) => {

props.onSavePaymentMethodChange(e.target.checked);

};

return (

);

};

export default ConsentCollection;

```

When you call [confirm](https://docs.stripe.com/js/custom_checkout/confirm), you can indicate to Stripe that your customer has provided consent by passing the `savePaymentMethod` parameter. When you save a customer’s payment details, you’re responsible for complying with all applicable laws, regulations, and network rules.

#### HTML + JS

```js

const checkout = stripe.initCheckout({clientSecret});

const button = document.getElementById('pay-button');

const errors = document.getElementById('confirm-errors');

const checkbox = document.getElementById('save-payment-method-checkbox');

const loadActionsResult = await checkout.loadActions();

if (loadActionsResult.type === 'success') {

const {actions} = loadActionsResult;

button.addEventListener('click', () => {

// Clear any validation errors

errors.textContent = '';

const savePaymentMethod = checkbox.checked;

actions.confirm({savePaymentMethod}).then((result) => {

if (result.type === 'error') {

errors.textContent = result.error.message;

}

});

});

}

```

#### React

```jsx

import React from 'react';

import {useCheckout} from '@stripe/react-stripe-js/checkout';

type Props = {

savePaymentMethod: boolean;

}

const PayButton = (props: Props) => {

const checkoutState = useCheckout();

const [loading, setLoading] = React.useState(false);

const [error, setError] = React.useState(null);

if (checkoutState.type === 'loading') {

return (

Loading...

);

} else if (checkoutState.type === 'error') {

return (

Error: {checkoutState.error.message}

);

}

const {confirm} = checkoutState.checkout;

const handleClick = () => {

setLoading(true);confirm({savePaymentMethod: props.savePaymentMethod}).then((result) => {

if (result.type === 'error') {

setError(result.error)

}

setLoading(false);

})

};

return (

{error &&

{error.message}

}

)

};

export default PayButton;

```

### Render saved payment methods

Use the [savedPaymentMethods](https://docs.stripe.com/js/custom_checkout/session_object#custom_checkout_session_object-savedPaymentMethods) array on the front end to render the customer’s available payment methods.

> The `savedPaymentMethods` array includes only the payment methods that have [allow_redisplay](https://docs.stripe.com/api/payment_methods/object.md#payment_method_object-allow_redisplay) set to `always`. Follow the steps for [collecting consent](https://docs.stripe.com/payments/save-during-payment.md#collect-consent) from your customer and make sure to properly set the `allow_redisplay` parameter.

#### HTML + JS

```html

```

```js

const checkout = stripe.initCheckout({clientSecret});

const loadActionsResult = await checkout.loadActions();

if (loadActionsResult.type === 'success') {

const container = document.getElementById('saved-payment-methods');

const {actions} = loadActionsResult;

actions.getSession().savedPaymentMethods.forEach((pm) => {

const label = document.createElement('label');

const radio = document.createElement('input');

radio.type = 'radio';

radio.value = pm.id;

label.appendChild(radio);

label.appendChild(document.createTextNode(`Card ending in ${pm.card.last4}`));

container.appendChild(label);

});

}

```

#### React

```jsx

import React from 'react';

import {useCheckout} from '@stripe/react-stripe-js/checkout';

type Props = {

selectedPaymentMethod: string | null;

onSelectPaymentMethod: (paymentMethod: string) => void;

};

const PaymentMethods = (props: Props) => {const checkoutState = useCheckout();

if (checkoutState.type === 'loading') {

return (

Loading...

);

} else if (checkoutState.type === 'error') {

return (

Error: {checkoutState.error.message}

);

}const {savedPaymentMethods} = checkoutState.checkout;

const handleOptionChange = (e: React.ChangeEvent) => {

props.onSelectPaymentMethod(e.target.value);

};

return (

{savedPaymentMethods.map((pm) => (

))}

);

};

export default PaymentMethods;

```

### Confirm with a saved payment method

When your customer selects a saved payment method and is ready to complete checkout, call [confirm](https://docs.stripe.com/js/custom_checkout/confirm) and pass in the [paymentMethod](https://docs.stripe.com/js/custom_checkout/confirm#custom_checkout_session_confirm-options-paymentMethod) ID.

#### HTML + JS

```html

```

```js

const checkout = stripe.initCheckout({clientSecret});

const loadActionsResult = await checkout.loadActions();

if (loadActionsResult.type === 'success') {

const container = document.getElementById('saved-payment-methods');

const {actions} = loadActionsResult;

actions.getSession().savedPaymentMethods.forEach((pm) => {

const label = document.createElement('label');

const radio = document.createElement('input');

radio.type = 'radio';

radio.value = pm.id;

label.appendChild(radio);

label.appendChild(document.createTextNode(`Card ending in ${pm.card.last4}`));

container.appendChild(label);

});

}

```

#### React

```jsx

import React from 'react';

import {useCheckout} from '@stripe/react-stripe-js/checkout';

type Props = {

selectedPaymentMethod: string | null;

}

const PayButton = (props: Props) => {

const checkoutState = useCheckout();

const [loading, setLoading] = React.useState(false);

if (checkoutState.type === 'loading') {

return (

Loading...

);

} else if (checkoutState.type === 'error') {

return (

Error: {checkoutState.error.message}

);

}

const {confirm} = checkoutState.checkout;

const handleClick = () => {

setLoading(true);confirm({paymentMethod: props.selectedPaymentMethod}).then((result) => {

if (result.error) {

// Confirmation failed. Display the error message.

}

setLoading(false);

})

};

return (

)

};

export default PayButton;

```

# Payment Intents API

> This is a Payment Intents API for when payment-ui is elements. View the full page at https://docs.stripe.com/payments/save-during-payment?payment-ui=elements.

Use the [Payment Intents API](https://docs.stripe.com/api/payment_intents.md) to save payment details from a purchase. There are several use cases:

- Charge a customer for an e-commerce order and store the details for future purchases.

- Initiate the first payment of a series of recurring payments.

- Charge a deposit and store the details to charge the full amount later.

> #### Card-present transactions

>

> Card-present transactions, such as payments through Stripe Terminal, use a different process for saving the payment method. For details, see [the Terminal documentation](https://docs.stripe.com/terminal/features/saving-payment-details/save-after-payment.md).

## Compliance

You’re responsible for your compliance with all applicable laws, regulations, and network rules when saving a customer’s payment details. These requirements generally apply if you want to save your customer’s payment method for future use, such as displaying a customer’s payment method to them in the checkout flow for a future purchase or charging them when they’re not actively using your website or app. Add terms to your website or app that state how you plan to save payment method details and allow customers to opt in.

When you save a payment method, you can only use it for the specific usage you have included in your terms. To charge a payment method when a customer is offline and save it as an option for future purchases, make sure that you explicitly collect consent from the customer for this specific use. For example, include a “Save my payment method for future use” checkbox to collect consent.

To charge them when they’re offline, make sure your terms include the following:

- The customer’s agreement to your initiating a payment or a series of payments on their behalf for specified transactions.

- The anticipated timing and frequency of payments (for example, if the charges are for scheduled installments, subscription payments, or unscheduled top-ups).

- How you determine the payment amount.

- Your cancellation policy, if the payment method is for a subscription service.

Make sure you keep a record of your customer’s written agreement to these terms.

## Set up Stripe [Server-side]

First, [register](https://dashboard.stripe.com/register) for a Stripe account.

Use our official libraries to access the Stripe API from your application:

#### Ruby

```bash

# Available as a gem

sudo gem install stripe

```

```ruby

# If you use bundler, you can add this line to your Gemfile

gem 'stripe'

```

#### Python

```bash

# Install through pip

pip3 install --upgrade stripe

```

```bash

# Or find the Stripe package on http://pypi.python.org/pypi/stripe/

```

```python

# Find the version you want to pin:

# https://github.com/stripe/stripe-python/blob/master/CHANGELOG.md

# Specify that version in your requirements.txt file

stripe>=5.0.0

```

#### PHP

```bash

# Install the PHP library with Composer

composer require stripe/stripe-php

```

```bash

# Or download the source directly: https://github.com/stripe/stripe-php/releases

```

#### Java

```java

/*

For Gradle, add the following dependency to your build.gradle and replace with

the version number you want to use from:

- https://mvnrepository.com/artifact/com.stripe/stripe-java or

- https://github.com/stripe/stripe-java/releases/latest

*/

implementation "com.stripe:stripe-java:31.0.0"

```

```xml

com.stripe

stripe-java

31.0.0

```

```bash

# For other environments, manually install the following JARs:

# - The Stripe JAR from https://github.com/stripe/stripe-java/releases/latest

# - Google Gson from https://github.com/google/gson

```

#### Node.js

```bash

# Install with npm

npm install stripe --save

```

#### Go

```bash

# Make sure your project is using Go Modules

go mod init

# Install stripe-go

go get -u github.com/stripe/stripe-go/v83

```

```go

// Then import the package

import (

"github.com/stripe/stripe-go/v83"

)

```

#### .NET

```bash

# Install with dotnet

dotnet add package Stripe.net

dotnet restore

```

```bash

# Or install with NuGet

Install-Package Stripe.net

```

## Create a Customer [Server-side]

To set a card up for future payments, you must attach it to a *Customer* (Customer objects represent customers of your business. They let you reuse payment methods and give you the ability to track multiple payments). Create a Customer object when your customer creates an account with your business. Customer objects allow for reusing payment methods and tracking across multiple payments.

