Create destination charges

Create charges on your platform account, collect fees, and immediately transfer the remaining funds to your connected accounts.

Create destination charges when customers transact with your platform for products or services provided by your connected accounts and you immediately transfer funds to your connected accounts. With this charge type:

- You create a charge on your platform’s account.

- You determine whether some or all of those funds are transferred to the connected account.

- Your account balance is debited for the cost of the Stripe fees, refunds, and chargebacks.

This charge type is most optimal for marketplaces such as Airbnb, a home rental marketplace or Lyft, a ridesharing app.

With certain exceptions, if your platform and a connected account aren’t in the same region, you must specify the connected account as the settlement merchant using the on_behalf_of parameter on the Payment Intent.

We recommend using destination charges for connected accounts that don’t have access to the full Stripe Dashboard.

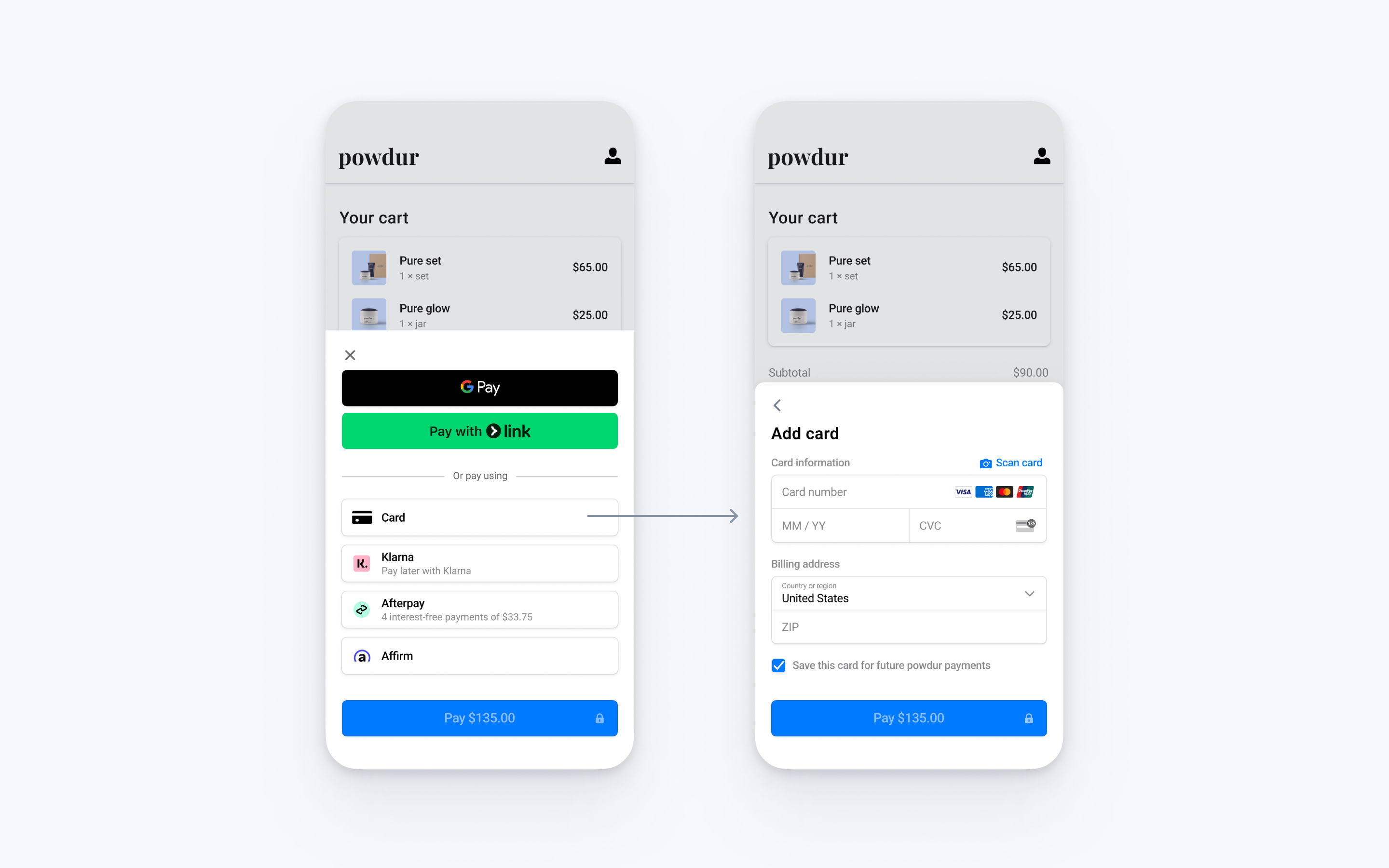

Integrate Stripe’s prebuilt payment UI into the checkout of your Android app with the PaymentSheet class.

