Disputes analytics

Learn how dispute volume, rates, and outcomes affect your business.

Use the Disputes page in the Stripe Dashboard to understand and analyze your card dispute volume, dispute rate, and the outcomes to dispute submissions.

To view analytics, click Payments > Analytics > Disputes in the Dashboard. To respond to disputes, use the main Disputes page.

The Disputes analytics page includes the following for card disputes:

- Subsequent disputes (multiple disputes on the same charge)

- Early fraud warnings (EFW)

The following aren’t included in the card Disputes analytics page:

- Non-card payment methods, such as bank debits or buy now, pay later

- Inquiries

- Hidden disputes (disputes that Stripe handles automatically, so they don’t appear in your Dashboard, often because the transaction was protected by a liability shift)

- RDR (Rapid Dispute Resolution) and prevented disputes

Disputes analytics helps you:

- Monitor your card dispute rate and fraud rate

- Analyze disputes across various categories, such as by card brand and country

- Understand the reasons behind disputes

- Track and improve your dispute evidence submission performance

How disputes affect you

Regular monitoring of your dispute activity can help you understand:

- The financial impact of disputes on your business.

- Whether or not your dispute rate puts you at risk of entering monitoring programs operated by card networks. If placed in such a program, you can incur additional monthly fines and fees until you reduce your disputes or fraud levels.

- Whether or not you want to change your fraud strategy. Tools such as Radar can help businesses protect themselves against fraud. If you use Radar for Fraud Teams, you might want to consider customizing your interventions based on your fraud rate. Consider the tradeoffs between preventing fraud while also making sure that your strategy minimizes the impact to legitimate customers attempting to purchase.

To learn more about disputes, see How disputes work.

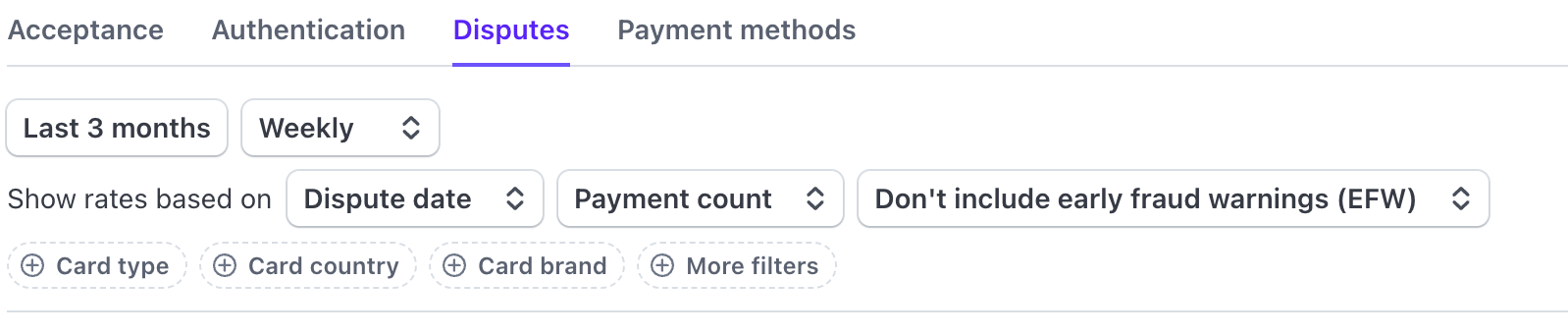

Configure your data set

Use filters to control all the metrics, charts, and tables on this page.

Filters to configure your data

Specify currency

If you don’t apply a currency filter, all payments appear in your default settlement currency, regardless of the actual payment currency. If you apply a currency filter, only payments made using the applied currency appear.

To change the currency, click + More filters > Currency, and select the currency you want from the list.

Specify Connect

By default, metrics include charge activity for all of your connected accounts. Use the Connected accounts filter to exclude data from your connected accounts. Data from standard connected accounts is only visible if you enable platform controls.

Specify rate calculation

You can configure your metrics and rates based on either:

- Dispute date: The date when a customer created the dispute.

- Payment date: The date of the original payment.

By default, metrics are based on the dispute date. This date always falls on or after the payment date due to the time lag between a payment and the cardholder filing a dispute with their card issuing bank.

Analyzing by the dispute date shows your financial impact based on when we debit fees or disputed funds from your account. Analyzing by payment date can help you assess the effectiveness of your fraud strategies during the time those payments were originally made. Dispute rates based on payment date might seem lower for recent days or weeks because customers can wait weeks to file disputes.

Specify early fraud warnings

Early fraud warnings (EFWs) are alerts that the card networks send when they suspect a payment might be fraudulent. These warnings come from card issuers who analyze payment reports. Keep in mind that not every EFW leads to an actual fraudulent dispute, and therefore not all EFWs lead to a financial impact to your business. However, EFWs that are considered in Visa’s VAMP program for monitoring, can result in fines.

If a warning turns into a confirmed fraud case, it’s no longer counted as an EFW. Instead, it becomes an actual dispute.

By default, we track EFWs in your dispute metrics because they can help with awareness of potential issues, and make sure your fraud metrics accurately reflect confirmed cases.

EFWs are included in your calculations, by default, but you can choose to include or exclude them:

- To include them, select Include early fraud warnings.

- To exclude them, select Don’t include early fraud warnings.

