# Build a custom checkout page that includes Link

Integrate Link using the Payment Element or Link Authentication Element.

If your customer is an Accounts v2 entity, use our [guide](https://docs.stripe.com/billing/v1-v2-customer-map.md) to replace `Customer` and event references in your code with the equivalent Accounts v2 API references.

This guide walks you through how to accept payments with [Link](https://docs.stripe.com/payments/link.md) using the [Payment Intents API](https://docs.stripe.com/api/payment_intents.md) and either the [Payment Element](https://docs.stripe.com/payments/payment-element.md) or [Link Authentication Element](https://docs.stripe.com/payments/elements/link-authentication-element.md).

There are three ways you can secure a customer email address for Link authentication and enrollment:

- **Pass in an email address:** You can pass an email address to the Payment Element using [defaultValues](https://docs.stripe.com/js/elements_object/create_payment_element#payment_element_create-options-defaultValues). If you’re already collecting the email address and or customer’s phone number in the checkout flow, we recommend this approach.

- **Collect an email address:** You can collect an email address directly in the Payment Element. If you’re not collecting the email address anywhere in the checkout flow, we recommend this approach.

- **Link Authentication Element:** You can use the Link Authentication Element to create a single email input field for both email collection and Link authentication. We recommend doing this if you use the [Address Element](https://docs.stripe.com/elements/address-element.md).

Collect a customer email address for Link authentication or enrollment

## Set up Stripe [Server-side]

First, [create a Stripe account](https://dashboard.stripe.com/register) or [sign in](https://dashboard.stripe.com/login).

Use our official libraries to access the Stripe API from your application:

#### Ruby

```bash

# Available as a gem

sudo gem install stripe

```

```ruby

# If you use bundler, you can add this line to your Gemfile

gem 'stripe'

```

#### Python

```bash

# Install through pip

pip3 install --upgrade stripe

```

```bash

# Or find the Stripe package on http://pypi.python.org/pypi/stripe/

```

```python

# Find the version you want to pin:

# https://github.com/stripe/stripe-python/blob/master/CHANGELOG.md

# Specify that version in your requirements.txt file

stripe>=5.0.0

```

#### PHP

```bash

# Install the PHP library with Composer

composer require stripe/stripe-php

```

```bash

# Or download the source directly: https://github.com/stripe/stripe-php/releases

```

#### Java

```java

/*

For Gradle, add the following dependency to your build.gradle and replace with

the version number you want to use from:

- https://mvnrepository.com/artifact/com.stripe/stripe-java or

- https://github.com/stripe/stripe-java/releases/latest

*/

implementation "com.stripe:stripe-java:31.0.0"

```

```xml

com.stripe

stripe-java

31.0.0

```

```bash

# For other environments, manually install the following JARs:

# - The Stripe JAR from https://github.com/stripe/stripe-java/releases/latest

# - Google Gson from https://github.com/google/gson

```

#### Node.js

```bash

# Install with npm

npm install stripe --save

```

#### Go

```bash

# Make sure your project is using Go Modules

go mod init

# Install stripe-go

go get -u github.com/stripe/stripe-go/v83

```

```go

// Then import the package

import (

"github.com/stripe/stripe-go/v83"

)

```

#### .NET

```bash

# Install with dotnet

dotnet add package Stripe.net

dotnet restore

```

```bash

# Or install with NuGet

Install-Package Stripe.net

```

## Create a PaymentIntent [Server-side]

Stripe uses a [PaymentIntent](https://docs.stripe.com/api/payment_intents.md) object to represent your intent to collect payment from a customer, tracking charge attempts and payment state changes throughout the process.

If you collect card details for [future usage with Setup Intents](https://docs.stripe.com/payments/save-and-reuse.md), list payment methods manually instead of using dynamic payment methods. To use Link without dynamic payment methods, update your integration to pass `link` to `payment_method_types`.

When you create a PaymentIntent, [dynamically offer your customers the most relevant payment methods](https://docs.stripe.com/payments/payment-methods/dynamic-payment-methods.md), including Link, by using dynamic payment methods. To use dynamic payment methods, don’t include the `payment_method_types` parameter. Optionally, you can also enable `automatic_payment_methods`.

> When your integration doesn’t set the `payment_method_types` parameter, some payment methods turn on automatically, including cards and wallets.

To add Link to your Elements integration using dynamic payment methods:

1. In your Dashboard [payment method settings](https://dashboard.stripe.com/settings/payment_methods), turn on Link.

1. If you have an existing integration that manually lists payment methods, remove the [payment_method_types](https://docs.stripe.com/api/payment_intents/object.md#payment_intent_object-payment_method_types) parameter from your integration.