```curl

curl https://api.stripe.com/v1/customers \

-u "<>:" \

-d name="Jenny Rosen" \

--data-urlencode email="jennyrosen@example.com"

```

```cli

stripe customers create \

--name="Jenny Rosen" \

--email="jennyrosen@example.com"

```

```ruby

client = Stripe::StripeClient.new("<>")

customer = client.v1.customers.create({

name: 'Jenny Rosen',

email: 'jennyrosen@example.com',

})

```

```python

client = StripeClient("<>")

customer = client.v1.customers.create({

"name": "Jenny Rosen",

"email": "jennyrosen@example.com",

})

```

```php

$stripe = new \Stripe\StripeClient('<>');

$customer = $stripe->customers->create([

'name' => 'Jenny Rosen',

'email' => 'jennyrosen@example.com',

]);

```

```java

StripeClient client = new StripeClient("<>");

CustomerCreateParams params =

CustomerCreateParams.builder()

.setName("Jenny Rosen")

.setEmail("jennyrosen@example.com")

.build();

Customer customer = client.v1().customers().create(params);

```

```node

const stripe = require('stripe')('<>');

const customer = await stripe.customers.create({

name: 'Jenny Rosen',

email: 'jennyrosen@example.com',

});

```

```go

sc := stripe.NewClient("<>")

params := &stripe.CustomerCreateParams{

Name: stripe.String("Jenny Rosen"),

Email: stripe.String("jennyrosen@example.com"),

}

result, err := sc.V1Customers.Create(context.TODO(), params)

```

```dotnet

var options = new CustomerCreateOptions

{

Name = "Jenny Rosen",

Email = "jennyrosen@example.com",

};

var client = new StripeClient("<>");

var service = client.V1.Customers;

Customer customer = service.Create(options);

```

Successful creation returns the [Customer](https://docs.stripe.com/api/customers/object.md) object. You can inspect the object for the customer `id` and store the value in your database for later retrieval.

You can find these customers in the [Customers](https://dashboard.stripe.com/customers) page in the Dashboard.

## Enable payment methods

View your [payment methods settings](https://dashboard.stripe.com/settings/payment_methods) and enable the payment methods you want to support. You need at least one payment method enabled to create a *PaymentIntent* (The Payment Intents API tracks the lifecycle of a customer checkout flow and triggers additional authentication steps when required by regulatory mandates, custom Radar fraud rules, or redirect-based payment methods).

By default, Stripe enables cards and other prevalent payment methods that can help you reach more customers, but we recommend turning on additional payment methods that are relevant for your business and customers. See [Payment method support](https://docs.stripe.com/payments/payment-methods/payment-method-support.md) for product and payment method support, and our [pricing page](https://stripe.com/pricing/local-payment-methods) for fees.

## Create a payment [Server-side]

> If you want to render the Payment Element without first creating a PaymentIntent, see [Collect payment details before creating an Intent](https://docs.stripe.com/payments/accept-a-payment-deferred.md?type=payment).

The [PaymentIntent](https://docs.stripe.com/api/payment_intents.md) object represents your intent to collect payment from a customer and tracks charge attempts and state changes throughout the payment process.

A high-level overview of the payments integration this document describes. (See full diagram at https://docs.stripe.com/payments/save-during-payment)

### Create the PaymentIntent

Create a PaymentIntent on your server. Specify an [amount](https://docs.stripe.com/api/payment_intents/create.md#create_payment_intent-amount), [currency](https://docs.stripe.com/api/payment_intents/create.md#create_payment_intent-currency), and [customer](https://docs.stripe.com/api/payment_intents/create.md#create_payment_intent-customer). In the latest version of the API, specifying the `automatic_payment_methods` parameter is optional because Stripe enables its functionality by default. Enable [setup_future_usage](https://docs.stripe.com/api/payment_intents/create.md#create_payment_intent-setup_future_usage). The payment methods you configured in the Dashboard are automatically added to the Payment Intent.

If you don’t want to use the Dashboard or if you want to specify payment methods manually, you can list them using the `payment_method_types` [attribute](https://docs.stripe.com/api/payment_intents/create.md#create_payment_intent-payment_method_types).

```curl

curl https://api.stripe.com/v1/payment_intents \

-u "<>:" \

-d customer="{{CUSTOMER_ID}}" \

-d amount=1099 \

-d currency=usd \

-d setup_future_usage=off_session \

-d "automatic_payment_methods[enabled]"=true

```

```cli

stripe payment_intents create \

--customer="{{CUSTOMER_ID}}" \

--amount=1099 \

--currency=usd \

--setup-future-usage=off_session \

-d "automatic_payment_methods[enabled]"=true

```

```ruby

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = Stripe::StripeClient.new("<>")

payment_intent = client.v1.payment_intents.create({

customer: '{{CUSTOMER_ID}}',

amount: 1099,

currency: 'usd',

setup_future_usage: 'off_session',

automatic_payment_methods: {enabled: true},

})

```

```python

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = StripeClient("<>")

# For SDK versions 12.4.0 or lower, remove '.v1' from the following line.

payment_intent = client.v1.payment_intents.create({

"customer": "{{CUSTOMER_ID}}",

"amount": 1099,

"currency": "usd",

"setup_future_usage": "off_session",

"automatic_payment_methods": {"enabled": True},

})

```

```php

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

$stripe = new \Stripe\StripeClient('<>');

$paymentIntent = $stripe->paymentIntents->create([

'customer' => '{{CUSTOMER_ID}}',

'amount' => 1099,

'currency' => 'usd',

'setup_future_usage' => 'off_session',

'automatic_payment_methods' => ['enabled' => true],

]);

```

```java

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

StripeClient client = new StripeClient("<>");

PaymentIntentCreateParams params =

PaymentIntentCreateParams.builder()

.setCustomer("{{CUSTOMER_ID}}")

.setAmount(1099L)

.setCurrency("usd")

.setSetupFutureUsage(PaymentIntentCreateParams.SetupFutureUsage.OFF_SESSION)

.setAutomaticPaymentMethods(

PaymentIntentCreateParams.AutomaticPaymentMethods.builder().setEnabled(true).build()

)

.build();

// For SDK versions 29.4.0 or lower, remove '.v1()' from the following line.

PaymentIntent paymentIntent = client.v1().paymentIntents().create(params);

```

```node

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

const stripe = require('stripe')('<>');

const paymentIntent = await stripe.paymentIntents.create({

customer: '{{CUSTOMER_ID}}',

amount: 1099,

currency: 'usd',

setup_future_usage: 'off_session',

automatic_payment_methods: {

enabled: true,

},

});

```

```go

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

sc := stripe.NewClient("<>")

params := &stripe.PaymentIntentCreateParams{

Customer: stripe.String("{{CUSTOMER_ID}}"),

Amount: stripe.Int64(1099),

Currency: stripe.String(stripe.CurrencyUSD),

SetupFutureUsage: stripe.String(stripe.PaymentIntentSetupFutureUsageOffSession),

AutomaticPaymentMethods: &stripe.PaymentIntentCreateAutomaticPaymentMethodsParams{

Enabled: stripe.Bool(true),

},

}

result, err := sc.V1PaymentIntents.Create(context.TODO(), params)

```

```dotnet

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

var options = new PaymentIntentCreateOptions

{

Customer = "{{CUSTOMER_ID}}",

Amount = 1099,

Currency = "usd",

SetupFutureUsage = "off_session",

AutomaticPaymentMethods = new PaymentIntentAutomaticPaymentMethodsOptions

{

Enabled = true,

},

};

var client = new StripeClient("<>");

var service = client.V1.PaymentIntents;

PaymentIntent paymentIntent = service.Create(options);

```

> Always decide how much to charge on the server side, a trusted environment, as opposed to the client. This prevents malicious customers from being able to choose their own prices.

### Retrieve the client secret

The PaymentIntent includes a *client secret* (The client secret is a unique key returned from Stripe as part of a PaymentIntent. This key lets the client access important fields from the PaymentIntent (status, amount, currency) while hiding sensitive ones (metadata, customer)) that the client side uses to securely complete the payment process. You can use different approaches to pass the client secret to the client side.

#### Single-page application

Retrieve the client secret from an endpoint on your server, using the browser’s `fetch` function. This approach is best if your client side is a single-page application, particularly one built with a modern frontend framework like React. Create the server endpoint that serves the client secret:

#### Ruby

```ruby

get '/secret' do

intent = # ... Create or retrieve the PaymentIntent

{client_secret: intent.client_secret}.to_json

end

```

#### Python

```python

from flask import Flask, jsonify

app = Flask(__name__)

