Define a custom pricing strategy

Assess your connected accounts with custom pricing strategies.

A pricing scheme is a list of conditional fees. For each applicable transaction, Stripe evaluates the list in the order you specify and applies the first matching conditional fee. If no conditional fees match the transaction, Stripe applies your default fee. Stripe calculates the fee in the specified currency, and then converts it to the settlement currency of the payment, if needed.

Create a pricing scheme

To create a pricing scheme:

From the Platform pricing page in your Stripe Dashboard (Settings > Connect > Platform pricing), click Get Started.

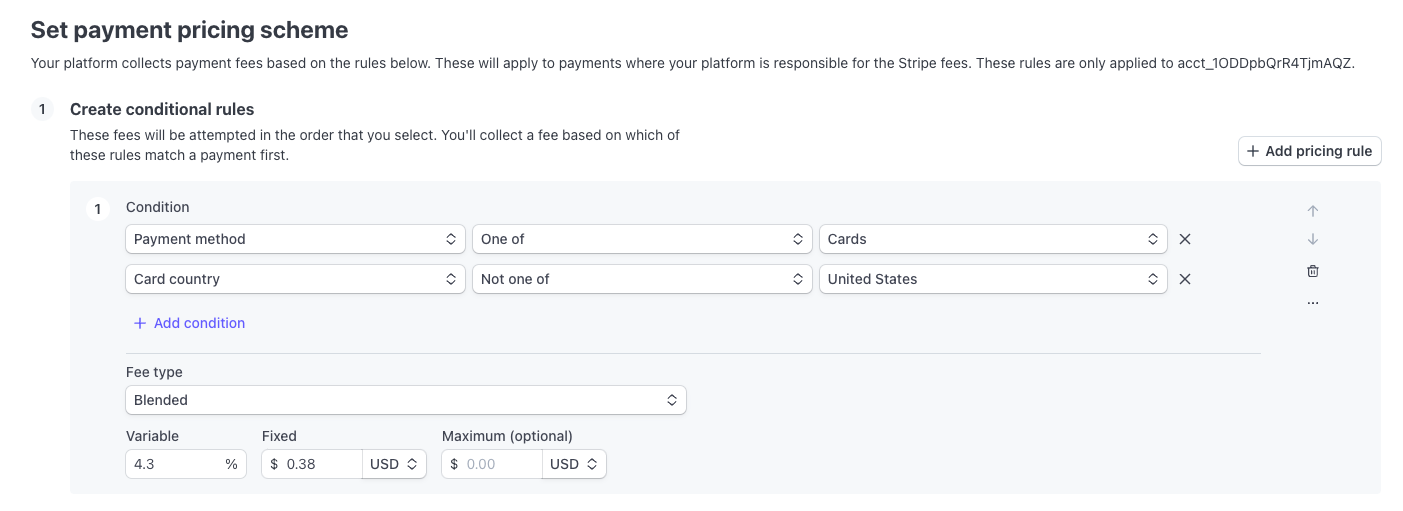

In the Edit default pricing scheme editor, click Add pricing rule.

Define the rule.

- Condition: Use the dropdown menus to write one or more conditions based on a transaction property, an operator, and a value.

- Fee type: Specify how to calculate the fee.

- Fixed: Charge a specific amount, such as 1.10 USD, for every payment.

- Variable: Charge a percentage, such as .45%, of the total amount of the payment.

- Minimum (optional): Specify a minimum amount to charge, even if the percentage calculation is less.

- Maximum (optional): Specify a maximum amount to charge, even if the percentage calculation is more.

- Blended: Charge a percentage of the total payment, plus a fixed amount.

- Maximum (optional): Specify a maximum amount to charge, even if the calculated fee is more.

Add up to 125 rules for the scheme in the order to evaluate them. Stripe applies the first rule that matches the payment and discontinues the evaluation.

After you define all your pricing rules, Set fallback rule lets you define the fee to apply when a transaction doesn’t match any of the scheme rules.

- Set a variable amount, fixed amount, or both.

- If you set a zero amount fallback rule fee, you won’t recoup your processing cost for any transactions that don’t match any of the scheme rules.

(Optional) Click Add modifier to increase or decrease the calculated application fee by a specified percentage (0-100).

Click Save and enable to implement the change immediately. If you want to schedule the pricing change for a later date and time, click Schedule for later. If you want to save the pricing change without implementing it yet, click Save and disable.

Explicit application fees override pricing scheme

Enabled pricing tools apply fees to all eligible payments, unless overridden by an explicit application_ or transfer_ parameter on the payment. Remove these parameters from your payment integration to apply your pricing scheme configuration.

Saving the pricing scheme applies it to all eligible connected accounts. You can view the progress of this update on your Platform Pricing page. The time to complete depends on the number of connected accounts on your platform.