### Retrieve the client secret

The PaymentIntent includes a *client secret* (The client secret is a unique key returned from Stripe as part of a PaymentIntent. This key lets the client access important fields from the PaymentIntent (status, amount, currency) while hiding sensitive ones (metadata, customer)) that the client side uses to securely complete the payment process. You can use different approaches to pass the client secret to the client side.

#### Single-page application

Retrieve the client secret from an endpoint on your server, using the browser’s `fetch` function. This approach is best if your client side is a single-page application, particularly one built with a modern frontend framework like React. Create the server endpoint that serves the client secret:

#### Ruby

```ruby

get '/secret' do

intent = # ... Create or retrieve the PaymentIntent

{client_secret: intent.client_secret}.to_json

end

```

#### Python

```python

from flask import Flask, jsonify

app = Flask(__name__)

@app.route('/secret')

def secret():

intent = # ... Create or retrieve the PaymentIntent

return jsonify(client_secret=intent.client_secret)

```

#### PHP

```php

$intent->client_secret));

?>

```

#### Java

```java

import java.util.HashMap;

import java.util.Map;

import com.stripe.model.PaymentIntent;

import com.google.gson.Gson;

import static spark.Spark.get;

public class StripeJavaQuickStart {

public static void main(String[] args) {

Gson gson = new Gson();

get("/secret", (request, response) -> {

PaymentIntent intent = // ... Fetch or create the PaymentIntent

Map map = new HashMap();

map.put("client_secret", intent.getClientSecret());

return map;

}, gson::toJson);

}

}

```

#### Node.js

```javascript

const express = require('express');

const app = express();

app.get('/secret', async (req, res) => {

const intent = // ... Fetch or create the PaymentIntent

res.json({client_secret: intent.client_secret});

});

app.listen(3000, () => {

console.log('Running on port 3000');

});

```

#### Go

```go

package main

import (

"encoding/json"

"net/http"

stripe "github.com/stripe/stripe-go/v76.0.0"

)

type CheckoutData struct {

ClientSecret string `json:"client_secret"`

}

func main() {

http.HandleFunc("/secret", func(w http.ResponseWriter, r *http.Request) {

intent := // ... Fetch or create the PaymentIntent

data := CheckoutData{

ClientSecret: intent.ClientSecret,

}

w.Header().Set("Content-Type", "application/json")

w.WriteHeader(http.StatusOK)

json.NewEncoder(w).Encode(data)

})

http.ListenAndServe(":3000", nil)

}

```

#### .NET

```csharp

using System;

using Microsoft.AspNetCore.Mvc;

using Stripe;

namespace StripeExampleApi.Controllers

{

[Route("secret")]

[ApiController]

public class CheckoutApiController : Controller

{

[HttpGet]

public ActionResult Get()

{

var intent = // ... Fetch or create the PaymentIntent

return Json(new {client_secret = intent.ClientSecret});

}

}

}

```

And then fetch the client secret with JavaScript on the client side:

```javascript

(async () => {

const response = await fetch('/secret');

const {client_secret: clientSecret} = await response.json();

// Render the form using the clientSecret

})();

```

#### Server-side rendering

Pass the client secret to the client from your server. This approach works best if your application generates static content on the server before sending it to the browser.

Add the [client_secret](https://docs.stripe.com/api/payment_intents/object.md#payment_intent_object-client_secret) in your checkout form. In your server-side code, retrieve the client secret from the PaymentIntent:

#### Ruby

```erb

```

```ruby

get '/checkout' do

@intent = # ... Fetch or create the PaymentIntent

erb :checkout

end

```

#### Python

```html

```

```python

@app.route('/checkout')

def checkout():

intent = # ... Fetch or create the PaymentIntent

return render_template('checkout.html', client_secret=intent.client_secret)

```

#### PHP

```php

...

...

```

#### Java

```html

```

```java

import java.util.HashMap;

import java.util.Map;

import com.stripe.model.PaymentIntent;

import spark.ModelAndView;

import static spark.Spark.get;

public class StripeJavaQuickStart {

public static void main(String[] args) {

get("/checkout", (request, response) -> {

PaymentIntent intent = // ... Fetch or create the PaymentIntent

Map map = new HashMap();

map.put("client_secret", intent.getClientSecret());

return new ModelAndView(map, "checkout.hbs");

}, new HandlebarsTemplateEngine());

}

}

