File with Taxually

Learn more about filing with Taxually.

Stripe Tax integrates with Taxually to automate tax filing. Together, they help you file on time and avoid errors that can occur with manual filing. Learn how to register with Taxually with local tax authorities outside the US.

Note

In some regions, filings with Taxually are only available as part of a Stripe Tax subscription. Check your plan in the Dashboard under Stripe plans.

Set up Stripe Tax

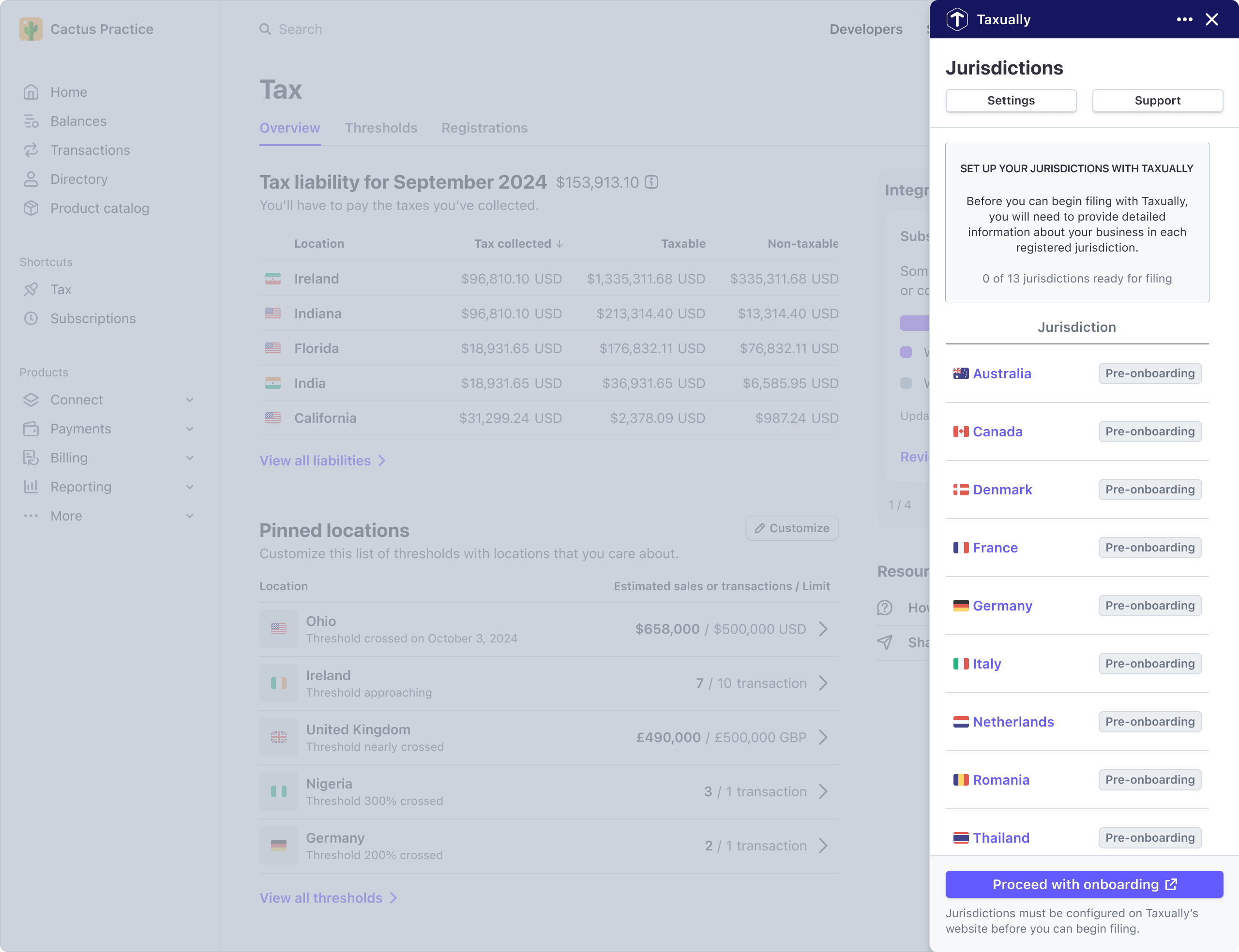

Follow our set up guide to enable calculations and collection with Stripe Tax. Specifically, make sure that you’ve added your tax registrations in Stripe Tax and are able to collect tax. Taxually automatically retrieves your registrations and tax liabilities.

