Enable businesses on your platform to accept payments directly

Facilitate direct payments to businesses on your SaaS platform from their own customers.

This guide covers letting your users accept payments, moving a portion of your users’ earnings into your balance, and paying out the remainder to your users’ bank accounts. To illustrate these concepts, we’ll use an example platform that lets businesses build their own online stores.

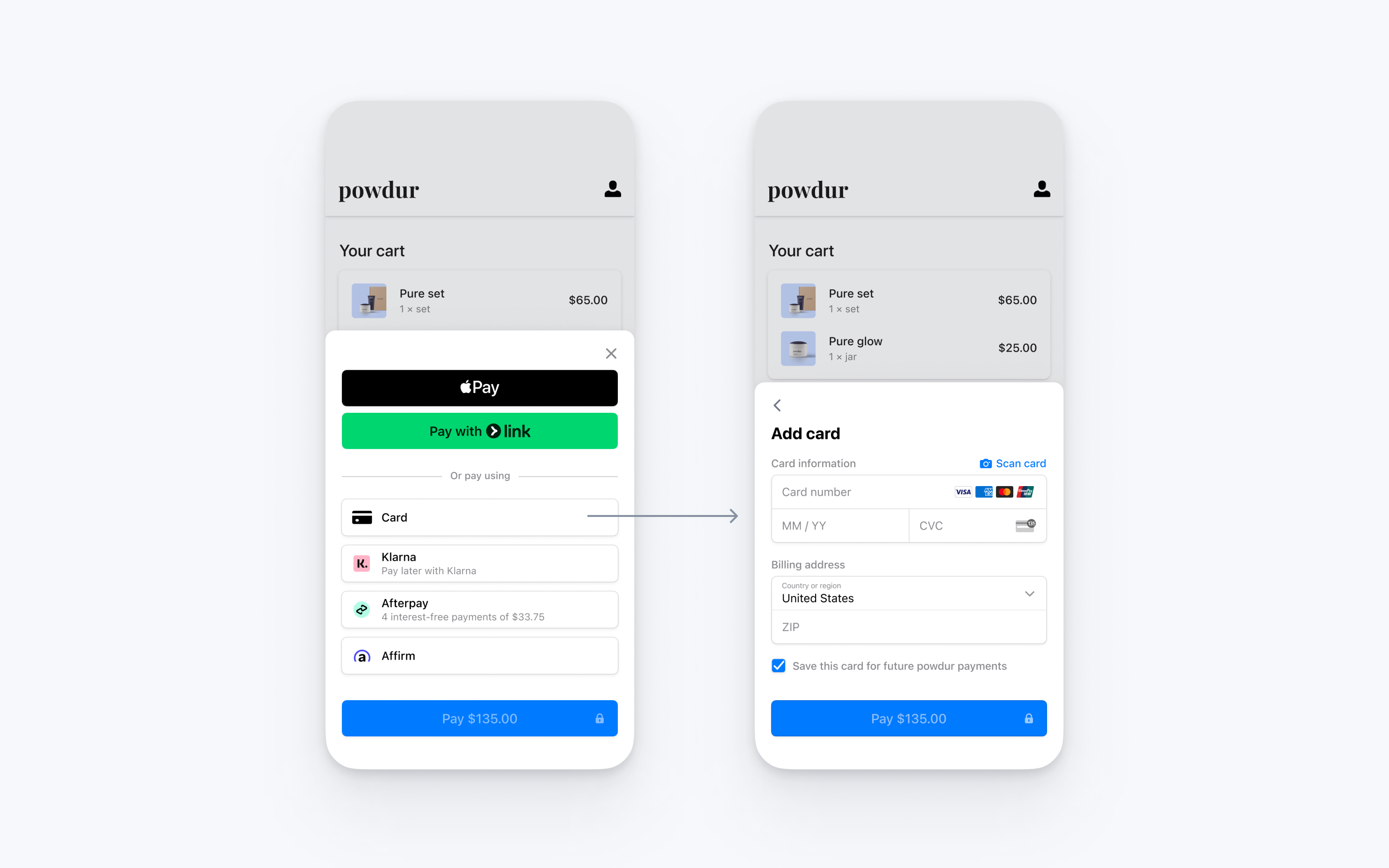

Integrate Stripe’s prebuilt payment UI into the checkout of your iOS app with the PaymentSheet class. See our sample integration on GitHub.

Prerequisites

- Register your platform.

- Add business details to activate your account.

- Complete your platform profile.