Set up StripeServer-sideClient-side

First, you need a Stripe account. Register now.

Server-side

This integration requires endpoints on your server that talk to the Stripe API. Use the official libraries for access to the Stripe API from your server:

Client-side

The Stripe Android SDK is open source and fully documented.

To install the SDK, add stripe-android to the dependencies block of your app/build.gradle file:

Note

For details on the latest SDK release and past versions, see the Releases page on GitHub. To receive notifications when a new release is published, watch releases for the repository.

Configure the SDK with your Stripe publishable key so that it can make requests to the Stripe API, such as in your Application subclass:

Add an endpointServer-side

Note

To display the PaymentSheet before you create a PaymentIntent, see Collect payment details before creating an Intent.

This integration uses three Stripe API objects:

PaymentIntent: Stripe uses this to represent your intent to collect payment from a customer, tracking your charge attempts and payment state changes throughout the process.

(Optional) Customer: To set up a payment method for future payments, you must attach it to a Customer. Create a Customer object when your customer creates an account with your business. If your customer is making a payment as a guest, you can create a Customer object before payment and associate it with your own internal representation of the customer’s account later.

(Optional) CustomerSession: Information on the Customer object is sensitive, and can’t be retrieved directly from an app. A CustomerSession grants the SDK temporary scoped access to the Customer and provides additional configuration options. See a complete list of configuration options.

Note

If you never save cards to a Customer and don’t allow returning Customers to reuse saved cards, you can omit the Customer and CustomerSession objects from your integration.

For security reasons, your app can’t create these objects. Instead, add an endpoint on your server that:

- Retrieves the Customer, or creates a new one.

- Creates a CustomerSession for the Customer.

- Creates a PaymentIntent with the amount, currency, and customer.

- Returns the Payment Intent’s client secret, the CustomerSession’s

client_, the Customer’s id, and your publishable key to your app.secret

The payment methods shown to customers during the checkout process are also included on the PaymentIntent. You can let Stripe pull payment methods from your Dashboard settings or you can list them manually. Regardless of the option you choose, know that the currency passed in the PaymentIntent filters the payment methods shown to the customer. For example, if you pass eur on the PaymentIntent and have OXXO enabled in the Dashboard, OXXO won’t be shown to the customer because OXXO doesn’t support eur payments.

Unless your integration requires a code-based option for offering payment methods, Stripe recommends the automated option. This is because Stripe evaluates the currency, payment method restrictions, and other parameters to determine the list of supported payment methods. Payment methods that increase conversion and that are most relevant to the currency and customer’s location are prioritized.

Integrate the payment sheetClient-side

Before displaying the mobile Payment Element, your checkout page should:

- Show the products being purchased and the total amount

- Collect any required shipping information using the Address Element

- Include a checkout button to present Stripe’s UI

Setting allowsDelayedPaymentMethods to true allows delayed notification payment methods like US bank accounts. For these payment methods, the final payment status isn’t known when the PaymentSheet completes, and instead succeeds or fails later. If you support these types of payment methods, inform the customer their order is confirmed and only fulfill their order (for example, ship their product) when the payment is successful.

Handle post-payment eventsServer-side

Stripe sends a payment_intent.succeeded event when the payment completes. Use the Dashboard webhook tool or follow the webhook guide to receive these events and run actions, such as sending an order confirmation email to your customer, logging the sale in a database, or starting a shipping workflow.

Listen for these events rather than waiting on a callback from the client. On the client, the customer could close the browser window or quit the app before the callback executes, and malicious clients could manipulate the response. Setting up your integration to listen for asynchronous events is what enables you to accept different types of payment methods with a single integration.

In addition to handling the payment_ event, we recommend handling these other events when collecting payments with the Payment Element:

| Event | Description | Action |

|---|---|---|

| payment_intent.succeeded | Sent when a customer successfully completes a payment. | Send the customer an order confirmation and fulfill their order. |

| payment_intent.processing | Sent when a customer successfully initiates a payment, but the payment has yet to complete. This event is most commonly sent when the customer initiates a bank debit. It’s followed by either a payment_ or payment_ event in the future. | Send the customer an order confirmation that indicates their payment is pending. For digital goods, you might want to fulfill the order before waiting for payment to complete. |

| payment_intent.payment_failed | Sent when a customer attempts a payment, but the payment fails. | If a payment transitions from processing to payment_, offer the customer another attempt to pay. |

Test the integration

See Testing for additional information to test your integration.

