Understand your Connect business

Use the Connect overview page to gain insight into your payments business and connected accounts.

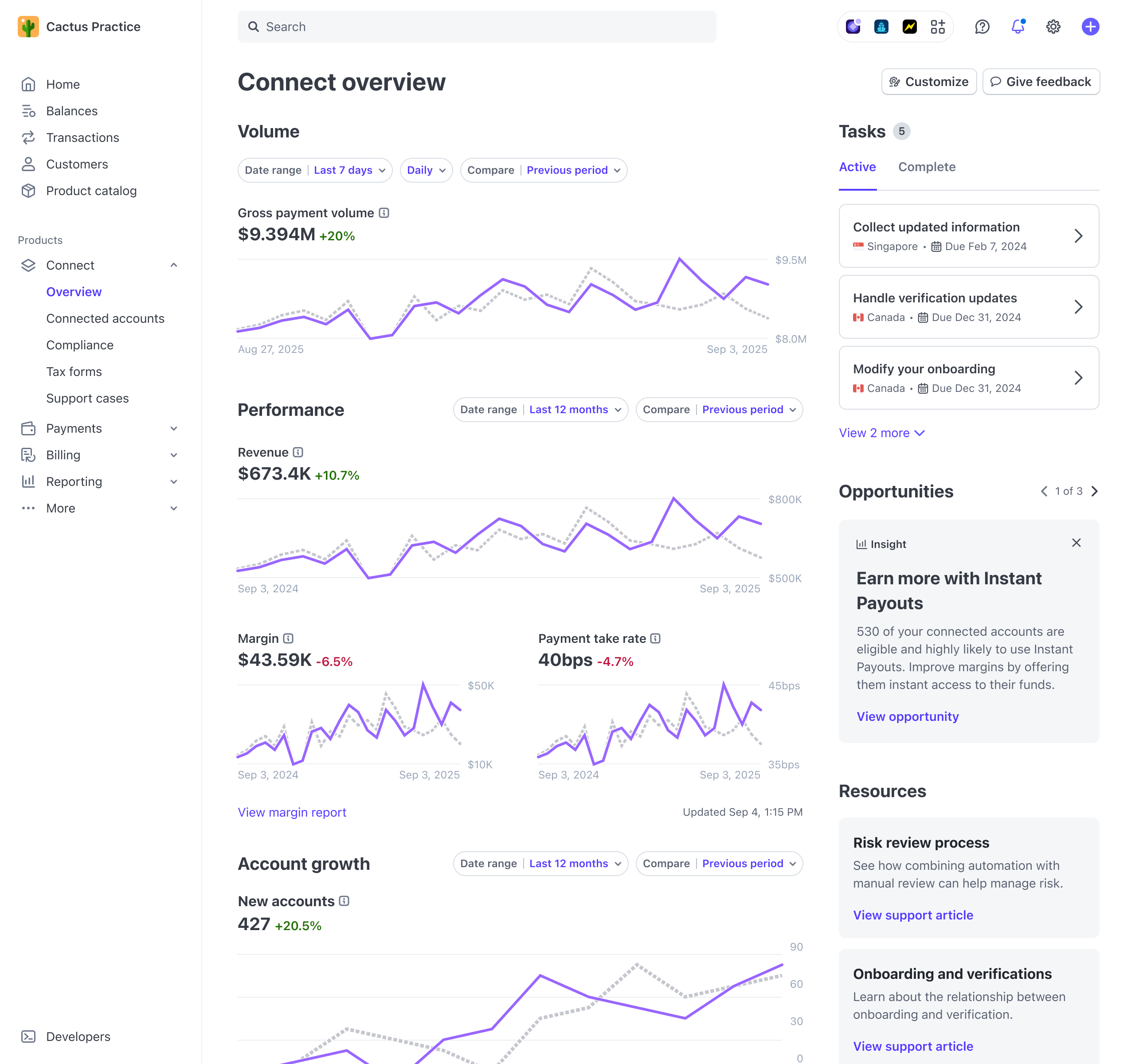

Use the Connect overview page in your Dashboard to understand your Connect payments business and identify opportunities for growth.

The Connect overview page includes five sections:

Volume

This section of the page displays top-level metrics about the volume of funds processed through Connect. It includes the following data:

- Gross payment volume: Total payment volume processed by connected accounts on your platform.

- Gross transfer volume: Total volume you have transferred to connected accounts on your platform.

You can display either or both of these charts by clicking Customize in the top right of the page. If the payment volume experience is enabled, you also see your performance metrics.

Performance Prviate preview

This section of the page displays high-level financial performance metrics that you can use to better understand the health of your payments business.

This data is calculated monthly, and data for the most recent month appears 7 days after the end of the month. For example, data from April appears on May 7.

Private preview

Our performance metrics are currently in private preview. We automatically enable them when your account becomes eligible.

The Performance section includes the following data:

Revenue: Total fees collected from connected accounts, minus refunded fees and reversed account debits and transfers. Includes Stripe fees, network fees, and fees from payments and other Stripe products.

collected fees - refunded fees - reversed account debits - reversed transfers from accountsMargin: Total fees collected from connected accounts, minus Stripe fees and network fees. Includes fees from payments and other Stripe products.

revenue - Stripe fees - network feesPayment take rate: Take rate is the margin from your gross payment volume, expressed in basis points (bps). It only includes the margin from payments, not from other Stripe products.

(payment margin / gross payment volume) * 10,000

Supported charges

Performance supports the following charge types:

- Direct charges where the platform collects application fees

- Destination charges where the platform collects application fees, with or without

on_behalf_ of

Performance doesn’t support the following charge types:

- Direct charges where the connected account is responsible for paying Stripe fees

- Direct charges on the platform (such as SaaS subscriptions run on the same account)

- Separate charges and transfers

- Direct charges initiated by a connected account

- Direct charges for accounts that are no longer connected to your platform

To learn more about surfaced fees and earnings, see Connect margin reports.

Account growth

This section of the page displays a graph of the number of connected accounts added to your platform over time. It also shows your top accounts by payments, transfers, revenue, and margin, as well as accounts with the largest changes in those metrics.

This data is calculated monthly, and data for the most recent month appears 7 days after the end of the month. For example, data from April appears on May 7.

Tasks

The tasks section of the page displays cards representing platform tasks that you must complete. The tasks depend on the types of connected accounts that your platform supports. Each card links to a details page that explains how to complete that task.

If you have no open tasks to complete, you don’t see the Tasks section.

Opportunities

This section of the page displays opportunities that Stripe has identified for your payments business, such as opportunities to introduce new Stripe products to your connected accounts. For example, we might identify your platform as a good candidate to offer Instant Payouts to your connected accounts.

Related features

To understand account restrictions and the compliance of your connected accounts, see the Connect compliance page.

Connect reports

The reports that used to appear on the Connect analytics page under Reports on connected accounts now appear on the Legacy exports tab of the Compliance and documents page.