Install the Taxually Stripe app

Install the Taxually app from the Stripe App Marketplace. The installation process requires you to accept the terms of service and grant necessary permissions.

Create a Taxually account

After you install it, the Taxually App displays your active registrations from Stripe Tax. To onboard to any of these locations for filing, you’ll receive a prompt to set up a Taxually account. Click Continue Onboarding to proceed and:

- Create a Taxually Account

- Add your business information

Note

After installing the Taxually App, you might receive a prompt to enable a Stripe Tax subscription before proceeding. See the available plans.

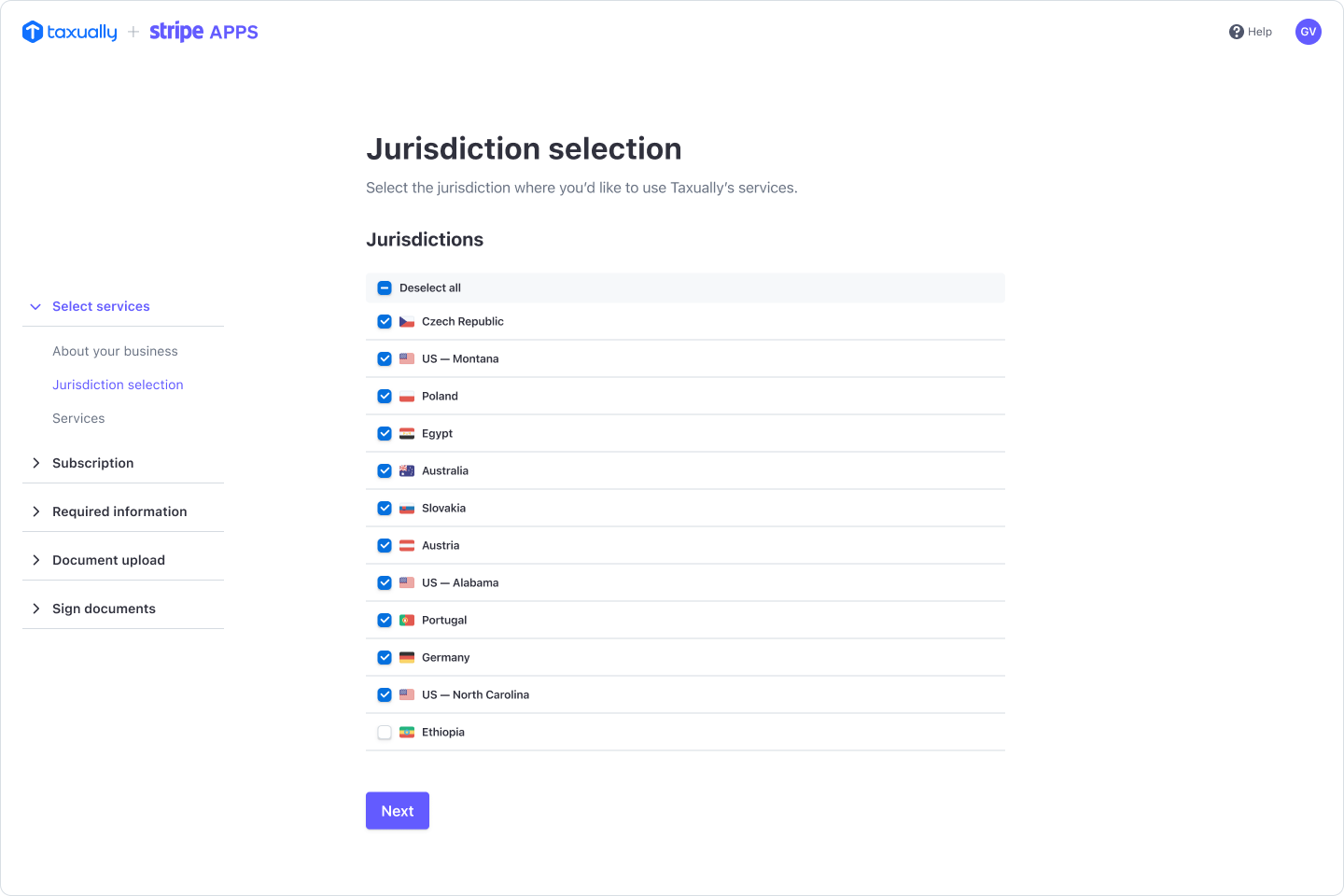

Select jurisdictions

Select where you want to file taxes. Only select locations where:

- You’re registered to collect taxes

- You’ve added your registration to Stripe

If you don’t have any registrations, you must register with local tax authorities where you have tax obligations. If you sell remotely in the US, Stripe can register with local tax authorities for you.

