Request a payment data import

Securely import sensitive payment data.

Stripe enables you to retain your existing customer and payment data when you migrate to Stripe. We work with your team and current payment provider, as needed, to securely migrate your information.

This process allows you to accept and charge new customers on Stripe and continue charging your existing customers with your current processor until the migration is complete. Your customers incur no downtime. After the migration process completes, you can process all payments on Stripe.

This guide describes how to migrate to Stripe from another payment processor or a custom payment solution. You’ll also build a Stripe integration that you can test before you go live. If you have any questions about the migration process or integrating with Stripe, see support. If you haven’t already, review Stripe pricing.

If you have to transfer sensitive payment information, you must complete a Data migration request before you migrate. We can help you do so in a secure and PCI-compliant way.

Review Stripe integration features

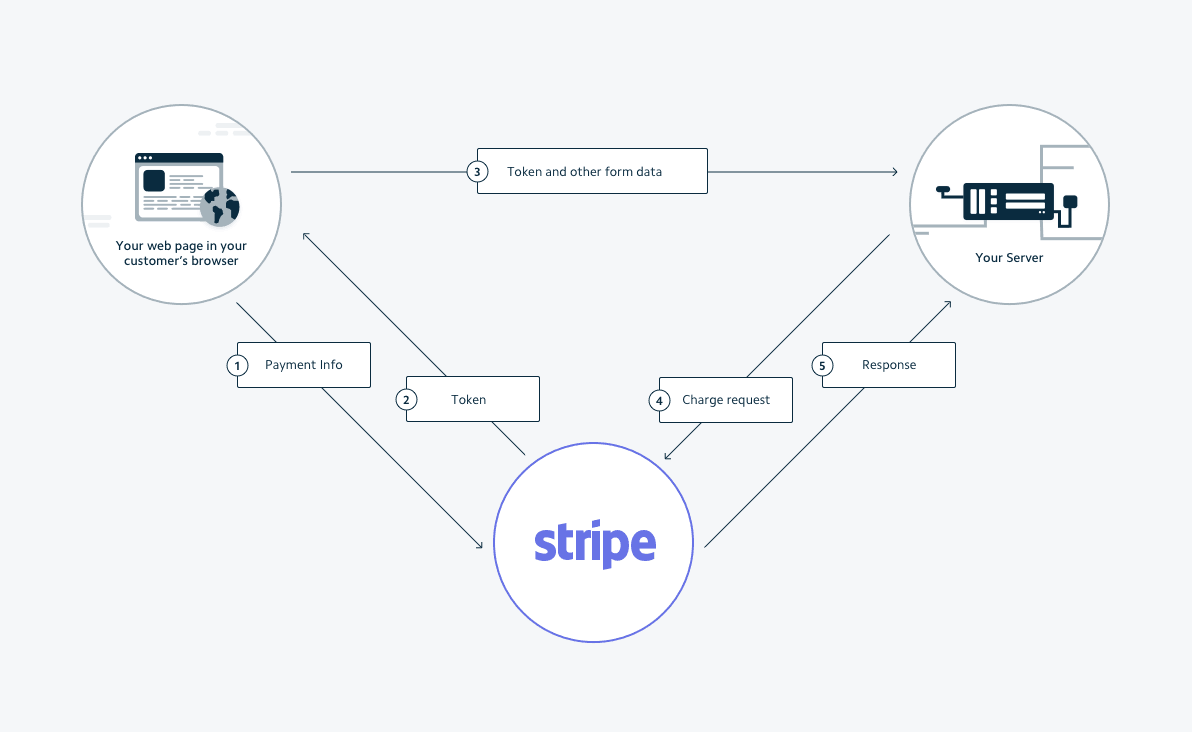

Stripe simplifies your security requirements so that your customers don’t have to leave your site to complete a payment. We do this through a combination of client-side and server-side steps:

- From your website running in the customer’s browser, Stripe securely collects their payment details.

- Stripe responds with a representative token.

- The browser submits the token to your server, along with any other form data.