Download data

To download these analytics, click Download at the top of each chart. The CSV file you download matches any filters you selected, or matches your defaults if you apply no filters.

Key metrics

These metrics show how often your business faces payment disputes on card transactions. Common terms for disputes include the following:

| Term | Definition |

|---|---|

| Disputes | Total number of disputes from card payments |

| Dispute volume | Total amount from disputes from card payments (defaults to your settlement currency) |

| Dispute rate | Percentage of card payments that led to disputes, out of all accepted card payments |

| Fraud rate | Percentage of card payments identified as fraudulent, out of all accepted payments. Fraudulent disputes are a subset of disputes |

Disputes breakdown report

The Disputes breakdown report allows you to view card dispute metrics across several common card categories.

Click the drop-down menu to select different categories:

- Dispute reason

- Card country

- Card brand

- Card type

- Input method

- Currency

Below the drop-down, click the tabs to compare:

- Dispute count breakdowns (in absolute numbers or as a share of disputes)

- Total dispute volume

- Dispute rate

This report helps you understand where and how often disputes occur for your business, so you can identify trends to help you address issues.

Disputes reasons

Viewing data by dispute reason helps you understand the top five categories associated with your disputes. To see all the dispute reasons in the Dashboard, click the All reasons drop down.

Monthly submission performance

Caution

The Monthly submission performance report isn’t influenced by any date or metric configuration selections. You always see metrics for a 12-month time period, aggregated monthly, and based on the dispute date rather than the payment date. However, any filters you selected still apply to the metrics in the Monthly submission performance report.

The submission performance chart has the following tabs:

- Smart disputes: Compares the total funds recovered from disputes you won using manual evidence submission versus those recovered through Stripe’s automated Smart Disputes.

- Win rate: The frequency that you win disputes you’ve challenged by evidence submission (includes won disputes using Smart Disputes).

- Evidence submission rate: The frequency that you challenge disputes by submitting evidence to the card issuing bank (includes challenged disputes using Smart Disputes).

Smart disputes

This chart shows you how much revenue you recover from disputes you won using Smart Disputes.

Smart Disputes uses an AI rules engine to analyze incoming disputes. It extracts relevant evidence from Stripe’s extensive internal data, your transaction data, and cardholder data. The system compiles evidence to submit based on the dispute reason code and Stripe’s knowledge of convincing evidence. Smart Disputes eligibility is determined by multiple factors, including the dispute reason code, payment method, evidence availability, evidence relevance, and cost.

When you receive a dispute that’s eligible for Smart Disputes, Stripe notifies you by email and in the Dashboard. If you don’t take any action, Smart Disputes automatically submits the pre-filled evidence packet just before the dispute times out. This ensures you don’t miss any deadlines. If you don’t want to use Smart Disputes, you can respond to the dispute by countering manually, or accepting the dispute before the deadline.

Win rate

A won dispute is a dispute from a customer you challenged that the issuing bank overturned in your favor. The win rate is always based on the dispute date (the date when the dispute was created). Additionally, when you win a dispute challenge, Stripe assigns a won dispute to the dispute creation date, rather than the evidence submission or challenge outcome dates.

The number of won disputes might appear lower for recent months, because of the time it takes for card issuing banks to process dispute challenges. After you challenge the dispute (by submitting evidence), the card issuer then evaluates the evidence and decides the outcome, which might take 60–75 days, depending on the card network.

All disputes that you challenge are counted in the win rate metric as soon as you submit them to the card issuing bank. Because outcomes can take time to be decided, the metric may appear lower while banks are still processing challenges. The win rate excludes disputes that were never challenged.

Evidence submission rate

The evidence submission rate is the number of disputes with submitted evidence divided by the total number of disputes created in a given month. The rate is based on the date of the dispute, not the evidence submission date. For example, if you receive a dispute in April, and you submit evidence in May (within the 7-21 day challenge window), the submission affects your April rate, not May.

Monthly disputes outcomes

Caution

Your date and metric configuration selections don’t affect the Monthly disputes outcomes report. This report always shows metrics:

- Over a 12-month time period

- Aggregated monthly

- Based on the dispute date rather than the payment date

- Based on the payment count, rather than the payment volume

However, any filters you selected still apply to the metrics in the Monthly disputes outcomes report.

The submission outcome chart has the following tabs:

| Tab | Definition |

|---|---|

| Disputes | Shows the total number of disputes you’ve received from customers by their latest evidence submission statuses (which includes Needs response, Under review, Won, and Lost disputes) |

| Share of disputes | Presents disputes by their latest evidence submission statuses as a percentage of total disputes |

| Dispute volume | Displays the total monetary value of disputes by their latest evidence submission statuses |

The following table shows example values for disputes during the challenge lifecycle:

| Value | Definition |

|---|---|

Needs response | Dispute within the response window that you haven’t challenged or accepted |

Under review | Dispute that you challenged with submitted evidence, but Stripe has yet to receive a response from the cardholder’s issuing bank |

Won | Dispute that the cardholder’s issuing bank overturned in your favor |

Protected | Dispute Stripe might’ve challenged on your behalf and covered the loss for you as part of Stripe’s deprecated Chargeback Protection |

Lost | Dispute you challenged where the cardholder’s issuing bank upheld the dispute in the cardholder’s favor. Or, a dispute you failed to challenge during the evidence submission window |