Create separate charges and transfers

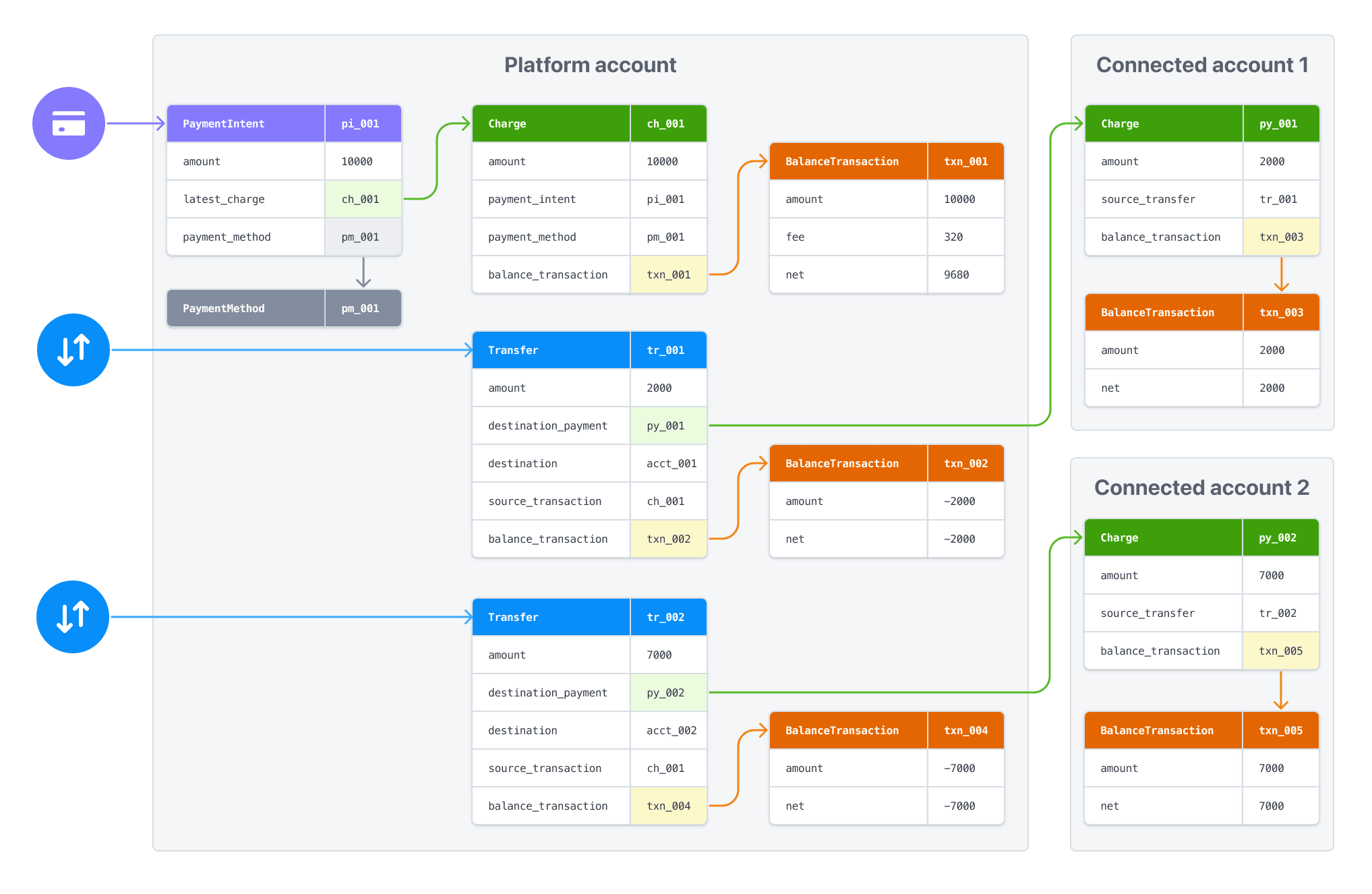

Create charges on your platform account and transfer funds to multiple connected accounts.

Create separate charges and transfers to transfer funds from one payment to multiple connected accounts, or when a specific user isn’t known at the time of the payment. The charge on your platform account is decoupled from the transfers to your connected accounts. With this charge type:

- You create a charge on your platform’s account and also transfer funds to your connected accounts. The payment appears as a charge on your account and there are also transfers to connected accounts (amount determined by you), which are withdrawn from your account balance.

