Build a subscriptions integration

Create and manage subscriptions to accept recurring payments.

Integration effort

UI customization

Integration type

Use prebuilt hosted pages to collect payments and manage your subscriptions.

What you’ll build

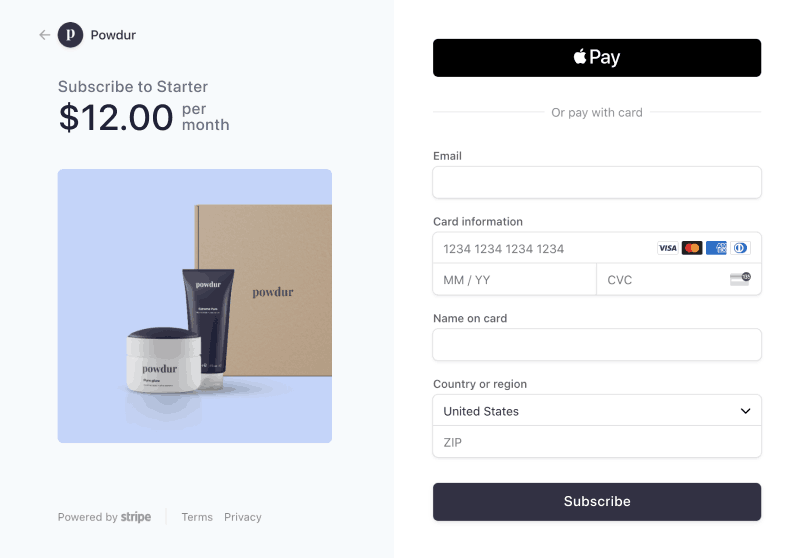

This guide describes how to sell fixed-price monthly subscriptions using Stripe Checkout.

This guide shows you how to:

- Model your business by building a product catalog.

- Add a Checkout session to your site, including a button and success and cancellation pages.

- Monitor subscription events and provision access to your service.

- Set up the customer portal.

- Add a customer portal session to your site, including a button and redirect.

- Let customers manage their subscription through the portal.

- Learn how to use flexible billing mode to access enhanced billing behavior and additional features.

After you complete the integration, you can extend it to:

- Display taxes

- Apply discounts

- Offer customers a free trial period

- Add payment methods

- Integrate the hosted invoice page

- Use Checkout in setup mode

- Set up usage-based billing, pricing tiers, and usage-based pricing

- Manage prorations

- Allow customers to subscribe to multiple products

- Integrate entitlements to manage access to your product’s features

Set up Stripe

Install the Stripe client of your choice:

Optionally, install the Stripe CLI. The CLI provides webhook testing, and you can run it to create your products and prices.

# Install Homebrew to run this command: https://brew.sh/ brew install stripe/stripe-cli/stripe # Connect the CLI to your dashboard stripe login

For additional install options, see Get started with the Stripe CLI.

Create the pricing modelDashboard or Stripe CLI

Recurring pricing models represent the products or services you sell, how much they cost, what currency you accept for payments, and the service period for subscriptions. To build the pricing model, create products (what you sell) and prices (how much and how often to charge for your products).

This example uses flat-rate pricing with two different service-level options: Basic and Premium. For each service-level option, you need to create a product and a recurring price. To add a one-time charge for something like a setup fee, create a third product with a one-time price.

Each product bills at monthly intervals. The price for the Basic product is 5 USD. The price for the Premium product is 15 USD. See the flat rate pricing guide for an example with three tiers.

Go to the Add a product page and create two products. Add one price for each product, each with a monthly recurring billing period:

Premium product: Premium service with extra features

- Price: Flat rate | 15 USD

Basic product: Basic service with minimum features

- Price: Flat rate | 5 USD

After you create the prices, record the price IDs so you can use them in other steps. Price IDs look like this: price_.

When you’re ready, use the Copy to live mode button at the top right of the page to clone your product from a sandbox to live mode.

If you offer multiple billing periods, use Checkout to upsell customers on longer billing periods and collect more revenue upfront.