- Customize your brand settings. Add a business name, icon, and brand color.

Set up StripeServer-sideClient-side

First, you need a Stripe account. Register now.

Server-side

This integration requires endpoints on your server that talk to the Stripe API. Use our official libraries for access to the Stripe API from your server:

Client-side

The Stripe iOS SDK is open source, fully documented, and compatible with apps supporting iOS 13 or above.

Note

For details on the latest SDK release and past versions, see the Releases page on GitHub. To receive notifications when a new release is published, watch releases for the repository.

Configure the SDK with your Stripe publishable key on app start. This enables your app to make requests to the Stripe API.

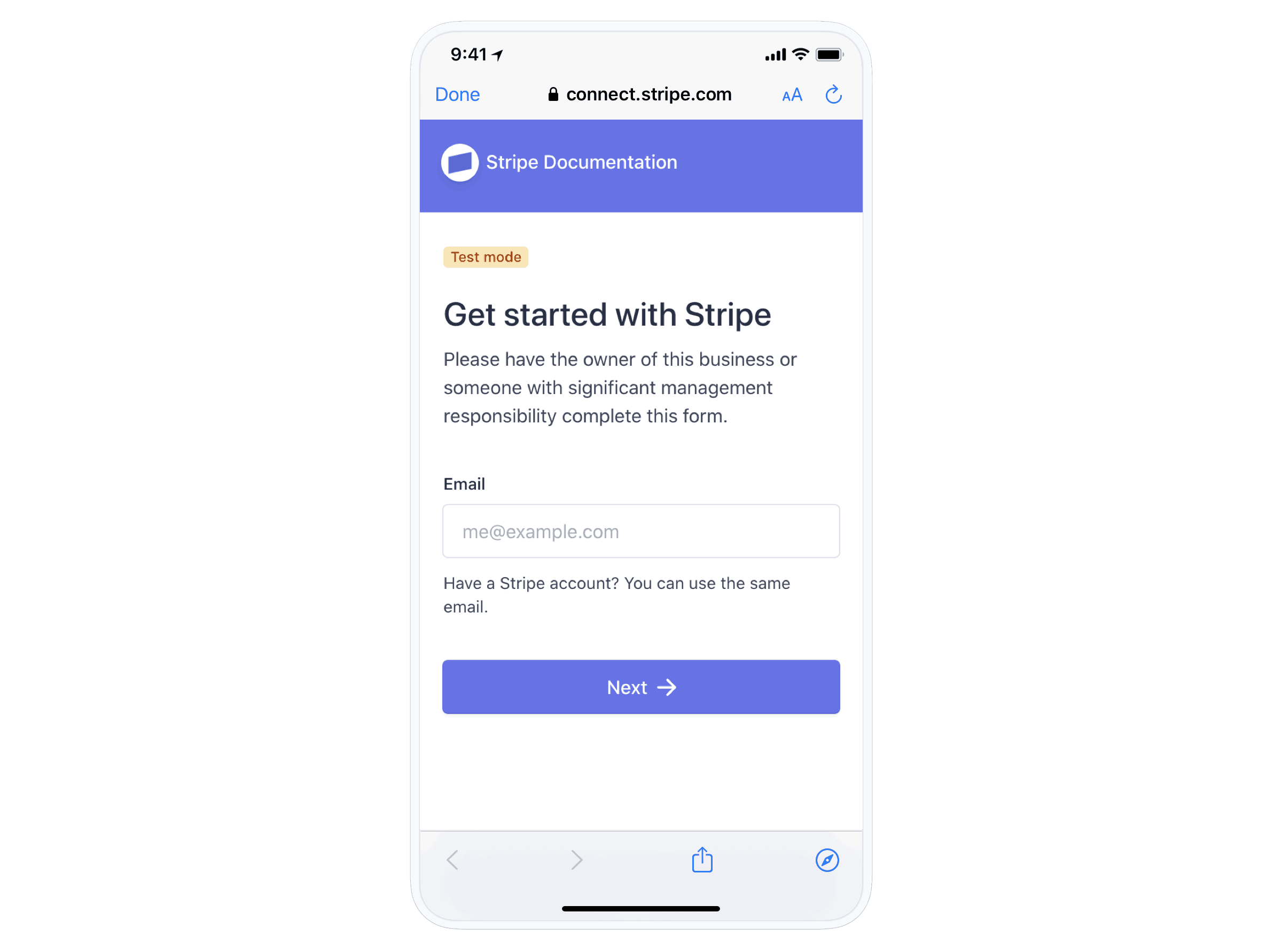

Create a connected account

When a user (seller or service provider) signs up on your platform, create a user Account (referred to as a connected account) so you can accept payments and move funds to their bank account. Connected accounts represent your user in Stripe’s API and help facilitate the collection of onboarding requirements so Stripe can verify the user’s identity. In our store builder example, the connected account represents the business setting up their Internet store.