- You can transfer funds to multiple connected accounts.

- Your account balance is debited for the cost of the Stripe fees, refunds, and chargebacks.

This charge type helps marketplaces split payments between multiple parties. For example, a restaurant delivery platform that splits payments between the restaurant and the deliverer.

Note

Funds segregation is a private preview feature that keeps payment funds in a protected holding state before you transfer them to connected accounts. This prevents allocated funds from being used for unrelated platform operations. Contact your Stripe account manager to request access.

Stripe supports separate charges and transfers in the following regions:

Cross-border transfers

Stripe supports cross-border transfers on the payments balance between the United States, Canada, United Kingdom, EEA, and Switzerland. In other scenarios, your platform and any connected account must be in the same region. Attempting to transfer funds across unsupported borders or balances returns an error. See Cross-border payouts for supported funds flows between other regions.

You must only use transfers in combination with the permitted use cases for charges, tops-ups and fees. We recommend using separate charges and transfers only when you’re responsible for negative balances of your connected accounts.

Build a custom payments integration by embedding UI components on your site, using Stripe Elements. The client-side and server-side code builds a checkout form that accepts various payment methods. See how this integration compares to Stripe’s other integration types.

Integration effort

Integration type

Combine UI components into a custom payment flow

UI customization

CSS-level customization with the Appearance API

First, register for a Stripe account.

Use our official libraries to access the Stripe API from your application:

Create a PaymentIntentServer-side

Stripe uses a PaymentIntent object to represent your intent to collect payment from a customer, tracking charge attempts and payment state changes throughout the process.

The payment methods shown to customers during the checkout process are also included on the PaymentIntent. You can let Stripe automatically pull payment methods from your Dashboard settings or you can list them manually.

Unless your integration requires a code-based option for offering payment methods, don’t list payment methods manually. Stripe evaluates the currency, payment method restrictions, and other parameters to determine the list of supported payment methods. Stripe prioritizes payment methods that help increase conversion and are most relevant to the currency and the customer’s location. Stripe hides lower priority payment methods in an overflow menu.

Retrieve the client secret

The PaymentIntent includes a client secret that the client side uses to securely complete the payment process. You can use different approaches to pass the client secret to the client side.

Collect payment detailsClient-side

Collect payment details on the client with the Payment Element. The Payment Element is a prebuilt UI component that simplifies collecting payment details for a variety of payment methods.

The Payment Element contains an iframe that securely sends payment information to Stripe over an HTTPS connection. Avoid placing the Payment Element within another iframe because some payment methods require redirecting to another page for payment confirmation.

If you do choose to use an iframe and want to accept Apple Pay or Google Pay, the iframe must have the allow attribute set to equal "payment *".

The checkout page address must start with https:// rather than http:// for your integration to work. You can test your integration without using HTTPS, but remember to enable it when you’re ready to accept live payments.

The Payment Element renders a dynamic form that allows your customer to pick a payment method. For each payment method, the form automatically asks the customer to fill in all necessary payment details.

Customize appearance

Customize the Payment Element to match the design of your site by passing the appearance object into options when creating the Elements provider.

Collect addresses

By default, the Payment Element only collects the necessary billing address details. Some behavior, such as calculating tax or entering shipping details, requires your customer’s full address. You can:

- Use the Address Element to take advantage of autocomplete and localization features to collect your customer’s full address. This helps ensure the most accurate tax calculation.

- Collect address details using your own custom form.

Request Apple Pay merchant token

If you’ve configured your integration to accept Apple Pay payments, we recommend configuring the Apple Pay interface to return a merchant token to enable merchant initiated transactions (MIT). Request the relevant merchant token type in the Payment Element.

Submit the payment to StripeClient-side

Use stripe.confirmPayment to complete the payment using details from the Payment Element. Provide a return_url to this function to indicate where Stripe should redirect the user after they complete the payment. Your user may be first redirected to an intermediate site, like a bank authorization page, before being redirected to the return_. Card payments immediately redirect to the return_ when a payment is successful.

If you don’t want to redirect for card payments after payment completion, you can set redirect to if_. This only redirects customers that check out with redirect-based payment methods.