OptionalEnable Google Pay

Set up your integration

To use Google Pay, first enable the Google Pay API by adding the following to the <application> tag of your AndroidManifest.xml:

<application> ... <meta-data android:name="com.google.android.gms.wallet.api.enabled" android:value="true" /> </application>

For more details, see Google Pay’s Set up Google Pay API for Android.

Add Google Pay

To add Google Pay to your integration, pass a PaymentSheet.GooglePayConfiguration with your Google Pay environment (production or test) and the country code of your business when initializing PaymentSheet.Configuration.

Test Google Pay

Google allows you to make test payments through their Test card suite. The test suite supports using Stripe test cards.

You must test Google Pay using a physical Android device instead of a simulated device, in a country where Google Pay is supported. Log in to a Google account on your test device with a real card saved to Google Wallet.

OptionalCustomize the sheet

All customization is configured using the PaymentSheet.Configuration object.

Appearance

Customize colors, fonts, and more to match the look and feel of your app by using the appearance API.

Payment method layout

Configure the layout of payment methods in the sheet using paymentMethodLayout. You can display them horizontally, vertically, or let Stripe optimize the layout automatically.

Collect users addresses

Collect local and international shipping or billing addresses from your customers using the Address Element.

Business display name

Specify a customer-facing business name by setting merchantDisplayName. By default, this is your app’s name.

Dark mode

By default, PaymentSheet automatically adapts to the user’s system-wide appearance settings (light and dark mode). You can change this by setting light or dark mode on your app:

Default billing details

To set default values for billing details collected in the payment sheet, configure the defaultBillingDetails property. The PaymentSheet pre-populates its fields with the values that you provide.

Configure collection of billing details

Use BillingDetailsCollectionConfiguration to specify how you want to collect billing details in the PaymentSheet.

You can collect your customer’s name, email, phone number, and address.

If you want to attach default billing details to the PaymentMethod object even when those fields aren’t collected in the UI, set billingDetailsCollectionConfiguration. to true.

Note

Consult with your legal counsel regarding laws that apply to collecting information. Only collect phone numbers if you need them for the transaction.

OptionalComplete payment in your UI

You can present Payment Sheet to only collect payment method details and complete the payment back in your app’s UI. This is useful if you have a custom buy button or require additional steps after payment details are collected.

Note

A sample integration is available on our GitHub.

- First, initialize PaymentSheet.FlowController instead of

PaymentSheetusing one of the Builder methods.

- Next, call

configureWithPaymentIntentwith the Stripe object keys fetched from your backend and update your UI in the callback using getPaymentOption(). This contains an image and label representing the customer’s currently selected payment method.

- Next, call presentPaymentOptions to collect payment details. When the customer finishes, the sheet is dismissed and calls the paymentOptionCallback passed earlier in

create. Implement this method to update your UI with the returnedpaymentOption.

- Finally, call confirm to complete the payment. When the customer finishes, the sheet is dismissed and calls the paymentResultCallback passed earlier in

create.

Setting allowsDelayedPaymentMethods to true allows delayed notification payment methods like US bank accounts. For these payment methods, the final payment status isn’t known when the PaymentSheet completes, and instead succeeds or fails later. If you support these types of payment methods, inform the customer their order is confirmed and only fulfill their order (for example, ship their product) when the payment is successful.

Collect fees

When a payment is processed, rather than transfer the full amount of the transaction to a connected account, your platform can decide to take a portion of the transaction amount in the form of fees. You can set fee pricing in two different ways:

Use the Platform Pricing Tool to set and test application fee pricing rules. This no-code feature in the Stripe Dashboard is currently only available for platforms responsible for paying Stripe fees.

Set your pricing rules in-house, specifying fees directly in a PaymentIntent using either the application_fee_amount or transfer_data[amount] parameter. Fees set with this method override the pricing logic specified in the Platform Pricing Tool.

Specify the settlement merchant

The settlement merchant is dependent on the capabilities set on an account and how a charge is created. The settlement merchant determines whose information is used to make the charge. This includes the statement descriptor (either the platform’s or the connected account’s) that’s displayed on the customer’s credit card or bank statement for that charge.

