Design an advanced Connect integration using the Accounts v1 APILegacy

Learn about alternative configuration combinations for a Connect integration based on the Accounts v1 API.

Accounts v2 API integrations

This guide only applies to existing Connect platforms that use the Accounts v1 API. If you’re a new Connect user, use the Accounts v2 API instead. See the Interactive platform guide for information about how to configure a Connect platform using the Accounts v2 API.

Use this guide to explore different Connect integrations and create a list of personalised integration steps. Before starting your integration in a sandbox environment, you must create a Stripe Account or log in and onboard your platform to Connect.

Select properties

Create and onboard accounts

Stripe enables you to create accounts on behalf of users, called connected accounts. When using Connect, you create connected accounts for each user that receives money on your platform.

Set up dashboard flows

Connected accounts need access to a dashboard to manage their account. Provide connected accounts with access to the Stripe Dashboard, the Express Dashboard, or a dashboard built using the Stripe API and embedded components.

Accept a payment

You create a charge to accept a payment from a customer on behalf of your connected account. The type of charge you create:

- Determines how payment funds are split among all parties involved

- Impacts how the charge appears on the customer’s bank or billing statement (with your platform’s information or your user’s)

- Determines which account Stripe debits for refunds and chargebacks

Stripe fees

Pay out users

When the funds from the payment settle and your user’s connected account has a positive Stripe balance, you can pay out those funds to their external account.

By default, Stripe pays out funds that have settled in your connected accounts’ balances on a daily rolling basis. If you prefer, you can configure different automatic payout schedules, trigger payouts manually instead of automatically, or pay out instantly.

Responsibility for negative balances

Integration steps for your selections

The following integration steps are based on the options you selected above. You can see different steps by selecting different options above or in the panel to the right of the steps. The options on this page only control the steps displayed below. They don’t affect your platform configuration.

The following button generates an LLM prompt based on your selections. It only supports Stripe-hosted Dashboard and hosted onboarding.

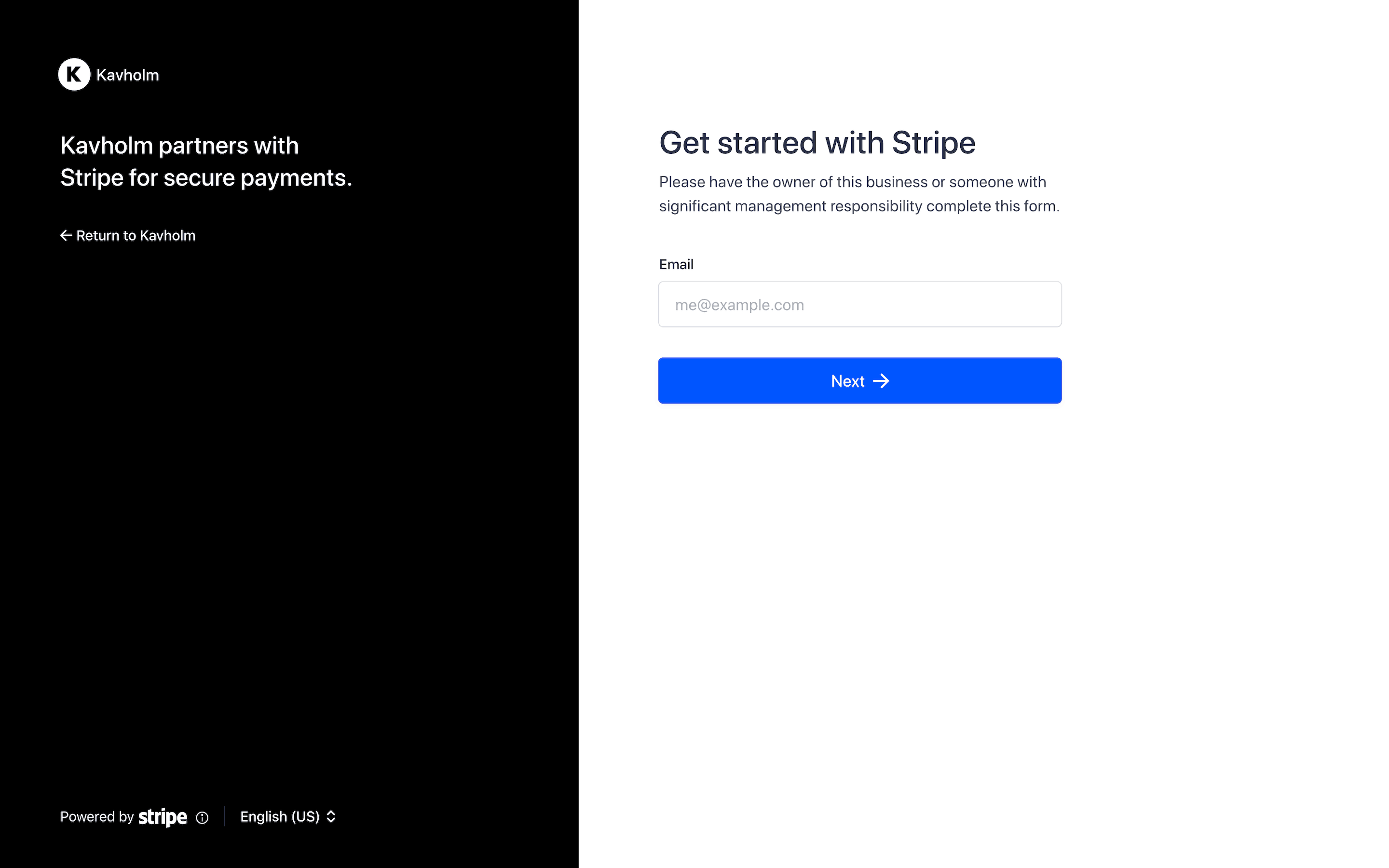

Create connected accounts and collect requirements using Stripe-hosted onboarding. Learn more

Create direct charges. Your connected accounts will pay Stripe fees. Learn more

Understand the Stripe Dashboard and control what your connected accounts can do with it.

Understand how Stripe handles negative balance liabilities on your connected accounts. Learn more

Understand how to control bank account and debit card payouts.