Accept in-app payments

Build a customized payments integration in your iOS, Android, or React Native app using the Payment Element.

The Payment Element is a customizable component that renders a list of payment methods that you can add into any screen in your app. When customers interact with payment methods in the list, the component opens individual bottom sheets to collect payment details.

The Payment Element allows you to accept multiple payment methods using a single integration. In this integration, you build a custom payment flow where you render the Payment Element, create the PaymentIntent, and confirm the payment in your app.

Set up StripeServer-sideClient-side

Server-side

This integration requires endpoints on your server that talk to the Stripe API. Use our official libraries for access to the Stripe API from your server:

Client-side

The React Native SDK is open source and fully documented. Internally, it uses the native iOS and Android SDKs. To install Stripe’s React Native SDK, run one of the following commands in your project’s directory (depending on which package manager you use):

Next, install some other necessary dependencies:

- For iOS, go to the ios directory and run

pod installto ensure that you also install the required native dependencies. - For Android, there are no more dependencies to install.

Note

We recommend following the official TypeScript guide to add TypeScript support.

Stripe initialization

To initialize Stripe in your React Native app, either wrap your payment screen with the StripeProvider component, or use the initStripe initialization method. Only the API publishable key in publishableKey is required. The following example shows how to initialize Stripe using the StripeProvider component.

import { useState, useEffect } from 'react'; import { StripeProvider } from '@stripe/stripe-react-native'; function App() { const [publishableKey, setPublishableKey] = useState(''); const fetchPublishableKey = async () => { const key = await fetchKey(); // fetch key from your server here setPublishableKey(key); }; useEffect(() => { fetchPublishableKey(); }, []); return ( <StripeProvider publishableKey={publishableKey} merchantIdentifier="merchant.identifier" // required for Apple Pay urlScheme="your-url-scheme" // required for 3D Secure and bank redirects > {/* Your app code here */} </StripeProvider> ); }

Enable payment methods

View your payment methods settings and enable the payment methods you want to support. You need at least one payment method enabled to create a PaymentIntent.

By default, Stripe enables cards and other prevalent payment methods that can help you reach more customers, but we recommend turning on additional payment methods that are relevant for your business and customers. See Payment method support for product and payment method support, and our pricing page for fees.

Collect payment detailsClient-side

Initialize the Embedded Payment Element

Use the useEmbeddedPaymentElement hook to create and display the Embedded Payment Element in your React Native app. This hook requires two configuration objects:

EmbeddedPaymentElementConfiguration: General settings (for example,returnURL).IntentConfiguration: Payment-specific details (for example, amount, currency, and aconfirmHandlercallback).

The hook returns an object with the embeddedPaymentElementView React component and other helper methods. For a full list of options and return values, see the Stripe React Native SDK docs.

Note

Implementing confirmHandler is required, but for this step you can leave it as an empty function and implement it later.

import { useState, useCallback, useEffect } from 'react'; import { useEmbeddedPaymentElement, IntentConfiguration, EmbeddedPaymentElementConfiguration, IntentCreationCallbackParams, } from '@stripe/stripe-react-native'; function MyCheckoutComponent() { const [intentConfig, setIntentConfig] = useState<IntentConfiguration | null>(null); const [elementConfig, setElementConfig] = useState<EmbeddedPaymentElementConfiguration | null>(null); const initialize = useCallback(() => { const newIntentConfig: IntentConfiguration = { mode: { amount: 1099, currencyCode: 'USD', }, confirmHandler: async ( confirmationToken, callback: (params: IntentCreationCallbackParams) => void ) => { // You'll implement this in the "Confirm the payment" section below }, }; const newElementConfig: EmbeddedPaymentElementConfiguration = { merchantDisplayName: 'Your Business Name', returnURL: 'your-app://stripe-redirect', }; setIntentConfig(newIntentConfig); setElementConfig(newElementConfig); }, []); const { embeddedPaymentElementView, paymentOption, confirm, update, clearPaymentOption, loadingError, isLoaded, } = useEmbeddedPaymentElement( intentConfig!, elementConfig! ); useEffect(() => { initialize(); }, [initialize]); }

Add the Embedded Payment Element view

After the useEmbeddedPaymentElement hook has successfully initialized, include the embeddedPaymentElementView in your component to display the Embedded Payment Element in your checkout UI.