Step 2.1: Create a connected account and prefill information Server-side

Use the /v1/accounts API to create a connected account. You can create the connected account by using the default connected account parameters, or by specifying the account type.

If you’ve already collected information for your connected accounts, you can prefill that information on the Account object. You can prefill any account information, including personal and business information, external account information, and so on.

Connect Onboarding doesn’t ask for the prefilled information. However, it does ask the account holder to confirm the prefilled information before accepting the Connect service agreement.

When testing your integration, prefill account information using test data.

Step 2.2: Create an account link Server-side

You can create an account link by calling the Account Links API with the following parameters:

accountrefresh_url return_url type=account_onboarding

Step 2.3: Redirect your user to the account link URL Client-side

The response to your Account Links request includes a value for the key url. Redirect to this link to send your user into the flow. Account Links are temporary and are single-use only because they grant access to the connected account user’s personal information. Authenticate the user in your application before redirecting them to this URL. If you want to prefill information, you must do so before generating the account link. After you create the account link for a Standard account, you won’t be able to read or write information for the account.

Security tip

Don’t email, text, or otherwise send account link URLs outside of your platform application. Instead, provide them to the authenticated account holder within your application.

Step 2.4: Handle the user returning to your platform Client-side

Connect Onboarding requires you to pass both a return_ and refresh_ to handle all cases where the user is redirected to your platform. It’s important that you implement these correctly to provide the best experience for your user. You can set up a universal link to enable iOS to redirect to your app automatically.

return_url

Stripe issues a redirect to this URL when the user completes the Connect Onboarding flow. This doesn’t mean that all information has been collected or that there are no outstanding requirements on the account. This only means the flow was entered and exited properly.

No state is passed through this URL. After a user is redirected to your return_, check the state of the details_ parameter on their account by doing either of the following:

refresh_url

Your user is redirected to the refresh_ in these cases:

- The link is expired (a few minutes went by since the link was created)

- The user already visited the link (the user refreshed the page or clicked back or forward in the browser)

- Your platform is no longer able to access the account

- The account has been rejected

Your refresh_ should trigger a method on your server to call Account Links again with the same parameters, and redirect the user to the Connect Onboarding flow to create a seamless experience.

Step 2.5: Handle users that haven’t completed onboarding

A user that is redirected to your return_ might not have completed the onboarding process. Use the /v1/accounts endpoint to retrieve the user’s account and check for charges_. If the account isn’t fully onboarded, provide UI prompts to allow the user to continue onboarding later. The user can complete their account activation through a new account link (generated by your integration). You can check the state of the details_ parameter on their account to see if they’ve completed the onboarding process.

Enable payment methods

View your payment methods settings and enable the payment methods you want to support. Card payments are enabled by default but you can enable and disable payment methods as needed.

Add an endpointServer-side

Note

To display the PaymentSheet before you create a PaymentIntent, see Collect payment details before creating an Intent.

This integration uses three Stripe API objects:

PaymentIntent: Stripe uses this to represent your intent to collect payment from a customer, tracking your charge attempts and payment state changes throughout the process.

(Optional) Customer: To set up a payment method for future payments, you must attach it to a Customer. Create a Customer object when your customer creates an account with your business. If your customer is making a payment as a guest, you can create a Customer object before payment and associate it with your own internal representation of the customer’s account later.

(Optional) Customer Ephemeral Key: Information on the Customer object is sensitive, and can’t be retrieved directly from an app. An Ephemeral Key grants the SDK temporary access to the Customer.

Note

If you never save cards to a Customer and don’t allow returning Customers to reuse saved cards, you can omit the Customer and Customer Ephemeral Key objects from your integration.

For security reasons, your app can’t create these objects. Instead, add an endpoint on your server that:

- Retrieves the Customer, or creates a new one.

- Creates an Ephemeral Key for the Customer.

- Creates a PaymentIntent with the amount, currency, and customer. You can also optionally include the

automatic_parameter. Stripe enables its functionality by default in the latest version of the API.payment_ methods - Returns the Payment Intent’s client secret, the Ephemeral Key’s

secret, the Customer’s id, and your publishable key to your app.