@app.route('/secret')

def secret():

intent = # ... Create or retrieve the PaymentIntent

return jsonify(client_secret=intent.client_secret)

```

#### PHP

```php

$intent->client_secret));

?>

```

#### Java

```java

import java.util.HashMap;

import java.util.Map;

import com.stripe.model.PaymentIntent;

import com.google.gson.Gson;

import static spark.Spark.get;

public class StripeJavaQuickStart {

public static void main(String[] args) {

Gson gson = new Gson();

get("/secret", (request, response) -> {

PaymentIntent intent = // ... Fetch or create the PaymentIntent

Map map = new HashMap();

map.put("client_secret", intent.getClientSecret());

return map;

}, gson::toJson);

}

}

```

#### Node.js

```javascript

const express = require('express');

const app = express();

app.get('/secret', async (req, res) => {

const intent = // ... Fetch or create the PaymentIntent

res.json({client_secret: intent.client_secret});

});

app.listen(3000, () => {

console.log('Running on port 3000');

});

```

#### Go

```go

package main

import (

"encoding/json"

"net/http"

stripe "github.com/stripe/stripe-go/v76.0.0"

)

type CheckoutData struct {

ClientSecret string `json:"client_secret"`

}

func main() {

http.HandleFunc("/secret", func(w http.ResponseWriter, r *http.Request) {

intent := // ... Fetch or create the PaymentIntent

data := CheckoutData{

ClientSecret: intent.ClientSecret,

}

w.Header().Set("Content-Type", "application/json")

w.WriteHeader(http.StatusOK)

json.NewEncoder(w).Encode(data)

})

http.ListenAndServe(":3000", nil)

}

```

#### .NET

```csharp

using System;

using Microsoft.AspNetCore.Mvc;

using Stripe;

namespace StripeExampleApi.Controllers

{

[Route("secret")]

[ApiController]

public class CheckoutApiController : Controller

{

[HttpGet]

public ActionResult Get()

{

var intent = // ... Fetch or create the PaymentIntent

return Json(new {client_secret = intent.ClientSecret});

}

}

}

```

And then fetch the client secret with JavaScript on the client side:

```javascript

(async () => {

const response = await fetch('/secret');

const {client_secret: clientSecret} = await response.json();

// Render the form using the clientSecret

})();

```

#### Server-side rendering

Pass the client secret to the client from your server. This approach works best if your application generates static content on the server before sending it to the browser.

Add the [client_secret](https://docs.stripe.com/api/payment_intents/object.md#payment_intent_object-client_secret) in your checkout form. In your server-side code, retrieve the client secret from the PaymentIntent:

#### Ruby

```erb

```

```ruby

get '/checkout' do

@intent = # ... Fetch or create the PaymentIntent

erb :checkout

end

```

#### Python

```html

```

```python

@app.route('/checkout')

def checkout():

intent = # ... Fetch or create the PaymentIntent

return render_template('checkout.html', client_secret=intent.client_secret)

```

#### PHP

```php

...

...

```

#### Java

```html

```

```java

import java.util.HashMap;

import java.util.Map;

import com.stripe.model.PaymentIntent;

import spark.ModelAndView;

import static spark.Spark.get;

public class StripeJavaQuickStart {

public static void main(String[] args) {

get("/checkout", (request, response) -> {

PaymentIntent intent = // ... Fetch or create the PaymentIntent

Map map = new HashMap();

map.put("client_secret", intent.getClientSecret());

return new ModelAndView(map, "checkout.hbs");

}, new HandlebarsTemplateEngine());

}

}

```

#### Node.js

```html

```

```javascript

const express = require('express');

const expressHandlebars = require('express-handlebars');

const app = express();

app.engine('.hbs', expressHandlebars({ extname: '.hbs' }));

app.set('view engine', '.hbs');

app.set('views', './views');

app.get('/checkout', async (req, res) => {

const intent = // ... Fetch or create the PaymentIntent

res.render('checkout', { client_secret: intent.client_secret });

});

app.listen(3000, () => {

console.log('Running on port 3000');

});

```

#### Go

```html

```

```go

package main

import (

"html/template"

"net/http"

stripe "github.com/stripe/stripe-go/v76.0.0"

)

type CheckoutData struct {

ClientSecret string

}

func main() {

checkoutTmpl := template.Must(template.ParseFiles("views/checkout.html"))

http.HandleFunc("/checkout", func(w http.ResponseWriter, r *http.Request) {

intent := // ... Fetch or create the PaymentIntent

data := CheckoutData{

ClientSecret: intent.ClientSecret,

}

checkoutTmpl.Execute(w, data)

})

http.ListenAndServe(":3000", nil)

}

```

#### .NET

```html

```

```csharp

using System;

using Microsoft.AspNetCore.Mvc;

using Stripe;

namespace StripeExampleApi.Controllers

{

[Route("/[controller]")]

public class CheckoutApiController : Controller

{

public IActionResult Index()

{

var intent = // ... Fetch or create the PaymentIntent

ViewData["ClientSecret"] = intent.ClientSecret;

return View();

}

}

}

```

## Collect payment details [Client-side]

Collect payment details on the client with the [Payment Element](https://docs.stripe.com/payments/payment-element.md). The Payment Element is a prebuilt UI component that simplifies collecting payment details for a variety of payment methods.

The Payment Element contains an iframe that securely sends payment information to Stripe over an HTTPS connection. Avoid placing the Payment Element within another iframe because some payment methods require redirecting to another page for payment confirmation.

If you do choose to use an iframe and want to accept Apple Pay or Google Pay, the iframe must have the [allow](https://developer.mozilla.org/en-US/docs/Web/HTML/Element/iframe#attr-allowpaymentrequest) attribute set to equal `"payment *"`.

The checkout page address must start with `https://` rather than `http://` for your integration to work. You can test your integration without using HTTPS, but remember to [enable it](https://docs.stripe.com/security/guide.md#tls) when you’re ready to accept live payments.

#### HTML + JS

### Set up Stripe.js

The Payment Element is automatically available as a feature of Stripe.js. Include the Stripe.js script on your checkout page by adding it to the `head` of your HTML file. Always load Stripe.js directly from js.stripe.com to remain PCI compliant. Don’t include the script in a bundle or host a copy of it yourself.

```html

Checkout

```

Create an instance of Stripe with the following JavaScript on your checkout page:

```javascript

// Set your publishable key: remember to change this to your live publishable key in production

// See your keys here: https://dashboard.stripe.com/apikeys

const stripe = Stripe('<>');

```

### Add the Payment Element to your payment page

The Payment Element needs a place to live on your payment page. Create an empty DOM node (container) with a unique ID in your payment form:

```html

```

When the previous form loads, create an instance of the Payment Element and mount it to the container DOM node. Pass the [client secret](https://docs.stripe.com/api/payment_intents/object.md#payment_intent_object-client_secret) from the previous step into `options` when you create the [Elements](https://docs.stripe.com/js/elements_object/create) instance:

Handle the client secret carefully because it can complete the charge. Don’t log it, embed it in URLs, or expose it to anyone but the customer.

```javascript

const options = {

clientSecret: '{{CLIENT_SECRET}}',

// Fully customizable with appearance API.

appearance: {/*...*/},

};

// Set up Stripe.js and Elements to use in checkout form, passing the client secret obtained in a previous stepconst elements = stripe.elements(options);

// Create and mount the Payment Element

const paymentElementOptions = { layout: 'accordion'};

const paymentElement = elements.create('payment', paymentElementOptions);

paymentElement.mount('#payment-element');

```

#### React

### Set up Stripe.js

Install [React Stripe.js](https://www.npmjs.com/package/@stripe/react-stripe-js) and the [Stripe.js loader](https://www.npmjs.com/package/@stripe/stripe-js) from the npm public registry:

```bash

npm install --save @stripe/react-stripe-js @stripe/stripe-js

```

### Add and configure the Elements provider to your payment page

To use the Payment Element component, wrap your checkout page component in an [Elements provider](https://docs.stripe.com/sdks/stripejs-react.md#elements-provider). Call `loadStripe` with your publishable key, and pass the returned `Promise` to the `Elements` provider. Also pass the [client secret](https://docs.stripe.com/api/payment_intents/object.md#payment_intent_object-client_secret) from the previous step as `options` to the `Elements` provider.