Caution

If isLoaded never becomes true, verify that embeddedPaymentElementView remains in your component’s render tree at all times. On Android, the native view must be mounted for initialization to complete. Use opacity to control visibility instead of conditionally rendering the view, as shown in the example below.

import { View, Text, ActivityIndicator } from 'react-native'; function MyCheckoutComponent() { // Other component code remains the same return ( <View> {/* Handle loading errors through the loadingError property */} {loadingError && ( <View> <Text>Failed to load payment form: {loadingError.message || String(loadingError)}</Text> </View> )} {/* Keep the view in the render tree for Android, control visibility with opacity */} <View style={{ opacity: isLoaded ? 1 : 0 }}> {embeddedPaymentElementView} </View> {/* Show loading indicator while the view is loading */} {!loadingError && !isLoaded && ( <View style={{ paddingVertical: 16, alignItems: 'center' }}> <ActivityIndicator /> </View> )} </View> ); }

Now you can run your app and see the Embedded Mobile Payment Element.

Optional Display the selected payment option

The useEmbeddedPaymentElement hook provides a paymentOption property in its return object. You can use this to access details about the customer’s selected payment option, such as a label (for example, “····4242”), image (for example, a VISA logo), or billing details to display in your UI.

The paymentOption property is reactive, meaning it automatically updates when the selected payment option changes. You don’t need to implement a separate delegate method. Instead, you can use this property directly in your component, and React re-renders the component whenever the paymentOption changes.

import { View, Text, Image } from 'react-native'; function MyCheckoutComponent() { // Other component code remains the same return ( // Other component code remains the same // Display the currently selected payment option (label and image) <View style={{ paddingVertical: 12 }}> <View style={{ flexDirection: 'row', alignItems: 'center', gap: 8 }}> {paymentOption?.image && ( <Image source={{ uri: `data:image/png;base64,${paymentOption.image}` }} style={{ width: 32, height: 20 }} resizeMode="contain" /> )} <Text> Selected: {paymentOption?.label ?? 'None'} </Text> </View> </View> ); }

Optional Update payment details

As the customer performs actions that change the payment details (for example, applying a discount code), update the EmbeddedPaymentElement instance to reflect the new values by calling the update method. Some payment methods, like Apple Pay and Google Pay, show the amount in the UI, so make sure it’s always accurate and up to date.

When the update call completes, update your UI. The update call might change the customer’s currently selected payment option.

Note

Always use await when calling the update API to ensure loading states are properly sequenced. Without await, the loading indicator may disappear before the update completes.

import { useState, useCallback } from 'react'; import { View, Button, ActivityIndicator } from 'react-native'; function MyCheckoutComponent() { // Other component code remains the same const [isUpdating, setIsUpdating] = useState(false); const handleUpdate = useCallback(async () => { // Create a new IntentConfiguration object with updated values const updatedIntentConfig: IntentConfiguration = { ...intentConfig!, mode: { amount: 999, // Updated amount after applying discount code currencyCode: 'USD', }, }; setIsUpdating(true); try { await update(updatedIntentConfig); } catch (error) { // Handle any unexpected errors console.error('Unexpected error during update:', error); } finally { setIsUpdating(false); } }, [intentConfig, update]); // Example of how to use the handleUpdate function const applyDiscountCode = useCallback(async (discountCode: string) => { // Validate discount code with your server try { const response = await fetch('https://your-server.com/apply-discount', { method: 'POST', headers: { 'Content-Type': 'application/json' }, body: JSON.stringify({ discountCode }), }); if (response.ok) { // Update the intent configuration with the new amount await handleUpdate(); } } catch (error) { console.error('Failed to apply discount:', error); } }, [handleUpdate]); return ( <View> {/* Hide view and show loading indicator during update */} <View style={{ opacity: isUpdating ? 0 : 1 }}> {embeddedPaymentElementView} </View> {isUpdating && ( <View style={{ paddingVertical: 16, alignItems: 'center' }}> <ActivityIndicator /> </View> )} <Button title="Apply Discount Code" onPress={() => applyDiscountCode('123456')} disabled={isUpdating} /> </View> ); }