- Your server-side code uses that token in an API request (for example, when creating a charge).

This approach simplifies your website’s checkout flow, while sensitive payment information never touches your server. This allows you to operate in accordance with PCI-compliance regulations, which can save you time and provide financial benefits.

The Stripe payment process flow

Compared to other payment processors, a Stripe integration can differ in the following ways:

- Your customer never leaves your website.

- Token creation isn’t tied to a specific product or amount.

- It doesn’t require you to create of a client-side key on-demand. You use a set, publishable API key instead.

Create a Stripe account

Before integrating with Stripe, you must create a Stripe account.

- Create an account by entering your email address, full name and country, and creating a password.

- Fill out your business profile.

- In the Dashboard, click Verify your email. Stripe sends a verification email to your email address.

- Verify your email address.

Build a Stripe integration

For all new customer tokens (not imported), implement the following:

Use Customer objects to save the card information.

Collect and tokenise customer card information with one of our recommended payments integrations. Build your Stripe integration before you ask your payment processor to transfer data to Stripe. For most startups, we recommend building an Embedded Checkout integration, a payment form you embed in your website.

To set up this integration, see the Embedded Checkout Quickstart and accept payments for one-time and subscription payments (if applicable).

Create charges for these new customers.

Using this approach, you can accept payments from your new customers on Stripe without affecting your current customers in your existing processor during the migration process.

Integration considerations

Designing your integration before you ask your payment processor to transfer data to Stripe is the most efficient way to handle imported data. Some actions you can take before requesting an import include:

- Remap customer records

- Protect updates to saved payment methods during the migration.

- Enable all optimisations, such as Adaptive Acceptance, card account updater (CAU) and network tokens.

OptionalMap customers to Stripe IDs

If you prefer, you can configure your integration to import the payment method data from prior records into existing Stripe Customer objects. Doing so prevents the migration from creating a new (possibly duplicate) customer in your Stripe account for each unique customer ID in the files we receive from your prior processor.

After migrating, you might still have to update some records to correspond with the new Stripe Customer identifier, if:

- You created the Stripe

Customerbefore migration, then we imported the payment information to update this customer record. - We imported the payment information as a new customer record.

For example, customer jenny.rosen@example.com might have ID 42 in your database, corresponding to ID 1893 in your previous processor’s system, but is ID cus_ in your Stripe account. In this case, you must now map your ID 42 to the Stripe ID cus_ in your database. Stripe provides a post-import mapping file to help you identify required remapping.

OptionalProtect updates to saved payment methods

If customers update their payment information with your previous processor in the window between transferring the data and completing the import, those changes are lost.

Update your site’s process for handling updates to saved payments to prevent errors or billing issues for your customers. This includes preparations to perform a self-migration for any customer without a stored Stripe Customer ID:

- Create a new Customer object in Stripe for your customer.

- Attach the payment method to the

Customerobject. - If necessary, migrate subscriptions.

After migration completes, Stripe automatically handles card-triggered updates, such as expiry date changes.

Test your Stripe integration

To test your embedded payment form integration:

- Create an embedded Checkout Session and mount the payment form on your page.

- Fill out the payment details with a method from the table below.

- Enter any future date for card expiry.

- Enter any 3-digit number for CVC.

- Enter any billing postal code.

- Click Pay. You’re redirected to your

return_.url - Go to the Dashboard and look for the payment on the Transactions page. If your payment succeeded, you’ll see it in that list.

- Click your payment to see more details, like a Checkout summary with billing information and the list of purchased items. You can use this information to fulfil the order.

Learn more about testing your integration.

See Testing for additional information to test your integration.

Request and confirm the migration details

- After you complete your integration and are ready to process payments on Stripe, request your payment data from your previous processor. Many processors require the account owner to request a data transfer.

- Log in to your Stripe account to submit the migration request form to request your import migration.

- Engage with Stripe through the authenticated email thread we create upon receipt of your migration request.

Warning

Never send sensitive credit card details or customer information directly to Stripe. If you have this data, let us know in your migration request form so we can help you securely transfer your data.