Make sure the return_ corresponds to a page on your website that provides the status of the payment. When Stripe redirects the customer to the return_, we provide the following URL query parameters:

| Parameter | Description |

|---|---|

payment_ | The unique identifier for the PaymentIntent. |

payment_ | The client secret of the PaymentIntent object. |

Caution

If you have tooling that tracks the customer’s browser session, you might need to add the stripe. domain to the referrer exclude list. Redirects cause some tools to create new sessions, which prevents you from tracking the complete session.

Use one of the query parameters to retrieve the PaymentIntent. Inspect the status of the PaymentIntent to decide what to show your customers. You can also append your own query parameters when providing the return_, which persist through the redirect process.

Handle post-payment eventsServer-side

Stripe sends a payment_intent.succeeded event when the payment completes. Use the Dashboard webhook tool or follow the webhook guide to receive these events and run actions, such as sending an order confirmation email to your customer, logging the sale in a database, or starting a shipping workflow.

Listen for these events rather than waiting on a callback from the client. On the client, the customer could close the browser window or quit the app before the callback executes, and malicious clients could manipulate the response. Setting up your integration to listen for asynchronous events is what enables you to accept different types of payment methods with a single integration.

In addition to handling the payment_ event, we recommend handling these other events when collecting payments with the Payment Element:

| Event | Description | Action |

|---|---|---|

| payment_intent.succeeded | Sent when a customer successfully completes a payment. | Send the customer an order confirmation and fulfill their order. |

| payment_intent.processing | Sent when a customer successfully initiates a payment, but the payment has yet to complete. This event is most commonly sent when the customer initiates a bank debit. It’s followed by either a payment_ or payment_ event in the future. | Send the customer an order confirmation that indicates their payment is pending. For digital goods, you might want to fulfill the order before waiting for payment to complete. |

| payment_intent.payment_failed | Sent when a customer attempts a payment, but the payment fails. | If a payment transitions from processing to payment_, offer the customer another attempt to pay. |

Create a TransferServer-side

On your server, send funds from your account to a connected account by creating a Transfer and specifying the transfer_ used.

Transfer and charge amounts don’t have to match. You can split a single charge between multiple transfers or include multiple charges in a single transfer. The following example creates an additional transfer associated with the same transfer_.

Transfer options

You can assign any value to the transfer_ string, but it must represent a single business action. You can also make a transfer with neither an associated charge nor a transfer_—for example, when you must pay a provider but there’s no associated customer payment.

Note

The transfer_ only identifies associated objects. It doesn’t affect any standard functionality. To prevent a transfer from executing before the funds from the associated charge are available, use the transfer’s source_ attribute.

By default, a transfer request fails when the amount exceeds the platform’s available account balance. Stripe doesn’t automatically retry failed transfer requests.

You can avoid failed transfer requests for transfers that are associated with charges. When you specify the associated charge as the transfer’s source_transaction, the transfer request automatically succeeds. However, we don’t execute the transfer until the funds from that charge are available in the platform account.

Note

If you use separate charges and transfers, take that into account when planning your payout schedule. Automatic payouts can interfere with transfers that don’t have a defined source_.

Test the integration

See Testing for additional information to test your integration.

OptionalEnable additional payment methods

Navigate to Manage payment methods for your connected accounts in the Dashboard to configure which payment methods your connected accounts accept. Changes to default settings apply to all new and existing connected accounts.

Consult the following resources for payment method information:

- A guide to payment methods to help you choose the correct payment methods for your platform.

- Account capabilities to make sure your chosen payment methods work for your connected accounts.

- Payment method and product support tables to make sure your chosen payment methods work for your Stripe products and payments flows.