```

#### Node.js

```html

```

```javascript

const express = require('express');

const expressHandlebars = require('express-handlebars');

const app = express();

app.engine('.hbs', expressHandlebars({ extname: '.hbs' }));

app.set('view engine', '.hbs');

app.set('views', './views');

app.get('/checkout', async (req, res) => {

const intent = // ... Fetch or create the PaymentIntent

res.render('checkout', { client_secret: intent.client_secret });

});

app.listen(3000, () => {

console.log('Running on port 3000');

});

```

#### Go

```html

```

```go

package main

import (

"html/template"

"net/http"

stripe "github.com/stripe/stripe-go/v76.0.0"

)

type CheckoutData struct {

ClientSecret string

}

func main() {

checkoutTmpl := template.Must(template.ParseFiles("views/checkout.html"))

http.HandleFunc("/checkout", func(w http.ResponseWriter, r *http.Request) {

intent := // ... Fetch or create the PaymentIntent

data := CheckoutData{

ClientSecret: intent.ClientSecret,

}

checkoutTmpl.Execute(w, data)

})

http.ListenAndServe(":3000", nil)

}

```

#### .NET

```html

```

```csharp

using System;

using Microsoft.AspNetCore.Mvc;

using Stripe;

namespace StripeExampleApi.Controllers

{

[Route("/[controller]")]

public class CheckoutApiController : Controller

{

public IActionResult Index()

{

var intent = // ... Fetch or create the PaymentIntent

ViewData["ClientSecret"] = intent.ClientSecret;

return View();

}

}

}

```

## Collect customer email

Link authenticates a customer by using their email address. Depending on your checkout flow, you have the following options: pass an email to the Payment Element, collect it directly within the Payment Element, or use the Link Authentication Element. Of these, Stripe recommends passing a customer email address to the Payment Element if available.

#### Pass in an email

If *any* of the following apply to you:

- You know your customer’s email address before they arrive at the payment page (from a customer profile, for example).

- You don’t need to collect a shipping address from your customer.

- You prefer to use your own email input field that you place ahead of the payment form.

Then, integrate Link by passing the customer email to the Payment Element, which creates faster checkout by triggering the Link authentication flow as soon as your customer reaches the payment step. This option integrates one element, the Payment Element.