Confirm the payment

When the customer taps the checkout button, call the confirm() method provided by the useEmbeddedPaymentElement hook to complete the payment. Make sure to disable user interaction during the confirmation process to prevent multiple submissions or interfering actions.

import { useCallback, useState } from 'react'; import { View, Button, Alert, ActivityIndicator } from 'react-native'; function MyCheckoutComponent() { // Other component code remains the same. const [isProcessing, setIsProcessing] = useState(false); const { confirm } = useEmbeddedPaymentElement(intentConfig!, elementConfig!); const handleSubmit = useCallback(async () => { setIsProcessing(true); // Disable user interaction, show a spinner. try { const result = await confirm(); switch (result.status) { case 'completed': // Payment completed - show a confirmation screen. Alert.alert('Success', 'Payment was completed successfully!'); break; case 'failed': // Encountered an unrecoverable error. You can display the error to the user, log it, and so on. Alert.alert('Error', `Payment failed: ${result.error.message}`); break; case 'canceled': // Customer canceled - you should probably do nothing. console.log('Payment was canceled by the user'); break; } } catch (error) { // Handle any unexpected errors console.error('Unexpected error during confirmation:', error); Alert.alert('Error', 'An unexpected error occurred'); } finally { setIsProcessing(false); // Re-enable user interaction, hide spinner. } }, [confirm]); // The rest of the component code. return ( <View> {/* Other UI elements */} <Button title="Confirm Payment" onPress={handleSubmit} disabled={isProcessing || !paymentOption} /> {isProcessing && <ActivityIndicator size="large" />} </View> ); }

Next, implement the confirmHandler callback you passed to the IntentConfiguration earlier to send a request to your server. Your server creates a PaymentIntent and returns its client secret. For more information about this process, see Creating a PaymentIntent.

When the server request returns, call the intentCreationCallback with either your server response’s client secret or an error. The Embedded Payment Element confirms the PaymentIntent using the client secret or displays a localized error message in its UI. After confirmation completes, the Embedded Payment Element becomes unusable. At this point, navigate the user to a receipt screen or similar confirmation page in your app.

function MyCheckoutComponent() { const handleConfirm = useCallback(async ( confirmationToken, intentCreationCallback: (params: IntentCreationCallbackParams) => void ) => { try { // Make a request to your own server and receive a client secret or an error. const response = await fetch('https://your-server.com/create-intent', { method: 'POST', headers: { 'Content-Type': 'application/json', }, body: JSON.stringify({ confirmation_token_id: confirmationToken.id, // Add any other necessary data. }), }); if (!response.ok) { throw new Error('Server response was not ok'); } const { clientSecret } = await response.json(); // Call the `intentCreationCallback` with the client secret. intentCreationCallback({ clientSecret }); } catch (error) { // Call the `intentCreationCallback` with the error. intentCreationCallback({ error: (error as IntentCreationError) }); } }, []); const intentConfig: IntentConfiguration = { mode: { amount: 1099, currencyCode: 'USD', }, confirmHandler: handleConfirm, }; // The rest of your component code return ( // Your component ); }

Optional Clear the selected payment option

If you have payment options external to the Embedded Payment Element, you might need to clear the selected payment option. To do this, use the clearPaymentOption function provided by the useEmbeddedPaymentElement hook to deselect the currently selected payment option.

function MyCheckoutComponent() { // The rest of your component code const handleDeselectPaymentMethod = useCallback(() => { clearPaymentOption(); }, [clearPaymentOption]); // The rest of your component code }

Set up a return URL (iOS Only)Client-side

When a customer exits your app (for example to authenticate in Safari or their banking app), provide a way for them to automatically return to your app. Many payment method types require a return URL. If you don’t provide one, we can’t present payment methods that require a return URL to your users, even if you’ve enabled them.

