Embedded Finance integration guide

Build an embedded financial services integration with Issuing and Financial Accounts for platforms.

Build a US embedded financial services offering using Stripe Issuing and Financial Accounts for platforms. Use Issuing to create cards, and Financial Accounts for platforms to store balances and fund card spend.

By the end of this guide, you’ll know how to:

- Create verified connected accounts representing your business customers with relevant Issuing and Financial Accounts for platforms capabilities

- Create financial accounts that you can use as a wallet for your business customers and add funds to using an external bank account

- Create virtual cards for your business customers and use these cards to spend funds from a wallet

Before you begin

- Sign up for a Stripe account.

- Activate Issuing and Financial Accounts for platforms in a sandbox environment from the Dashboard. For more information, see API access to Issuing and Financial Accounts for platforms.

- Configure your Connect platform branding settings for your business and add an icon.

Create connected accounts

Create a connected account

Create a connected account to represent a business customer of your platform. For example, if your product is a SaaS platform for restaurants, each restaurant would be represented as a connected account.

Connect account types

Issuing only supports connected accounts that don’t use a Stripe-hosted Dashboard, and where your platform is responsible for requirements collection and loss liability, also known as a Custom connected account. Learn how to create connected accounts that work with Issuing. If your existing accounts don’t match this configuration, you must recreate them.

The following request creates a US-based connected account with the correct configuration and requests the requisite capabilities:

The user’s account information appears in the response:

{ ... "id": "{{CONNECTED_ACCOUNT_ID}}", "controller": { "stripe_dashboard": { "type": "none" }, "fees": { "payer": "application" }, "losses": { "payments": "application" }, "is_controller": true, "type": "application", "requirement_collection": "application" }, ... }

Note the connected account’s id. You’ll provide this value to authenticate as the connected account by passing it into requests in the Stripe-Account header.

If a connected account already exists, you can add the requisite capabilities by specifying the connected account id in the request:

Verify the connected account

Choose one of the following onboarding options:

At this point, Stripe has created and verified the connected account with active relevant capabilities to use Issuing and Financial Accounts for platforms.

To learn more, see:

Create financial accounts and add funds

After you enable Financial Accounts on your platform, add FinancialAccount objects to your platform architecture to enable the efficient storing, sending, and receiving of funds. Stripe attaches a financial account to your platform account after enablement, and lets you provision an individual financial account for each eligible connected account on your platform.

In the Stripe API, FinancialAccount objects serve as the source and destination of money movement API requests. You request Features through the API to assign to FinancialAccounts that provide additional functionality for the financial accounts on your platform.

A financial account operates a distinct balance of funds from the connected account payments balance of the account it’s linked to. For example, the owner of a connected account on your platform might have a 100 USD connected account balance and a 200 USD financial account balance. In this scenario, the connected account owner has a sum of 300 USD spread between their financial account and connected account balances. These two balances remain separate, but the API provides the ability to move money from the connected account balance to the financial account balance.

Create a Financial Account

After Stripe adds the treasury capability to an account and it’s marked active, you can create a FinancialAccount object for the connected account. To do this, call FinancialAccounts and request the Features you want to provide:

The response, when you request features on financial account creation, indicates their status in the active_, pending_, and restricted_ parameters:

{ "object": "treasury.financial_account", "created": 1612927106, "id": "fa_123", "country": "US", "supported_currencies": ["usd"], "active_features": ["card_issuing"], "pending_features": ["financial_addresses.aba"], "restricted_features": [], // No FinancialAddress added as the financial_addresses.aba feature is not yet active "financial_addresses": [], "livemode": true, "status": "open", ... }

Activation might be instantaneous for some features (for example, card_). However, other features, like financial_, activate asynchronously and might stay pending for up to 30 minutes while Stripe communicates with external systems. After all of the relevant features are active, you get confirmation on the treasury. webhook listener. See Available features for more information on financial account features.

