Collect payments then pay out on your marketplace

Collect payments from customers and pay them out to sellers or service providers on your marketplace.

This guide demonstrates how to accept payments from customers and move funds to the bank accounts of your sellers or service providers, without writing code. Use this guide if you:

- Want to accept payments from customers and pay out sellers or service providers without writing code.

- Want to rapidly test product-market fit without coding.

- Are a marketplace that is selling directly to end customers (as opposed to a SaaS platform who is selling software to help others operate their own business).

In this example, we’ll build a marketplace that allows T-shirt artists to sell customised T-shirts. You can use the concepts covered in this guide in other business applications as well.

Prerequisites

- Register your platform.

- Add business details to activate your account.

- Complete your platform profile.

- Customise your Connect brand settings on the Stripe Dashboard settings page and customise your Payment Link brand settings on the Checkout Branding settings page.

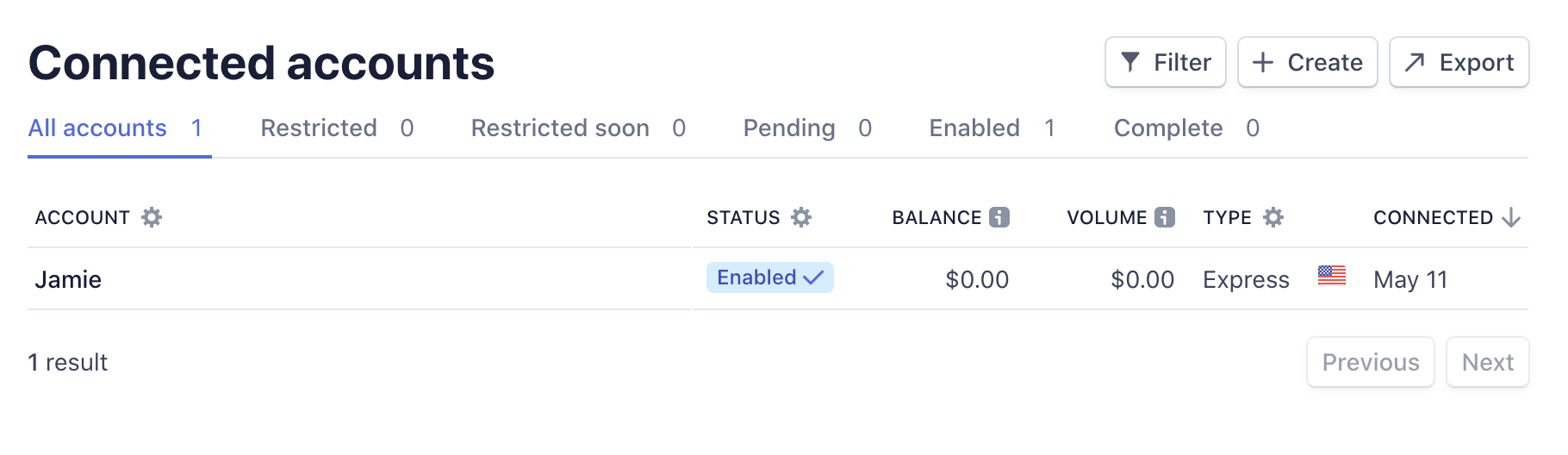

Create a connected account

When a seller or service provider signs up on your marketplace, you need to create a user account (referred to as a connected account) so you can move funds to their bank account. Connected accounts represent your sellers or service providers. In our T-shirt marketplace example, the connected account represents the artist making the shirts.

