Rancang integrasi Connect lanjutan menggunakan Accounts v1 APITerdahulu

Pelajari kombinasi konfigurasi alternatif untuk integrasi Connect berdasarkan Accounts v1 API.

Integrasi Accounts v2 API

Panduan ini hanya berlaku bagi platform Connect yang sudah ada yang menggunakan Accounts v1 API. Jika Anda adalah pengguna baru Connect, gunakan Accounts v2 API sebagai gantinya. Lihat Panduan platform interaktif untuk informasi tentang cara mengonfigurasi platform Connect menggunakan Accounts v2 API.

Gunakan panduan ini untuk menjelajahi integrasi Connect yang berbeda dan membuat daftar langkah-langkah integrasi yang dipersonalisasi. Sebelum memulai integrasi di lingkungan sandbox, Anda harus membuat Akun Stripe atau masuk dan mengintegrasikan platform ke Connect.

Pilih properti

Buat dan lakukan onboarding akun

Strip memungkinkan Anda membuat akun atas nama pengguna, yang disebut akun terhubung. Ketika menggunakan Connect, Anda membuat akun terhubung untuk setiap pengguna yang menerima uang pada platform Anda.

Siapkan alur dashboard

Akun terhubung membutuhkan akses ke dashboard untuk mengelola akunnya. Beri akun terhubung akses ke Dashboard Stripe, Dashboard Express, atau dashboard yang dibuat menggunakan Stripe API dan komponen tersemat.

Terima pembayaran

Anda membuat charge untuk menerima pembayaran dari pelanggan atas nama akun terhubung Anda. Tipe charge yang Anda buat:

- Menentukan cara dana pembayaran dibagi di antara semua pihak yang terlibat

- Memengaruhi cara charge ditampilkan pada rekening koran tagihan atau bank pelanggan (dengan informasi platform Anda atau milik pengguna)

- Menentukan rekening mana yang akan didebit Stripe untuk pengembalian dana dan chargeback

Biaya Stripe

Kirim pembayaran kepada pengguna

Bila dana dari pembayaran lunas dan akun terhubung pengguna memiliki saldo Stripe positif, Anda dapat mengirim pembayaran dana tersebut ke rekening eksternal mereka.

Secara default, Stripe mengirim pembayaran dana yang telah lunas di saldo akun terhubung Anda setiap harinya. Jika lebih memilihnya, Anda dapat melakukan konfigurasi jadwal payout otomatis yang berbeda, memicu payout secara manual bukannya secara otomatis, atau mengirim pembayaran secara instan.

Tanggung jawab atas saldo negatif

Langkah-langkah integrasi untuk pilihan Anda

Langkah-langkah integrasi berikut didasarkan pada opsi yang Anda pilih di atas. Anda dapat melihat langkah-langkah yang berbeda dengan memilih berbagai opsi di atas atau pada panel di sebelah kanan langkah-langkah. Opsi pada halaman ini hanya mengontrol langkah-langkah yang ditampilkan di bawah ini. Konfigurasi platform Anda tidak terpengaruh.

Tombol berikut menghasilkan perintah LLM berdasarkan pilihan Anda. Fitur ini hanya mendukung Dashboard yang dihosting oleh Stripe dan proses onboarding yang dihosting.

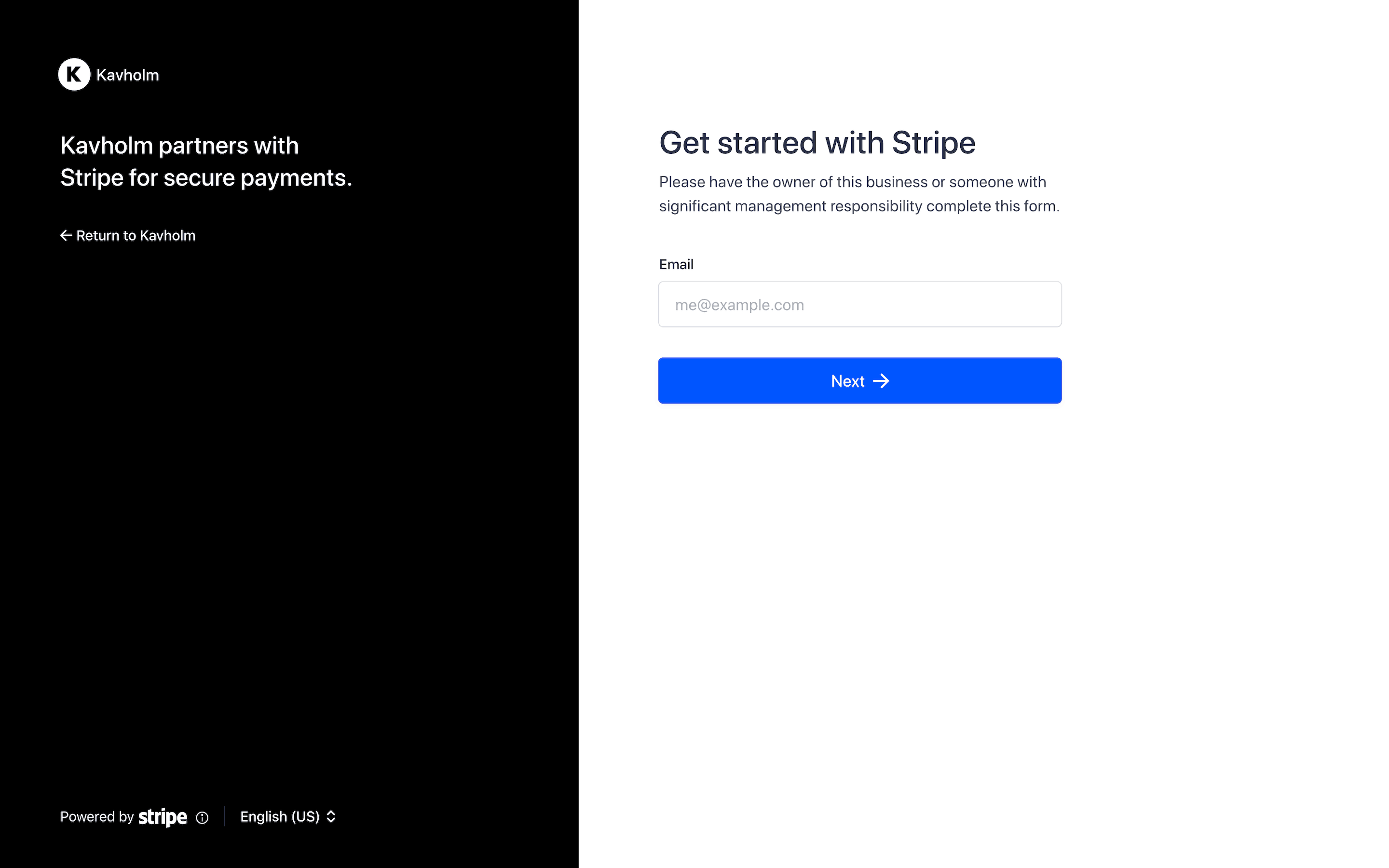

Buat akun terhubung dan kumpulkan persyaratan menggunakan layanan onboarding yang di-hosting oleh Stripe. Pelajari selengkapnya

Buat Direct Charges. Akun terhubung Anda akan membayar biaya Stripe. Pelajari selengkapnya

Pahami Dashboard Stripe dan kontrol yang dapat dilakukan akun terhubung Anda.

Pahami cara Stripe menangani pertanggungjawaban saldo negatif pada akun terhubung Anda. Pelajari selengkapnya

Memahami cara mengontrol payout rekening bank dan kartu debit.