For other pricing models, see Billing examples.

Create a Checkout SessionClient and Server

Add a checkout button to your website that calls a server-side endpoint to create a Checkout Session.

<html> <head> <title>Checkout</title> </head> <body> <form action="/create-checkout-session" method="POST"> <!-- Note: If using PHP set the action to /create-checkout-session.php --> <input type="hidden" name="priceId" value="price_G0FvDp6vZvdwRZ" /> <button type="submit">Checkout</button> </form> </body> </html>

On the backend of your application, define an endpoint that creates the session for your frontend to call. You need these values:

- The price ID of the subscription the customer is signing up for (your frontend passes this value)

- Your

success_, which is a page on your website that Checkout returns your customer to after they complete the paymenturl

You can optionally:

- Configure a billing cycle anchor to your subscription in this call.

- Use custom text to include your subscription and cancellation terms, and a link to where your customers can update or cancel their subscription. We recommend configuring email reminders and notifications for your subscribers.

If you created a one-time price in step 2, pass that price ID as well. After creating a Checkout Session, redirect your customer to the URL returned in the response.

You can enable more accurate and predictable subscription behavior when you create a Checkout Session by setting the billing mode type to flexible. You must use the Stripe API version 2025-06-30.basil or later.

Note

You can use lookup_keys to fetch prices rather than price IDs. For an example, see the sample application.

# Set your secret key. Remember to switch to your live secret key in production. # See your keys here: https://dashboard.stripe.com/apikeys Stripe.api_key =# The price ID passed from the front end. # price_id = params['priceId'] price_id = '{{PRICE_ID}}' session = Stripe::Checkout::Session.create({ success_url: 'https://example.com/success.html?session_id={CHECKOUT_SESSION_ID}', mode: 'subscription', line_items: [{ # For usage-based billing, don't pass quantity quantity: 1, price: price_id }], subscription_data: { billing_mode: { type: 'flexible' } } }) # Redirect to the URL returned on the session # redirect session.url, 303'sk_test_BQokikJOvBiI2HlWgH4olfQ2'

This example customizes the success_ by appending the session ID. Learn more about customizing your success page.

From your Dashboard, enable the payment methods you want to accept from your customers. Checkout supports several payment methods.

Provision and monitor subscriptionsServer

After the subscription signup succeeds, the customer returns to your website at the success_, which initiates a checkout. webhook. When you receive a checkout. event, use entitlements to provision the subscription. Continue to provision each month (if billing monthly) as you receive invoice. events. If you receive an invoice. event, notify your customer and send them to the customer portal to update their payment method.

To determine the next step for your system’s logic, check the event type and parse the payload of each event object, such as invoice.. Store the subscription. and customer. event objects in your database for verification.

For testing purposes, you can monitor events in the Events tab of Workbench. For production, set up a webhook endpoint and subscribe to appropriate event types. If you don’t know your STRIPE_ key, go to the destination details view of the Webhooks tab in Workbench to view it.

# Set your secret key. Remember to switch to your live secret key in production. # See your keys here: https://dashboard.stripe.com/apikeys Stripe.api_key =post '/webhook' do webhook_secret ='sk_test_BQokikJOvBiI2HlWgH4olfQ2'payload = request.body.read if !webhook_secret.empty? # Retrieve the event by verifying the signature using the raw body and secret if webhook signing is configured. sig_header = request.env['HTTP_STRIPE_SIGNATURE'] event = nil begin event = Stripe::Webhook.construct_event( payload, sig_header, webhook_secret ) rescue JSON::ParserError => e # Invalid payload status 400 return rescue Stripe::SignatureVerificationError => e # Invalid signature puts '⚠️ Webhook signature verification failed.' status 400 return end else data = JSON.parse(payload, symbolize_names: true) event = Stripe::Event.construct_from(data) end # Get the type of webhook event sent event_type = event['type'] data = event['data'] data_object = data['object'] case event_type when 'checkout.session.completed' # Payment is successful and the subscription is created. # You should provision the subscription and save the customer ID to your database. when 'invoice.paid' # Continue to provision the subscription as payments continue to be made. # Store the status in your database and check when a user accesses your service. # This approach helps you avoid hitting rate limits. when 'invoice.payment_failed' # The payment failed or the customer doesn't have a valid payment method. # The subscription becomes past_due. Notify your customer and send them to the # customer portal to update their payment information. else puts "Unhandled event type: \#{event.type}" end status 200 end'{{STRIPE_WEBHOOK_SECRET}}'