```jsx

import React from 'react';

import ReactDOM from 'react-dom';

import {Elements} from '@stripe/react-stripe-js';

import {loadStripe} from '@stripe/stripe-js';

import CheckoutForm from './CheckoutForm';

// Make sure to call `loadStripe` outside of a component’s render to avoid

// recreating the `Stripe` object on every render.

const stripePromise = loadStripe('<>');

function App() {

const options = {

// passing the client secret obtained in step 3

clientSecret: '{{CLIENT_SECRET}}',

// Fully customizable with appearance API.

appearance: {/*...*/},

};

return (

);

};

ReactDOM.render(, document.getElementById('root'));

```

### Add the Payment Element component

Use the `PaymentElement` component to build your form:

```jsx

import React from 'react';

import {PaymentElement} from '@stripe/react-stripe-js';

const CheckoutForm = () => {

return (

);

};

export default CheckoutForm;

```

Stripe Elements is a collection of drop-in UI components. To further customize your form or collect different customer information, browse the [Elements docs](https://docs.stripe.com/payments/elements.md).

The Payment Element renders a dynamic form that allows your customer to pick a payment method. For each payment method, the form automatically asks the customer to fill in all necessary payment details.

### Customize appearance

Customize the Payment Element to match the design of your site by passing the [appearance object](https://docs.stripe.com/js/elements_object/create#stripe_elements-options-appearance) into `options` when creating the `Elements` provider.

### Collect addresses

By default, the Payment Element only collects the necessary billing address details. Some behavior, such as [calculating tax](https://docs.stripe.com/api/tax/calculations/create.md) or entering shipping details, requires your customer’s full address. You can:

- Use the [Address Element](https://docs.stripe.com/elements/address-element.md) to take advantage of autocomplete and localization features to collect your customer’s full address. This helps ensure the most accurate tax calculation.

- Collect address details using your own custom form.

### Request Apple Pay merchant token

If you’ve configured your integration to [accept Apple Pay payments](https://docs.stripe.com/payments/accept-a-payment.md?platform=web&ui=elements#apple-pay-and-google-pay), we recommend configuring the Apple Pay interface to return a merchant token to enable merchant initiated transactions (MIT). [Request the relevant merchant token type](https://docs.stripe.com/apple-pay/merchant-tokens.md?pay-element=web-pe) in the Payment Element.

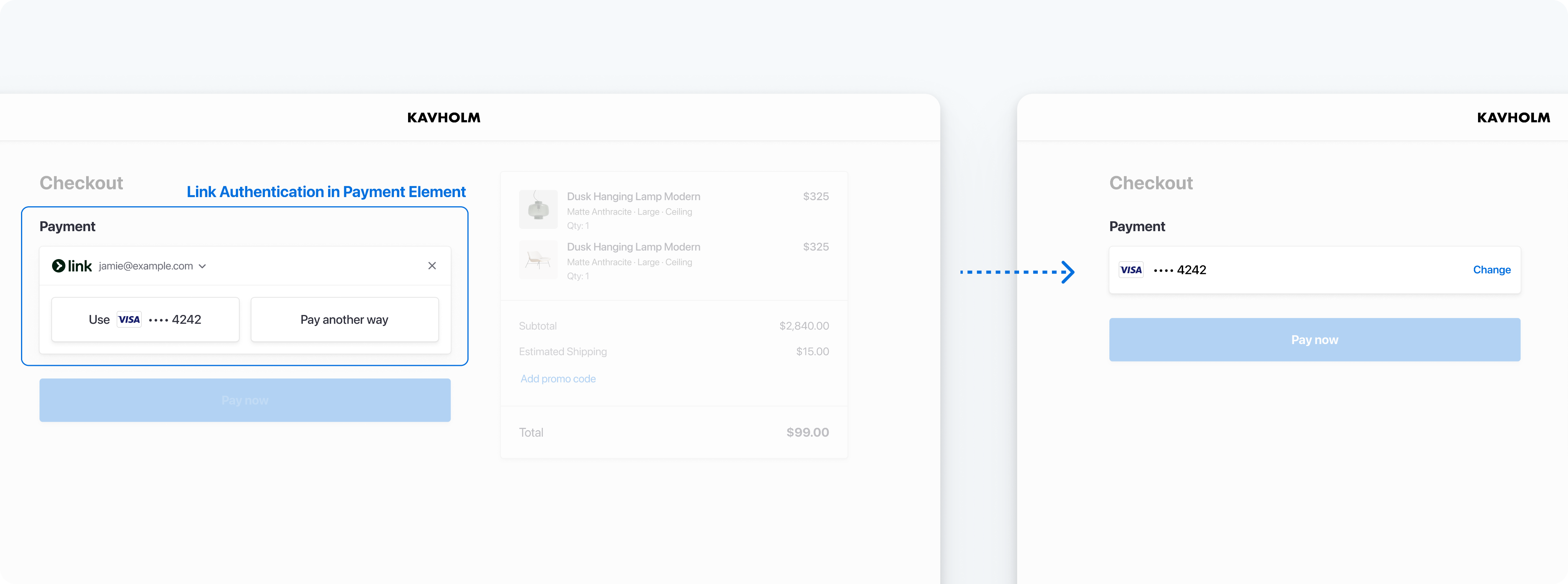

## Optional: Link in your checkout page [Client-side]

Let your customer check out faster by using [Link](https://docs.stripe.com/payments/link.md) in the [Payment Element](https://docs.stripe.com/payments/payment-element.md). You can autofill information for any logged-in customer already using Link, regardless of whether they initially saved their information in Link with another business. The default Payment Element integration includes a Link prompt in the card form. To manage Link in the Payment Element, go to your [payment method settings](https://dashboard.stripe.com/settings/payment_methods).

Collect a customer email address for Link authentication or enrollment

### Integration options

There are two ways you can integrate Link with the Payment Element. Of these, Stripe recommends passing a customer email address to the Payment Element if available. Remember to consider how your checkout flow works when deciding between these options:

| Integration option | Checkout flow | Description |

| ------------------------------------------------------------------ | ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ | ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| Pass a customer email address to the Payment Element (Recommended) | - Your customer enters their email address before landing on the checkout page (in a previous account creation step, for example).

- You prefer to use your own email input field. | Programmatically pass a customer email address to the Payment Element. In this scenario, a customer authenticates to Link directly in the payment form instead of a separate UI component. |

| Collect a customer email address in the Payment Element | - Your customers can choose to enter their email and authenticate or enroll with Link directly in the Payment Element during checkout.

- No code change is required. | If a customer hasn’t enrolled with Link and they choose a supported payment method in the Payment Element, they’re prompted to save their details using Link. For those who have already enrolled, Link automatically populates their payment information. |

Use [defaultValues](https://docs.stripe.com/js/elements_object/create_payment_element#payment_element_create-options-defaultValues) to pass a customer email address to the Payment Element.

```javascript

const paymentElement = elements.create('payment', {

defaultValues: {

billingDetails: {

email: 'foo@bar.com',

}

},

// Other options

});

```

For more information, read how to [build a custom checkout page that includes Link](https://docs.stripe.com/payments/link/add-link-elements-integration.md).

## Optional: Save and retrieve customer payment methods

You can configure the Payment Element to save your customer’s payment methods for future use. This section shows you how to integrate the [saved payment methods feature](https://docs.stripe.com/payments/save-customer-payment-methods.md), which enables the Payment Element to:

- Prompt buyers for consent to save a payment method

- Save payment methods when buyers provide consent

- Display saved payment methods to buyers for future purchases

- [Automatically update lost or expired cards](https://docs.stripe.com/payments/cards/overview.md#automatic-card-updates) when buyers replace them

Save payment methods.

Reuse a previously saved payment method.

### Enable saving the payment method in the Payment Element

When creating a [PaymentIntent](https://docs.stripe.com/api/payment_intents/.md) on your server, also create a [CustomerSession](https://docs.stripe.com/api/customer_sessions/.md) providing the [Customer ID](https://docs.stripe.com/api/customers/object.md#customer_object-id) and enabling the [payment_element](https://docs.stripe.com/api/customer_sessions/object.md#customer_session_object-components-payment_element) component for your session. Configure which saved payment method [features](https://docs.stripe.com/api/customer_sessions/create.md#create_customer_session-components-payment_element-features) you want to enable. For instance, enabling [payment_method_save](https://docs.stripe.com/api/customer_sessions/create.md#create_customer_session-components-payment_element-features-payment_method_save) displays a checkbox offering customers to save their payment details for future use.

You can specify `setup_future_usage` on a PaymentIntent or Checkout Session to override the default behavior for saving payment methods. This ensures that you automatically save the payment method for future use, even if the customer doesn’t explicitly choose to save it.

> Allowing buyers to remove their saved payment methods by enabling [payment_method_remove](https://docs.stripe.com/api/customer_sessions/create.md#create_customer_session-components-payment_element-features-payment_method_remove) impacts subscriptions that depend on that payment method. Removing the payment method detaches the [PaymentMethod](https://docs.stripe.com/api/payment_methods.md) from that [Customer](https://docs.stripe.com/api/customers.md).

#### Ruby

```ruby

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

Stripe.api_key = '<>'

post '/create-intent-and-customer-session' do

intent = Stripe::PaymentIntent.create({

amount: 1099,

currency: 'usd',

# In the latest version of the API, specifying the `automatic_payment_methods` parameter

# is optional because Stripe enables its functionality by default.

automatic_payment_methods: {enabled: true},

customer: {{CUSTOMER_ID}},

})

customer_session = Stripe::CustomerSession.create({

customer: {{CUSTOMER_ID}},

components: {

payment_element: {

enabled: true,

features: {

payment_method_redisplay: 'enabled',

payment_method_save: 'enabled',

payment_method_save_usage: 'off_session',

payment_method_remove: 'enabled',

},

},

},

})

