Bank reconciliation

Learn how to reconcile your Stripe payouts with cash in your bank.

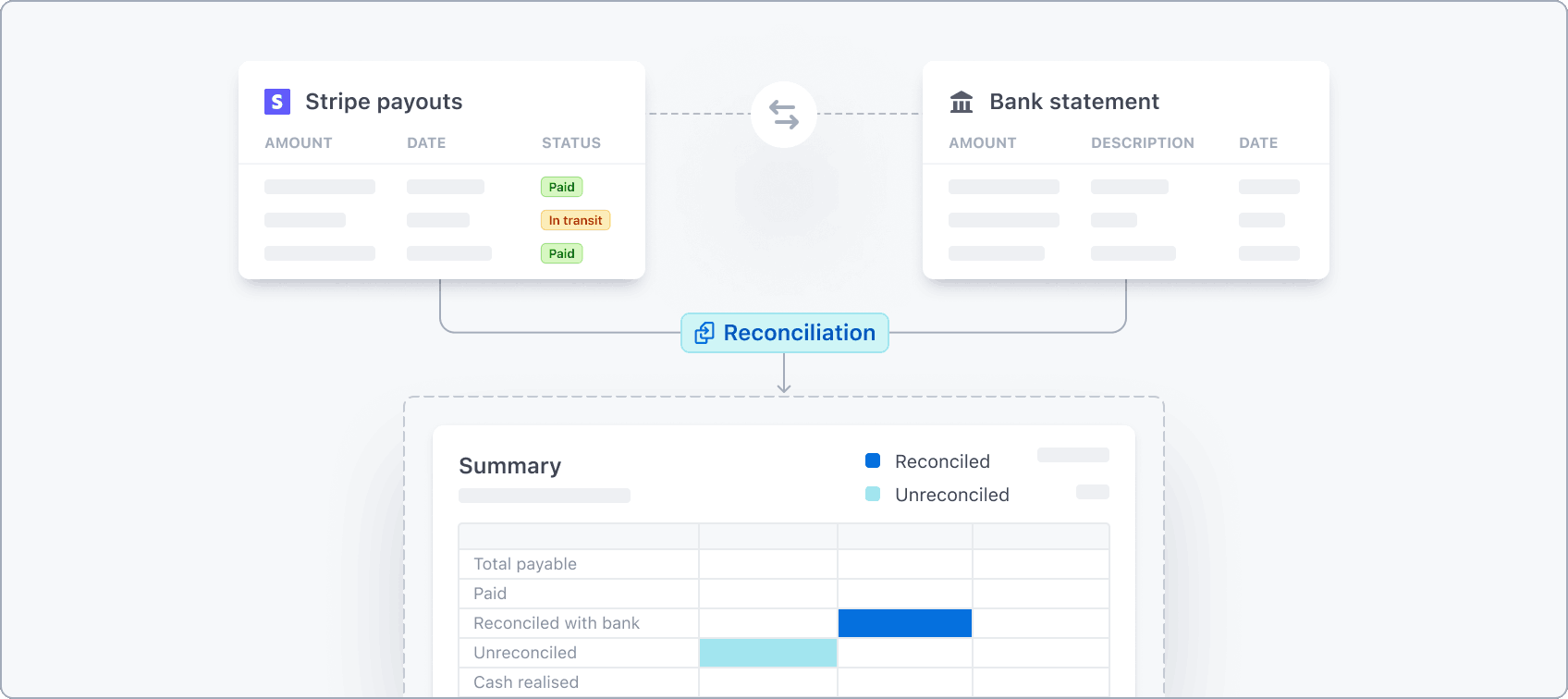

The Bank reconciliation report enables you to reconcile payouts generated by Stripe with the cash in your bank account, helping you track the cash from your business as it moves from Stripe to your bank.

The Bank reconciliation report allows you to:

- Understand the monthly summary of activity on your Stripe account and its impact on payouts and the cash in your bank.

- Track the amount of cash realized from Stripe in your bank account.

- Track all Stripe payouts and their reconciliation status with bank deposits in a single place.

- Make sure you have the data required to accurately close your books.

Bank reconciliation is currently only available for users with direct US-based Stripe accounts using an automated payout schedule. This feature isn’t yet accessible for:

- Stripe Connect accounts

- Users based outside the United States

- Manual or instant payouts

Note

Stripe’s reconciliation features aren’t a substitute for professional services or professional advice.

How Bank reconciliation works

Bank reconciliation helps you reconcile Stripe payouts with the deposits in your bank account, so you can keep track of all the funds received from Stripe and connect your revenue with cash in your bank. To enable the reconciliation, link your bank account to Stripe and approve access for reconciliation.

After you provide access to your bank statement, Stripe automatically reconciles the Stripe payouts with the corresponding deposit in your bank account to determine the amount received and any outstanding balance. You can then access the details of each Stripe payout, the bank deposit, and the corresponding reconciliation statuses from the Dashboard. We prepare the summaries based on your Stripe account’s timezone and UTC.

Link your bank account

If you already have a linked bank account with Stripe, you can skip this step. To link your bank account (or relink an inactive account):

- Click Link bank account from the bank reconciliation page.

- Review and consent to Stripe’s privacy policy, linked account terms, and the details of the bank account where your Stripe payouts are being deposited.

- Select your bank either from the list of the most frequently chosen banks shown in the tiles or by searching for it.

- Sign in to your banking portal and select the account where your Stripe payouts are being deposited.