The minimum event types to monitor:

| Event name | Description |

|---|---|

checkout. | Sent when a customer successfully completes the Checkout Session, informing you of a new purchase. |

invoice. | Sent each billing period when a payment succeeds. |

invoice. | Sent each billing period if there’s an issue with your customer’s payment method. |

For even more events to monitor, see Subscription webhooks.

Configure the customer portalDashboard

The customer portal lets your customers directly manage their existing subscriptions and invoices.

Use the Dashboard to configure the portal. At a minimum, make sure to configure the portal so that customers can update their payment methods.

Create a portal sessionServer

Define an endpoint that creates the customer portal session for your frontend to call. The CUSTOMER_ refers to the customer ID created by a Checkout Session that you saved while processing the checkout. event. You can also set a default redirect link for the portal in the Dashboard.

Pass an optional return_ value for the page on your site to redirect your customer to after they finish managing their subscription:

# Set your secret key. Remember to switch to your live secret key in production. # See your keys here: https://dashboard.stripe.com/apikeys Stripe.api_key =# This is the URL that users are redirected to after they're done # managing their billing. return_url ='sk_test_BQokikJOvBiI2HlWgH4olfQ2'customer_id ='{{DOMAIN_URL}}'session = Stripe::BillingPortal::Session.create({ customer: customer_id, return_url: return_url, }) # Redirect to the URL for the session # redirect session.url, 303'{{CUSTOMER_ID}}'

Send customers to the customer portalClient

On your frontend, add a button to the page at the success_ that provides a link to the customer portal:

<html> <head> <title>Manage Billing</title> </head> <body> <form action="/customer-portal" method="POST"> <!-- Note: If using PHP set the action to /customer-portal.php --> <button type="submit">Manage Billing</button> </form> </body> </html>

After exiting the customer portal, the customer returns to your website at the return_. Continue to monitor events to track the status of the customer’s subscription.

If you configure the customer portal to allow actions such as canceling a subscription, monitor additional events.

Test your integration

Test payment methods

Use the following table to test different payment methods and scenarios.

| Payment method | Scenario | How to test |

|---|---|---|

| BECS Direct Debit | Your customer successfully pays with BECS Direct Debit. | Fill out the form using the account number 900123456 and BSB 000000. The confirmed PaymentIntent initially transitions to processing, then transitions to the succeeded status three minutes later. |

| BECS Direct Debit | Your customer’s payment fails with an account_ error code. | Fill out the form using the account number 111111113 and BSB 000000. |

| Credit card | The card payment succeeds and doesn’t require authentication. | Fill out the credit card form using the credit card number 4242 4242 4242 4242 with any expiration, CVC, and postal code. |

| Credit card | The card payment requires authentication. | Fill out the credit card form using the credit card number 4000 0025 0000 3155 with any expiration, CVC, and postal code. |

| Credit card | The card is declined with a decline code like insufficient_. | Fill out the credit card form using the credit card number 4000 0000 0000 9995 with any expiration, CVC, and postal code. |

| SEPA Direct Debit | Your customer successfully pays with SEPA Direct Debit. | Fill out the form using the account number AT321904300235473204. The confirmed PaymentIntent initially transitions to processing, then transitions to the succeeded status three minutes later. |

| SEPA Direct Debit | Your customer’s PaymentIntent status transitions from processing to requires_. | Fill out the form using the account number AT861904300235473202. |

Monitor events

Set up webhooks to listen to subscription change events, such as upgrades and cancellations. You can view subscription webhook events in the Dashboard or with the Stripe CLI.

Learn more about testing your Billing integration.