{

client_secret: intent.client_secret,

customer_session_client_secret: customer_session.client_secret

}.to_json

end

```

#### Python

```python

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

stripe.api_key = '<>'

@app.route('/create-intent-and-customer-session', methods=['POST'])

def createIntentAndCustomerSession():

intent = stripe.PaymentIntent.create(

amount=1099,

currency='usd',

# In the latest version of the API, specifying the `automatic_payment_methods` parameter

# is optional because Stripe enables its functionality by default.

automatic_payment_methods={

'enabled': True,

},

customer={{CUSTOMER_ID}},

)

customer_session = stripe.CustomerSession.create(

customer={{CUSTOMER_ID}},

components={

"payment_element": {

"enabled": True,

"features": {

"payment_method_redisplay": "enabled",

"payment_method_save": "enabled",

"payment_method_save_usage": "off_session",

"payment_method_remove": "enabled",

},

},

},

)

return jsonify(

client_secret=intent.client_secret,

customer_session_client_secret=customer_session.client_secret

)

```

#### PHP

```php

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

$stripe = new \Stripe\StripeClient('<>');

$intent = $stripe->paymentIntents->create(

[

'amount' => 1099,

'currency' => 'usd',

// In the latest version of the API, specifying the `automatic_payment_methods` parameter

// is optional because Stripe enables its functionality by default.

'automatic_payment_methods' => ['enabled' => true],

'customer' => {{CUSTOMER_ID}},

]

);

$customer_session = $stripe->customerSessions->create([

'customer' => {{CUSTOMER_ID}},

'components' => [

'payment_element' => [

'enabled' => true,

'features' => [

'payment_method_redisplay' => 'enabled',

'payment_method_save' => 'enabled',

'payment_method_save_usage' => 'off_session',

'payment_method_remove' => 'enabled',

],

],

],

]);

echo json_encode(array(

'client_secret' => $intent->client_secret,

'customer_session_client_secret' => $customer_session->client_secret

));

```

#### Node.js

```javascript

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

const stripe = require('stripe')('<>');

app.post('/create-intent-and-customer-session', async (req, res) => {

const intent = await stripe.paymentIntents.create({

amount: 1099,

currency: 'usd',

// In the latest version of the API, specifying the `automatic_payment_methods` parameter

// is optional because Stripe enables its functionality by default.

automatic_payment_methods: {enabled: true},

customer: {{CUSTOMER_ID}},

});

const customerSession = await stripe.customerSessions.create({

customer: {{CUSTOMER_ID}},

components: {

payment_element: {

enabled: true,

features: {

payment_method_redisplay: 'enabled',

payment_method_save: 'enabled',

payment_method_save_usage: 'off_session',

payment_method_remove: 'enabled',

},

},

},

});

res.json({

client_secret: intent.client_secret,

customer_session_client_secret: customerSession.client_secret

});

});

```

#### Java

```java

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

Stripe.apiKey = "<>";

post(

"/create-intent-and-customer-session",

(request, response) -> {

response.type("application/json");

PaymentIntentCreateParams intentParams = PaymentIntentCreateParams.builder()

.setAmount(1099L)

.setCurrency("usd")

// In the latest version of the API, specifying the `automatic_payment_methods` parameter

// is optional because Stripe enables its functionality by default.

.setAutomaticPaymentMethods(

PaymentIntentCreateParams.AutomaticPaymentMethods.builder().setEnabled(true).build()

)

.setCustomer({{CUSTOMER_ID}})

.build();

PaymentIntent paymentIntent = PaymentIntent.create(intentParams);

CustomerSessionCreateParams csParams = CustomerSessionCreateParams.builder()

.setCustomer({{CUSTOMER_ID}})

.setComponents(CustomerSessionCreateParams.Components.builder().build())

.putExtraParam("components[payment_element][enabled]", true)

.putExtraParam(

"components[payment_element][features][payment_method_redisplay]",

"enabled"

)

.putExtraParam(

"components[payment_element][features][payment_method_save]",

"enabled"

)

.putExtraParam(

"components[payment_element][features][payment_method_save_usage]",

"off_session"

)

.putExtraParam(

"components[payment_element][features][payment_method_remove]",

"enabled"

)

.build();

CustomerSession customerSession = CustomerSession.create(csParams);

Map responseData = new HashMap<>();

responseData.put("clientSecret", paymentIntent.getClientSecret());

responseData.put("customerSessionClientSecret", customerSession.getClientSecret());

return StripeObject.PRETTY_PRINT_GSON.toJson(responseData);

}

);

```

#### Go

```go

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

stripe.Key = "<>"

type CheckoutData struct {

ClientSecret string `json:"client_secret"`

CustomerSessionClientSecret string `json:"customer_session_client_secret"`

}

func main() {

http.HandleFunc("/create-intent-and-customer-session", func(w http.ResponseWriter, r *http.Request) {

intentParams := &stripe.PaymentIntentParams{

Amount: stripe.Int64(1099),

Currency: stripe.String(string(stripe.CurrencyUSD)),

// In the latest version of the API, specifying the `automatic_payment_methods` parameter

// is optional because Stripe enables its functionality by default.

AutomaticPaymentMethods: &stripe.PaymentIntentAutomaticPaymentMethodsParams{

Enabled: stripe.Bool(true),

},

Customer: stripe.String({{CUSTOMER_ID}}),

};

intent, _ := .New(intentParams);

csParams := &stripe.CustomerSessionParams{

Customer: stripe.String({{CUSTOMER_ID}}),

Components: &stripe.CustomerSessionComponentsParams{},

}

csParam.AddExtra("components[payment_element][enabled]", true)

csParam.AddExtra(

"components[payment_element][features][payment_method_redisplay]",

"enabled",

)

csParam.AddExtra(

"components[payment_element][features][payment_method_save]",

"enabled",

)

csParam.AddExtra(

"components[payment_element][features][payment_method_save_usage]",

"off_session",

)

csParam.AddExtra(

"components[payment_element][features][payment_method_remove]",

"enabled",

)

customerSession, _ := customersession.New(csParams)

data := CheckoutData{

ClientSecret: intent.ClientSecret,

CustomerSessionClientSecret: customerSession.ClientSecret

}

w.Header().Set("Content-Type", "application/json")

w.WriteHeader(http.StatusOK)

json.NewEncoder(w).Encode(data)

})

}

```

#### .NET

```csharp

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

StripeConfiguration.ApiKey = "<>";

namespace StripeExampleApi.Controllers

{

[Route("create-intent-and-customer-session")]

[ApiController]

public class CheckoutApiController : Controller

{

[HttpPost]

public ActionResult Post()

{

var intentOptions = new PaymentIntentCreateOptions

{

Amount = 1099,

Currency = "usd",

// In the latest version of the API, specifying the `automatic_payment_methods` parameter

// is optional because Stripe enables its functionality by default.

AutomaticPaymentMethods = new PaymentIntentAutomaticPaymentMethodsOptions

{

Enabled = true,

},

Customer = {{CUSTOMER_ID}},

};

var intentService = new PaymentIntentService();

var intent = intentService.Create(intentOptions);

var customerSessionOptions = new CustomerSessionCreateOptions

{

Customer = {{CUSTOMER_ID}},

Components = new CustomerSessionComponentsOptions(),

}

customerSessionOptions.AddExtraParam("components[payment_element][enabled]", true);

customerSessionOptions.AddExtraParam(

"components[payment_element][features][payment_method_redisplay]",

"enabled");

customerSessionOptions.AddExtraParam(

"components[payment_element][features][payment_method_save]",

"enabled");

customerSessionOptions.AddExtraParam(

"components[payment_element][features][payment_method_save_usage]",

"off_session");

customerSessionOptions.AddExtraParam(

"components[payment_element][features][payment_method_remove]",

"enabled");

var customerSessionService = new CustomerSessionService();

var customerSession = customerSessionService.Create(customerSessionOptions);

return Json(new {

client_secret = intent.ClientSecret,

customerSessionClientSecret = customerSession.ClientSecret

});

}

}

}

```

Your Elements instance uses the CustomerSession’s *client secret* (A client secret is used with your publishable key to authenticate a request for a single object. Each client secret is unique to the object it's associated with) to access that customer’s saved payment methods. [Handle errors](https://docs.stripe.com/error-handling.md) properly when you create the CustomerSession. If an error occurs, you don’t need to provide the CustomerSession client secret to the Elements instance, as it’s optional.

Create the Elements instance using the client secrets for both the PaymentIntent and the CustomerSession. Then, use this Elements instance to create a Payment Element.

