay.

One CSR file must be used to issue exactly one certificate. If you switch your Apple Merchant ID, you must go to the iOS Certificate Settings in the Dashboard to obtain a new CSR and certificate.

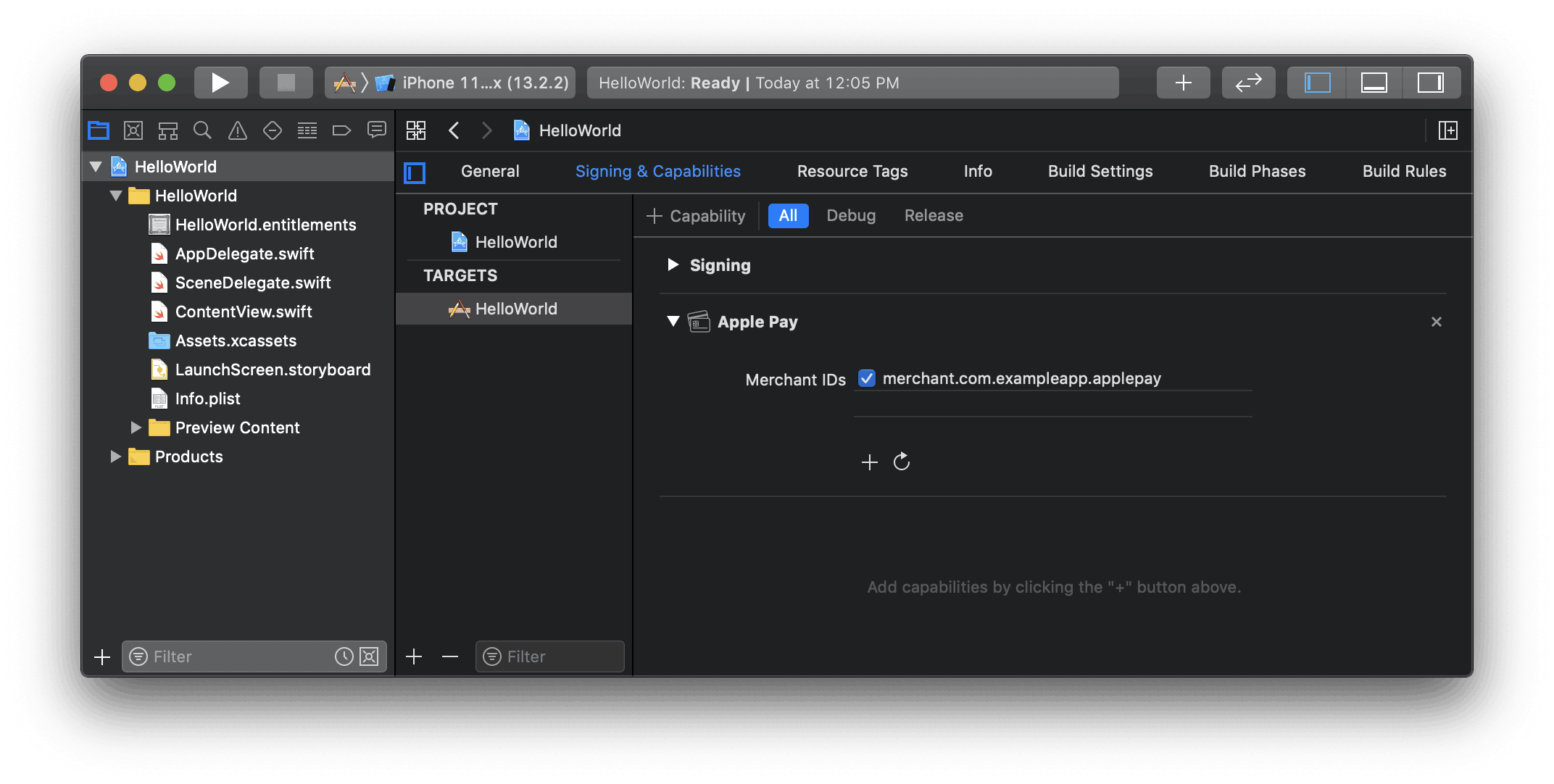

Integrate with Xcode

Add the Apple Pay capability to your app. In Xcode, open your project settings, click the Signing & Capabilities tab, and add the Apple Pay capability. You might be prompted to log in to your developer account at this point. Select the merchant ID you created earlier, and your app is ready to accept Apple Pay.