Link a bank account

To let your customers transfer money to and from an external account, create a SetupIntent with the required parameters, and denote that your customer owns the external account by attaching it to self:

The API response includes a unique identifier for the payment_ that’s used to reference this bank account when making ACH transfers:

{ "id": "{{SETUP_INTENT_ID}}", "object": "setup_intent", "next_action": { "type": "verify_with_microdeposits", "verify_with_microdeposits": { "arrival_date": 1642579200, "hosted_verification_url": "https://payments.stripe.com/microdeposit/sacs_test_xxx", "microdeposit_type": "amounts" } }, ... "payment_method": "{{PAYMENT_METHOD_ID}}", "payment_method_types": [ "us_bank_account" ] }

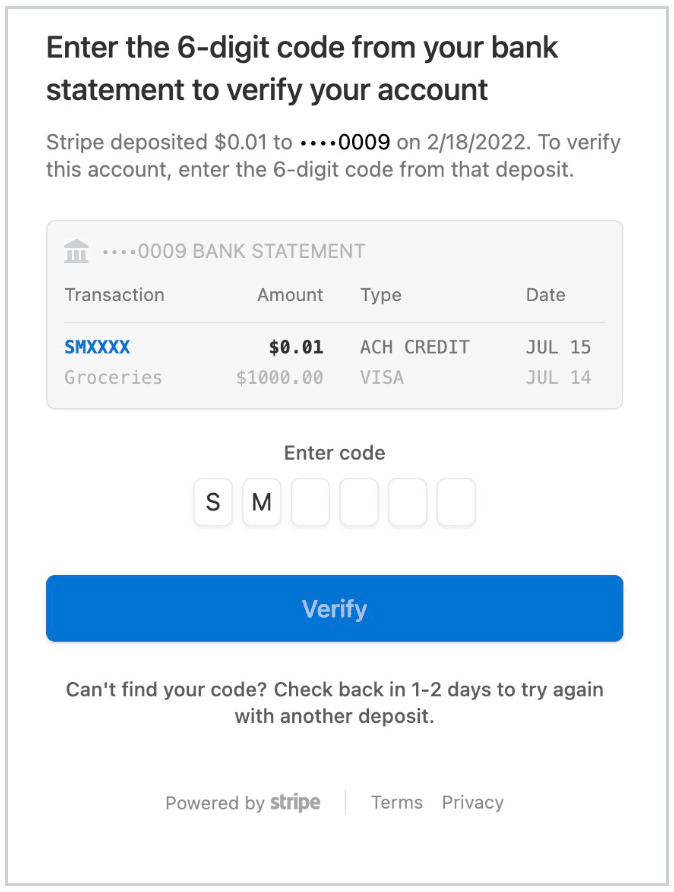

Before you can use a bank account, it must be verified using microdeposits (which we focus on here) or the faster financial connections option. The SetupIntent response from the previous step includes a hosted_ which you must present to your customer for them to input the associated descriptor code of the microdeposit. Use the value SM11AA to verify the bank account, or test a variety of other cases by using the test account numbers Stripe provides.

Microdeposit verification

Add funds to the financial account

At this point, the connected account has a FinancialAccount that has been loaded with funds received from an InboundTransfer that you can spend using cards or OutboundPayments like ACH or wires.

To learn more, see:

- Getting permissions for InboundTransfers

- Working with Financial Accounts for platforms

- Using Financial Accounts to move money

- Requesting features on a Financial Account

- Working with SetupIntents, PaymentMethods, and BankAccounts

- Moving money using InboundTransfer objects

- Moving money using ReceivedCredit objects

Use the card

Create an authorization

To observe the impact of card activity on the associated balance, generate a test authorization. You can do this in the Issuing page of the Dashboard for the connected account, or with the following call to the Authorization API:

After approval, Stripe creates an Authorization in a pending state while it waits for capture. Note the authorization id that you’ll use to capture the funds:

{ "id": "iauth_1NvPyY2SSJdH5vn2xZQE8C7k", "object": "issuing.authorization", "amount": 1000, ... "status": "pending", "transactions": [], }

You can use retrieve the balance details of the financial account and see the impact of the authorization:

The API response is a FinancialAccount object with a balance hash that details the funds and their availability:

{ "object": "treasury.financial_account", "id": "{{FINANCIAL_ACCOUNT_ID}}", ... "balance": { "cash": {"usd": 19000}, "inbound_pending": {"usd": 0}, "outbound_pending": {"usd": 1000} } }

The response indicates 190 USD is currently available for use with an additional 10 USD held in outbound_ from the pending authorization. You can now simulate capture of the authorization with the API.

Capture the funds

Capture the funds using the following code:

After the authorization is captured, Stripe creates an Issuing Transaction, the status of the authorization is set to closed, and a ReceivedDebit webhook is created with these details. Retrieving the balance details of the financial account again shows the outbound_ is now 0 USD while the available cash is remains 190 USD:

{ "object": "treasury.financial_account", "id": "{{FINANCIAL_ACCOUNT_ID}}", ... "balance": { "cash": {"usd": 19000}, "inbound_pending": {"usd": 0}, "outbound_pending": {"usd": 0} } }