Crie cobranças de destino

Crie cobranças na conta da sua plataforma, colete tarifas e transfira imediatamente os fundos restantes para suas contas conectadas.

Crie cobranças de destino quando os clientes fizerem transações com sua plataforma para produtos ou serviços fornecidos por suas contas conectadas e você transferir fundos imediatamente para suas contas conectadas. Com este tipo de cobrança:

- Você cria uma cobrança na conta da sua plataforma.

- Você determina se alguns ou todos os fundos são transferidos para a conta conectada.

- O custo das tarifas da Stripe e de reembolsos ou estornos é debitado da sua conta.

Esse tipo de cobrança é mais ideal para marketplaces como o Airbnb, um marketplace de aluguel residencial, ou a Lyft, um aplicativo de transporte por aplicativo.

Com algumas exceções, se a sua plataforma e uma conta conectada não estiverem na mesma região, você deverá especificar a conta conectada como o comerciante de liquidação usando o parâmetro on_behalf_of no Payment Intent.

Recomendamos usar cobranças de destino para contas conectadas que não têm acesso ao Stripe Dashboard completo.

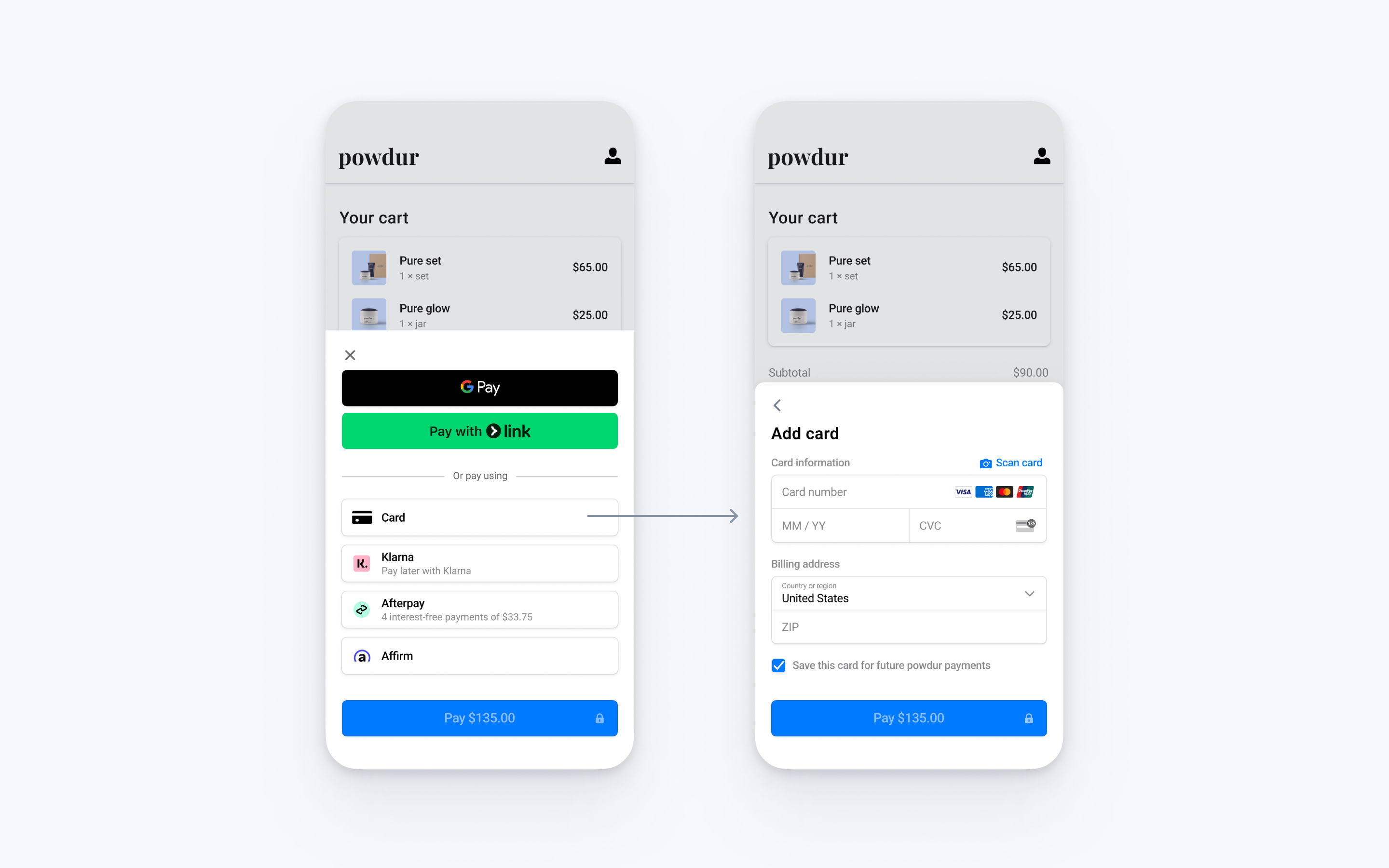

Integre a IU de pagamento incorporada da Stripe no checkout do seu aplicativo Android com a classe PaymentSheet.

Configurar a StripeLado do servidorLado do cliente

Primeiro, você precisa de uma conta Stripe. Cadastre-se agora.

Lado do servidor

Esta integração exige que os endpoints do seu servidor se comuniquem com a API da Stripe. Use as bibliotecas oficiais para acessar a API da Stripe pelo seu servidor:

Lado do cliente

O SDK da Stripe para Android é de código aberto e totalmente documentado.

Para instalar o SDK, adicione stripe-android ao bloco dependencies do arquivo app/build.gradle:

Nota

Veja mais informações sobre o último lançamento de SDK e as versões anteriores na página Lançamentos no GitHub. Para receber notificações quando um novo lançamento for publicado, assista aos lançamentos do repositório.