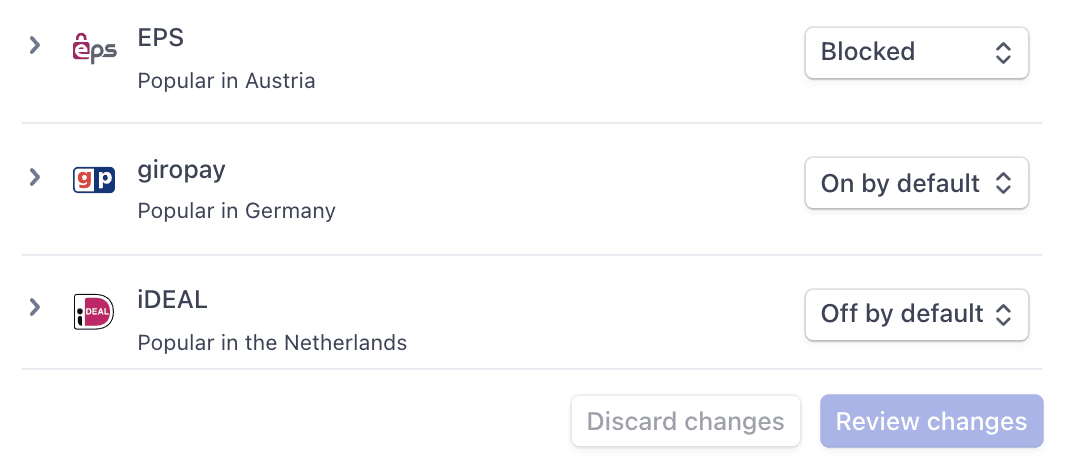

For each payment method, you can select one of the following dropdown options:

| On by default | Your connected accounts accept this payment method during checkout. Some payment methods can only be off or blocked. This is because your connected accounts with access to the Stripe Dashboard must activate them in their settings page. |

| Off by default | Your connected accounts don’t accept this payment method during checkout. If you allow your connected accounts with access to the Stripe Dashboard to manage their own payment methods, they have the ability to turn it on. |

| Blocked | Your connected accounts don’t accept this payment method during checkout. If you allow your connected accounts with access to the Stripe Dashboard to manage their own payment methods, they don’t have the option to turn it on. |

