支払いを最適化する

Authorization Boost が決済成功率を高め、処理コストを削減する方法をご紹介します。

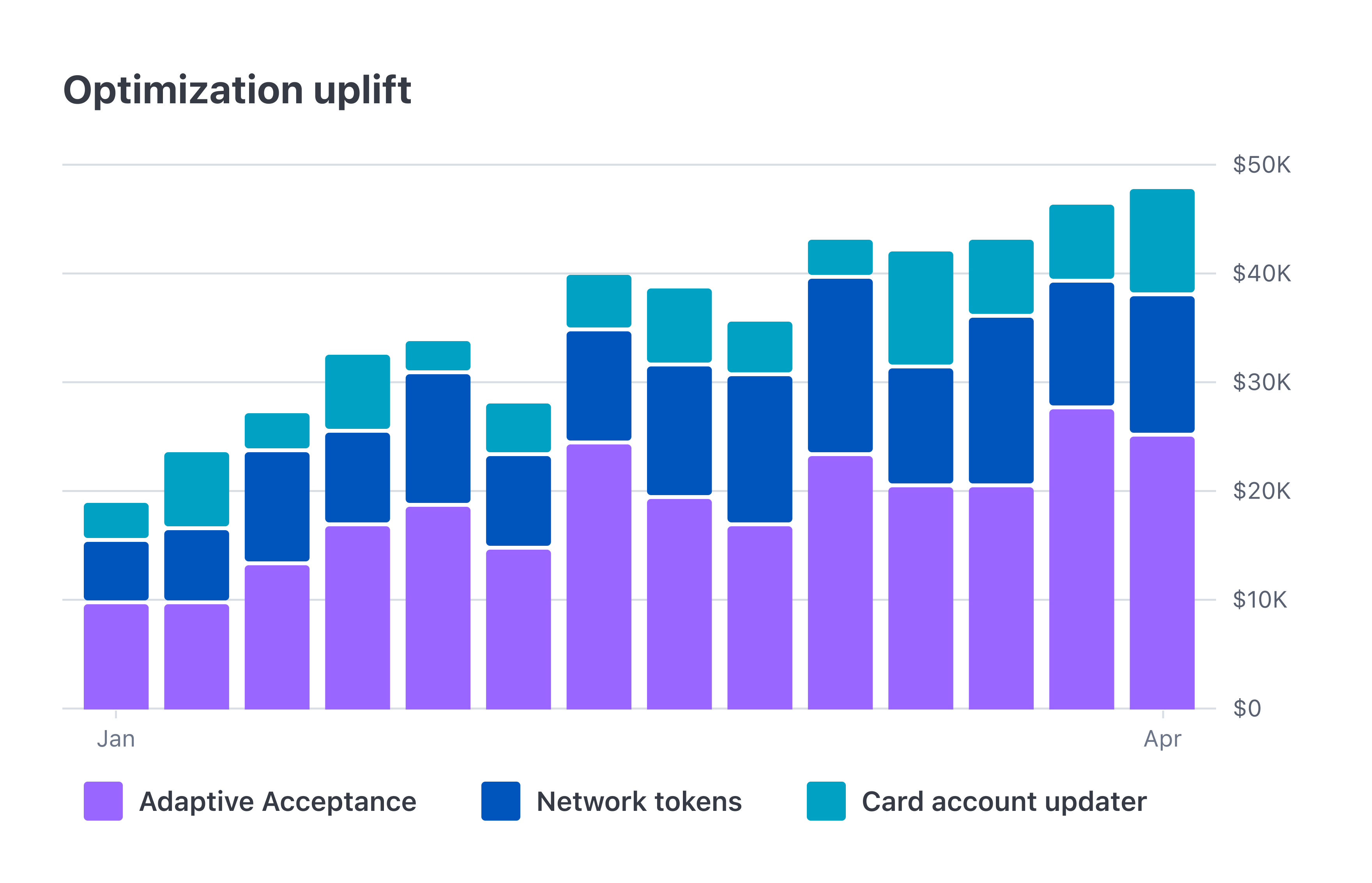

Optimization ページを使用して、最適化機能による決済ボリューム、成功率、およびコスト削減の推定増加量を確認できます。このページでは、Stripe Authorization Boost features について説明しています。これは、失敗した、または適切にフォーマットされていない決済試行に対して AI による調整を適用することで、card-not-present (CNP) 決済の成功率向上に役立てられる機能です。IC+ 料金体系をご利用の場合は、一部の最適化機能によりネットワークコストも削減されます。

メモ

Stripe はオーソリブースト機能を使用した場合の結果を保証するものではありません。最適化の計算は概算であり、Stripe から提供されたデータを使用して、これらの機能を使用するかどうかの意思決定に役立てることができます。このページを定期的に参照して、最新の最適化機能情報を入手してください。

Authorization Boost 機能

Stripe は、以下の Authorization Boost 機能を使用して成功率を向上させ、カード非提示決済のコストを削減します。承認率の最適化 の詳細をご確認ください。