Configure o SDK com sua chave publicável da Stripe, de modo que seja possível fazer solicitações à API Stripe, como em sua subcategoria Application:

Nota

Use suas chaves de teste enquanto testa e desenvolve, e suas chaves de modo de produção quando publicar seu aplicativo.

Adicionar um endpointLado do servidor

Nota

Para exibir o PaymentSheet antes de criar um PaymentIntent, consulte Colete os dados de pagamento antes de criar um Intent.

Esta integração usa três objetos da API da Stripe:

PaymentIntent: A Stripe usa isso para representar sua intenção de coletar o pagamento de um cliente, acompanhando suas tentativas de cobrança e alterações no estado do pagamento durante todo o processo.

(Opcional) Customer: Para configurar uma forma de pagamento para pagamentos futuros, vincule-a a um Customer. Crie um objeto Customer quando o cliente abrir uma conta na sua empresa. Se o cliente pagar como convidado, você pode criar o objeto Customer antes do pagamento e associá-lo à sua representação interna da conta do cliente, mais tarde.

(Opcional) CustomerSession: Os dados do objeto Customer são confidenciais e não podem ser recuperados diretamente do aplicativo. Uma CustomerSession concede ao SDK acesso temporário com escopo definido ao cliente e fornece opções de configuração adicionais. Consulte uma lista completa de opções de configuração.

Nota

Se você nunca salva cartões para um cliente e não permite que clientes retornando reutilizem cartões salvos, é possível omitir os objetos cliente e CustomerSession da sua integração.

Por motivos de segurança, o aplicativo não pode criar esses objetos. Para isso, adicione um endpoint ao servidor para:

- Recuperar ou criar um Customer.

- Cria uma CustomerSession para o cliente.

- Cria um PaymentIntent com o valor, a moeda e o cliente.