The payment methods shown to customers during the checkout process are also included on the PaymentIntent. You can let Stripe pull payment methods from your Dashboard settings or you can list them manually. Regardless of the option you choose, know that the currency passed in the PaymentIntent filters the payment methods shown to the customer. For example, if you pass eur on the PaymentIntent and have OXXO enabled in the Dashboard, OXXO won’t be shown to the customer because OXXO doesn’t support eur payments.

Unless your integration requires a code-based option for offering payment methods, Stripe recommends the automated option. This is because Stripe evaluates the currency, payment method restrictions, and other parameters to determine the list of supported payment methods. Payment methods that increase conversion and that are most relevant to the currency and customer’s location are prioritized.

Integrate the payment sheetClient-side

To display the mobile Payment Element on your checkout screen, make sure you:

- Display the products the customer is purchasing along with the total amount

- Use the Address Element to collect any required shipping information from the customer

- Add a checkout button to display Stripe’s UI

If PaymentSheetResult is ., inform the user (for example, by displaying an order confirmation screen).

Setting allowsDelayedPaymentMethods to true allows delayed notification payment methods like US bank accounts. For these payment methods, the final payment status isn’t known when the PaymentSheet completes, and instead succeeds or fails later. If you support these types of payment methods, inform the customer their order is confirmed and only fulfill their order (for example, ship their product) when the payment is successful.

Set up a return URLClient-side

The customer might navigate away from your app to authenticate (for example, in Safari or their banking app). To allow them to automatically return to your app after authenticating, configure a custom URL scheme and set up your app delegate to forward the URL to the SDK. Stripe doesn’t support universal links.

Handle post-payment eventsServer-side

Stripe sends a payment_intent.succeeded event when the payment completes. Use the Dashboard webhook tool or follow the webhook guide to receive these events and run actions, such as sending an order confirmation email to your customer, logging the sale in a database, or starting a shipping workflow.

Listen for these events rather than waiting on a callback from the client. On the client, the customer could close the browser window or quit the app before the callback executes, and malicious clients could manipulate the response. Setting up your integration to listen for asynchronous events is what enables you to accept different types of payment methods with a single integration.

In addition to handling the payment_ event, we recommend handling these other events when collecting payments with the Payment Element:

| Event | Description | Action |

|---|---|---|

| payment_intent.succeeded | Sent when a customer successfully completes a payment. | Send the customer an order confirmation and fulfill their order. |

| payment_intent.processing | Sent when a customer successfully initiates a payment, but the payment has yet to complete. This event is most commonly sent when the customer initiates a bank debit. It’s followed by either a payment_ or payment_ event in the future. | Send the customer an order confirmation that indicates their payment is pending. For digital goods, you might want to fulfill the order before waiting for payment to complete. |

| payment_intent.payment_failed | Sent when a customer attempts a payment, but the payment fails. | If a payment transitions from processing to payment_, offer the customer another attempt to pay. |

Test the integration

See Testing for additional information to test your integration.

OptionalEnable Apple Pay

Note

If your checkout screen has a dedicated Apple Pay button, follow the Apple Pay guide and use ApplePayContext to collect payment from your Apple Pay button. You can use PaymentSheet to handle other payment method types.

Register for an Apple Merchant ID

Obtain an Apple Merchant ID by registering for a new identifier on the Apple Developer website.

Fill out the form with a description and identifier. Your description is for your own records and you can modify it in the future. Stripe recommends using the name of your app as the identifier (for example, merchant.).

Create a new Apple Pay certificate

Create a certificate for your app to encrypt payment data.

Go to the iOS Certificate Settings in the Dashboard, click Add new application, and follow the guide.

Download a Certificate Signing Request (CSR) file to get a secure certificate from Apple that allows you to use Apple Pay.

One CSR file must be used to issue exactly one certificate. If you switch your Apple Merchant ID, you must go to the iOS Certificate Settings in the Dashboard to obtain a new CSR and certificate.