Adaptive Acceptance

Adaptive Acceptance は、AI を使用して、クレジットカード発行会社の設定に基づいて決済リクエストを再フォーマットします。Stripe は、決済の送信前または決済が拒否された後で、これらの変更を行うことができます。

たとえば、Stripe は拒否された決済をリアルタイムで選択的に調整して再試行するため、膨大な数の誤った拒否を回収できます。また、Adaptive Acceptance は、IC+ 料金体系のビジネスにコスト最適化を適用して、ネットワーク手数料やインターチェンジフィーを削減する場合もあります。

| 最適化が適用されるタイミング | 説明 |

|---|---|

| リカバリー | Adaptive Acceptance は、最初に拒否された決済を再試行し、再試行が成功します。または、Stripe はカード発行会社の設定に基づいて決済をオーソリ前に再フォーマットします。 |

コスト削減 | 過度な再試行の防止: Stripe は、ネットワーク再試行ペナルティが発生し、失敗する可能性が高い決済をブロックします。 拒否の防止: Stripe は、成功する見込みのないクレジットカードネットワークへの決済をブロックし、決済に対する追加のブランドフィーを回避します。 データのみ 3DS: Stripe は データのみフロー を通じて発行者に追加の取引データを共有することで、カード保有者に追加認証を求めることなくブランドフィーを削減します。 |

自動カード更新機能

カード番号や有効期限は定期的に変更されるため、古いカード情報はオンライン事業にとって決済の失敗の一般的な原因となります。Stripe では、主要なカードネットワークが提供する自動カード更新機能を利用し、保存されたカード決済情報を自動的に取得・更新することで、承認率を改善します。

| 最適化が適用されるタイミング | 説明 |

|---|---|

| リカバリー | 成功した決済は、以前に基になるクレジットカード情報の更新が行われたクレジットカードを使用して行われます。更新には、クレジットカードの有効期限またはプライマリーアカウント番号 (PAN) の変更が含まれます。 |

| コスト削減 | 該当しない |

ネットワークトークン

ネットワークトークンは、より安全なカード番号の代用となる決済クレデンシャルです。ネットワークトークンを使用すると、基盤となるカードデータが変更された場合でも、最新のクレデンシャルで決済を処理できるため、成功率が向上します。インターチェンジプライシングを利用している企業にとっては、ネットワークトークンを使用することでコストを削減することもできます。

Stripe では、主要なカードネットワークと統合し、カードをトークン化しています。詳しくは ネットワークトークン をご覧ください。

| 最適化が適用されるタイミング | 説明 |

|---|---|

| リカバリー | ネットワークトークンを使用して決済が成功します。ネットワークトークンが決済の成功につながる確率は、基になるクレジットカード情報が以前に更新されている場合に大幅に高くなります。更新には、クレジットカードの有効期限または PAN (プライマリーアカウント番号) の変更が含まれます。 |

| コスト削減 | 決済ではネットワークトークンが使用されるため、インターチェンジレートの軽減やスキーム手数料のペナルティを回避できます。 |

Stripe による最適化からの回収収入の計算方法

各決済について、Stripe は、最適化が成功の要因である可能性を評価します。ただし、それ以外の方法ではまだ承認されている決済もあるからです。このアプローチは、Stripe がビジネスに対する真の影響をより正確に見積もるのに役立ちます。1 つの決済に複数の最適化を適用する場合、メリットは承認の最も可能性の高いものに帰属します。化を適用する場合、メリットは承認の最も可能性の高いものに帰属します。

計算例を以下に示します。

- どの支払いが最適化機能の使用の恩恵を受けたかを判断します。たとえば、お客様のビジネスには、機能を利用して最適化された 100 件の支払いがあり、各支払い金額が

50 USDであるとします。 - この機能によって決済が成功する可能性が推定され、そうでない場合は失敗する確率を判断します。この例では、適用された最適化の 100 件の決済ごとに

20%の可能性を想定します (実際の可能性は異なる場合があります)。 - 回収された決済額を計算するには、最適化された決済に起因する合計金額を合計し、この合計に同機能の結果として承認される確率を乗じます。この例では、推定回収額は

100 payments * 50 USD * 0.となります。20 = 1,000 USD

Stripe による最適化からのコスト削減の計算方法

最適化機能は、IC+ 料金体系を採用している企業のネットワークコストを削減するのに役立ちます。たとえば、Adaptive Acceptance は、不要なネットワーク手数料を節約するために、成功する可能性が低い決済をブロックする場合があります。また、ネットワークトークンはインターチェンジレートを下げ、特定の市場におけるスキーム手数料のペナルティを回避します。

Stripe は、決済ごとに、最適化によって削減できたネットワークコストを計算します。Stripe は、インターチェンジフィーとスキーム手数料のルール、またはカードネットワークの仕様を使用して、最適化を使用せずに発生していたコストを計算します。

メモ

Stripe は、最適化を使用しない場合のネットワークコストと、最適化を使用した場合のネットワークコストの予想を推測します。ただし、Stripe はこれらの推定をアカウントに適用される手数料と直接照合しません。