Stripe can import your customer billing address information and payment details. You can also:

- Migrate specific payment types

- Migrate subscriptions or import them using the Billing Migration Toolkit.

Your previous processor might take a few days or several weeks to transfer the final data to Stripe. Allow for this transition time in your migration plan. After your previous processor transfers your data, Stripe reviews the data and identifies any problems with the import. We work with you and your previous processor to correct any issues. We then share a summary of the import for your final review and approval.

After your approval, Stripe imports the data into your account. We create a Customer for each unique customer in the transferred data file, and create and attach the customer’s cards as Card or Payment Method objects. If the transferred data specifies the customer’s default card, we set that as the customer’s default payment method for charges and subscription payments.

If your Stripe account has accumulated significant customer records by the time you migrate, consider mapping import data into existing Stripe Customer objects instead of creating new Customer objects.

Stripe typically imports data within 10 business days of receiving the correct data from your previous processor, along with any supplementary data files you want to share with our team.

Update your integration

After completing the import, Stripe sends you a choice of a CSV or JSON file that shows the mapped relationship between your current processor’s IDs and the imported Stripe object IDs. Parse this mapping file and update your database accordingly. Make sure your integration handled any card updates that took place during the transition.

Post import mapping file

After you update your integration with this mapping file, you can begin charging all of your customers on Stripe.

{ "1893": { "cards": { "2600": { "id": "card_2222222222", "fingerprint": "x9yW1WE4nLvl6zjg", "last4": "4242", "exp_month": 1, "exp_year": 2020, "brand": "Visa" }, "3520": { "id": "card_3333333333", "fingerprint": "nZnMWbJBurX3VHIN", "last4": "0341", "exp_month": 6, "exp_year": 2021, "brand": "Mastercard" } }, "id": "cus_abc123def456" } }

The example JSON mapping above shows:

- Imported customer ID 1893 as a new Stripe

Customerwith IDcus_.abc123def456 - Imported customer card ID 2600 as a new Stripe

Cardwith IDcard_.2222222222 - Imported customer card ID 3520 as a new Stripe

Cardwith IDcard_.3333333333

Stripe can import card data as PaymentMethods instead of Card objects if you specify it in your migration request. The following examples show the mapping files for different types of payment information imports.

Monitor your imported payments

After migrating, monitor your payments performance to make sure the acceptance rate for imported payment data matches your expectations.

Payment acceptance (or issuer authorisation rate) is the percentage of transactions that issuers successfully authorise out of all transactions submitted for payment. This metric excludes blocked transactions (for example due to Radar rules) because those are never submitted for authorisation.

In both your general approach and post migration, align your payment authorisation optimisation goals with your business objectives. For example, a digital goods business with low unit cost might set their risk level to block fewer payments. Consider the potential effects:

- Increased conversion rates due to less friction.

- Increased exposure to fraud due to riskier payments getting through.

- Lower raw issuer authorisation rates due to fraud model blocks by the issuer.

Make sure you provide accurate data (such as cardholder name, billing address and email). Reflecting the cardholder’s intent maximises successful authorisation potential.

Identify cards on file

Payment data migrations involve cards on file (cards saved for a future merchant-initiated or off session payment for the same customer). Make sure you store imported payment data and label payments using those cards on file with the correct off_ parameter. If you improperly identify cards on file:

- Issuers who can’t confirm a cardholder’s consent to future or recurring payments might decline them.

- The payment data might be ineligible for certain Stripe optimisation products such as Card account updater (CAU) and Network tokens (NT).

Monitor decline reasons for optimisation opportunities

Following your migration, your issuer decline reasons can help you identify whether migrated payment data is transacting as expected. Spikes in certain types of declines might benefit from the following optimisation products:

- Card account updater: Stripe partnerships with card networks allow us to automatically obtain updates for expired or replaced cards in both real time and the background.