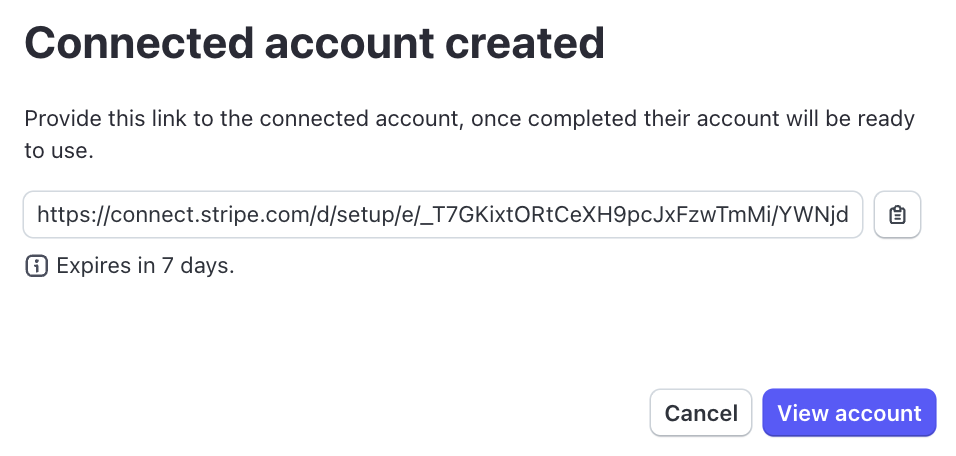

Create a connected account onboarding link

This link directs sellers and service providers to a sign-up form where they can provide their identity and bank account information to onboard to your marketplace. In our example of a T-shirt marketplace, share this link with the T-shirt artist to onboard them. This link expires after 90 days and is for use by a single seller or service provider. After they complete the onboarding flow, you can see their account details in your Connected accounts page. Repeat these steps any time you need to add additional sellers or service providers.