To provide a return URL:

- Register a custom URL. Universal links aren’t supported.

- Configure your custom URL.

- Set up your root component to forward the URL to the Stripe SDK as shown below.

Note

If you’re using Expo, set your scheme in the app. file.

import { useEffect, useCallback } from 'react'; import { Linking } from 'react-native'; import { useStripe } from '@stripe/stripe-react-native'; export default function MyApp() { const { handleURLCallback } = useStripe(); const handleDeepLink = useCallback( async (url: string | null) => { if (url) { const stripeHandled = await handleURLCallback(url); if (stripeHandled) { // This was a Stripe URL - you can return or add extra handling here as you see fit } else { // This was NOT a Stripe URL – handle as you normally would } } }, [handleURLCallback] ); useEffect(() => { const getUrlAsync = async () => { const initialUrl = await Linking.getInitialURL(); handleDeepLink(initialUrl); }; getUrlAsync(); const deepLinkListener = Linking.addEventListener( 'url', (event: { url: string }) => { handleDeepLink(event.url); } ); return () => deepLinkListener.remove(); }, [handleDeepLink]); return ( <View> <AwesomeAppComponent /> </View> ); }

For more information on native URL schemes, refer to the Android and iOS docs.

Create a PaymentIntentServer-side

On your server, create a PaymentIntent with an amount and currency. You can manage payment methods from the Dashboard. Stripe handles the return of eligible payment methods based on factors such as the transaction’s amount, currency, and payment flow. To prevent malicious customers from choosing their own prices, always decide how much to charge on the server-side (a trusted environment) and not the client.

If the call succeeds, return the PaymentIntent client secret. If the call fails, handle the error and return an error message with a brief explanation for your customer.

Note

Verify that all IntentConfiguration properties match your PaymentIntent (for example, setup_, amount, and currency).

Handle post-payment eventsServer-side

Stripe sends a payment_intent.succeeded event when the payment completes. Use the Dashboard webhook tool or follow the webhook guide to receive these events and run actions, such as sending an order confirmation email to your customer, logging the sale in a database, or starting a shipping workflow.

Listen for these events rather than waiting on a callback from the client. On the client, the customer could close the browser window or quit the app before the callback executes, and malicious clients could manipulate the response. Setting up your integration to listen for asynchronous events is what enables you to accept different types of payment methods with a single integration.

In addition to handling the payment_ event, we recommend handling these other events when collecting payments with the Payment Element:

| Event | Description | Action |

|---|---|---|

| payment_intent.succeeded | Sent when a customer successfully completes a payment. | Send the customer an order confirmation and fulfill their order. |

| payment_intent.processing | Sent when a customer successfully initiates a payment, but the payment has yet to complete. This event is most commonly sent when the customer initiates a bank debit. It’s followed by either a payment_ or payment_ event in the future. | Send the customer an order confirmation that indicates their payment is pending. For digital goods, you might want to fulfill the order before waiting for payment to complete. |

| payment_intent.payment_failed | Sent when a customer attempts a payment, but the payment fails. | If a payment transitions from processing to payment_, offer the customer another attempt to pay. |

Test the integration

See Testing for additional information to test your integration.