- Automatic retries (Dunning): Use caution because retrying numerous cards (such as after a migration) can appear suspicious to issuers. If you use Stripe Smart retries for your billing payments, our AI model analyses decline code, payment method updates, and bank risk threshold activity to retry recurring revenue payments more strategically.

- Network tokens: Replace a specific payment account number (PAN) with a secure token from the card network to make sure PAN updates (like renewal or replacement) automatically reflect in the token.

- Adaptive acceptance: Stripe uses AI to assess the effect of minor adjustments (such as formatting) to an authorisation request in real time, then refines the payment retry before returning the original decline to the customer.

- Customer outreach: Asking your customer to log in and re-enter or re-verify their payment details often re-establishes your business’s trustworthiness with the customer and the payment providers. Consider notifying customers through channels other than email, such as text messages or in-app notifications.

The following table shows which optimisation products offer improvement for a variety of decline reasons.

| Decline codes might include | Migration effect | Do | Don’t |

|---|---|---|---|

| Updates to card data during the natural migration lag can cause saved card data to be out of date. |

| Retry |

| Changes to your statement descriptor or other identification markers might trigger issuer risk models or confuse your customer. |

| Card account updater |

| Some migrated payment data might be missing initial card validation details, such as the network token or original transaction ID. |

| Network tokens |

| Customers might report lost or stolen cards during a migration lag. Look out for a special CONTAC event in conjunction with these declines. |

|

|

1 Retrying lost or stolen payment data can appear suspicious to card issuers.

OptionalMigrate subscriptions

Migrations that involve subscriptions typically involve these stages:

Set up your billing integration.

Import your subscriptions to Stripe Billing.

You can import existing subscriptions by using either the Subscriptions API or the Dashboard’s Billing migration toolkit.

After leaving your payment processor, confirm they have cancelled all automatic billing of your customers.

Migration PGP key

If you’re unfamiliar with PGP, see GPG and start by importing a public key. After you familiarise yourself with the basics of PGP, use the following PGP key to encrypt sensitive data (such as credit card information) for PCI-compliant migration.