- Retorna o segredo do cliente do Payment Intent, o

client_da CustomerSession, o id do Cliente e sua chave publicável para seu aplicativo.secret

As formas de pagamento mostradas aos clientes durante o processo de checkout também são incluídas no PaymentIntent. Você pode permitir que a Stripe obtenha as formas de pagamento das configurações do Dashboard ou listá-las manualmente. Independentemente da opção escolhida, saiba que a moeda passada no PaymentIntent filtra as formas de pagamento mostradas para o cliente. Por exemplo, se você passar EUR no eur e a OXXO estiver ativada no Dashboard, a OXXO não será exibida ao cliente porque a OXXO não aceita pagamentos em eur.

Se sua integração não exige uma opção baseada em código para oferecer formas de pagamento, a Stripe recomenda a opção automática. Isso ocorre porque a Stripe avalia a moeda, as restrições de forma de pagamento e outros parâmetros para determinar a lista de formas de pagamento aceitas. Priorizamos as formas de formas de pagamento que aumentam a conversão e que são mais relevantes para a moeda e a localização do cliente.

Integrar a descrição da compraLado do cliente

Antes de exibir o Element Pagamento para dispositivos móveis, a página de checkout deve:

- Mostrar os produtos sendo comprados e o valor total

- Colete todas as informações de envio necessárias usando o Address Element

- Incluir um botão de checkout para apresentar a IU da Stripe

Configurar allowsDelayedPaymentMethods como verdadeiro permite formas de pagamento de notificação assíncrona como contas bancárias dos EUA. Para essas formas de pagamento, o status final do pagamento não é conhecido quando o PaymentSheet é concluído, sendo efetivado ou não posteriormente. Se você aceitar esses tipos de formas de pagamento, informe o cliente que seu pedido está confirmado e somente processe o pedido (por exemplo, fazendo o envio do produto) quando o pagamento for bem-sucedido.

Gerenciar eventos pós-pagamentoLado do servidor

Stripe envia um evento payment_intent.succeeded quando o pagamento é concluído. Use a ferramenta Dashboard webhook ou siga o guia de webhooks para receber esses eventos e executar ações, como enviar um e-mail de confirmação do pedido ao cliente, registrar a venda em um banco de dados ou iniciar um fluxo de trabalho de envio.

Escute esses eventos em vez de aguardar um retorno de chamada do cliente. No cliente, o consumidor pode fechar a janela do navegador ou sair do aplicativo antes da execução do retorno de chamada, o que permite que clientes mal-intencionados manipulem a resposta. Configurar sua integração para escutar eventos assíncronos é o que permite a você aceitar diferentes tipos de formas de pagamento com uma única integração.

Além de gerenciar o evento payment_, recomendamos gerenciar esses outros eventos ao coletar pagamentos com o Element Pagamento:

| Evento | Descrição | Ação |

|---|---|---|

| payment_intent.succeeded | Enviado quando um cliente conclui um pagamento com êxito. | Envie ao cliente uma confirmação de pedido e processe o pedido. |

| payment_intent.processing | Enviado quando um cliente inicia um pagamento, mas o pagamento ainda precisa ser concluído. Esse evento costuma ser enviado quando um cliente inicia um débito bancário. Ele é seguido por um evento payment_ ou payment_ no futuro. | Envie ao cliente uma confirmação do pedido que indica que o pagamento está pendente. Para produtos digitais, pode ser necessário executar o pedido antes de aguardar a conclusão do pagamento. |

| payment_intent.payment_failed | Enviado quando um cliente tenta fazer um pagamento, mas o pagamento falha. | Se um pagamento passa de processing para payment_, ofereça ao cliente outra tentativa para pagar. |

Testar a integração

Consulte Testes para obter mais informações sobre como testar sua integração.

OpcionalAtivar Google Pay

Configurar a integração

Para usar o Google Pay, habilite a API Google Pay adicionando o seguinte à <application> tag do seu AndroidManifest.xml:

<application> ... <meta-data android:name="com.google.android.gms.wallet.api.enabled" android:value="true" /> </application>

Veja mais detalhes na Configuração da API Google Pay do Google Pay para Android.