Payment method options

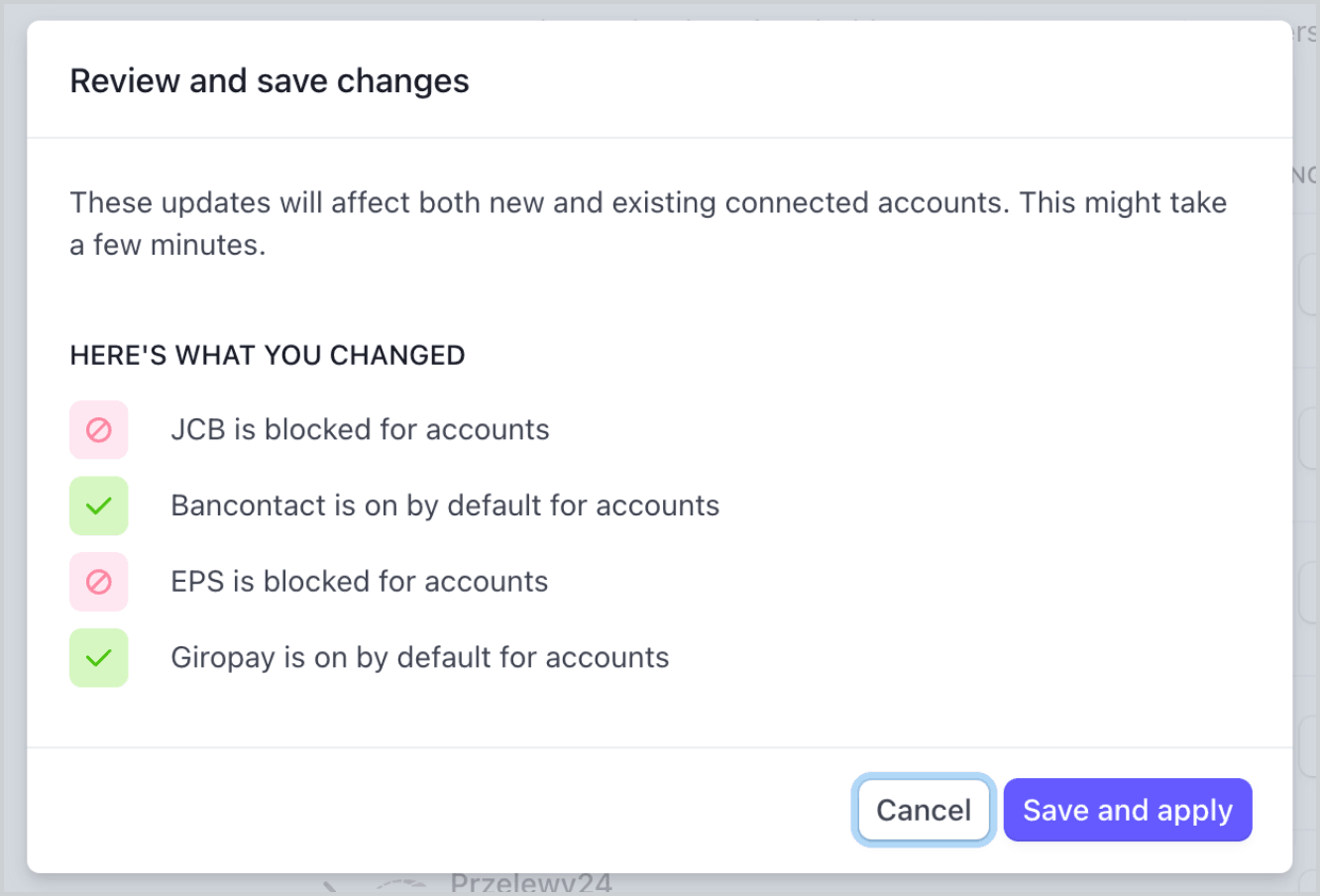

If you make a change to a payment method, you must click Review changes in the bottom bar of your screen and Save and apply to update your connected accounts.

Save dialog

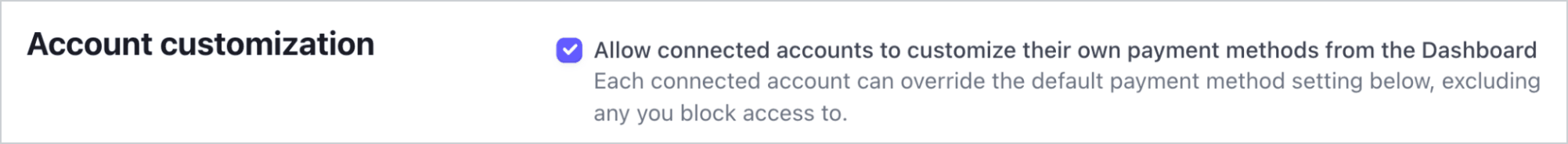

Allow connected accounts to manage payment methods

Stripe recommends allowing your connected accounts to customize their own payment methods. This option allows each connected account with access to the Stripe Dashboard to view and update their Payment methods page. Only owners of the connected accounts can customize their payment methods. The Stripe Dashboard displays the set of payment method defaults you applied to all new and existing connected accounts. Your connected accounts can override these defaults, excluding payment methods you have blocked.

Check the Account customization checkbox to enable this option. You must click Review changes in the bottom bar of your screen and then select Save and apply to update this setting.

Account customization checkbox

Payment method capabilities

To allow your connected accounts to accept additional payment methods, their Accounts must have active payment method capabilities.

If you selected the “On by default” option for a payment method in Manage payment methods for your connected accounts, Stripe automatically requests the necessary capability for new and existing connected accounts if they meet the verification requirements. If the connected account doesn’t meet the requirements or if you want to have direct control, you can manually request the capability in the Dashboard or with the API.

Most payment methods have the same verification requirements as the card_ capability, with some restrictions and exceptions. The payment method capabilities table lists the payment methods that require additional verification.

Specify the settlement merchant

The settlement merchant is dependent on the capabilities set on an account and how a charge is created. The settlement merchant determines whose information is used to make the charge. This includes the statement descriptor (either the platform’s or the connected account’s) that’s displayed on the customer’s credit card or bank statement for that charge.

Specifying the settlement merchant allows you to be more explicit about who to create charges for. For example, some platforms prefer to be the settlement merchant because the end customer interacts directly with their platform (such as on-demand platforms). However, some platforms have connected accounts that interact directly with end customers instead (such as a storefront on an e-commerce platform). In these scenarios, it might make more sense for the connected account to be the settlement merchant.

You can set the on_ parameter to the ID of a connected account to make that account the settlement merchant for the payment. When using on_:

- Charges settle in the connected account’s country and settlement currency.

- The fee structure for the connected account’s country is used.

- The connected account’s statement descriptor is displayed on the customer’s credit card statement.

- If the connected account is in a different country than the platform, the connected account’s address and phone number are displayed on the customer’s credit card statement.

- The number of days that a pending balance is held before being paid out depends on the delay_days setting on the connected account.