PGP migration key

-----BEGIN PGP PUBLIC KEY BLOCK----- mQINBF0dLOEBEADMhdKpL6HmgV3rGuW/Qj9by6I/bdCOX9HrGf6MNXr00rtOKSQ5 KpM6pacMxXeaUKXgKGiU6gFWq3r6NXLRcKCmTGlnyuS2gI1Pv6R3uo+tjzeuRhiR dKFiGDZOcreZ7b2x6q4DmpAIdf4mnVwHvLT2IeZBIDb/VlZnyIBBtUiTohmL6rVp waAsjutd9tmnAQg/Mu/Y4C2QArr2Bqy9XlD1osyqBBOaWLKM/opoh4gpxSH90f5C ymAZykMMk8EnPQ6F8lro6BFkOSw1wu47fBijf7pq1a15JyoA66UkPmCXiuV0XrJc k6stzjh1zPBrhdtcQ6TaDsyxoPCzLJ4I38SSGtXdJ+jfn8WTt1Qbl4JSI1UfrbSL nnoaAnKjy4H5q3MI7o3b87IKYe4zzFn0vPU4xOaT7AJNPu0x/BBk0bGFGw37i8+5 6FXmb+wWloT1aCA5GzpvmYGrQNK2aI2vCTlOg0IJJJzLCXpar4RzB5mSFoxaRlC/ VW5o2TndrWmQKW0yiAlTefh1Kk88h8E0bCVcklaTTaXkNk5OJJiVvf2XjbIPcKoq mQ7N0ExfEiDQhgmABbG3KmWjHjvciaMsxVKYE1nBOhyPXaT3BRuKbOcyhWX8SF07 B31Awq/WKhMH/S6LZOqg9ui7UyohS1XkLiFhlPOStkK4Hn77guVidsTARQARAQAB tDdTdHJpcGUgSW1wb3J0IEtleSAoUENJKSA8c3VwcG9ydC1taWdyYXRpb25zQHN0 cmlwZS5jb20+iQJUBBMBCAA+AhsDBQsJCAcCBhUKCQgLAgQWAgMBAh4BAheAFiEE rr98SDjETS/cmaP5nHi3Ygwema0FAmiIR7MFCQ28XdIACgkQnHi3Ygwema0CWhAA qp0oE4JN5vibCoEw+g3YFOpkGSwQtK1Ean3UITw62kjG0gg7VXe+b9TX0QxpYDvb pYzhc2Cjwz1owyJw3WvB6VZlEUR0IBFNJXDZJmDnkrgRa2FV0Zw5GUvRg9DCKzi1 29xjOVyHYgt8fOTPEzvqfWDI1tAfzCthtGh91iSmYqcfyQN/c69is770VZIryp1i mlt3a/65nh8wkaI8rmZOsoolDkOJ1u9cJwhFL5Vcj9b2RRXjpk/yBmTtFt5SrdmJ wT92/l5Zz4ZWPg44yFPKpZxarrz2Rf4pZu7EV0E/+tWGW+Pe5g+n/3UYB/lLI9gM JACV1OSEncN9Qb8voqE1gHSJFtr3oFgHkLpkz0kKy7/SLf7HfCjuAU98aLs5/lLO V0jCscrLEMATRWrAcNKuIYv5wihMZSb25jG573+YqAmb7Pl/mo66UOVYNLcGG1TH ytBDXplnp7a5RKfjxOem36nJNO1jyuFHHVZPX1P9nGR1g1bwHfTFkZB5uOPVSTTa 5dkLwWe/3p/VrdxGzQIHQZYnvInp4Db9Spl0WWvfZc2uztagUlYA1KikxDqAqCDz wjYWP5l3WWb6WpoxlfbCjP6clDeZhPCEu0iAsJOqKCN3GVBYM8quaMZllV/L/Qto LswrTvLpYcgxokbFF7UfnoQ9X1MT7fL8OlOMZyzvX9iJAlQEEwEIAD4CGwMFCwkI BwIGFQoJCAsCBBYCAwECHgECF4AWIQSuv3xIOMRNL9yZo/mceLdiDB6ZrQUCXbtk kwUJAu9TYwAKCRCceLdiDB6ZrRvyD/9QHjvBRlFsA6XDr98/ik0xlx3vkVU6fx2c xWu2C+yGEQwe1QZzctKfWALuANLEUKuoVWM/waqyfazAMzKHY+X7P4f8kilu14iF hlCux+nh+N63jmKCQDDv3DmpTCmOisRjS4XDkKwIIIUSDmgUiEkYGXjTzWGTTE/w