Adicionar Google Pay

Para adicionar o Google Pay à sua integração, passe uma PaymentSheet.GooglePayConfiguration com seu ambiente do Google Pay (produção ou teste) e o código do país da sua empresa quando inicializar PaymentSheet.Configuration.

Testar Google Pay

O Google permite que você faça pagamentos de teste por meio de seu Pacote de cartão de teste. O Pacote de cartão de teste é compatível com os cartões de teste da Stripe.

Você precisa testar o Google Pay usando um dispositivo Android físico em vez de um dispositivo simulado, em um país onde o Google Pay é compatível. Faça login em uma conta do Google em seu dispositivo de teste com um cartão real salvo na Carteira do Google.

OpcionalPersonalizar a descrição

Toda personalização é configurada usando o objeto PaymentSheet.Configuration.

Aparência

Personalize cores, fontes e outros atributos de acordo com a aparência do aplicativo usando a API Appearance.

Layout da forma de pagamento

Configure o layout das formas de pagamento na planilha usando paymentMethodLayout. Você pode exibi-los horizontalmente, verticalmente ou deixar a Stripe otimizar o layout automaticamente.

Coletar endereços de usuários

Colete endereços de entrega ou cobrança locais e internacionais de seus clientes usando o Address Element.

Nome de exibição da empresa

Especifique o nome da empresa exibido para o cliente definindo merchantDisplayName. Por padrão, esse é o nome do seu aplicativo.

Modo escuro

Por padrão, o PaymentSheet se adapta automaticamente às configurações de aparência do sistema do usuário (modo claro e escuro). É possível alterar isso configurando modo claro ou escuro no seu aplicativo:

Dados de faturamento padrão

Para definir valores padrão para dados de faturamento coletados na descrição da compra, configure a propriedade defaultBillingDetails. A PaymentSheet preenche previamente seus campos com os valores que você informou.

Configurar coleta de dados de cobrança

Usar BillingDetailsCollectionConfiguration para especificar como você deseja coletar dados de cobrança no PaymentSheet.

Você pode coletar o nome, e-mail, número de telefone e endereço do cliente.

Se quiser anexar detalhes de cobrança padrão ao objeto PaymentMethod mesmo quando esses campos não forem coletados na IU, defina billingDetailsCollectionConfiguration. como true.

Nota

Consulte seu jurídico sobre as leis que se aplicam à coleta de dados. Só colete números de telefone se precisar deles para a transação.

OpcionalConclua o pagamento em sua IU

Você pode exibir a Payment Sheet apenas para coletar dados da forma de pagamento e concluir o pagamento na IU do aplicativo. Isso é útil quando você tem um botão de compra personalizado ou precisa de mais etapas após a coleta dos dados do pagamento.

Nota

Um exemplo de integração está disponível no nosso GitHub.

- Primeiro, inicialize PaymentSheet.FlowController em vez de

PaymentSheetusando um dos métodos do Builder.

- Em seguida, chame

configureWithPaymentIntentcom as chaves do objeto Stripe recuperadas do backend e atualize a IU no callback usando getPaymentOption(). Isso contém uma imagem e um rótulo que representam a forma de pagamento selecionada atualmente pelo cliente.

- Em seguida, chame presentPaymentOptions para coletar os detalhes do pagamento. Quando o cliente termina, a descrição da compra é descartada e chama o paymentOptionCallback passado anteriormente em

create. Implemente essa forma para atualizar a IU com opaymentOptionretornado.

- Por fim, chame confirm para finalizar o pagamento. Quando o cliente termina, a descrição da compra é descartada e chama o paymentResultCallback passado anteriormente em

create.