```javascript

// Create the CustomerSession and obtain its clientSecret

const res = await fetch("/create-intent-and-customer-session", {

method: "POST"

});

const {

customer_session_client_secret: customerSessionClientSecret

} = await res.json();

const elementsOptions = {

clientSecret: '{{CLIENT_SECRET}}',customerSessionClientSecret,

// Fully customizable with appearance API.

appearance: {/*...*/},

};

// Set up Stripe.js and Elements to use in checkout form, passing the client secret

// and CustomerSession's client secret obtained in a previous step

const elements = stripe.elements(elementsOptions);

// Create and mount the Payment Element

const paymentElementOptions = { layout: 'accordion'};

const paymentElement = elements.create('payment', paymentElementOptions);

paymentElement.mount('#payment-element');

```

When confirming the PaymentIntent, Stripe.js automatically controls setting [setup_future_usage](https://docs.stripe.com/api/payment_intents/object.md#payment_intent_object-setup_future_usage) on the PaymentIntent and [allow_redisplay](https://docs.stripe.com/api/payment_methods/object.md#payment_method_object-allow_redisplay) on the PaymentMethod, depending on whether the customer checked the box to save their payment details.

### Enforce CVC recollection

Optionally, specify `require_cvc_recollection` [when creating the PaymentIntent](https://docs.stripe.com/api/payment_intents/create.md#create_payment_intent-payment_method_options-card-require_cvc_recollection) to enforce CVC recollection when a customer is paying with a card.

### Detect the selection of a saved payment method

To control dynamic content when a saved payment method is selected, listen to the Payment Element `change` event, which is populated with the selected payment method.

```javascript

paymentElement.on('change', function(event) {

if (event.value.payment_method) {

// Control dynamic content if a saved payment method is selected

}

})

```

## Optional: Collect address details [Client-side]

#### HTML + JS

The [Address Element](https://docs.stripe.com/elements/address-element.md) lets you collect shipping or billing addresses. Create an empty DOM node for the Address Element. Display it after the Link Authentication Element:

```html

```

Then, create an instance of the Address Element, and mount it to the DOM node:

```javascript

// Customize the appearance of Elements using the Appearance API.

const appearance = { /* ... */ };

// Enable the skeleton loader UI for the optimal loading experience.

const loader = 'auto';

const stripe = Stripe('<>');

// Create an elements group from the Stripe instance passing in the clientSecret and, optionally, appearance.

const elements = stripe.elements({clientSecret, appearance, loader});

// Create Element instances

const linkAuthenticationElement = elements.create("linkAuthentication");const addressElement = elements.create("address", {

mode: 'shipping',

allowedCountries: ['US']

});

const paymentElement = elements.create("payment");

// Mount the Elements to their corresponding DOM node

linkAuthenticationElement.mount("#link-authentication-element");addressElement.mount("#address-element");

paymentElement.mount("#payment-element");

```

Display the Address Element before the Payment Element. The Payment Element dynamically detects address data collected by the Address Element, hiding unnecessary fields and collecting additional billing address details as necessary.

### Retrieve address information

The Address Element automatically passes the shipping address when a customer submits payment, but you can also retrieve the address details on the frontend using the `change` event. The `change` event sends whenever the user updates any field in the Address Element, or after selecting saved addresses:

```javascript

addressElement.on('change', (event: AddressChangeEvent) => {

const address = event.value;

})

```

### Prefill a shipping address

Use [defaultValues](https://docs.stripe.com/js/elements_object/create_address_element#address_element_create-options-defaultValues) to prefill address information, speeding checkout for your customers.

```javascript

// Create addressElement with the defaultValues option

const addressElement = elements.create("address", {

mode: 'shipping',

defaultValues: {

name: 'Jane Doe',

address: {

line1: '354 Oyster Point Blvd',

line2: '',

city: 'South San Francisco',

state: 'CA',

postal_code: '94080',

country: 'US',

}

}

});

// Mount the Element to its corresponding DOM node

addressElement.mount("#address-element");

```

#### React

To collect addresses, create an empty DOM node for the [Address Element](https://docs.stripe.com/elements/address-element.md) to render into. The Address Element must be displayed after the Link Authentication Element for Link to autofill a customer’s saved address details:

```jsx

import {loadStripe} from "@stripe/stripe-js";

import {

Elements,

LinkAuthenticationElement,AddressElement,

PaymentElement,

} from "@stripe/react-stripe-js";

const stripe = loadStripe('<>');

// Customize the appearance of Elements using the Appearance API.

const appearance = {/* ... */};

// Enable the skeleton loader UI for the optimal loading experience.

const loader = 'auto';

const CheckoutPage = ({clientSecret}) => (

);

export default function CheckoutForm() {

return (

);

}

```

Display the `AddressElement` before the `PaymentElement`. The `PaymentElement` dynamically detects address data collected by the `AddressElement`, hiding unnecessary fields and collecting additional billing address details as necessary.

### Retrieve address information

The `AddressElement` automatically passes the shipping address when a customer submits the payment, but you can also retrieve the address details on the frontend using the `onChange` property. The `onChange` handler sends an event whenever the user updates any field in the Address Element or selects a saved address:

```jsx

{

setAddressState(event.value);

}} />

```

### Prefill a shipping address

Use [defaultValues](https://docs.stripe.com/js/elements_object/create_address_element#address_element_create-options-defaultValues) to prefill address information, speeding checkout for your customers.

```jsx

```

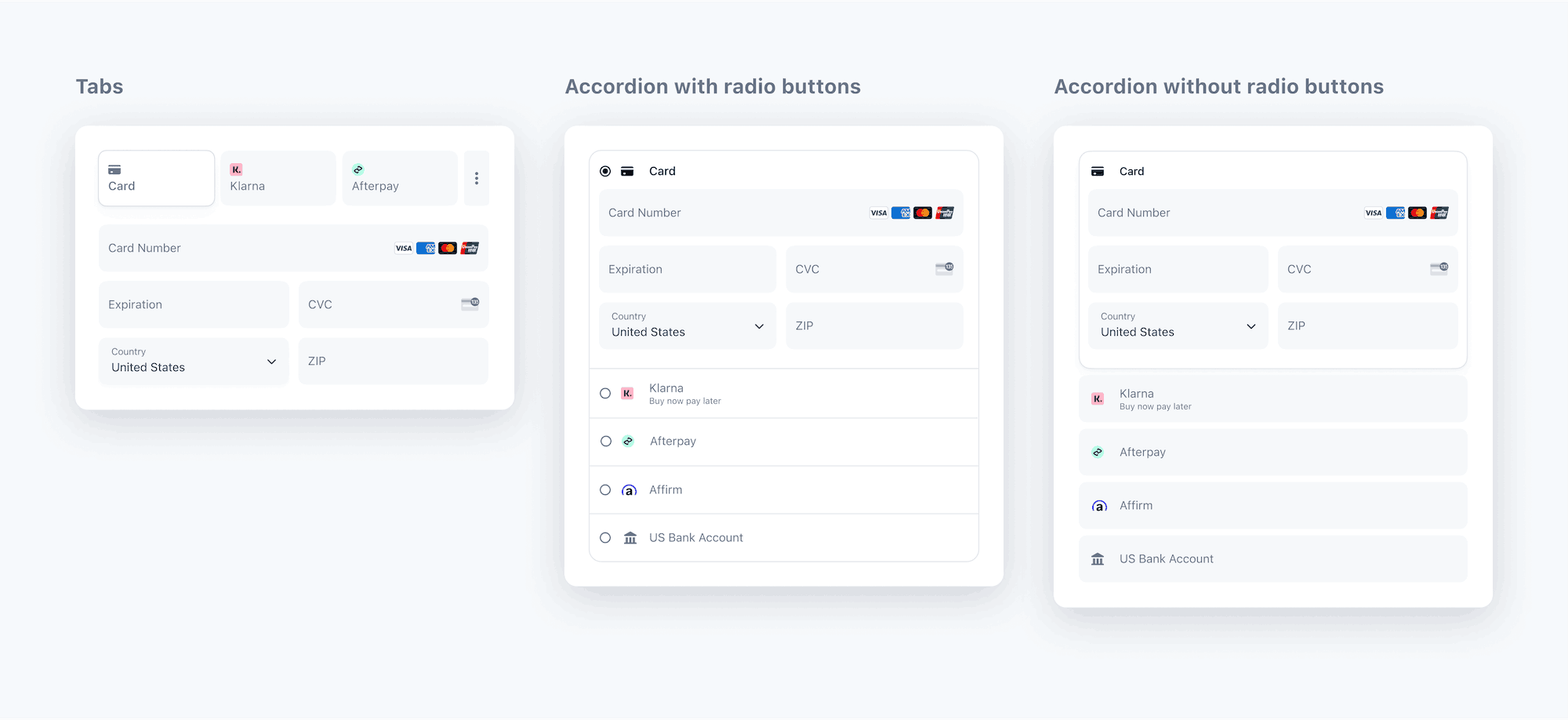

## Optional: Customize the layout [Client-side]

You can customize the Payment Element’s layout (accordion or tabs) to fit your checkout interface. For more information about each of the properties, see [elements.create](https://docs.stripe.com/js/elements_object/create_payment_element#payment_element_create-options).

#### Accordion

You can start using the layout features by passing a layout `type` and other optional properties when creating the Payment Element:

```javascript

const paymentElement = elements.create('payment', {

layout: {

type: 'accordion',

defaultCollapsed: false,

radios: true,

spacedAccordionItems: false

}

});

```

#### Tabs

### Specify the layout

Set the value for layout to `tabs`. You also have the option to specify other properties, such as the ones in the following example:

```javascript

const paymentElement = elements.create('payment', {

layout: {

type: 'tabs',

defaultCollapsed: false,

}

});

```

The following image is the same Payment Element rendered using different layout configurations:

Payment Element layouts

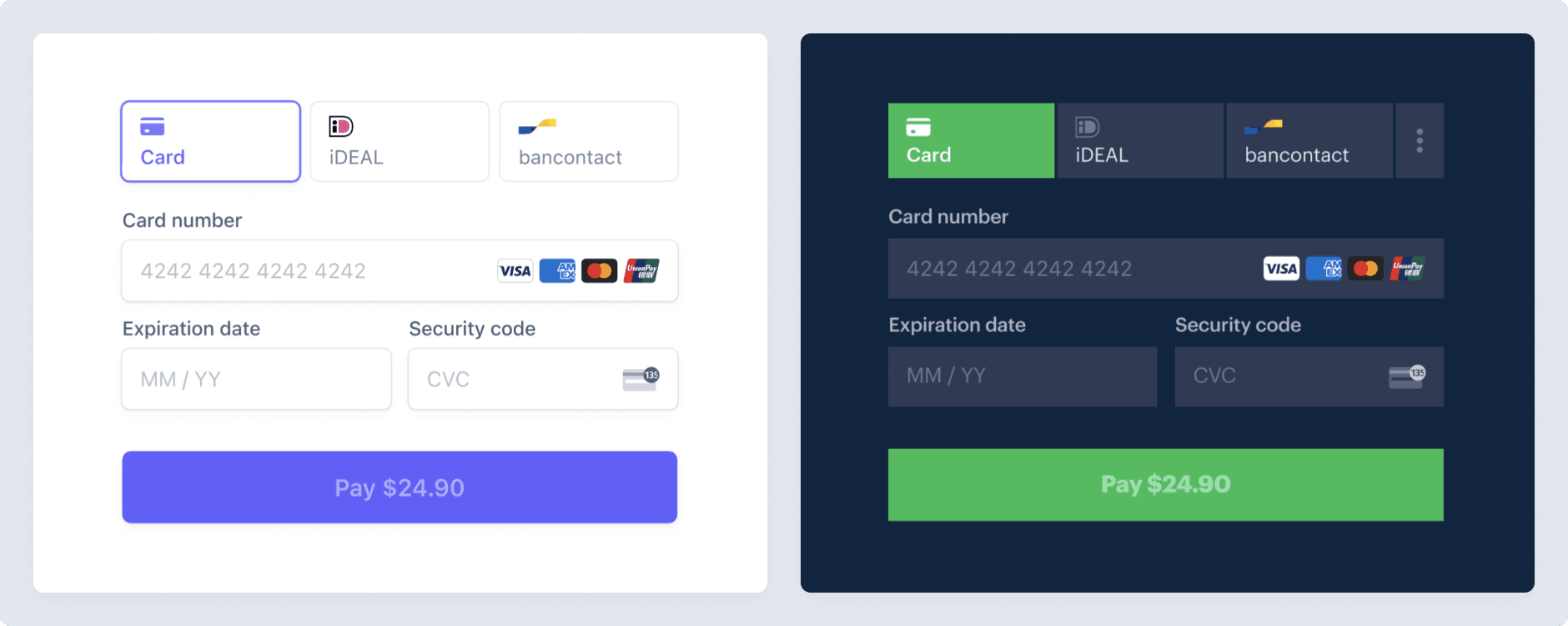

## Optional: Customize the appearance [Client-side]

Now that you’ve added the Payment Element to your page, you can customize its appearance to make it fit your design. To learn more about customizing the Payment Element, see [Elements Appearance API](https://docs.stripe.com/elements/appearance-api.md).

Customize the Payment Element

## Optional: Fetch updates from the server [Client-side]

You might want to update attributes on the PaymentIntent after the Payment Element renders, such as the [amount](https://docs.stripe.com/api/payment_intents/update.md#update_payment_intent-amount) (for example, discount codes or shipping costs). You can [update the PaymentIntent](https://docs.stripe.com/api/payment_intents/update.md) on your server, then call [elements.fetchUpdates](https://docs.stripe.com/js/elements_object/fetch_updates) to see the new amount reflected in the Payment Element. This example shows you how to create the server endpoint that updates the amount on the PaymentIntent:

#### Ruby

```ruby

get '/update' do

intent = Stripe::PaymentIntent.update(

'{{PAYMENT_INTENT_ID}}',

{amount: 1499},

)

{status: intent.status}.to_json

end

```

#### Python

```python

@app.route('/update')

def secret():

intent = stripe.PaymentIntent.modify(

"{{PAYMENT_INTENT_ID}}",

amount=1499,

)

return jsonify(status=intent.status)

```

#### PHP

```php

paymentIntents->update(

'{{PAYMENT_INTENT_ID}}',

['amount' => 1499]

);

echo json_encode(array('status' => $intent->status));

?>

```

#### Java

```java

import java.util.HashMap;

import java.util.Map;

import com.stripe.model.PaymentIntent;

import com.google.gson.Gson;

import static spark.Spark.get;

public class StripeJavaQuickStart {

public static void main(String[] args) {

Gson gson = new Gson();

get("/update", (request, response) -> {

PaymentIntent paymentIntent =

PaymentIntent.retrieve(

"{{PAYMENT_INTENT_ID}}"

);

Map params = new HashMap<>();

params.put("amount", 1499);

PaymentIntent updatedPaymentIntent =

paymentIntent.update(params);

Map response = new HashMap();

response.put("status", updatedPaymentIntent.getStatus());

return map;

}, gson::toJson);

}

}

```

#### Node.js

```javascript

app.get('/update', async (req, res) => {

const intent = await stripe.paymentIntents.update(

'{{PAYMENT_INTENT_ID}}',

{amount: 1499}

);

res.json({status: intent.status});

});

```

#### Go

```go

package main

import (

"encoding/json"

"net/http"

stripe "github.com/stripe/stripe-go/v76.0.0"

)

type UpdateData struct {

Status string `json:"status"`

}

func main() {

http.HandleFunc("/update", func(w http.ResponseWriter, r *http.Request) {

params := &stripe.PaymentIntentParams{

Amount: stripe.Int64(1499),

}

pi, _ := paymentintent.Update(

"{{PAYMENT_INTENT_ID}}",

params,

)

data := UpdateData{

Status: pi.Status,

}

w.Header().Set("Content-Type", "application/json")

w.WriteHeader(http.StatusOK)

json.NewEncoder(w).Encode(data)

})

http.ListenAndServe(":3000", nil)

}

```

#### .NET

```csharp

using System;

using Microsoft.AspNetCore.Mvc;

using Stripe;

namespace StripeExampleApi.Controllers

{

[Route("update")]

[ApiController]

public class CheckoutApiController : Controller

{

[HttpPost]

public ActionResult Post()

{

var options = new PaymentIntentUpdateOptions

{

Amount = 1499,

};

var service = new PaymentIntentService();

var intent = service.Update(

"{{PAYMENT_INTENT_ID}}",

options);

return Json(new {status = intent.Status});

}

}

}

```

This example demonstrates how to update the UI to reflect these changes on the client side:

```javascript

(async () => {

const response = await fetch('/update');

if (response.status === 'requires_payment_method') {

const {error} = await elements.fetchUpdates();

}

})();

```

## Submit the payment to Stripe [Client-side]

Use [stripe.confirmPayment](https://docs.stripe.com/js/payment_intents/confirm_payment) to complete the payment using details from the Payment Element. Provide a [return_url](https://docs.stripe.com/api/payment_intents/create.md#create_payment_intent-return_url) to this function to indicate where Stripe should redirect the user after they complete the payment. Your user may be first redirected to an intermediate site, like a bank authorization page, before being redirected to the `return_url`. Card payments immediately redirect to the `return_url` when a payment is successful.

If you don’t want to redirect for card payments after payment completion, you can set [redirect](https://docs.stripe.com/js/payment_intents/confirm_payment#confirm_payment_intent-options-redirect) to `if_required`. This only redirects customers that check out with redirect-based payment methods.

#### HTML + JS

```javascript

const form = document.getElementById('payment-form');

form.addEventListener('submit', async (event) => {

event.preventDefault();

const {error} = await stripe.confirmPayment({

//`Elements` instance that was used to create the Payment Element

elements,

confirmParams: {

return_url: 'https://example.com/order/123/complete',

},

});

if (error) {

// This point will only be reached if there is an immediate error when

// confirming the payment. Show error to your customer (for example, payment

// details incomplete)

const messageContainer = document.querySelector('#error-message');

messageContainer.textContent = error.message;

} else {

// Your customer will be redirected to your `return_url`. For some payment

// methods like iDEAL, your customer will be redirected to an intermediate

// site first to authorize the payment, then redirected to the `return_url`.