hszmWo/K7Y0n37gteLF0pH10rr/cQrP4PgtQEPIpIdRooiL2tgAx2fGcUxyC4FsO CHK/1gIKdu/cUaWOZj2cdde1khOHrkcOeM/mOwt+e5u6QgPmAm7q0TBxzfUbRxhE oDWICSxlL6ZjFpzK9e+D7QwAP9991NNrumaOmmvB5Q3v0tnrR2NwwJSaveHIfagz Ej+RVEUQWGUCbdqCnE8CbD/MCxL5sMS47tgbzd03A88DKH+y464eh+Jt1aaidNqq k3rug7kmsvPMNe8lhUPjHm/e4gGgBfU8aRbnMeR6K+9w9mnFEzZi48AhXMFVMg3p acaXYajk0Z3yJpJgpSYU9oC+1zlHsdrQyrBXIszbv285mcDpubBvoXwJ2NE7+WM8 qHjNlL1RH8ueNmkfUed1p2S2JGnjus4PzJB1c0VbC0Z/w5OcYYMsCfnXOr9PVig2 I099h9k04M/NlNg0CkhUF/hU40h0j1Rjrodq2pA4pjmDjrNSOuSJd04MzKJ0PlXi lxXTLWPSPokCigQTAQgAfgWCZoX/LwWJC7oVTgULCQgHAgmQnHi3Ygwema01FAAA AAAAHAAQc2FsdEBub3RhdGlvbnMub3BlbnBncGpzLm9yZ8lEWqzpgmaFZNuUMypY pbYGFQoJCAsCBBYCAwECF4ACmwMCHgEWIQSuv3xIOMRNL9yZo/mceLdiDB6ZrQAA Q5MP/jfANxfiNIGsMrIpR7ehxNPBUWckHtZewG4JhOxzzvgx0Z5xu5I/NoLKX5x4 tWkDZuEmDVnyFkKA6k5KcjoQOFhMLyc8bbAPs/YIb4D0aAvz1OY6+OChuxQkAu+z D6o3RalSjbSwyYmPjaLZ+d2MoXASI+kmfQEynXO5zb3Hnst+f8GDLIatbdC5tKCv 3Lnb+KWfjVtRZRCpZDSEYq8l3D7pnADFsSI397A7A/lfmJXIx5sNVZkJnRKmt63y bK7CCOyKdeTFPw+ZCaB3Zx6LRdrLOvgU0TYXiUqHcv89BGls0WjDOgqBl2Gh2pLd uZPAQd2SY0Z7Q0WcvGIkrI9/6gBRtOutTLCz0VqaPbIk7QitPyveCtzw2skHKamQ 3OqnGd7Arl0yjwsJVVYXgno+XnZkT/Mwh94qLjKhDk3DEuVKMPWTCuILRvc2EGLG ZCUa75tQkOY7Lxr5okDuHDejwex4frUdWTGywX49fTLn3s++zPCK5gUHwUjPGuk5 T7mVs88InYersl3XjD4TBXu1jeqdVUxurJfaTWfwMm8zj3aESOs9/iut7SdRmju2 1uH795gAdoKROLxQ+IVh+1+TkTKk5Ez3E7PqMKw3iO2t5UhcxFrzKWcWGIjiFczL Tkl3sUuRQiK6mMrWfogbfSukNLtXssIQQgWV2lEyMbUZJhnnuQINBGiIR7ABEADD 52AdYHl2ADOO/27jBhM1G7cm0evyIBqsKmcMiSW5A7UKASBIkkVYoG/BxhLsXiEe AtW03mMuSVz+aEa4ceUgfIqFOfX9NDT4fXx7XZl/IrtsUFUHX8odhjXaw1w6emYK k1NYfILdjUJw9Bg2yOo/hgbggGlPQq48EuAdRfCRD5WqblBj6IiwPfqLFuTqRk5m v0R96SMKbnjnu23mR3utPU9RKfWtp9CKsV8zJdqnLHGhjw85Og5pOIcOLzGoOczP r3Fr8u58RErrxQOJJixsVHrPHg8xkP/apS7LNZFpCOuVHKqCS3qtU6eSXjv7Ewm8 SrGMoveb4zSs3duS+VLSjzcXGiMT+8HbyRgKsVbrbPm6h1KafAyLltpfn8yGxB0J OhharUyxvvQ2Vm18EGWmGqI4fsyI3jI09AiAgr4tmq5r9rywgTG6ZCm0YqPfM9fR XR2j7MiEZb+aJnAoxFzzA6ml6xdxVIidUbvpUwE4O4g7VN0teSwaJ5FVNIFGcAg+ FUtICFKCUiqBJgNnF+7+0B8kvjsrzA1516WPT63H98QCtqQJ5KHYZCvwYpH1tblY