Configurar allowsDelayedPaymentMethods como verdadeiro permite formas de pagamento de notificação assíncrona como contas bancárias dos EUA. Para essas formas de pagamento, o status final do pagamento não é conhecido quando o PaymentSheet é concluído, sendo efetivado ou não posteriormente. Se você aceitar esses tipos de formas de pagamento, informe o cliente que seu pedido está confirmado e somente processe o pedido (por exemplo, fazendo o envio do produto) quando o pagamento for bem-sucedido.

Tarifas cobradas

Quando um pagamento é processado, em vez de transferir o valor total da transação para uma conta conectada, sua plataforma pode decidir cobrar uma parte do valor da transação na forma de tarifas. Você pode definir os preços das tarifas de duas maneiras diferentes:

Use a ferramenta de preços da plataforma para definir e testar as regras de preços das tarifas da plataforma. No momento, esse recurso no-code no Stripe Dashboard só está disponível para plataformas responsáveis pelo pagamento das tarifas da Stripe.

Defina internamente as regras de preços, especificando as tarifas diretamente em um PaymentIntent usando o parâmetro application_fee_amount ou transfer_data[amount]. As tarifas definidas com esse método substituem a lógica de preços especificada na ferramenta de preços da plataforma.

Especificar o comerciante da liquidação

O comerciante da liquidação depende das funções da conta e da forma de criação da cobrança. O comerciante da liquidação determina quais dados são usados para fazer a cobrança. Isso inclui a descrição no extrato (da plataforma ou da conta conectada) exibida sobre essa cobrança no extrato bancário ou de cartão de crédito do cliente.

A especificação do comerciante da liquidação permite que você defina mais explicitamente para quem as cobranças são criadas. Por exemplo, algumas plataformas preferem ser o comerciante da liquidação porque o cliente final interage diretamente com a plataforma (como plataformas sob demanda). No entanto, algumas plataformas têm contas conectadas que interagem diretamente com os clientes finais (como lojas de uma plataforma de e-commerce). Nesses cenários, pode fazer mais sentido que a conta conectada seja o comerciante da liquidação.

Você pode definir o parâmetro on_ para o ID de uma conta conectada para tornar essa conta o comerciante de liquidação do pagamento. Quando usar on_:

- As cobranças são liquidadas no país da conta conectada e na moeda de liquidação.

- É usada a estrutura de tarifas do país da conta conectada.

- A descrição no extrato da conta conectada é exibida no extrato do cartão de crédito do cliente.

- Se a conta conectada estiver em um país diferente do da plataforma, o endereço e o número de telefone da conta conectada serão exibidos no extrato do cartão de crédito do cliente.

- O número de dias que um saldo pendente é retido antes de receber o repasse depende da configuração delay_days na conta conectada.

API Accounts v2

Você não pode usar a API Accounts v2 para gerenciar as configurações de repasse. Use a API Accounts v1.

Se on_ for omitido, a plataforma será a empresa registrada para o pagamento.

Cuidado

O parâmetro on_ só é aceito para contas conectadas com uma função de pagamentos, como card_payments. As contas sujeitas ao contrato de serviços de destinatário não podem solicitar card_ nem outras funções de pagamento.

Emitir reembolsos

Se você está usando a API Payment Intents, os reembolsos devem ser emitidos para a cobrança criada mais recentemente.

As cobranças criadas na conta da plataforma podem ser reembolsadas usando a chave secreta da conta da plataforma. No reembolso de uma cobrança que tem transfer_, por padrão, a conta de destino mantém os fundos que foram transferidos para ela e o saldo negativo do reembolso é coberto pela conta da plataforma. Para recuperar os fundos da conta conectada a fim de cobrir o reembolso, defina o parâmetro reverse_ como true na criação do reembolso:

Por padrão, o valor total da cobrança é reembolsado, mas você pode criar um reembolso parcial definindo amount como um inteiro positivo.