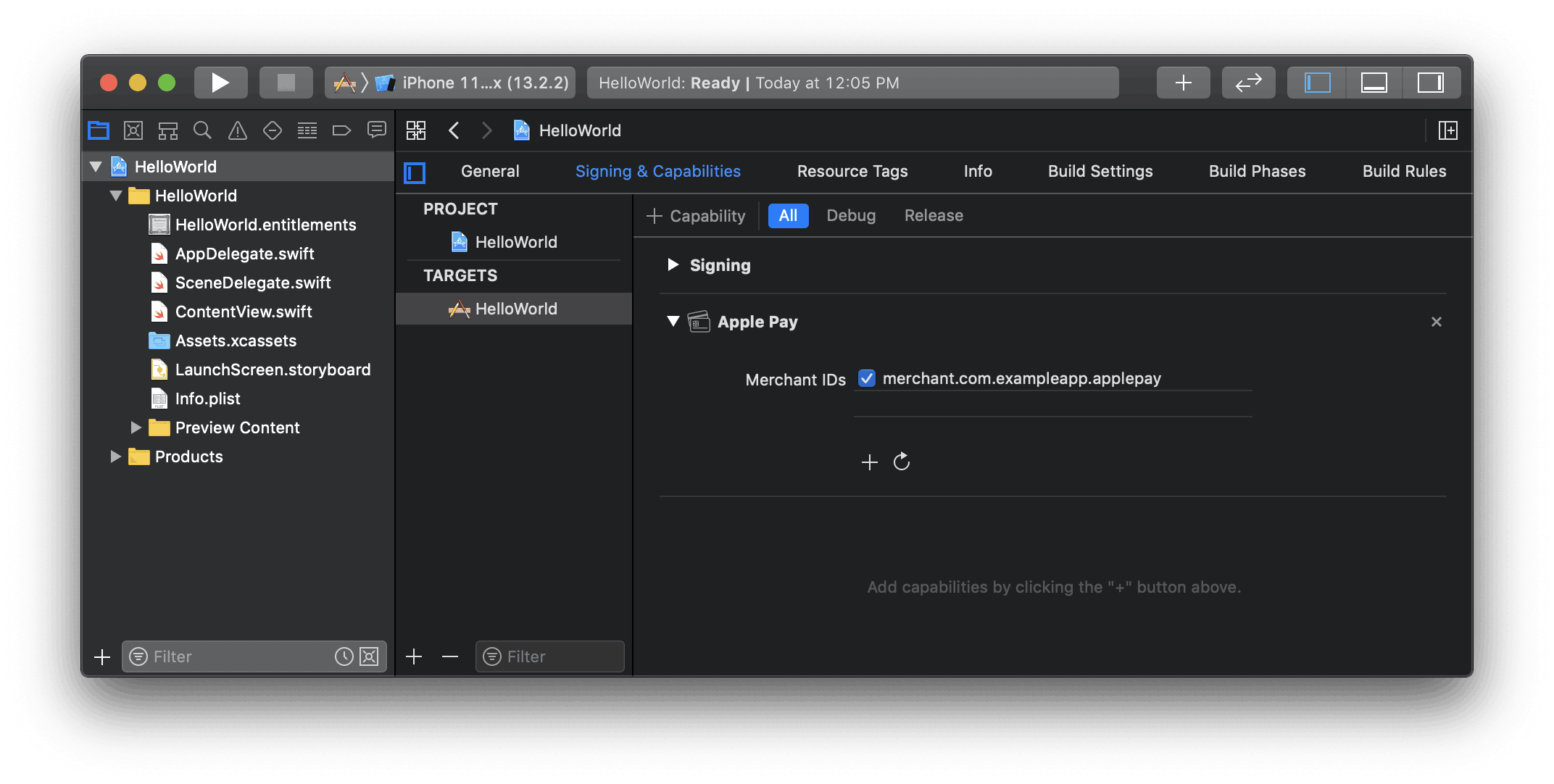

Integrate with Xcode

Add the Apple Pay capability to your app. In Xcode, open your project settings, click the Signing & Capabilities tab, and add the Apple Pay capability. You might be prompted to log in to your developer account at this point. Select the merchant ID you created earlier, and your app is ready to accept Apple Pay.

Enable the Apple Pay capability in Xcode

Add Apple Pay

Order tracking

To add order tracking information in iOS 16 or later, configure an authorizationResultHandler in your PaymentSheet.. Stripe calls your implementation after the payment is complete, but before iOS dismisses the Apple Pay sheet.

In your authorizationResultHandler implementation, fetch the order details from your server for the completed order. Add the details to the provided PKPaymentAuthorizationResult and call the provided completion handler.

