Issuing disputes

Learn how to use Issuing to dispute transactions.

When an issue with a transaction occurs, a User or their cardholder can dispute the charge. Common issues include fraud, product/service not received, or processing error.

Stripe offers a guided Dashboard process and an API to submit disputes and monitor them through to resolution. This process typically takes between 30 and 90 days. If you manage a low volume of disputes, we recommend using the Dashboard. If you manage a high volume of disputes, we recommend using the API.

Caution

You can’t dispute an authorisation. Acquiring businesses reverse authorisations at their discretion. You can file a dispute after the authorisation is complete and the acquiring business captures the transaction.

Considerations before initiating a dispute

Network rules

We process disputes according to rules and guidelines of the card network that handled the transaction. For the complete details regarding the rules and guidelines that apply to disputes, refer to the Visa and Mastercard rulebooks.

Submitting valid disputes

A dispute can only be submitted once. After submission, no additional edits or supplemental evidence are allowed to be added. It’s the user’s responsibility to properly submit the dispute based on the requirements established by the card network. Filing an invalid or incomplete dispute might result in a loss.

Consumer disputes

For consumer disputes (for example, not received, cancelled, not as described), cardholders are required to attempt to resolve the dispute with the business before filing a dispute. Documentation regarding the cardholder’s attempt to resolve the dispute must be included in the dispute submission.

How Card Networks define fraud

For both Visa and Mastercard, a fraudulent transaction is defined as one where the cardholder denies participating in the charge. If the cardholder acknowledges they participated in the transaction (for example a scam); they should file the dispute under a different reason for which they have dispute rights.

Requirements for fraud disputes (for Platforms)

Platforms must allow their connected accounts to submit fraudulent disputes directly to Stripe through a dashboard that you, as the Platform, make available using our APIs or embedded components. You can’t restrict their ability to submit such disputes in any way. After fraud disputes are submitted, Stripe will review them to determine if the cardholder needs to be reimbursed.

Blocked dispute submissions

Stripe might block fraud dispute submission if the transaction doesn’t qualify for fraud protection under local regulations and the account holder has no dispute rights according to network rules.

For platforms

If you’re obligated to submit a dispute and you submit it, you’ve fulfilled your obligation, regardless of whether Stripe blocks the submission.

Card networks might consider a dispute invalid for the following reasons (among others):

- The transaction is a refund and not a capture.

- The transaction is a mobile push payment transaction.

- The dispute time frame has expired

In the Dashboard, the dispute transaction button is only enabled for eligible transactions. In the API, attempting to dispute an ineligible transaction results in an error.

Expiry

Card networks establish a time frame by which a dispute can be submitted. A dispute submitted after this time frame is considered expired and is lost. The time frame varies depending on dispute reason and the card network.

For Visa, fraudulent and processing error disputes must be filed within 110 days of the transaction date. ‘Authorisation’ disputes must be filed within 65 days of the transaction date. Consumer disputes such as ‘Cancelled’, ‘Not Received’ and ‘Not as Described’ must be filed within 110 days of the merchandise or service expected at date.

Partial amounts

Disputes can be filed for the full amount or for a partial amount. If there are refunds, they must be accounted for and only a partial dispute can be filed. Certain dispute reasons, such as incorrect amount, require that only a partial dispute amount is filed. For many consumer disputes, the dispute amount is partial in cases when part of the merchandise order or service was received.

Lifecycle

In this lifecycle diagram, “business” refers to the acquiring business, the business receiving the payment.

Newly-created disputes begin in an unsubmitted status. At this point, you can update their evidence and metadata. After you’ve added all the required evidence, you can then submit the dispute. If you don’t submit a dispute within 110 days of the transaction clearing, its status becomes expired.

Stripe and card networks process disputes that have a status of submitted. As such, you can’t update dispute evidence, but you can still update their metadata. Submitted disputes enter into a multi-step process defined by card networks and participating banks. After a dispute is resolved, Stripe transitions it to either the terminal won or lost status.

Creation

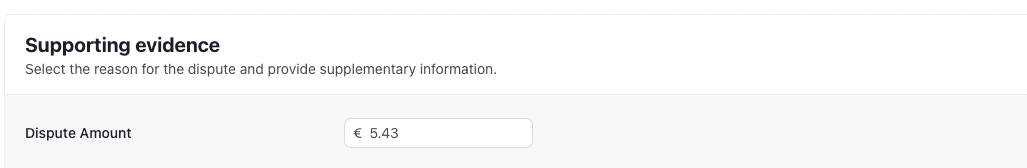

Fill in the Dispute Amount field to indicate the disputed amount (full or partial). The field’s initial value is the transaction amount. Submissions that have empty Dispute Amount fields create disputes with the full transaction amount.

Dispute Amount field on the Issuing dispute creation page

Update

Submission

Resolution

Testing

Webhooks

To be notified of changes to your disputes, you can listen for Issuing dispute webhook events. All Issuing dispute events contain the updated Dispute object.

| Webhook events | Trigger |

|---|---|

issuing_ | Dispute created. |

issuing_ | Dispute updated. |

issuing_ | Dispute submitted. |

issuing_ | Funds transferred to your Issuing balance (usually associated with won dispute status). |

issuing_ | Funds deducted from your Issuing balance (usually associated with a provisional credit clawback). |

issuing_ | Dispute transitioned into a won, lost, or expired status. |

Dispute reasons and evidence

Different dispute reasons have varying requirements on what is needed for a proper submission. Complete dispute submission and the quality of the associated documentation directly influences your chances of winning. The strongest disputes have clear, descriptive documentation.