Adaptive Acceptance によるコスト削減方法

過度な再試行の防止: この機能を使用すると、以前に試行した決済をブロックできるため、再試行によるペナルティ手数料を節約できます。過度な再試行の防止により、ネットワークの拒否やアドバイスコードに基づくネットワークペナルティ手数料の対象となり、失敗する可能性が高い決済がブロックされます。

決済の失敗の防止: Stripe は AI を使用して、決済が成功する確率を推定します。成功する可能性が低い決済は、カードネットワークに到達する前にブロックされるため、不要なブランドフィーを節約できます。Stripe は、カードネットワークによる決済の試行に関連するネットワークコストとして節約額を計算します。

データのみ 3DS: Stripe は、データのみフローを利用することで、カード保有者に追加の負担を与えることなくブランドフィーを削減します。

ネットワークトークンによるコスト削減

インターチェンジフィーの節約: ネットワークトークンを使用する一部の決済は、インターチェンジレートの引き下げの対象となります。たとえば、Visa は一部の市場で消費者向けクレジットカード非提示決済に対して一定の割引を提供しています。すべての業種が対象になるわけではなく、対象は 加盟店カテゴリーコード (MCC) に基づきます。

スキーム手数料の節約: ネットワークトークンは、古い認証情報の使用に対してネットワークブランドフィーを請求するクレジットカードブランドのブランドフィーを防ぐことができます。たとえば、Mastercard は、古いカード詳細を使用して決済を試行する際に、認証情報継続プログラム (CCP) 手数料を請求します。

Optimization ページには、アメリカとカナダでの国内決済のコスト削減の見積もりのみが表示されますが、他の市場でもコスト削減を実現できる可能性があります。

Stripe は、Visa Digital Credential Updater (VDCU) 手数料など、ネットワークトークンの使用によって発生する可能性のある手数料を反映していません。このような手数料は、ネットワークトークンによる全体的なコスト削減のメリットを減少させます。

日付範囲と集計を指定

日付範囲と集計フィルターを指定できます。範囲と集計を指定すると、すべてのグラフ、指標、表に適用されます。さまざまな集計を選択すると、目標に基づいて傾向とパターンをより明確に確認するのに役立ちます。

日付範囲を指定する

日付範囲を選択し、分析する特定の期間を選択します。分析のニーズに応じて、事前定義されたオプション (過去 3 カ月 や 過去 6 カ月 など) から選択するか、カスタムの日付範囲を設定できます。

集計方法を指定する

日付範囲セレクターの横で、集計期間を選択します。これにより、週次や月次など、特定の期間のデータを表示できます。

Authorization Boost の影響

このレポートを使用して、各最適化機能の推定回収額、回収された決済件数、成功率の増加、コスト削減額を確認します。

- 最適化機能を使用して回収された支払い額を確認するには、支払い額 をクリックします。

- 最適化を使用して回収された支払い件数を確認するには、Payments をクリックします。

- 最適化を使用して節約されたコストを確認するには、コスト削減 をクリックします。

| 回収額 | 最適化機能の結果として正常に処理された決済の推定合計金額。最適化機能がない場合に失敗した可能性があります。収入維持の観点で、最適化の財務的影響を測定します。 |

| 回収した支払い | 最適化機能の結果として正常に承認された個別の決済の推定数。最適化機能がない場合、拒否された可能性があります。 |

| 成功率の上昇 | 最適化機能の結果として増加した承認率の推定値。Stripe は、この機能を使用しない場合の成功率に基づいて、これをモデル化します。 |

| コスト削減 | 最適化機能による推定ネットワークコストの削減額の合計。IC+ ビジネスのコスト削減を促進する可能性のある機能は、Adaptive Acceptance とネットワークトークンです。 |

機能ごとの内訳ではなく、影響メトリックのサマリービューが必要な場合は、Show summary というラベルの付いたこのレポートでスイッチを有効にできます。

コスト削減は、Authorization Boost を使用する IC+ ビジネスの Adaptive Acceptance で利用できます。過去 12 カ月間に Adaptive Acceptance とネットワークトークンで 100 USD 以上相当のコスト削減を達成したビジネスの場合、コスト削減がダッシュボードに表示されます。

内訳をダウンロード

回収された金額と決済に関する分析をダウンロードするには、チャートの下部にある ダウンロード をクリックします。ダウンロードすると、Stripe が決済成功率のメリットのために最適化機能を適用した個別の決済と、この機能を使用した結果として決済が成功した推定可能性が示されます。

決済成功率

このチャートは、最適化を適用しない場合の推定決済成功率を視覚的に比較する際に役立ちます。このチャートの成功率は、非対面クレジットカード決済のみを対象としており、重複排除されたレートではなく未加工のレートを示しています。未加工のレートは、同じ購入を行うすべての試行をカウントしますが、重複排除されたレートは再試行をグループ化し、最終結果に基づいて受け入れを計算します。

青い点線は、最適化機能を適用しない場合の推定率です。