Link autofills the collected email in the checkout form for faster checkout

Link provides an authentication prompt for an existing customer

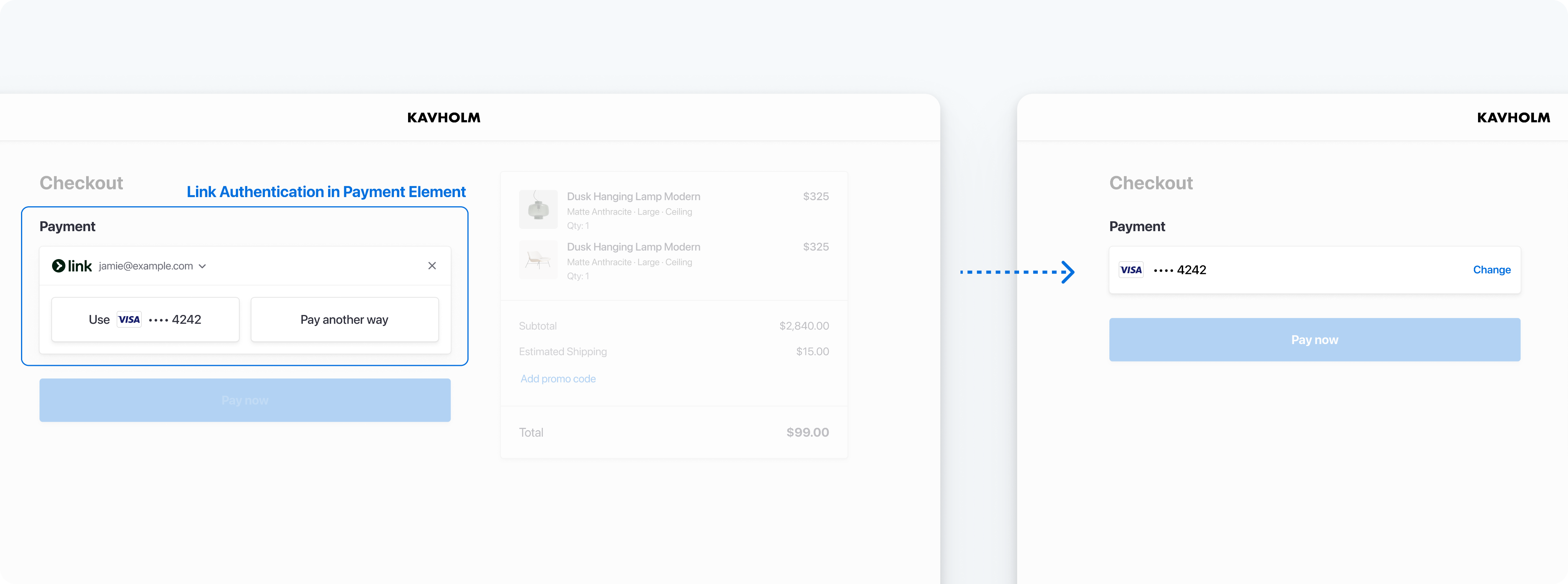

In this flow, you maintain email collection in your own form field *before* the customer reaches the payment step, and then pass the email to the Payment Element. The Payment Element authenticates the customer at the payment step and either shows the customer’s payment details saved in their Link account, or displays the Link account creation form after entering card details. This is what it looks like:

Integrate Link using the Link Authentication Element (See full diagram at https://docs.stripe.com/payments/link/add-link-elements-integration)

This integration option doesn’t collect the customer’s shipping address. If you need to collect a shipping address, integrate Link by using the Link Authentication Element, Address Element, and Payment Element.

#### Collect an email

Link authentication in the Payment Element allows your customers to enter an email address directly in the Payment Element with no additional integration work required.

In this flow, your customer enters their email address and authenticates or enrolls with Link directly in the Payment Element during checkout. If a customer hasn’t enrolled with Link and they choose a supported payment method in the Payment Element, they’re prompted to save their details using Link. For those who have already enrolled, Link automatically populates their payment information.

#### Use the Link Authentication Element

If *any* of the following apply to you:

- You want a single, optimized component for email collection and Link authentication.

- You need to collect a shipping address from your customer.

Then use the integration flow that implements these elements: the Link Authentication Element, Payment Element and optional Address Element.