Disputes can be submitted with one of these reasons:

- Cancelled: The cardholder cancelled or returned merchandise or cancelled services, and the business didn’t process a credit or void a transaction receipt.

- Duplicate: Covers processing error dispute types, including duplicate transaction, incorrect amount, and paid by other means.

- Fraudulent: The cardholder did not authorise the transaction.

- Merchandise not as described: The cardholder received the merchandise, but it didn’t match what was presented at time of purchase, or it was damaged or defective.

- Not received: The cardholder participated in the transaction but didn’t receive the merchandise or service.

- No valid authorisation: (API only) The business processed a transaction without a valid authorisation.

- Service not as described: The cardholder received the service, but it didn’t match what was presented at time of purchase.

- Other: A dispute scenario that doesn’t clearly qualify as any other dispute reason. Disputes submitted under this reason will be manually recategorised by Stripe. Please include the actual dispute reason in the evidence explanation when filing these disputes.

In the Dashboard, Merchandise not as described and Service not as described are consolidated under Not as described.

Each reason requires a different set of evidence:

Fraud disputes

You can dispute a transaction for fraud if the cardholder claims they didn’t authorise the transaction.

Before filing a dispute:

- Confirm with the cardholder that they didn’t make the transaction in error, and that it wasn’t made by someone known to them. Transactions made by a friend or family member, for example, don’t constitute fraud for dispute purposes.

- Cancel the affected card if submitting a dispute using the API. Filing a dispute will automatically cancel the card if done in the Dashboard.

In certain situations, you can lose fraud dispute rights for a transaction:

- For card-present transactions: A card network might automatically reject a fraud dispute because liability defaults to the issuer.

- For card-not-present transactions: A card network might automatically reject a fraud dispute if the cardholder was authenticated during the transaction. That often happens when 3D Secure was requested or a secured payment method like Apple Pay was used.

Authorisation disputes

Each time an acquiring business processes a transaction, they must first request an authorisation from the issuer. If a business captures a payment without a valid authorisation or if they did obtain an authorisation but it’s expired, you can dispute the transaction. Choose the reason for dispute based on the method used to submit the dispute:

- Filing a dispute through the API: File the dispute under the

no_reason.valid_ authorization - Filing a dispute through the Dashboard: File the dispute under the

otherreason and specify in theexplanationfield that you are filing a ‘no authorization’ dispute.

Authorisation disputes are distinct from fraud disputes:

- File a fraud dispute when the cardholder didn’t participate in the transaction.

- File an authorisation dispute when the business didn’t obtain a valid authorisation for the transaction.

Another reason for an authorisation dispute is an overcapture. An overcapture occurs when the captured amount exceeds the authorised amount. When you submit an authorisation dispute for an overcapture, you must adjust the dispute amount to include only the amount that exceeded the authorisation.

Note

Some Merchant Category Codes (MCCs) allow overcaptures of certain amounts or disallow authorisation disputes. For details, refer to the current card network rules for your region.

Withdrawing

Stripe can only withdraw a dispute within 1 day of its submission to the card network. If you want to withdraw a dispute, contact Stripe Support immediately.

Liability for fraud (platforms in the USA)

Most aspects of Regulation Z don’t apply to business-purpose cards, but Regulation Z does protect users of business-purpose cards from fraud and other types of “unauthorised card use”, which means the use of a charge card by a person who doesn’t have the authority to use it. In most cases, an account holder can’t be held responsible for unauthorised use of cards linked to their account unless a reasonable investigation into the fraud is conducted. However, if the account holder has 10 or more employee authorised users, they might not qualify for this protection.

When one of your users disputes a transaction because the user believes it was unauthorised, Stripe sends the dispute to the card network for adjudication (as with any other type of disputed transaction). Stripe or the card network determines who must pay for the fraud: you or the business.

If Stripe or the card network determines the business is liable for the fraud, then neither you nor your user are responsible for the disputed transactions.

If Stripe or the card network determines that you’re liable for the fraud, then you might be required to pay for the disputed transaction. Stripe performs a reasonable investigation into the dispute to determine whether fraud actually occurred or whether the user doesn’t qualify for protection under Regulation Z. If the investigation uncovers that unauthorised card use actually occurred and that the user qualifies for protection, then you remain liable for the unauthorised transactions. Alternatively, if the investigation uncovers that unauthorised card use didn’t occur or that the user doesn’t qualify for protection, then we hold the accountholder responsible for the disputed charges.

Email connected accounts

Issuing platforms must send regulated notice emails to connected accounts when a dispute is submitted, and again when a dispute is won or lost. Learn more about regulated notices.

Use with Financial Accounts for platforms

Disputes of ReceivedDebits on FinancialAccounts have a corresponding DebitReversal after the dispute is submitted.