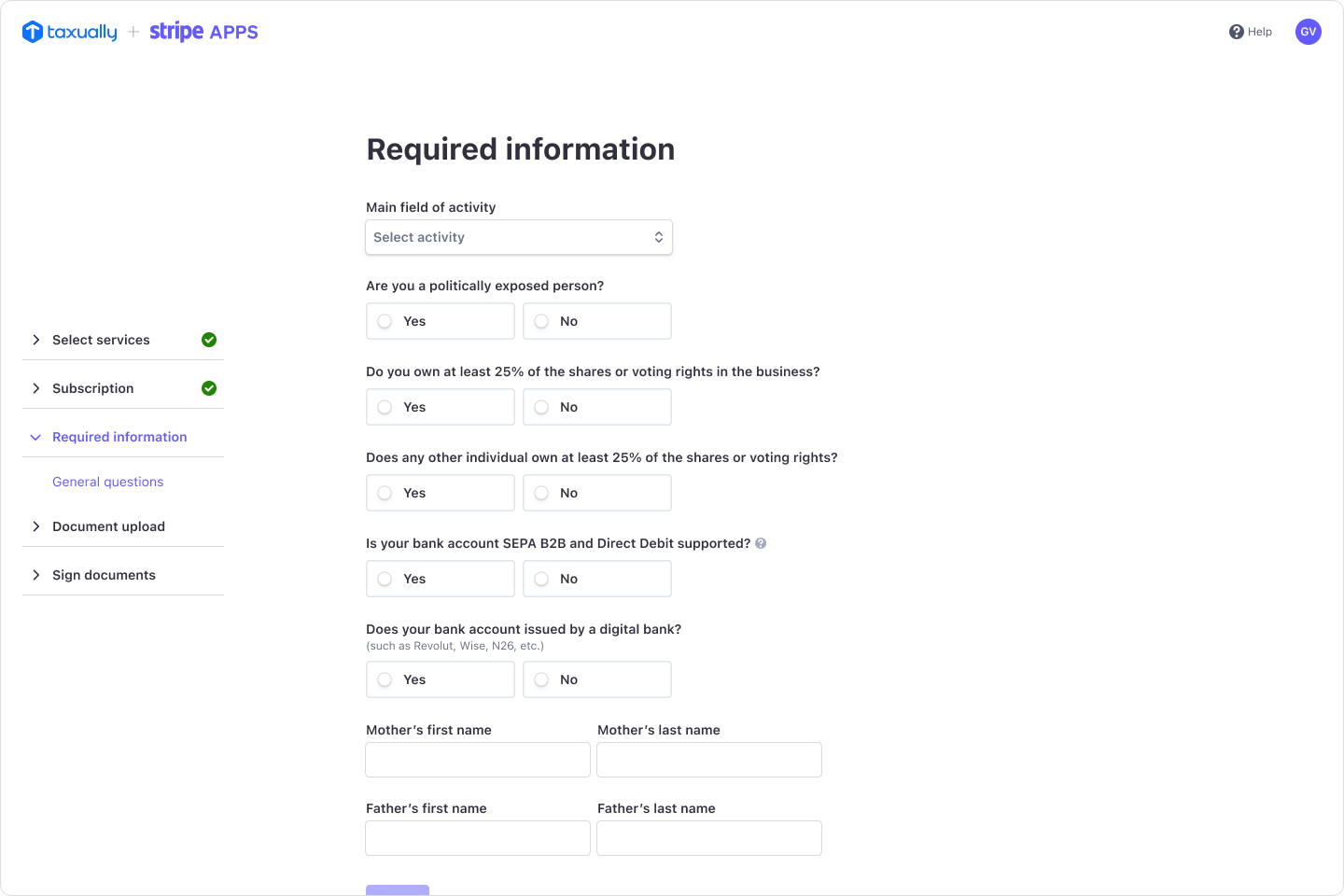

Provide documentation

Provide your business registration documents, Tax ID numbers, and location-specific forms to Taxually. Before submitting, make sure your documents aren’t expired and all text is clear and readable. For filing in the US and Canada, Taxually might prompt you to create a new account with LumaTax and enter details (for example, Department of Revenue login credentials) in the LumaTax portal.

Submit and await approval

When you submit your documents, Taxually reviews your application to check all requirements for your selected locations. You’ll get an email when the review is complete. After that, you can file tax returns through your Dashboard from the Taxually App.

If you need help during any part of this setup process, contact Support for assistance.