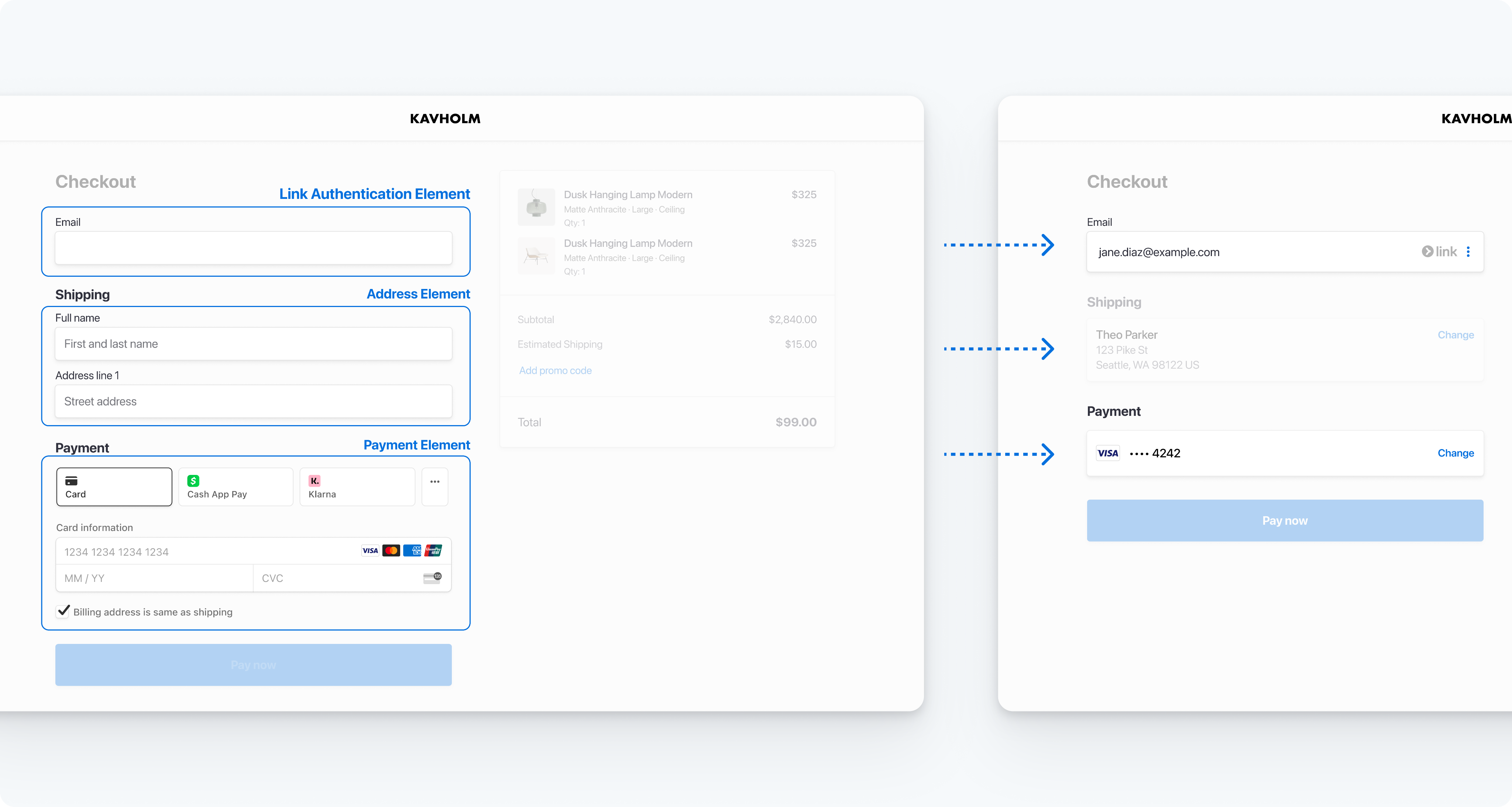

A Link-enabled checkout page has the Link Authentication Element at the beginning, followed by the Address Element, and the Payment Element at the end. You can also display the Link Authentication Element on separate pages, in this same order, for multi-page checkout flows.

Create a payment form using multiple Elements

The integration works as follows:

A diagram describing how to integrate Link using the Link Authentication Element (See full diagram at https://docs.stripe.com/payments/link/add-link-elements-integration)

## Set up your payment form [Client-side]

Now you can set up your custom payment form with the Elements prebuilt UI components. Your payment page address must start with `https://` rather than `http://` for your integration to work. You can test your integration without using HTTPS. [Enable HTTPS](https://docs.stripe.com/security/guide.md#tls) when you’re ready to accept live payments.

#### Pass in an email

The Payment Element renders a prefilled customer contact form that includes the phone number and email address. It also renders a dynamic form that allows your customer to pick a payment method type. This form automatically collects all necessary payments details for the payment method type selected by the customer.

What’s more, the Payment Element handles the display of Link-saved payment methods for authenticated customers.

#### React

### Set up Stripe Elements

Install [React Stripe.js](https://www.npmjs.com/package/@stripe/react-stripe-js) and the [Stripe.js loader](https://www.npmjs.com/package/@stripe/stripe-js) from the npm public registry:

```bash

npm install --save @stripe/react-stripe-js @stripe/stripe-js

```

### Build the payment form

On your payment page, wrap your payment form with the `Elements` component, passing the [client secret](https://docs.stripe.com/api/payment_intents/object.md#payment_intent_object-client_secret).

If you have other customer information, pass it to the `defaultValues.billingDetails` object for the `PaymentElement`. Prefilling as much information as possible simplifies Link account creation and reuse for your customers. You can also pass in the [appearance object](https://docs.stripe.com/js/elements_object/update#elements_update-options-appearance), customizing the Elements to match the design of your site.

Then, render the `PaymentElement` in your payment form. We recommend passing at least the customer’s email address into [defaultValues](https://docs.stripe.com/js/elements_object/create_payment_element#payment_element_create-options-defaultValues) to prefill their data for Link.

```jsx

import {loadStripe} from "@stripe/stripe-js";

import {

Elements,

PaymentElement,

} from "@stripe/react-stripe-js";

const stripe = loadStripe('<>');

// Customize the appearance of Elements using the Appearance API.

const appearance = {/* ... */};

const CheckoutPage = ({clientSecret}) => (

);

export default function CheckoutForm() {

return (

);

}

```

#### HTML + JS

### Set up Stripe Elements

Include the Stripe.js script on your payment page by adding it to the `head` of your HTML file. Always load Stripe.js directly from js.stripe.com to remain PCI compliant. Don’t include the script in a bundle or host a copy of it yourself.

```html

Checkout

```

Create an instance of the [Stripe object](https://docs.stripe.com/js.md#stripe-function) by providing your publishable [API key](https://docs.stripe.com/keys.md) as the first parameter:

```javascript

// Set your publishable key: remember to change this to your live publishable key in production

// See your keys here: https://dashboard.stripe.com/apikeys

const stripe = Stripe('<>');

```

### Add Link Elements to your payment page

On your payment page, create empty DOM nodes with unique IDs for Elements to render into:

```html

```

When the form you just configured loads, create a new Elements group, passing the [client secret](https://docs.stripe.com/api/payment_intents/object.md#payment_intent_object-client_secret). You can also pass in the [appearance object](https://docs.stripe.com/js/elements_object/update#elements_update-options-appearance), customizing the Elements to match the design of your site.