OptionalEnable saved cardsServer-sideClient-side

EmbeddedPaymentElement can display a Save this card for future use checkbox that saves the customer’s card. It can also display the customer’s saved cards. To enable this checkbox, the customer must have an associated Customer object on your server. To enable a checkbox that allows the customer to save their card, create a CustomerSession with payment_ set to enabled.

const stripe = require("stripe")(); const express = require('express'); const app = express(); app.set('trust proxy', true); app.use(express.json()); app.post('/payment-sheet', async (req, res) => { // Use an existing Customer ID if this is a returning customer. const customer = await stripe.customers.create(); const customerSession = await stripe.customerSessions.create({ customer: customer.id, mobile_payment_element: { enabled: true, features: { payment_method_save: 'enabled', payment_method_redisplay: 'enabled', payment_method_remove: 'enabled' } }, }); res.json({ customerSessionClientSecret: customerSession.client_secret, customer: customer.id, }); });"sk_test_BQokikJOvBiI2HlWgH4olfQ2"

Next, configure EmbeddedPaymentElement with the Customer’s ID and the CustomerSession client secret.

const embeddedConfig: EmbeddedPaymentElementConfiguration = { merchantDisplayName: "Example, Inc.", customerId: customer, customerSessionClientSecret: customerSessionClientSecret, ... };

OptionalAllow delayed payment methodsClient-side

Delayed payment methods don’t guarantee that you’ll receive funds from your customer at the end of checkout. That’s because they take time to settle (for example, US Bank Accounts, SEPA Debit, iDEAL, Bancontact, and Sofort) or because they require customer action to complete (for example, OXXO, Konbini, and Boleto).

By default, EmbeddedPaymentElement doesn’t display delayed payment methods. To display them, when you initialize EmbeddedPaymentElementConfiguration, set allowsDelayedPaymentMethods to true.

const embeddedConfig: EmbeddedPaymentElementConfiguration = { // Other EmbeddedPaymentElementConfiguration remains the same allowsDelayedPaymentMethods: true, };

If the customer successfully uses one of these delayed payment methods in EmbeddedPaymentElement, the payment result returned is ..

OptionalEnable Apple Pay

Register for an Apple Merchant ID

Obtain an Apple Merchant ID by registering for a new identifier on the Apple Developer website.

Fill out the form with a description and identifier. Your description is for your own records and you can modify it in the future. Stripe recommends using the name of your app as the identifier (for example, merchant.).

Create a new Apple Pay certificate

Create a certificate for your app to encrypt payment data.

Go to the iOS Certificate Settings in the Dashboard, click Add new application, and follow the guide.

Download a Certificate Signing Request (CSR) file to get a secure certificate from Apple that allows you to use Apple Pay.

One CSR file must be used to issue exactly one certificate. If you switch your Apple Merchant ID, you must go to the iOS Certificate Settings in the Dashboard to obtain a new CSR and certificate.