Review Stripe’s Pricing page for guidance in defining your pricing schemes. Factors to consider include, but aren’t limited to:

- Which countries you support connected accounts in

- Whether any connected accounts support cross-border transactions

- Which payment methods you support

- How much Stripe charges you based on your contract

Override a specific account

After you set up a pricing scheme, you can override the rules for connected accounts if the fee payer is the platform.

Select the account from the Connected accounts page in your Dashboard.

In the Account Pricing section, click the Payment pricing default overflow menu () and select Customize pricing to create a new override, or click Edit to update an existing override, if one exists.

For a new override scheme, choose:

- Create a new scheme: define the override rules from scratch.

- Copy from default platform pricing scheme: define the override rules by editing your default platform scheme.

Create the override scheme for the connected account using the same steps for creating the default platform scheme in the previous section.

Click Save or close the editor without saving to cancel.

Revert overridden pricing schemes

After you create an override scheme, any updates to your platform pricing scheme don’t affect the pricing scheme of overridden connected accounts. To reapply your platform pricing scheme to an overridden connected account:

Select the account from the Connected accounts page in your Dashboard.

In the Account Pricing section, click the Custom scheme overflow menu () and select Revert to platform pricing.

Export pricing schemes

You can export all pricing schemes as CSV files. To export your platform pricing scheme:

From the Platform pricing page in your Stripe Dashboard (Settings > Connect > Platform pricing), click Get Started.

Navigate to the overflow menu () next to a scheme. Under Scheme actions, select Export pricing.

When you export pricing, it downloads a file with the name

pricing-<schema name>-<live|testmode>.csv

To export an override scheme:

Select the account from the Connected accounts page in your Dashboard.

In the Account Pricing section, click the Custom scheme overflow menu () and select Export pricing.

When you export pricing, it downloads a file with the name

pricing-<connected account>-<schema name>-<live|testmode>.csv

Available columns

| Column name | Description |

|---|---|

| Rule # | This is the rule number as shown in the pricing scheme. |

| Fee modifier # | If present, the “Rule #” column is empty. This indicates configured markups or discounts and their order of application. |

| Fixed amount | The specific amount charged with this rule. |

| Minimum | The minimum amount this rule charges. |

| Maximum | The maximum amount this rule charges. |

| Variable rate percent | The percentage of the payment amount charged with this rule. |

| Condition | Configured conditions expressed as a semicolon delimited list. |

Rule type | One of

|

Supported rule conditions by payment type

Most pricing rules are based on simple logical conditions, such as segmenting pricing by payment method. You can also write rule conditions based on complex variables, such as your custom metadata values. The following table describes some of the properties you can use to define a pricing schedule rule condition, and the types of payments they apply to.

| Condition property | Relevant payment type | Description |

|---|---|---|

| Payment method | All payments | The payment method used, for example card, us_bank_account, or boleto. |

| Presentment currency | All payments | The currency that the customer paid in. |

| Settlement merchant country | All payments | The country of the payment settlement merchant. |

| Card brand | Card payments | The card network provider, such as Visa or Mastercard. |

| Card present | Card payments | Whether or not the payment is in-person |

| Card country | Card payments | The issuing country of the card that the customer paid with. |

| Card product code | Card payments | The product code of the card that the customer paid with. |

| Card type | Card payments | Funding source of the card, such as a credit card or debit card. |

| Card product category | Card payments | Card class classification, such as a Standard or Premium card. |

| Card border | Card payments | Whether the card used is a domestic or international card. |

Currency conversion | All payments | Whether presentment and settlement currencies differ from one another. The type of charge dictates which settlement account the rule evaluates:

This evaluation affects charges only and doesn’t apply to transfers. |

| Card network | Card payments | The card network that processed the payment, such as Visa, Mastercard, or American Express. |

| Manually entered | Card payments | Whether a business entered card details into the Stripe Dashboard to process the payment rather than using an online payment form or terminal. |

| UK or European Economic Area card charge | Card payments | Whether the merchant and the card country are both within the European Economic Area or the United Kingdom. |

| UK and European Economic Area cross border charge | Card payments | Whether the merchant is in the European Economic Area or the UK, and the card holder is in the other. |

| Klarna payment category | Klarna payments | The Klarna payment category used on a Klarna payment. |

| Klarna customer country | Klarna payments | The country of the customer making the Klarna payment. |

| US Bank Account availability | US Bank Account payments | The settlement timing of the ACH Direct Debit payment. |

| Payment metadata | All payments | Custom key-value metadata that you include on the captured charge. You can create pricing rules based on this metadata. |

| Payout currency | All Instant Payouts | The currency of the Instant Payout. |

Payment metadata

As a platform, you can add custom metadata to payments and reference it in your pricing rules. First, add a metadata key-value pair to your PaymentIntent or Charge. Then, create pricing rules referencing this metadata value.