Create the Payment Link to accept payments

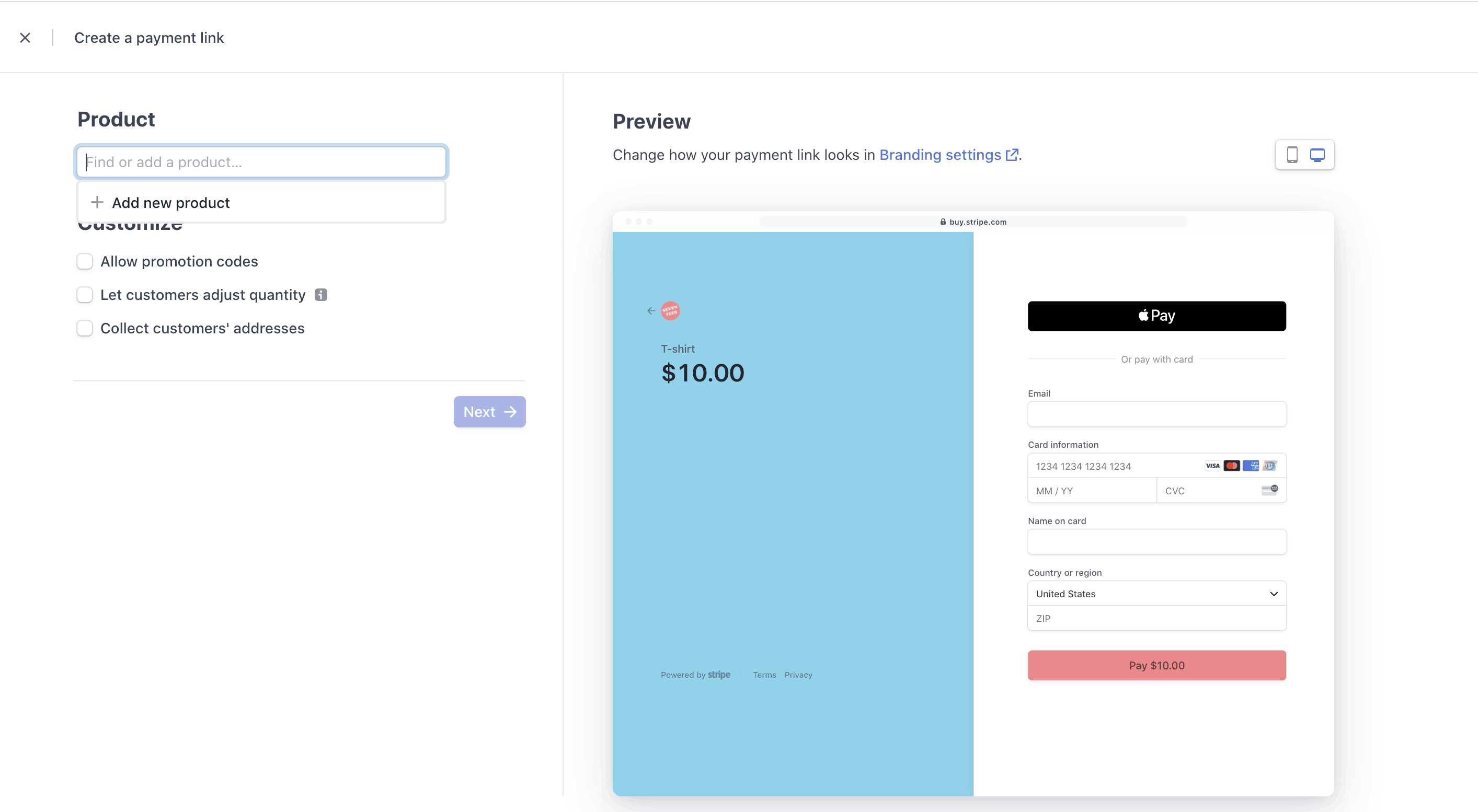

Now that you’ve created a connected account, create a Payment Link to accept payments from your customers—no coding required. When you send this link to your marketplace customer, they’ll land on a Stripe-hosted page where they can pay you. In the T-shirt marketplace example, customers buy T-shirts through your marketplace, and you pay T-shirt artists for designing and creating the T-shirts. To set this up, click on +Create link on the Payment Links page and follow the steps.