If you have other customer information, pass it to the `defaultValues.billingDetails` object of `PaymentElement`. Prefilling as much information as possible simplifies Link account creation and reuse for your customers.

Finally, create an instance of each Element and mount them to their corresponding DOM node:

```javascript

// Customize the appearance of Elements using the Appearance API.

const appearance = { /* ... */ };

// Create an elements group from the Stripe instance passing in the clientSecret and, optionally, appearance.

const elements = stripe.elements({clientSecret, appearance});

// Prefill customer data using the defaultValues option. Passing in the email

// is required for this integration. The other fields are optional.

const paymentElement = elements.create('payment', {

defaultValues: {

billingDetails: {

email: 'foo@bar.com',

name: 'John Doe',

phone: '888-888-8888',

},

},

});

// Mount the Elements to their corresponding DOM node

paymentElement.mount("#payment-element");

```

#### Collect an email

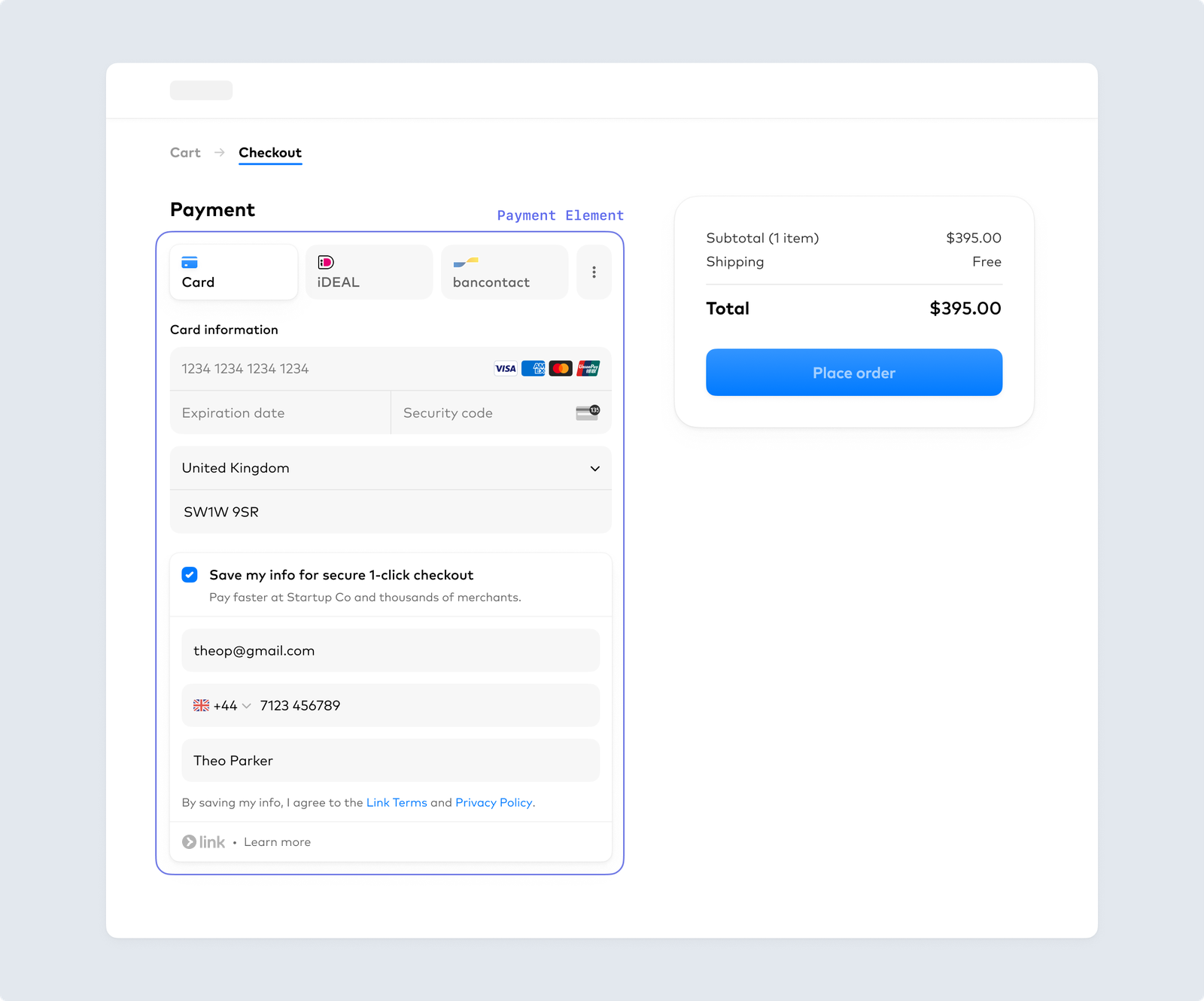

The Payment Element renders a prefilled customer contact form that includes the phone number and email address. It also renders a dynamic form that allows your customer to pick a payment method type. This form automatically collects all necessary payments details for the payment method type selected by the customer.