Pricing rule conditions based on payment metadata observe the following behavior:

- Pricing rule conditions can evaluate metadata defined in both PaymentIntents and Charges.

- A rule condition can only evaluate one key-value pair from the metadata parameter.

- If you include multiple metadata key-value conditions, the pricing tool only evaluates the first key-value condition.

- The pricing tool only evaluates metadata that’s available before payment is captured. Make sure you apply any updates before this point for accurate fee calculation.

- Use the API to update metadata in the PaymentIntent or Charge. The pricing tool can’t evaluate updates made through the Dashboard.

Fee modifier

You can use a fee modifier to adjust the application fee calculated by the conditional and fallback rules:

- Markup: Increases the fee amount by the specified percentage.

- Discount: Decreases the fee amount by the specified percentage.

Fee modifiers compound based on their sequence in the scheme definition. For example, adding a 5% discount followed by a 10% markup adjusts a 1.00 USD fee to a 1.05 USD fee (1.00 USD × 0.95 x 1.1 = 1.05 USD).

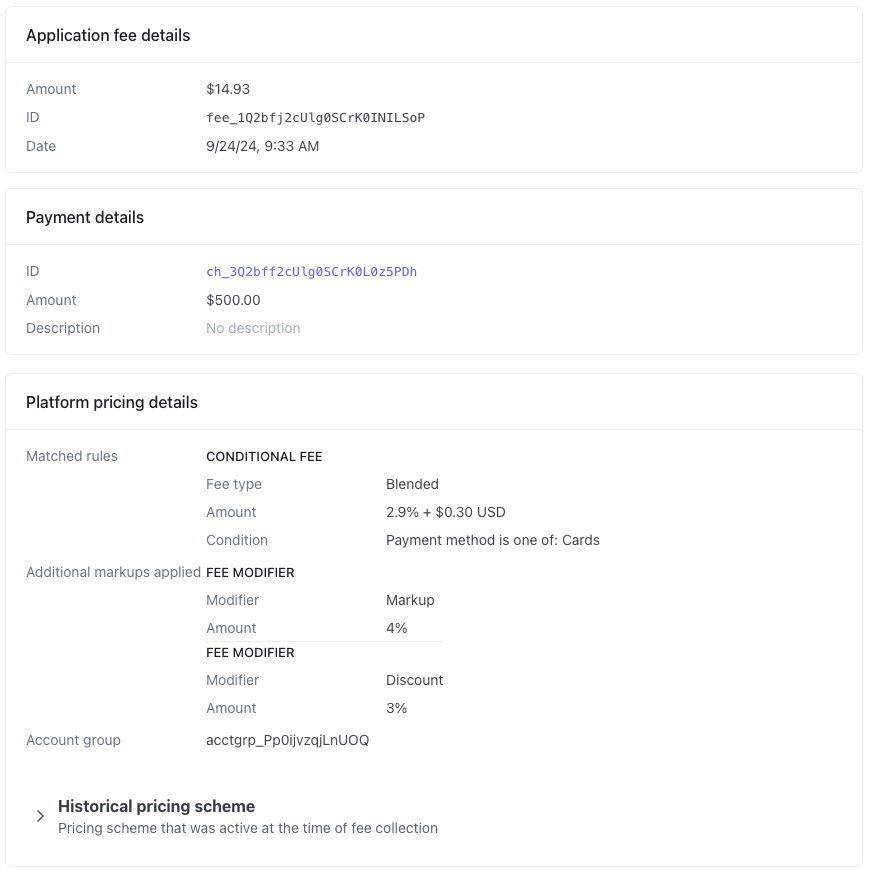

View platform pricing details

Select an applied fee from Collected Fees on the Payments page in your Dashboard. The Platform pricing details section shows the following details about how Stripe calculated the application fee from the pricing scheme:

- Matched rules: Shows which rule conditions matched the payment and were used to calculate the fee based on the captured payment and fee type.

- Additional markups applied: Shows whether the final calculation included any markups or discount adjustments.

- Historical pricing scheme: Shows a snapshot of the pricing scheme in place at the time of payment processing and fee calculation.

For example, assume a purchase of 500 USD. The payment matched a rule with the following conditions of the pricing scheme:

- The payment method is cards.

The pricing scheme also applied the following fee modifiers:

- 4% markup

- 3% discount

For this case, the platform pricing details show:

- The 2.9% + 0.30 USD rule applies because the payment method is a card. The calculation against the 500 USD payment equals a fee subtotal of 14.80 USD.

- The scheme also defines a 4% markup and a 3% discount. This calculates 14.8 × 1.04 × 0.97 = 14.93024, rounding to a total fee charged to the connected account of 14.93 USD.