XegzBj6D6iIvzU2y64z2S6h+sNQm3hCDzGR3tF7GPUvROlU84yh6s6paWfbU1N4B FePfRXsgokVHnySQ6fOyKOBQqPeonbQQFyQFhWUYNQARAQABiQJyBBgBCABmBYJo iEewBYkCUUMACZCceLdiDB6ZrTUUAAAAAAAcABBzYWx0QG5vdGF0aW9ucy5vcGVu cGdwanMub3JncK+GTUJHs+MV+2qdMoDXZwKbDBYhBK6/fEg4xE0v3Jmj+Zx4t2IM HpmtAADzng/9Hxm1uLdMPzABwGy3iWAH+b3V44YuR4HIuGoBUi6KiuoOFlBSr0bg oIUPfnCsapdJhVjoxcQGuT6DDiaAmib1acS7MUEQ/+yRe8dluAh3Rae5uOfocDNF GyhaMLN7/rzcpdCc0qMCt3A+ztfMdD1H6dxxeODXW80k3XvsxYpQsqV/ask2oKy7 NP8tDVPJc16tKHRDxsPnMUbYkIdLb5g3QG6bbfpqqiiOgFnEZV64PVWjuPOXu9Dn 1iHkaniFC7IyNz4UTIUI/2e5VBOdTePD5h84bfETiGP34x/4gfUbRSq0HUl2KTzA Z+6JjA8vR2XB7knXfWNS9yqTj/qd3b16dB9Nng3YhPcVx+4Vg3Ril2+4ZSHvcBFh O0o3/9V/jcPQkY8gr6vhzIY2mbCDWsaBt3W6Ng2khKyGLKptQDrLGg8ClwcJk5jI cr+nNsfd+0SPN5GqDHBO71PGtBdjYkRokokaN2GielTnbUPsp84zRfKw9W5l+Q3V Oh58dec99YU+8XG2zFsp4QhQaTYU23C+MpkH2Kqmh2kx87hwSg5ZXhhPWVBQT1BQ 1rTlrOTCXYFCH3OkuY/r81QDp2mUi8Fe86chx5oEpt2ssTXVsvSqUm1dG9D4ey0m meO+DkViiuNlh4HiR1bvUiEZgEXk9E4JJfiYu4G7XOgYDgoODEhlXCa5Ag0EaIhH sQEQALVNO9UXhXaPAPlMybrlrbOZzU3whEt1ZPNZKmkjTpcxZjQUx2yrUSZU2u+3 oehKyGBUy824iYoJB5AKVK91PctFYLwQt0hE4BEERED33tyIiiKqGz2BhSyjp4Co vH1/btVaVj+0n+tC6knhBio6ZrSunwSTD1BigPlPn9938AOhAJBU54yXxl/aImk9 O1yaL62L1jhyEv7BnuA5F4COuHvDOWb7vCI4XRzHp/c8kodqrl6srrtlEhWNfKf5 apjzozZYylO5u1isS6Axl9Q4xf1Goe/zCiK1Qt7Dd2zbcUtGLRNmP1CX+9N7kVuy RzKAsuCmCIGpd0gl1GMbaZDIbVd+7PM6kuzfNKRWS2+stcLnXcAswfhq9Zq6grYd m1KMwrncZSU0JqpPPM2pMdGsUlj79mWzWSPe2+q130bvKumgrHWx9ULScPaTzPtW r09GfWo1WVk/3ZPfSR7RoVePM2tlOaPxDqRkyB48pF/pKEi48NFnr833Uj41X77b cZ1lTxnO2yYOonZIqAfBMYAlJSwVxBOyXFcGQ4JwHWDi9awLVg/l3GI1Ej4AQiC+ 0pBQo+BTOyMyFc1k+lvpqmJGK8sOrh140v2cwrWCeG0Gfex9UvW5ij1f39s+VPhh ULQ7+q25Oa9KSucyfLdvNyuOkadY1VMkP8dtWuA3j01TNKvNABEBAAGJBN4EGAEI AtIFgmiIR7EFiQJRQwAJkJx4t2IMHpmtNRQAAAAAABwAEHNhbHRAbm90YXRpb25z Lm9wZW5wZ3Bqcy5vcmcnmN0IqYukWu5pzJ/oLc/5ApsCwaqgBBkBCABdBYJoiEex CZAmHJ8UDAH+qzUUAAAAAAAcABBzYWx0QG5vdGF0aW9ucy5vcGVucGdwanMub3Jn NKmnAi8o6+BMlW072h0jlhYhBPCl1ySA+BaTKEvAqyYcnxQMAf6rAAD8EBAAicic