Accounts v2 API

You can’t use the Accounts v2 API to manage payout settings. Use the Accounts v1 API.

If on_ is omitted, the platform is the business of record for the payment.

Caution

The on_ parameter is supported only for connected accounts with a payments capability such as card_payments. Accounts under the recipient service agreement can’t request card_ or other payments capabilities.

Collect fees

When using separate charges and transfers, the platform can collect fees on a charge by reducing the amount it transfers to the destination accounts. For example, consider a restaurant delivery service transaction that involves payments to the restaurant and to the driver:

- The customer pays a 100 USD charge.

- Stripe collects a 3.20 USD fee and adds the remaining 96.80 USD to the platform account’s pending balance.

- The platform transfers 70 USD to the restaurant’s connected account and 20 USD to the driver’s connected account.

- A platform fee of 6.80 USD remains in the platform account.

Application fees with funds segregation

Funds segregation is a private preview feature that allows you to debit application fees directly from allocated funds during transfer, providing clean accounting separation. Contact your Stripe account manager to request access.

To learn about processing payments in multiple currencies with Connect, see working with multiple currencies.

Transfer availability

The default behavior is to transfer funds from the platform account’s available balance. Attempting a transfer that exceeds the available balance fails with an error. To avoid this problem, when creating a transfer, tie it to an existing charge by specifying the charge ID as the source_ parameter. With a source_, the transfer request returns success regardless of your available balance if the related charge hasn’t settled yet. However, the funds don’t become available in the destination account until the funds from the associated charge are available to transfer from the platform account.

Transfers with funds segregation

The private preview funds segregation feature requires the source_ parameter for transfers from allocated funds so they are linked to their original payment.

Note

If a transfer fails due to insufficient funds in your platform balance, adding funds doesn’t automatically retry the failed action. After adding funds, you must repeat any failed transfers or payouts.

If the source charge has a transfer_ value, Stripe assigns the same value to the transfer’s transfer_. If it doesn’t, then Stripe generates a string in the format group_ plus the associated PaymentIntent ID, for example: group_. It assigns that string as the transfer_ for both the charge and the transfer.

Note

You must specify the source_ when you create a transfer. You can’t update that attribute later.

You can get the charge ID from the PaymentIntent:

- Get the PaymentIntent’s latest_charge attribute. This attribute is the ID of the most recent charge associated with the PaymentIntent.

- Request a list of charges, specifying the

payment_in the request. This method returns full data for all charges associated with the PaymentIntent.intent

When using this parameter:

- The amount of the transfer must not exceed the amount of the source charge

- You can create multiple transfers with the same

source_, as long as the sum of the transfers doesn’t exceed the source chargetransaction - The transfer takes on the pending status of the associated charge: if the funds from the charge become available in N days, the payment that the destination Stripe account receives from the transfer also becomes available in N days

- Stripe automatically creates a

transfer_for yougroup - The currency of the balance transaction associated with the charge must match the currency of the transfer

Asynchronous payment methods, like ACH, can fail after a subsequent transfer request is made. For these payments, avoid using source_. Instead, wait until a charge.succeeded event is triggered before transferring the funds. If you have to use source_ with these payments, you must implement functionality to manage payment failures.

When a payment used as a source_ fails, funds from your platform’s account balance are transferred to the connected account to cover the payment. To recover these funds, reverse the transfer associated with the failed source_.

Issue refunds

You can refund charges created on your platform using its secret key. However, refunding a charge has no impact on any associated transfers. It’s up to your platform to reconcile any amount owed back to it by reducing subsequent transfer amounts or by reversing transfers.

Refunds with funds segregation

The private preview funds segregation feature uses allocated funds for refunds before debiting your platform’s payments balance, providing clean accounting separation.

Reverse transfers

Connect supports the ability to reverse transfers made to connected accounts, either entirely or partially (by setting an amount value). Use transfer reversals only for refunds or disputes related to the charge, or to correct errors in the transfer.

Transfer reversals add the specified (or entire) amount back to the platform’s available balance, reducing the connected account’s available balance accordingly. It is only possible to reverse a transfer if the connected account’s available balance is greater than the reversal amount or has connected reserves enabled.

If the transfer reversal requires a currency conversion, and the reversal amount would result in a zero balance after the conversion, it returns an error.

Disabling refunds for a connected account won’t block the ability to process transfer reversals.