Se o valor total da cobrança é reembolsado, toda a transferência é anulada. Caso contrário, um valor proporcional da transferência é anulado.

Reembolsar tarifas da plataforma

Quando você reembolsa uma cobrança com uma tarifa da plataforma, por padrão, a conta da plataforma mantém os fundos da tarifa da plataforma. Para devolver esses fundos para a conta conectada, defina o parâmetro refund_application_fee como true na criação do reembolso:

Se você reembolsar a tarifa da plataforma em uma cobrança de destino, precisa anular a transferência. Se o valor total da cobrança é reembolsado, toda a tarifa da plataforma é anulada. Caso contrário, um valor proporcional da tarifa da plataforma é reembolsado.

Você também pode informar um valor false para refund_ e reembolsar a tarifa da plataforma separadamente usando a API.

Reembolsos com falha

Quando um reembolso falha ou você o cancela, o valor do reembolso não finalizado retorna ao seu saldo da conta da plataforma na Stripe. Crie uma transferência se precisar movimentar os fundos para a conta conectada.

Gerenciar contestações

Para cobranças de destino, com ou sem on_, a Stripe debita os valores da contestação e as tarifas da conta da sua plataforma.

Recomendamos configurar um webhook para escutar eventos criados por contestação. Se isso acontecer, tente recuperar fundos da conta conectada anulando a transferência pelo Dashboard ou criando uma anulação de transferência.

Se o saldo da conta conectada for negativo, a Stripe tenta debitar sua conta externa se debit_ estiver definido como true.

Se você desafiar a contestação e vencer, poderá transferir os fundos que devolveu anteriormente para a conta conectada. Se sua plataforma tiver saldo insuficiente, a transferência falhará. Evite erros de saldo insuficiente adicionando fundos ao seu saldo da Stripe.

Erro comum

A retransferência de uma anulação anterior está sujeita a restrições de transferências internacionais, o que significa que você pode não como pagar sua conta conectada. Aguarde para recuperar transferências de pagamento internacionais contestadas para cobranças de destino com on_ até depois que a contestação for perdida.

Transferências ignoradas devido ao status da conta

Para pagamentos que usam formas de pagamento assíncronas (como ACH ou débito SEPA), há um atraso entre o momento em que o pagamento é autorizado e o momento em que os fundos são disponibilizados. Nesse período, se a conta de destino perder a funcionalidade de transferência necessária ou for fechada, a Stripe não poderá concluir a transferência conforme solicitado originalmente.

Quando a Stripe tenta criar uma transferência, mas não consegue devido à perda de funcionalidade ou exclusão da conta, a criação da transferência é ignorada e os fundos permanecem no saldo da sua plataforma.

Para detectar transferências ignoradas, ouça o evento webhook charge.. Se o valor de transfer_data no objeto Cobrança for null, será uma indicação de uma transferência ignorada.

Quando você detectar uma transferência ignorada, poderá criar uma transferência depois que o problema for resolvido, se apropriado para a sua empresa.

Componentes integrados do Connect

As Destination Charges são suportadas por componentes integrados do Connect. Ao usar o componente de pagamentos integrado, você pode habilitar suas contas conectadas a visualizar informações de pagamento a partir do seu site. Para Destination Charges com on_, você pode usar o recurso destination_on_behalf_of_charge_management para permitir que suas contas conectadas visualizem mais detalhes, gerenciem reembolsos, contestações e permitam a captura de pagamentos.

Os seguintes componentes exibem informações sobre Destination Charges:

Componente de pagamentos: Exibe todos os pagamentos e contestações de uma conta.

Detalhes dos pagamentos: Exibe todos os pagamentos e contestações de uma conta.

Componente de lista de contestações: Exibe todas as contestações de uma conta.

Disputas para um componente de pagamento: Exibe as contestações para um único pagamento especificado. Você pode usá-lo para incluir a função de gerenciamento de contestação em uma página com sua IU de pagamentos.