What’s more, the Payment Element handles the display of Link-saved payment methods for authenticated customers. For this integration, you must leave Link turned on in your [Payment methods settings](https://dashboard.stripe.com/settings/payment_methods).

#### React

### Set up Stripe Elements

Install [React Stripe.js](https://www.npmjs.com/package/@stripe/react-stripe-js) and the [Stripe.js loader](https://www.npmjs.com/package/@stripe/stripe-js) from the npm public registry:

```bash

npm install --save @stripe/react-stripe-js @stripe/stripe-js

```

### Build the payment form

On your payment page, wrap your payment form with the `Elements` component, passing the [client secret](https://docs.stripe.com/api/payment_intents/object.md#payment_intent_object-client_secret).

If you have other customer information, pass it to the `defaultValues.billingDetails` object for the `PaymentElement`. Prefilling as much information as possible simplifies Link account creation and reuse for your customers. You can also pass in the [appearance object](https://docs.stripe.com/js/elements_object/update#elements_update-options-appearance), customizing the Elements to match the design of your site.

Then, render the `PaymentElement` in your payment form. We recommend passing at least the customer’s email address into [defaultValues](https://docs.stripe.com/js/elements_object/create_payment_element#payment_element_create-options-defaultValues) to prefill their data for Link.

```jsx

import {loadStripe} from "@stripe/stripe-js";

import {

Elements,

PaymentElement,

} from "@stripe/react-stripe-js";

const stripe = loadStripe('<>');

// Customize the appearance of Elements using the Appearance API.

const appearance = {/* ... */};

const CheckoutPage = ({clientSecret}) => (

);

export default function CheckoutForm() {

return (

);

}

```

#### HTML + JS

### Set up Stripe Elements

Include the Stripe.js script on your payment page by adding it to the `head` of your HTML file. Always load Stripe.js directly from js.stripe.com to remain PCI compliant. Don’t include the script in a bundle or host a copy of it yourself.

```html

Checkout

```

Create an instance of the [Stripe object](https://docs.stripe.com/js.md#stripe-function) by providing your publishable [API key](https://docs.stripe.com/keys.md) as the first parameter:

```javascript

// Set your publishable key: remember to change this to your live publishable key in production

// See your keys here: https://dashboard.stripe.com/apikeys

const stripe = Stripe('<>');

```

### Add Link Elements to your payment page

On your payment page, create empty DOM nodes with unique IDs for Elements to render into:

```html

```

When the form you just configured loads, create a new Elements group, passing the [client secret](https://docs.stripe.com/api/payment_intents/object.md#payment_intent_object-client_secret). You can also pass in the [appearance object](https://docs.stripe.com/js/elements_object/update#elements_update-options-appearance), customizing the Elements to match the design of your site.

If you have other customer information, pass it to the `defaultValues.billingDetails` object of `PaymentElement`. Prefilling as much information as possible simplifies Link account creation and reuse for your customers.

Finally, create an instance of each Element and mount them to their corresponding DOM node:

```javascript

// Customize the appearance of Elements using the Appearance API.

const appearance = { /* ... */ };

// Create an elements group from the Stripe instance passing in the clientSecret and, optionally, appearance.

const elements = stripe.elements({clientSecret, appearance});

// Create the Payment Element

const paymentElementOptions = { layout: 'accordion'};

const paymentElement = elements.create('payment', paymentElementOptions);

// Mount the Elements to their corresponding DOM node

paymentElement.mount("#payment-element");