After a few minutes, a successful link displays a confirmation page.

Summary

The Dashboard summary offers an overview of activities affecting your Stripe balance and the related payouts to your bank account. It breaks down your activity by reporting categories, linking it with Stripe’s payouts and the funds received in your bank. It helps you understand the Stripe payment amounts and corresponding cash reconciled with your bank each month. This aids in creating a revenue-to-cash breakdown necessary for your monthly close process.

Note

The activity available in the bank reconciliation summary corresponds to the Balance change from activity report. This includes all activity that affects your balance, including charges, refunds, disputes, other adjustments, and fees during a month.

The following example shows 8 days of activity for a Stripe account with daily automatic payouts and a payout speed of 2 business days. The account accepted a payment of 10 USD on January 28 and the funds became available on January 30, triggering the first payout to the bank account.

For simplicity, assume no fees or other debits on the example transactions.

| Date | Transaction | Payout | Received in bank |

|---|---|---|---|

| January 28 | 10 USD | ||

| January 29 | 30 USD | ||

| January 30 | 50 USD | 10 USD | 10 USD |

| January 31 | 70 USD | 30 USD | 30 USD |

| February 1 | 60 USD | 50 USD | 50 USD |

| February 2 | 100 USD | 70 USD | 70 USD |

| February 3 | 110 USD | 60 USD | 60 USD |

| February 4 | 100 USD | * |

* Banks typically don’t credit payouts on Sundays, which is reflected by the empty amount for Sunday, February 4 in this example.

Given the above account activity, the bank reconciliation summary on February 4 shows the following data:

| January | February | ||

|---|---|---|---|

| Total payable | Total | 160 USD | 270 USD |

| Pending | 0 USD | 110 USD | |

| Paid | 160 USD | 160 USD | |

| Reconciled with bank | Total | 160 USD | 60 USD |

| In same month | 40 USD | 60 USD | |

| In subsequent months | 120 USD | 0 USD | |

| Unreconciled | 0 USD | 100 USD |

The reconciliation example shows transactions totaling 160 USD and 270 USD were processed in January and February respectively.

In January:

- Stripe disbursed the entire 160 USD.

- Your bank processed 40 USD of the total in the same month as the transaction (January)

- Your bank processed 120 USD of the total in the following months (February).

In February:

- Stripe disbursed 160 USD of the 270 USD transaction total.

- 110 USD from February 3 hasn’t met the 2-day payout speed as of February 4, so is

Pending. - Your bank processed 60 USD of the paid out total in the same month as the transaction (February).

- Your bank hasn’t processed 100 USD paid on Sunday, February 4, which is

Unreconciled.

Cash realized in bank

The Cash realized in bank section shows you the total amount received from Stripe in your bank account during a calendar month. This helps you monitor your monthly cash inflow from Stripe. We capture this information from your bank statement and you can use it to update your cash accounts during the close process for the month.

Using the preceding example of account activity, the Cash realized in bank section has the following data:

| January | February | |

|---|---|---|

| Total cash realized in bank | 40 USD | 180 USD |

The total amount reconciled with the bank (220 USD) matches the sum of the amounts received in your bank account over the two months. Moreover, the sum of the amount reconciled from January’s subsequent months and the amount reconciled within the same month from February (120 USD + 60 USD = 180 USD) equals the total cash realized from Stripe in February (180 USD).

Payouts

The Payouts section provides a list of all the payouts made by Stripe, the bank deposits, and their corresponding reconciliation and payout statuses. You can filter and view this data based on payout date, method, payout status, and reconciliation status.

In the account activity example, the payouts have the following data:

| Payout date | Matching key | Payout status | Payout amount | Received in bank | Bank receipt date | Reconciliation status |

|---|---|---|---|---|---|---|

| February 5 | ST-1239R12DF | In transit | 120 USD | |||

| February 4 | ST-1334R12DG | Paid | 100 USD | Unreconciled | ||

| February 3 | ST-1436R12DH | Paid | 60 USD | 60 USD | February 3 | Reconciled |

| February 2 | ST-1537R12DI | Paid | 70 USD | 70 USD | February 2 | Reconciled |

| February 1 | ST-1639R12DJ | Paid | 50 USD | 50 USD | February 1 | Reconciled |

| January 31 | ST-1738R12DK | Paid | 30 USD | 30 USD | January 31 | Reconciled |

| January 30 | ST-1839R12DL | Paid | 10 USD | 10 USD | January 30 | Reconciled |

Payouts report

| Column name | Description |

|---|---|

payout_ | The date that the payout is expected to arrive in the bank. |

matching_ | The common reference key between Stripe payouts and your bank statements that we use to match records and perform reconciliation. |

payout_ | The status of the payout paid by Stripe. |

payout_ | The net amount paid by Stripe against the payout. |

received_ | The amount received in your bank account against the payout. |

bank_ | The date that the payout is received in your bank account. Stripe fetches this information from your bank deposits. |

reconciliation_ | The reconciliation status of the payout. We match Stripe payouts with your bank deposits and assign each payout one of the following statuses: ‘Reconciled’ or ‘Unreconciled’. |

How we use your data

The Bank reconciliation report uses your Stripe transactions and Financial Connections accounts to provide you with bank reconciliation services. You can control which Stripe products receive and use your financial accounts data from the Link external account settings page.

Note

The bank reconciliation services are provided “as-is.” There might be delays in data rendering. You’re responsible for checking the accuracy and completeness of the data.