To learn more about order tracking, see Apple’s Wallet Orders documentation.

let customHandlers = PaymentSheet.ApplePayConfiguration.Handlers( authorizationResultHandler: { result, completion in // Fetch the order details from your service MyAPIClient.shared.fetchOrderDetails(orderID: orderID) { myOrderDetails result.orderDetails = PKPaymentOrderDetails( orderTypeIdentifier: myOrderDetails.orderTypeIdentifier, // "com.myapp.order" orderIdentifier: myOrderDetails.orderIdentifier, // "ABC123-AAAA-1111" webServiceURL: myOrderDetails.webServiceURL, // "https://my-backend.example.com/apple-order-tracking-backend" authenticationToken: myOrderDetails.authenticationToken) // "abc123" // Call the completion block on the main queue with your modified PKPaymentAuthorizationResult completion(result) } } ) var configuration = PaymentSheet.Configuration() configuration.applePay = .init(merchantId: "merchant.com.your_app_name", merchantCountryCode: "US", customHandlers: customHandlers)

OptionalEnable card scanning

To enable card scanning support, set the NSCameraUsageDescription (Privacy - Camera Usage Description) in the Info.plist of your application, and provide a reason for accessing the camera (for example, “To scan cards”). Devices with iOS 13 or higher support card scanning.

OptionalCustomize the sheet

All customization is configured through the PaymentSheet.Configuration object.

Appearance

Customize colors, fonts, and so on to match the look and feel of your app by using the appearance API.

Payment method layout

Configure the layout of payment methods in the sheet using paymentMethodLayout. You can display them horizontally, vertically, or let Stripe optimize the layout automatically.

var configuration = PaymentSheet.Configuration() configuration.paymentMethodLayout = .automatic

Collect users addresses

Collect local and international shipping or billing addresses from your customers using the Address Element.

Merchant display name

Specify a customer-facing business name by setting merchantDisplayName. By default, this is your app’s name.

var configuration = PaymentSheet.Configuration() configuration.merchantDisplayName = "My app, Inc."

Dark mode

PaymentSheet automatically adapts to the user’s system-wide appearance settings (light and dark mode). If your app doesn’t support dark mode, you can set style to alwaysLight or alwaysDark mode.

var configuration = PaymentSheet.Configuration() configuration.style = .alwaysLight

Default billing details

To set default values for billing details collected in the payment sheet, configure the defaultBillingDetails property. The PaymentSheet pre-populates its fields with the values that you provide.

var configuration = PaymentSheet.Configuration() configuration.defaultBillingDetails.address.country = "US" configuration.defaultBillingDetails.email = "foo@bar.com"

Billing details collection

Use billingDetailsCollectionConfiguration to specify how you want to collect billing details in the payment sheet.

You can collect your customer’s name, email, phone number, and address.

If you only want to billing details required by the payment method, set billingDetailsCollectionConfiguration. to true. In that case, the PaymentSheet. are set as the payment method’s billing details.

If you want to collect additional billing details that aren’t necessarily required by the payment method, set billingDetailsCollectionConfiguration. to false. In that case, the billing details collected through the PaymentSheet are set as the payment method’s billing details.

var configuration = PaymentSheet.Configuration() configuration.defaultBillingDetails.email = "foo@bar.com" configuration.billingDetailsCollectionConfiguration.name = .always configuration.billingDetailsCollectionConfiguration.email = .never configuration.billingDetailsCollectionConfiguration.address = .full configuration.billingDetailsCollectionConfiguration.attachDefaultsToPaymentMethod = true

Note

Consult with your legal counsel regarding laws that apply to collecting information. Only collect phone numbers if you need them for the transaction.

OptionalComplete payment in your UI

You can present the Payment Sheet to only collect payment method details and then later call a confirm method to complete payment in your app’s UI. This is useful if you have a custom buy button or require additional steps after you collect payment details.

Complete the payment in your app’s UI

If PaymentSheetResult is ., inform the user (for example, by displaying an order confirmation screen).

Setting allowsDelayedPaymentMethods to true allows delayed notification payment methods like US bank accounts. For these payment methods, the final payment status isn’t known when the PaymentSheet completes, and instead succeeds or fails later. If you support these types of payment methods, inform the customer their order is confirmed and only fulfill their order (for example, ship their product) when the payment is successful.

Testing

Test your account creation flow by creating accounts and using OAuth. Test your Payment methods settings for your connected accounts by logging into one of your test accounts and navigating to the Payment methods settings. Test your checkout flow with your test keys and a test account. You can use our test cards to test your payments flow and simulate various payment outcomes.

Payouts

By default, any charge that you create for a connected account accumulates in the connected account’s Stripe balance and is paid out on a daily rolling basis. Connected accounts can manage their own payout schedules in the Stripe Dashboard.