How Financial Accounts for platforms works

Learn about connected accounts, financial accounts for platforms, and moving money.

Financial Accounts for platforms is a suite of APIs for Stripe Connect platforms that allows you to embed financial services in your product.

Stripe provides the infrastructure in partnership with trusted banks. You can use Financial Accounts for platforms to enable your connected accounts to hold funds, pay bills, earn cash back, and manage their cash flow.

Modular components for financial services

Financial Accounts for platforms provides modular components for building a full-featured, scalable financial product.

Financial Accounts for platforms use cases

The following are examples of some common Financial Accounts for platforms use cases:

| Use case | Description |

|---|---|

| Spend management | Build a spend management product for your customers to store funds on your platform and manage spending with branded cards. |

| Store and spend account | Create FDIC insurance-eligible accounts that allow businesses to store funds, earn cash back, accept checks, and pay contractors and vendors with ACH and wire transfers. |

| Programmatic money movement | Facilitate money movement between your platform’s connected accounts and from connected accounts to third-party accounts. |

Financial Accounts for platforms account architecture

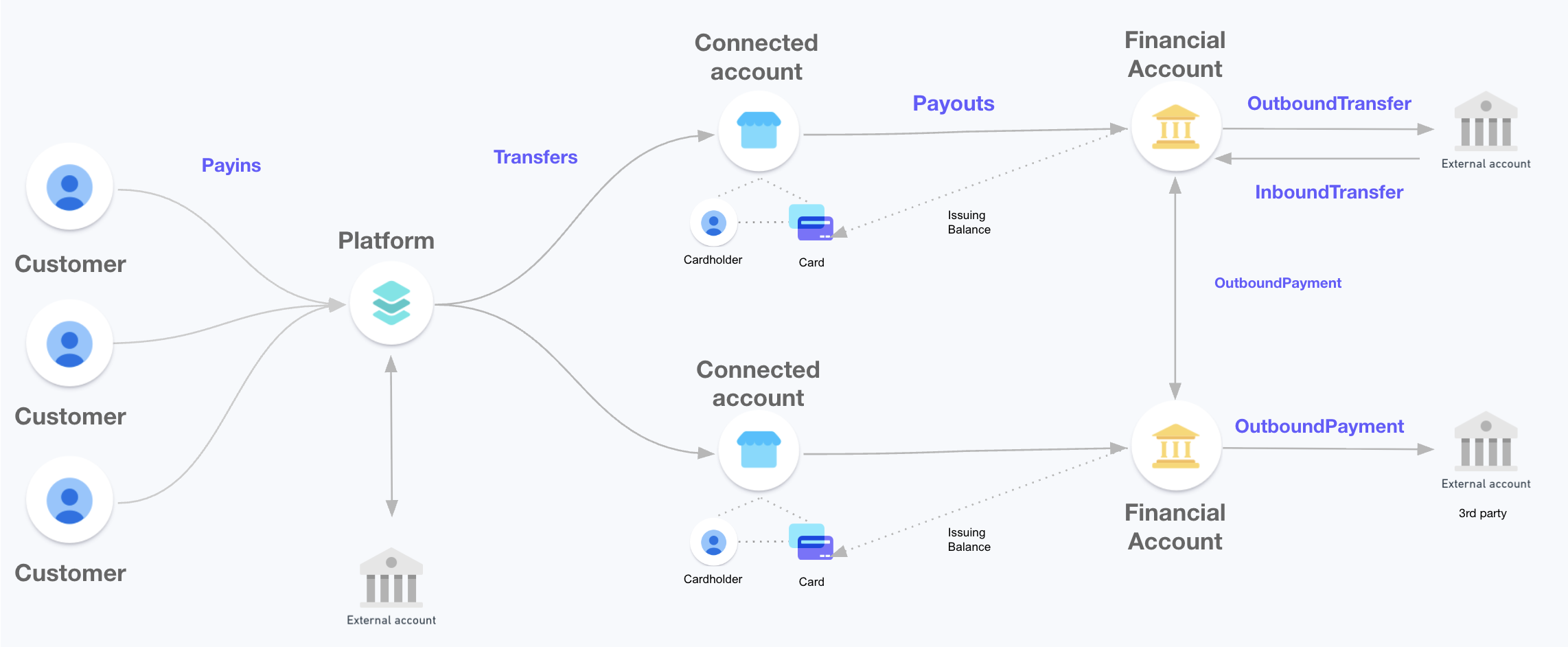

Using Connect, you onboard customers to your platform as connected accounts. You can create a financial account for each connected account to access your financial products. The following diagram illustrates an overview of a platform with Financial Accounts for platforms integration.

Financial Accounts for platforms architecture

Financial Accounts for platforms architectureConnected accounts

Connected accounts are sellers or service providers that use a platform. For example, if you’re a digital storefront platform owner, you provide an e-commerce framework that businesses use to establish online stores and collect payments. Each business that uses your storefront platform is a connected account.

Financial Accounts for platforms only supports connected accounts that don’t use a Stripe-hosted dashboard and where your platform is responsible for requirements collection and loss liability, including Custom connected accounts. Learn how to create connected accounts that work with Financial Accounts for platforms.

As a platform with connected accounts, you’re responsible for maintaining a minimum API version, communicating terms of service updates to your connected accounts, handling information requests from them, and providing them with support. Because your platform is ultimately responsible for the losses your connected accounts incur, you’re also responsible for vetting them for fraud. To learn more, read the Financial Accounts for platforms fraud guide.

Financial accounts

You can use the Financial Accounts for platforms endpoints of the Stripe API to create financial accounts, and attach them to connected accounts in a one-to-one relationship (unless you’re enrolled in the Multi Financial Account preview).

You can fund the financial accounts of your platform’s connected accounts and move money between them. Your connected accounts can also fund their financial accounts using a bank external to Stripe. If your platform uses Stripe Issuing, you can provide payment cards linked to the financial account balance of your connected accounts.

Financial accounts have routing numbers because they’re backed by US banking partners, and balances are eligible for FDIC pass-through insurance.

Sample integration

Follow our two-part sample integration to see how Financial Accounts for platforms works:

- Set up Financial Accounts for platforms and create cards with Issuing

- Use Financial Accounts for platforms with SetupIntents and PaymentMethods to move money

Financial Accounts for platforms is provided in the US by Stripe Payments Company, licensed money transmitter, with funds held at Stripe’s bank partners, Members FDIC. Card and other credit products are provided by Celtic Bank and serviced by Stripe, Inc. and its affiliate Stripe Servicing, Inc.