Enable the Apple Pay capability in Xcode

Add Apple Pay

Order tracking

To add order tracking information in iOS 16 or later, configure an authorizationResultHandler in your PaymentSheet.. Stripe calls your implementation after the payment is complete, but before iOS dismisses the Apple Pay sheet.

In your authorizationResultHandler implementation, fetch the order details from your server for the completed order. Add the details to the provided PKPaymentAuthorizationResult and return the modified result.

To learn more about order tracking, see Apple’s Wallet Orders documentation.

let customHandlers = PaymentSheet.ApplePayConfiguration.Handlers( authorizationResultHandler: { result in do { // Fetch the order details from your service let myOrderDetails = try await MyAPIClient.shared.fetchOrderDetails(orderID: orderID) result.orderDetails = PKPaymentOrderDetails( orderTypeIdentifier: myOrderDetails.orderTypeIdentifier, // "com.myapp.order" orderIdentifier: myOrderDetails.orderIdentifier, // "ABC123-AAAA-1111" webServiceURL: myOrderDetails.webServiceURL, // "https://my-backend.example.com/apple-order-tracking-backend" authenticationToken: myOrderDetails.authenticationToken) // "abc123" // Return your modified PKPaymentAuthorizationResult return result } catch { return PKPaymentAuthorizationResult(status: .failure, errors: [error]) } } ) var configuration = PaymentSheet.Configuration() configuration.applePay = .init(merchantId: "merchant.com.your_app_name", merchantCountryCode: "US", customHandlers: customHandlers)

OptionalCustomize the sheet

All customization is configured through the PaymentSheet.Configuration object.

Appearance

Customize colors, fonts, and so on to match the look and feel of your app by using the appearance API.

Payment method layout

Configure the layout of payment methods in the sheet using paymentMethodLayout. You can display them horizontally, vertically, or let Stripe optimize the layout automatically.

var configuration = PaymentSheet.Configuration() configuration.paymentMethodLayout = .automatic

Collect users addresses

Collect local and international shipping or billing addresses from your customers using the Address Element.

Merchant display name

Specify a customer-facing business name by setting merchantDisplayName. By default, this is your app’s name.

var configuration = PaymentSheet.Configuration() configuration.merchantDisplayName = "My app, Inc."

Dark mode

PaymentSheet automatically adapts to the user’s system-wide appearance settings (light and dark mode). If your app doesn’t support dark mode, you can set style to alwaysLight or alwaysDark mode.

var configuration = PaymentSheet.Configuration() configuration.style = .alwaysLight

Default billing details

To set default values for billing details collected in the payment sheet, configure the defaultBillingDetails property. The PaymentSheet pre-populates its fields with the values that you provide.

var configuration = PaymentSheet.Configuration() configuration.defaultBillingDetails.address.country = "US" configuration.defaultBillingDetails.email = "foo@bar.com"

Billing details collection

Use billingDetailsCollectionConfiguration to specify how you want to collect billing details in the payment sheet.

You can collect your customer’s name, email, phone number, and address.

If you only want to billing details required by the payment method, set billingDetailsCollectionConfiguration. to true. In that case, the PaymentSheet. are set as the payment method’s billing details.

If you want to collect additional billing details that aren’t necessarily required by the payment method, set billingDetailsCollectionConfiguration. to false. In that case, the billing details collected through the PaymentSheet are set as the payment method’s billing details.

var configuration = PaymentSheet.Configuration() configuration.defaultBillingDetails.email = "foo@bar.com" configuration.billingDetailsCollectionConfiguration.name = .always configuration.billingDetailsCollectionConfiguration.email = .never configuration.billingDetailsCollectionConfiguration.address = .full configuration.billingDetailsCollectionConfiguration.attachDefaultsToPaymentMethod = true

Note

Consult with your legal counsel regarding laws that apply to collecting information. Only collect phone numbers if you need them for the transaction.

OptionalEnable CVC recollection on confirmation

To re-collect the CVC of a saved card during PaymentIntent confirmation, your integration must collect payment details before creating a PaymentIntent.

Update the intent configuration

PaymentSheet. accepts an optional parameter that controls when to re-collect CVC for a saved card.

let intentConfig = PaymentSheet.IntentConfiguration( mode: .payment(amount: 1099, currency: "USD"), confirmHandler: { confirmationToken in // Handle ConfirmationToken... }, requireCVCRecollection: true)

Update parameters of the intent creation

To re-collect the CVC when confirming payment, include both the customerId and require_ parameters during the creation of the PaymentIntent.