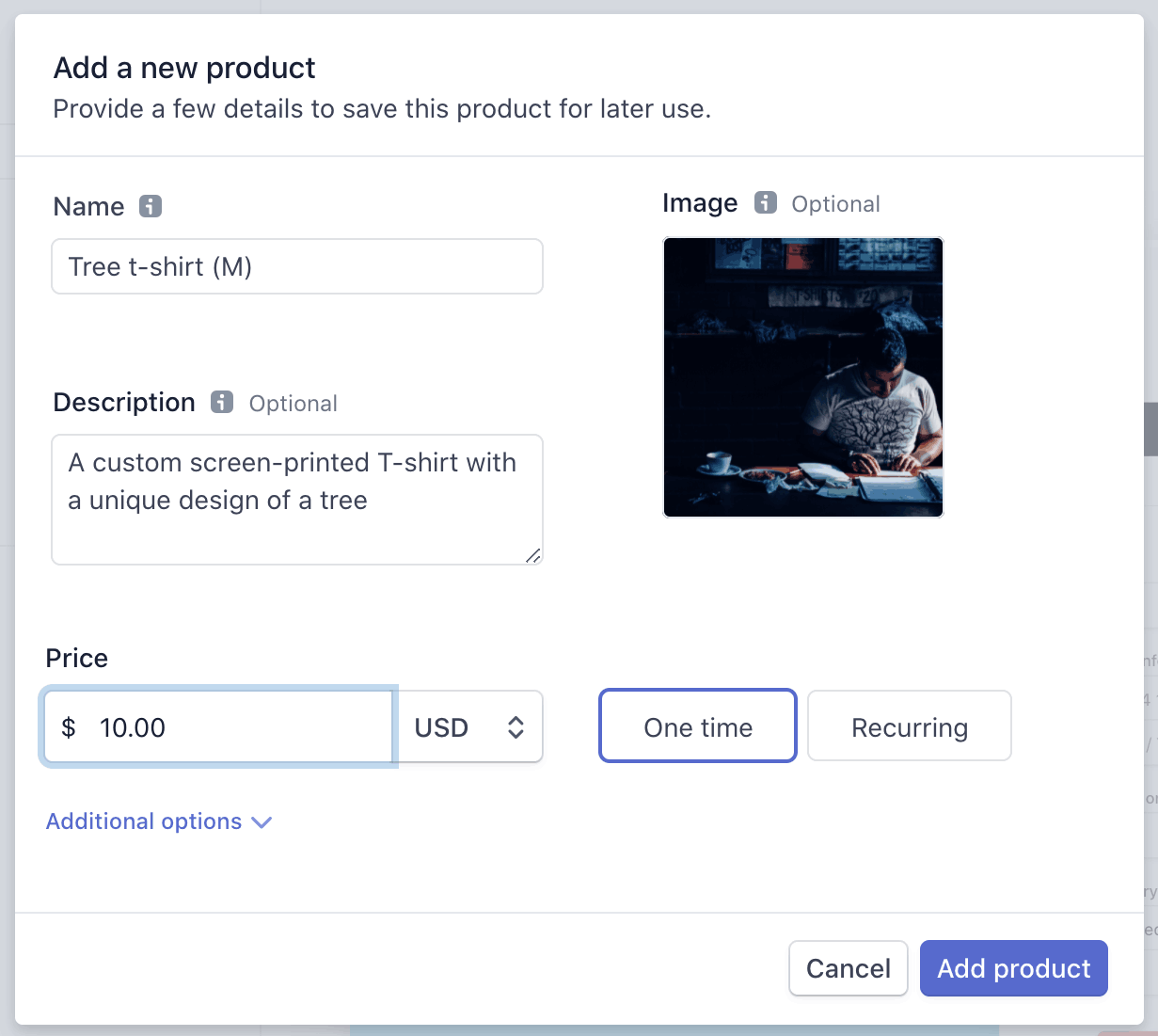

Step 2.1: Add the product

You configure Payment Links for a specific product and price so the first step is to add the product you want to sell. Click +Add new product to add a product.

Set your product name, description, and price, which are all visible to the customer on the Checkout page that you redirect them to. After entering the information for your new product click +Add product to add the product. In this example, we’re adding a medium-sized tree-patterned T-shirt product, so we’ll configure the Payment Link for this particular product. If we also wanted to sell small-sized T-shirts or T-shirts with other designs, we would follow the above steps to create a new Payment Link and a new product.

Step 2.2: Customise the Payment Link

You can customise your Payment Link to allow customers to enter promotion codes, adjust the quantity of the product, or enter their shipping and billing address. For our example of a T-shirt marketplace, we want to allow customers to buy a variable number of T-shirts. We also need to collect the customer’s shipping address so we can ship the T-shirts to them. To enable both of these, select Let customers adjust quantity and Collect customers’ addresses then click Next.

Step 2.3: Decide when to pay your connected account

You have two options for paying out your connected account.

- If you already know which connected account you want to pay using funds collected through this Payment Link, you can automatically pay out.

- However, if you don’t know the connected account ahead of time or need to pay multiple connected accounts, you can pay out later.

Share the Payment Link with your customers

Now that you’ve created your Payment Link, copy the Payment Link URL and share it publicly on your website or through social media. When a customer clicks on your Payment Link URL, they see your customised Checkout page (example below) and can enter their payment information—they can pay from mobile or desktop with a card, Apple Pay, or Google Pay.

After the payment

Step 4.1 View your payments

Go to the Payments page to see the list of payments your business has accepted. You can click on an individual payment to see more details about it, such as the shipping address if you chose to collect one. You can see the application fees your business collected for each payment, or go to the Balance page to see your total funds.

Step 4.2 Fulfilment

After the payment completes, you need to handle fulfilment of the product. In the T-shirt marketplace example, this would entail shipping the T-shirts to the buyer after payment.

OptionalAdd more payment methods

Payment Links supports more than 20 payment methods. You can enable payment methods in your Payment methods settings. After you enable payment methods, Stripe dynamically shows the payment methods most likely to increase conversion and most relevant to the currency and customer’s location.

Caution

Stripe introduced support for more payment methods on 25 January 2022. Payment links created before this date only support card payments and wallets. Create a new link to enable more payment methods.

Some payment methods, such as bank debits or vouchers, take 2-14 days to confirm the payment. Use webhooks to notify you when payment clears so you can start fulfilment. See our fulfilment guide.

Disputes

As the settlement merchant on charges, your platform is responsible for disputes. Make sure you understand the best practices for responding to disputes.

Payouts

By default, any funds that you transfer to a connected account accumulate in the connected account’s Stripe balance and are paid out on a daily rolling basis. You can change the payout frequency by going into the connected account’s details page, clicking the right-most button in the Balance section, and selecting Edit payout schedule.

Refunds

To issue refunds, go to the Payments page. Select individual payments by clicking the checkbox to the left of any payments you want to refund. After you select a payment, Stripe displays a Refund button in the upper-right corner of the page. Click the Refund button to issue a refund to customers for all payments you have selected.

Note

Connected accounts can’t initiate refunds for payments from the Express Dashboard by default. If your connected accounts use the Express Dashboard, you can either process refunds for them, or enable them to process refunds by customising Express dashboard features.