}

});

```

#### React

To call [stripe.confirmPayment](https://docs.stripe.com/js/payment_intents/confirm_payment) from your payment form component, use the [useStripe](https://docs.stripe.com/sdks/stripejs-react.md#usestripe-hook) and [useElements](https://docs.stripe.com/sdks/stripejs-react.md#useelements-hook) hooks.

If you prefer traditional class components over hooks, you can instead use an [ElementsConsumer](https://docs.stripe.com/sdks/stripejs-react.md#elements-consumer).

```jsx

import React, {useState} from 'react';

import {useStripe, useElements, PaymentElement} from '@stripe/react-stripe-js';

const CheckoutForm = () => {

const stripe = useStripe();

const elements = useElements();

const [errorMessage, setErrorMessage] = useState(null);

const handleSubmit = async (event) => {

// We don't want to let default form submission happen here,

// which would refresh the page.

event.preventDefault();

if (!stripe || !elements) {

// Stripe.js hasn't yet loaded.

// Make sure to disable form submission until Stripe.js has loaded.

return;

}

const {error} = await stripe.confirmPayment({

//`Elements` instance that was used to create the Payment Element

elements,

confirmParams: {

return_url: 'https://example.com/order/123/complete',

},

});

if (error) {

// This point will only be reached if there is an immediate error when

// confirming the payment. Show error to your customer (for example, payment

// details incomplete)

setErrorMessage(error.message);

} else {

// Your customer will be redirected to your `return_url`. For some payment

// methods like iDEAL, your customer will be redirected to an intermediate

// site first to authorize the payment, then redirected to the `return_url`.

}

};

return (

)

};

export default CheckoutForm;

```

> `stripe.confirmPayment` may take several seconds to complete. During that time, disable your form from being resubmitted and show a waiting indicator like a spinner. If you receive an error, show it to the customer, re-enable the form, and hide the waiting indicator. If the customer must perform additional steps to complete the payment, such as authentication, Stripe.js walks them through that process.

If the payment succeeded, the card is saved to the Customer object. This is reflected on the *PaymentMethod* (PaymentMethods represent your customer's payment instruments, used with the Payment Intents or Setup Intents APIs)’s [customer](https://docs.stripe.com/api/payment_methods/object.md#payment_method_object-customer) field. At this point, associate the ID of the *Customer* (Customer objects represent customers of your business. They let you reuse payment methods and give you the ability to track multiple payments) object with your own internal representation of a customer, if you have one. Now you can use the stored PaymentMethod object to collect payments from your customer in the future without prompting them for their payment details again.

Make sure the `return_url` corresponds to a page on your website that provides the status of the payment. When Stripe redirects the customer to the `return_url`, we provide the following URL query parameters:

| Parameter | Description |

| ------------------------------ | --------------------------------------------------------------------------------------------------------------------------------------------- |

| `payment_intent` | The unique identifier for the `PaymentIntent`. |

| `payment_intent_client_secret` | The [client secret](https://docs.stripe.com/api/payment_intents/object.md#payment_intent_object-client_secret) of the `PaymentIntent` object. |

> If you have tooling that tracks the customer’s browser session, you might need to add the `stripe.com` domain to the referrer exclude list. Redirects cause some tools to create new sessions, which prevents you from tracking the complete session.

Use one of the query parameters to retrieve the PaymentIntent. Inspect the [status of the PaymentIntent](https://docs.stripe.com/payments/paymentintents/lifecycle.md) to decide what to show your customers. You can also append your own query parameters when providing the `return_url`, which persist through the redirect process.

#### HTML + JS

```javascript

// Initialize Stripe.js using your publishable key

const stripe = Stripe('<>');

// Retrieve the "payment_intent_client_secret" query parameter appended to

// your return_url by Stripe.js

const clientSecret = new URLSearchParams(window.location.search).get(

'payment_intent_client_secret'

);

// Retrieve the PaymentIntent

stripe.retrievePaymentIntent(clientSecret).then(({paymentIntent}) => {

const message = document.querySelector('#message')

// Inspect the PaymentIntent `status` to indicate the status of the payment

// to your customer.

//

// Some payment methods will [immediately succeed or fail][0] upon

// confirmation, while others will first enter a `processing` state.

//

// [0]: https://stripe.com/docs/payments/payment-methods#payment-notification

switch (paymentIntent.status) {

case 'succeeded':

message.innerText = 'Success! Payment received.';

break;

case 'processing':

message.innerText = "Payment processing. We'll update you when payment is received.";

break;

case 'requires_payment_method':

message.innerText = 'Payment failed. Please try another payment method.';

// Redirect your user back to your payment page to attempt collecting

// payment again

break;

default:

message.innerText = 'Something went wrong.';

break;

}

});

```

#### React

```jsx

import React, {useState, useEffect} from 'react';

import {useStripe} from '@stripe/react-stripe-js';

const PaymentStatus = () => {

const stripe = useStripe();

const [message, setMessage] = useState(null);

useEffect(() => {

if (!stripe) {

return;

}

// Retrieve the "payment_intent_client_secret" query parameter appended to

// your return_url by Stripe.js

const clientSecret = new URLSearchParams(window.location.search).get(

'payment_intent_client_secret'

);

// Retrieve the PaymentIntent

stripe

.retrievePaymentIntent(clientSecret)

.then(({paymentIntent}) => {

// Inspect the PaymentIntent `status` to indicate the status of the payment

// to your customer.

//

// Some payment methods will [immediately succeed or fail][0] upon

// confirmation, while others will first enter a `processing` state.

//

// [0]: https://stripe.com/docs/payments/payment-methods#payment-notification

switch (paymentIntent.status) {

case 'succeeded':

setMessage('Success! Payment received.');

break;

case 'processing':

setMessage("Payment processing. We'll update you when payment is received.");

break;

case 'requires_payment_method':

// Redirect your user back to your payment page to attempt collecting

// payment again

setMessage('Payment failed. Please try another payment method.');

break;

default:

setMessage('Something went wrong.');

break;

}

});

}, [stripe]);

return message;

};

export default PaymentStatus;

```

## Charge the saved payment method later [Server-side]

> `bancontact`, `ideal`, and `sofort` are one-time payment methods by default. When set up for future usage, they generate a `sepa_debit` reusable payment method type so you need to use `sepa_debit` to query for saved payment methods.

> #### Compliance

>

> You’re responsible for your compliance with all applicable laws, regulations, and network rules when saving a customer’s payment details. When rendering past payment methods to your end customer for future purchases, make sure you’re listing payment methods where you’ve collected consent from the customer to save the payment method details for this specific future use. To differentiate between payment methods attached to customers that can and can’t be presented to your end customer as a saved payment method for future purchases, use the [allow_redisplay](https://docs.stripe.com/api/payment_methods/object.md#payment_method_object-allow_redisplay) parameter.

When you’re ready to charge your customer *off-session* (A payment is described as off-session if it occurs without the direct involvement of the customer, using previously-collected payment information), use the Customer and PaymentMethod IDs to create a PaymentIntent. To find a payment method to charge, list the payment methods associated with your customer. This example lists cards but you can list any supported [type](https://docs.stripe.com/api/payment_methods/object.md#payment_method_object-type).

```curl

curl -G https://api.stripe.com/v1/payment_methods \

-u "<>:" \

-d customer="{{CUSTOMER_ID}}" \

-d type=card

```

```cli

stripe payment_methods list \

--customer="{{CUSTOMER_ID}}" \

--type=card

```

```ruby

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = Stripe::StripeClient.new("<>")

payment_methods = client.v1.payment_methods.list({

customer: '{{CUSTOMER_ID}}',

type: 'card',

})

```

```python

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = StripeClient("<>")

# For SDK versions 12.4.0 or lower, remove '.v1' from the following line.

payment_methods = client.v1.payment_methods.list({

"customer": "{{CUSTOMER_ID}}",

"type": "card",

})

```

```php

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

$stripe = new \Stripe\StripeClient('<>');

$paymentMethods = $stripe->paymentMethods->all([

'customer' => '{{CUSTOMER_ID}}',

'type' => 'card',

]);

```

```java

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

StripeClient client = new StripeClient("<>");

PaymentMethodListParams params =

PaymentMethodListParams.builder()

.setCustomer("{{CUSTOMER_ID}}")

.setType(PaymentMethodListParams.Type.CARD)

.build();

// For SDK versions 29.4.0 or lower, remove '.v1()' from the following line.

StripeCollection stripeCollection =

client.v1().paymentMethods().list(params);

```

```node

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

const stripe = require('stripe')('<>');

const paymentMethods = await stripe.paymentMethods.list({

customer: '{{CUSTOMER_ID}}',

type: 'card',

});

```

```go

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

sc := stripe.NewClient("<>")

params := &stripe.PaymentMethodListParams{

Customer: stripe.String("{{CUSTOMER_ID}}"),

Type: stripe.String(stripe.PaymentMethodTypeCard),

}

result := sc.V1PaymentMethods.List(context.TODO(), params)

```

```dotnet