Specifying the settlement merchant allows you to be more explicit about who to create charges for. For example, some platforms prefer to be the settlement merchant because the end customer interacts directly with their platform (such as on-demand platforms). However, some platforms have connected accounts that interact directly with end customers instead (such as a storefront on an e-commerce platform). In these scenarios, it might make more sense for the connected account to be the settlement merchant.

You can set the on_ parameter to the ID of a connected account to make that account the settlement merchant for the payment. When using on_:

- Charges settle in the connected account’s country and settlement currency.

- The fee structure for the connected account’s country is used.

- The connected account’s statement descriptor is displayed on the customer’s credit card statement.

- If the connected account is in a different country than the platform, the connected account’s address and phone number are displayed on the customer’s credit card statement.

- The number of days that a pending balance is held before being paid out depends on the delay_days setting on the connected account.

Accounts v2 API

You can’t use the Accounts v2 API to manage payout settings. Use the Accounts v1 API.

If on_ is omitted, the platform is the business of record for the payment.

Caution

The on_ parameter is supported only for connected accounts with a payments capability such as card_payments. Accounts under the recipient service agreement can’t request card_ or other payments capabilities.

Issue refunds

If you are using the Payment Intents API, refunds should be issued against the most recent charge that is created.

Charges created on the platform account can be refunded using the platform account’s secret key. When refunding a charge that has a transfer_, by default the destination account keeps the funds that were transferred to it, leaving the platform account to cover the negative balance from the refund. To pull back the funds from the connected account to cover the refund, set the reverse_ parameter to true when creating the refund:

By default, the entire charge is refunded, but you can create a partial refund by setting an amount value as a positive integer.

If the refund results in the entire charge being refunded, the entire transfer is reversed. Otherwise, a proportional amount of the transfer is reversed.

Refund application fees

When refunding a charge with an application fee, by default the platform account keeps the funds from the application fee. To push the application fee funds back to the connected account, set the refund_application_fee parameter to true when creating the refund:

Note that if you refund the application fee for a destination charge, you must also reverse the transfer. If the refund results in the entire charge being refunded, the entire application fee is refunded as well. Otherwise, a proportional amount of the application fee is refunded.

Alternatively, you can provide a refund_ value of false and refund the application fee separately through the API.

Failed refunds

If a refund fails, or you cancel it, the amount of the failed refund returns to your platform account’s Stripe balance. Create a Transfer to move the funds to the connected account, as needed.

Handle disputes

For destination charges, with or without on_, Stripe debits dispute amounts and fees from your platform account.

We recommend setting up a webhook to listen to dispute created events. When that happens, you can attempt to recover funds from the connected account by reversing the transfer through the Dashboard or by creating a transfer reversal.

If the connected account has a negative balance, Stripe attempts to debit its external account if debit_ is set to true.

If you challenge the dispute and win, you can transfer the funds that you previously reversed back to the connected account. If your platform has an insufficient balance, the transfer fails. Prevent insufficient balance errors by adding funds to your Stripe balance.

Common mistake

Retransferring a previous reversal is subject to cross-border transfer restrictions, meaning you might have no means to repay your connected account. Instead, wait to recover disputed cross-border payment transfers for destination charges with on_ until after a dispute is lost.

Skipped transfers due to account status

For payments using asynchronous payment methods (such as ACH or SEPA Debit), there is a delay between when the payment is authorized and when the funds become available. During this time, if the destination account loses the required transfer capability or is closed, Stripe can’t complete the transfer as originally requested.

When Stripe attempts to create a transfer but can’t due to capability loss or account deletion, the transfer creation is skipped and the funds remain in your platform’s balance.

To detect skipped transfers, listen for the charge. webhook event. If the value of transfer_data on the Charge object is null, this indicates a skipped transfer.

When you detect a skipped transfer, you can create a transfer after the problem is resolved, if appropriate for your business.

Connect embedded components

Destination charges are supported by Connect embedded components. By using the payments embedded component, you can enable your connected accounts to view payment information from within your site. For destination charges with on_, you can use the destination_on_behalf_of_charge_management feature to allow your connected accounts to view additional details, manage refunds, disputes, and allow capturing payments.

The following components display information for destination charges:

Payments component: Displays all of an account’s payments and disputes.

Payments details: Displays all of an account’s payments and disputes.

Disputes list component: Displays all of an account’s disputes.

Disputes for a payment component: Displays the disputes for a single specified payment. You can use it to include dispute management functionality on a page with your payments UI.