Taxes

Learn about Stripe Tax and how to use it with invoices.

On an invoice, Stripe Tax calculates sales tax, VAT, and GST. To calculate these for each line item, Stripe uses:

- Your tax settings

- The customer’s tax settings and location

- The product tax code and price tax behavior

Set up the customer

We use the customer’s location to determine the relevant taxes to collect. Customers outside of the US need at least a country-level address, while customers in the US require a 5-digit postal code. For Canada, we need at least the province or postal code.

Set up line items

To calculate tax on each line item on an invoice, you need to set a tax behavior and optionally a tax code.

Customize tax settings for one-off line items

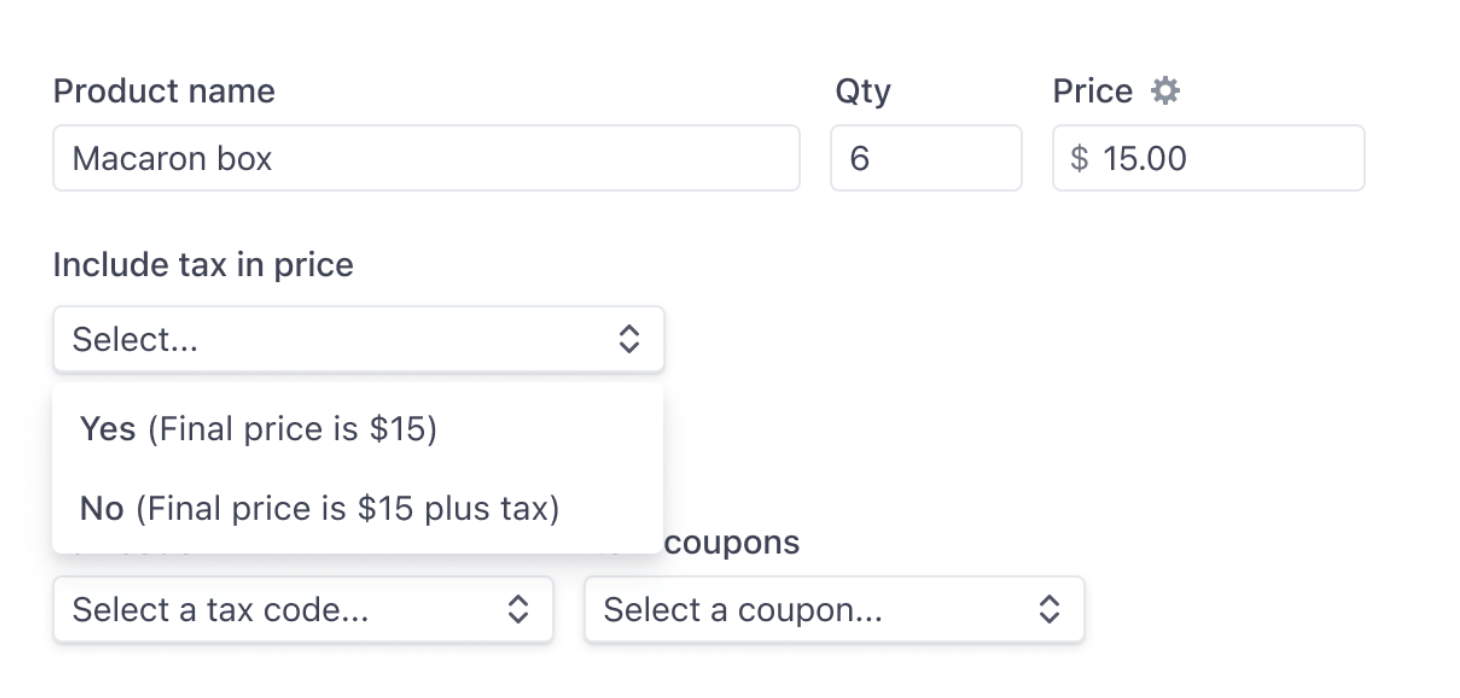

Customize line items in the Invoice Editor by selecting the tax behavior from the Include tax in price drop-down menu.

Customize tax settings for one-off line items

Customize tax settings for product-based line items

You can use both the Dashboard and the API to customize tax settings for product-based line items.

For more information on automatic tax calculation, see Automatically collect tax on invoices.

Net prices and taxes

You can issue invoices with line item prices that exclude inclusive tax. Tax-exclusive prices are only shown in the invoice PDF. That means, when using inclusive tax, the Hosted Invoice Page and invoice emails show tax-inclusive prices. You can define the settings for net prices in the Dashboard or API.

- Include inclusive tax—The invoice PDF displays line item prices including the inclusive tax. (This is the default.)

- Exclude tax—The invoice PDF displays line item prices excluding tax.

Order precedence

If you set a default for line item prices at the customer level, it takes precedence over account-level settings.