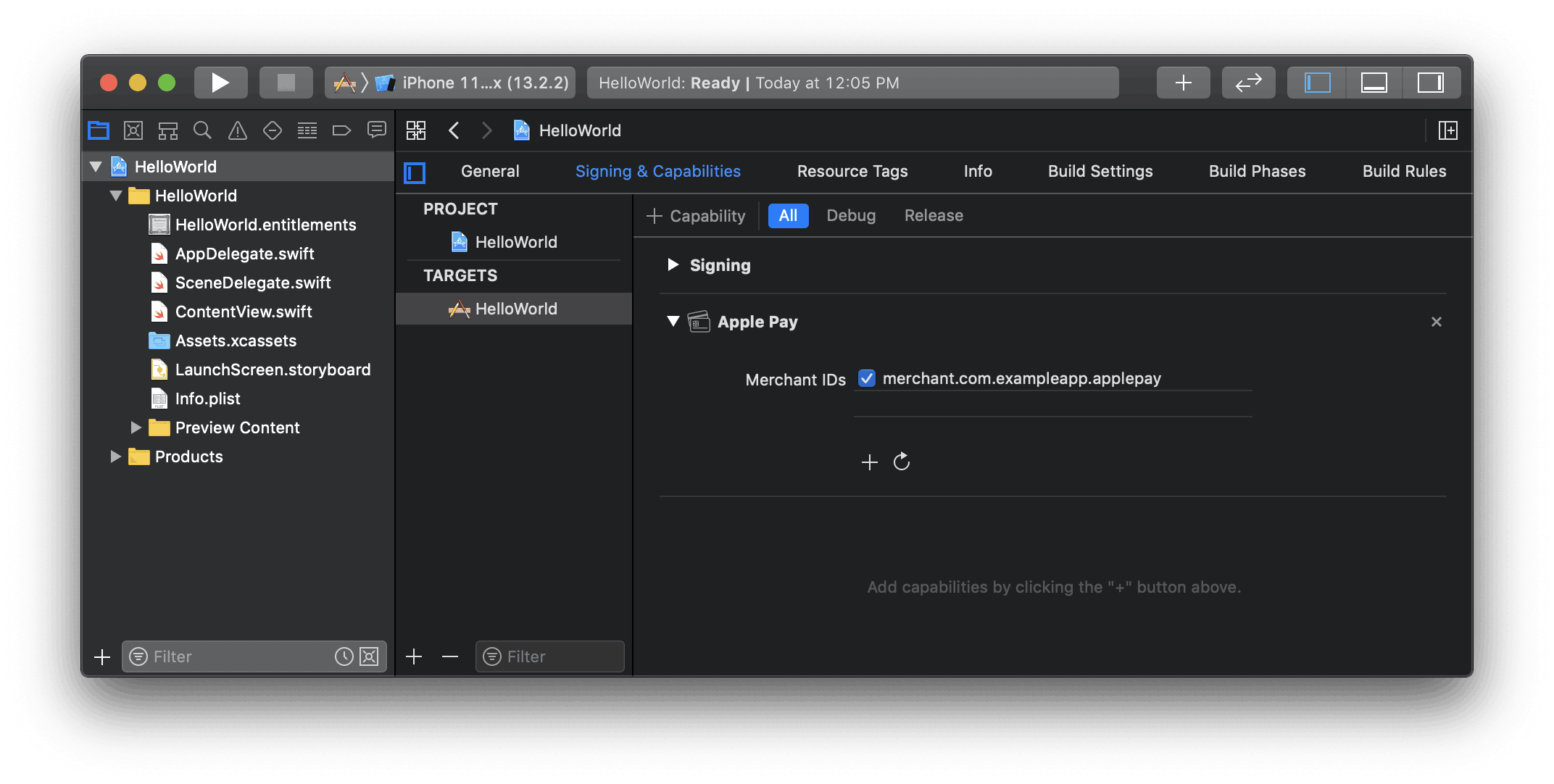

Integrate with Xcode

Add the Apple Pay capability to your app. In Xcode, open your project settings, click the Signing & Capabilities tab, and add the Apple Pay capability. You might be prompted to log in to your developer account at this point. Select the merchant ID you created earlier, and your app is ready to accept Apple Pay.

Enable the Apple Pay capability in Xcode

Add Apple Pay

Order tracking

To add order tracking information in iOS 16 or later, configure a setOrderTracking callback function. Stripe calls your implementation after the payment is complete, but before iOS dismisses the Apple Pay sheet.

In your implementation of setOrderTracking callback function, fetch the order details from your server for the completed order, and pass the details to the provided completion function.

To learn more about order tracking, see Apple’s Wallet Orders documentation.

const embeddedConfig: EmbeddedPaymentElementConfiguration = { // ... applePay: { // ... setOrderTracking: async complete => { const apiEndpoint = Platform.OS === 'ios' ? 'http://localhost:4242' : 'http://10.0.2.2:4567'; const response = await fetch( `${apiEndpoint}/retrieve-order?orderId=${orderId}`, { method: 'GET', headers: { 'Content-Type': 'application/json', }, }, ); if (response.status === 200) { const orderDetails = await response.json(); // orderDetails should include orderIdentifier, orderTypeIdentifier, // authenticationToken and webServiceUrl complete(orderDetails); } }, }, };

OptionalEnable Google Pay

Set up your integration

To use Google Pay, first enable the Google Pay API by adding the following to the <application> tag of your AndroidManifest.xml:

<application> ... <meta-data android:name="com.google.android.gms.wallet.api.enabled" android:value="true" /> </application>

For more details, see Google Pay’s Set up Google Pay API for Android.