e6nNWAUUkO6QpvZMwWIMSnXKZrtJZ51tBOKoNJL9T1ej4Xqwj6YWBrO0guRpkS3H IO51NpRTinyCUJeEIV0KLGrjelkrlaCHM/hdRR6RRfsOyPVrnVsjCDKyre55lpuu 0jVEsy86/7PjYwZXSWaudKbehPq9qFO4MOJPIn9Nw/ZgcuEMPpPBsnhKPXvcAoDl CFOJt7OIO1FBNDS+6Eo6H5nQx/bkgUk5bHLP1fD4pimMtkb9I3VkxIkUWJy2/S5M P0BckIG2Vcp7Wzrso2Px9RBb5rJ53kqZhid+KlIDV367zpfeH/ps+rE5winn4A/v Vo2Wh6duPuUDCJNKsmCS2EV/CSZl/ciTkdp6QX481hjJO3KUP/7ea0bsaKbn6lUp pU+9aKXHNtXDJIKI2YDYm7GWrwK7LBF87clCuk/fclpabXEH1Hal3iLFu3sg9Tg2 cWXB5TlQyExLr7QXOUj6/hg+QTWMHi+YlHXkYoLkViLD7BWLh9bNmiinlHVcuEdF ecuiSVSHWCpolCEf3KiqFz666yV7aC4sHZYaj8M1ZgTQJwX1QDxoM23AGfwy7gL9 8h8sigwXYQUanSshn9Epqf58RlmXcQOvpstxetat2hdL8aK/Bue2D0W7TXiRaxMD wYa2CQFuaVG7DD38VXQg2l0QtEDMeAkP/boB/kwWIQSuv3xIOMRNL9yZo/mceLdi DB6ZrQAACisQAMteqROrtHs7yhnJwQQczleH2OGXipPAOzjuMV4UOy+jArNe1KMv ejFYqe8Rm8JAhYv3FH0MXGXIA2rN5Hr8R+SoEW+bFcSqhXHhS+Q9pyJCXeUdfyTY IyFZ9gAStkAahJlVpfjrJQOWT1C9dKuuScM/oNqdS2EtTV1hzAa29+HNWrymHTCD qmFFXtml1wI3q3bXpm8O+rtip7NxUEFsfR0rWjWcpYmWZmaR3b48O2Q9a+K5j5xC 9/Uy8Af5UQx/eG1xIHcuOaRtFq5GnihoQO8bQBuO/ZWnC5/3JaeR7Z+b6pA+xAaS 3yFyqz5QZ7aBi5JzmtP1thrBSM3A9zccUXaodFJMi873o7Ikm2UOBRbekSFGZmrO xQJErZO+dsPbVo1bRiclhX7QAsekOrN5EoGHE70jydpjDEfMseSkYtagdJ+CeOGi fYkscA82n9T5L4AT/R8b4mRhXNpNzTgVPRIzy9p8D9F/1P2DMdkgxktL9ERwK5GK +mHmLbxvweaASItyL8p+jHsB2hvtHApspJJg6BBFJd9hyf9WrYXXYqOId1qaF63R I1BJnzLQEE67I3WH85OjDJkzKpmfXyaEIx3NPyAc5DNI9TzKVzN1aTxXERD2qhF4 poldz4ItCF+g7ojsIplxf6nFaYita51LjBwTGkXXi+J7bZAqu1koYOwZ =+4/r -----END PGP PUBLIC KEY BLOCK-----

This creates FILENAME.gpg with the following information:

- Key ID:

9C78B7620C1E99AD - Key type:

RSA - Key size:

4096 bits - Fingerprint:

AEBF 7C48 38C4 4D2F DC99 A3F9 9C78 B762 0C1E 99AD - User ID:

Stripe Import Key (PCI) <support-migrations@stripe.com>

After you import our key, you can encrypt files to send by running this command in your command line prompt:

gpg --encrypt --recipient 9C78B7620C1E99AD FILENAME

For more details on providing encrypted data to Stripe, see Upload supplementary data.