Add Google Pay

When you initialize EmbeddedPaymentElement, set merchantCountryCode to the country code of your business and set googlePay to true.

You can also use the test environment by passing the testEnv parameter. You can only test Google Pay on a physical Android device. Follow the React Native docs to test your application on a physical device.

const embeddedConfig: EmbeddedPaymentElementConfiguration = { // ... googlePay: { merchantCountryCode: 'US', testEnv: true, // use test environment }, };

OptionalEnable card scanning

To enable card scanning support for iOS, set the NSCameraUsageDescription (Privacy - Camera Usage Description) in the Info. of your application, and provide a reason for accessing the camera (for example, “To scan cards”). Devices with iOS 13 or higher support card scanning.

To enable card scanning support for Android, request production access to the Google Pay API from the Google Pay and Wallet Console.

- If you’ve enabled Google Pay, the card scanning feature is automatically available in our UI on eligible devices. To learn more about eligible devices, see the Google Pay API constraints

- Important: The card scanning feature only appears in builds signed with the same signing key registered in the Google Pay & Wallet Console. Test or debug builds using different signing keys (for example, builds distributed through Firebase App Tester) won’t show the Scan card option. To test card scanning in pre-release builds, you must either:

- Sign your test builds with your production signing key

- Add your test signing key fingerprint to the Google Pay and Wallet Console

OptionalCustomize the sheet

All customization is configured using EmbeddedPaymentElementConfiguration.

Appearance

Customize colors, fonts, and so on to match the look and feel of your app by using the appearance API.

Merchant display name

Specify a customer-facing business name by setting merchantDisplayName. By default, this is your app’s name.

const embeddedConfig: EmbeddedPaymentElementConfiguration = { // ... merchantDisplayName: 'Example Inc.', };

Dark mode

By default, EmbeddedPaymentElement automatically adapts to the user’s system-wide appearance settings (light and dark mode). You can change this by setting the style property to alwaysLight or alwaysDark mode on iOS.

const embeddedConfig: EmbeddedPaymentElementConfiguration = { // ... style: 'alwaysDark', };

On Android, set light or dark mode on your app:

// force dark AppCompatDelegate.setDefaultNightMode(AppCompatDelegate.MODE_NIGHT_YES) // force light AppCompatDelegate.setDefaultNightMode(AppCompatDelegate.MODE_NIGHT_NO)

Default billing details

To set default values for billing details collected in the EmbeddedPaymentElement, configure the defaultBillingDetails property. The EmbeddedPaymentElement pre-populates its fields with the values that you provide.

const uiConfig: EmbeddedPaymentElementConfiguration = { // ... defaultBillingDetails: { email: 'foo@bar.com', address: { country: 'US', }, }, };

Collect billing details

Use billingDetailsCollectionConfiguration to specify how you want to collect billing details in the EmbeddedPaymentElement.

You can collect your customer’s name, email, phone number, and address.

If you don’t intend to collect the values that the payment method requires, you must do the following:

- Attach the values that aren’t collected by

EmbeddedPaymentElementto thedefaultBillingDetailsproperty. - Set

billingDetailsCollectionConfiguration.toattachDefaultsToPaymentMethod true.

const newElementConfig: EmbeddedPaymentElementConfiguration = { // ... defaultBillingDetails: { email: 'foo@bar.com', } billingDetailsCollectionConfiguration: { name: PaymentSheet.CollectionMode.ALWAYS, email: PaymentSheet.CollectionMode.NEVER, address: PaymentSheet.AddressCollectionMode.FULL, attachDefaultsToPaymentMethod: true }, };

Note

Consult with your legal counsel regarding laws that apply to collecting information. Only collect phone numbers if you need them for the transaction.