```

#### Use the Link Authentication Element

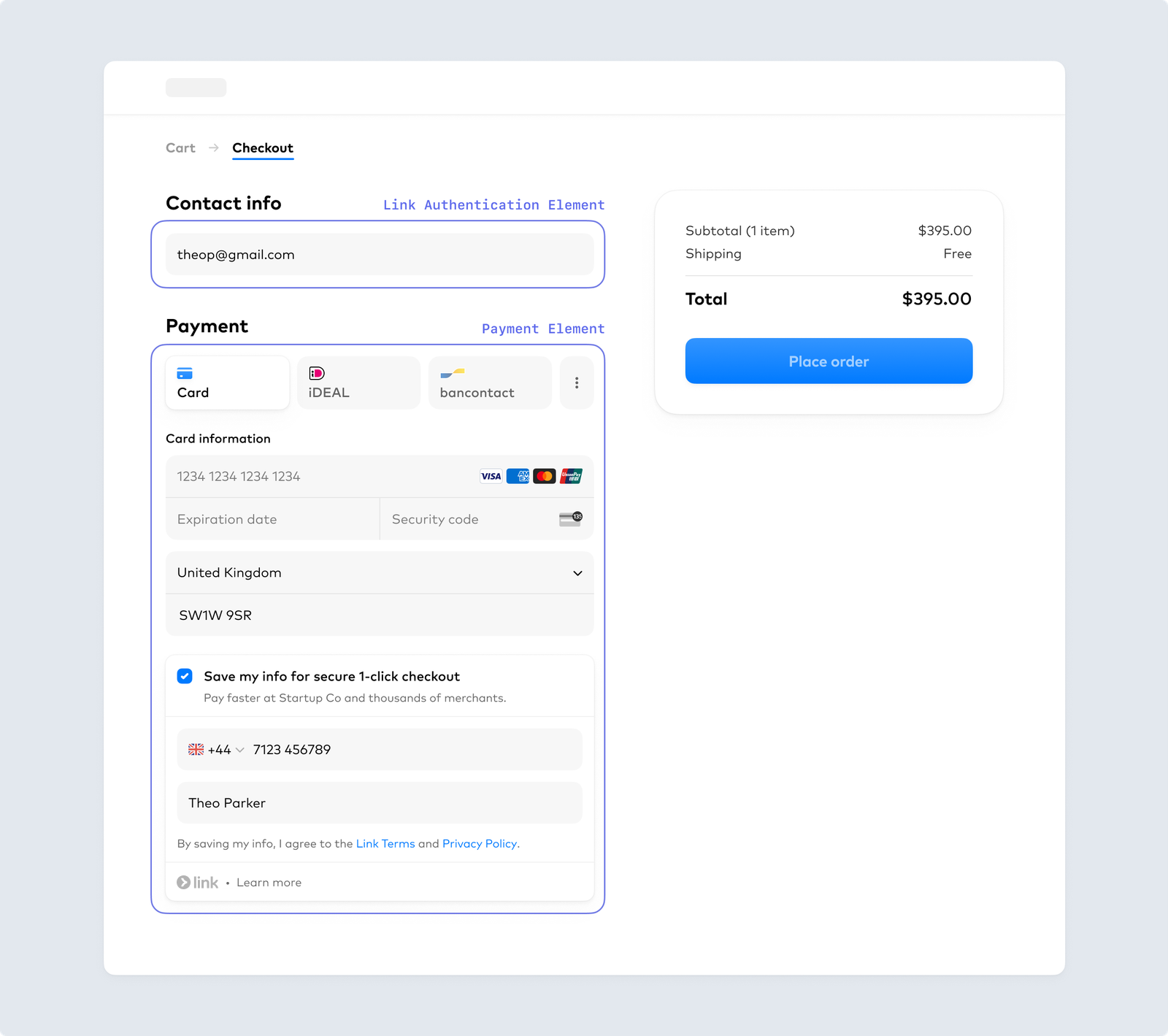

The Link Authentication Element renders an email address input. When Link matches a customer email with an existing Link account, it sends the customer a secure, one-time code to their phone to authenticate. If the customer successfully authenticates, Stripe displays their Link-saved addresses and payment methods automatically for them to use.

This integration also creates the Payment Element, which renders a dynamic form that allows your customer to pick a payment method type. The form automatically collects all necessary payments details for the payment method type selected by the customer. The Payment Element also handles the display of Link-saved payment methods for authenticated customers.

#### React

### Set up Stripe Elements

Install [React Stripe.js](https://www.npmjs.com/package/@stripe/react-stripe-js) and the [Stripe.js loader](https://www.npmjs.com/package/@stripe/stripe-js) from the npm public registry.

```bash

npm install --save @stripe/react-stripe-js @stripe/stripe-js

```

On your payment page, wrap your payment form with the `Elements` component, passing the [client secret](https://docs.stripe.com/api/payment_intents/object.md#payment_intent_object-client_secret) from [the previous step](https://docs.stripe.com/payments/link/add-link-elements-integration.md#web-create-intent). If you already collect the customer’s email in another part of your form, replace your existing input with the `linkAuthenticationElement`.

If you don’t collect email, add the `linkAuthenticationElement` to your checkout flow. You must place the `linkAuthenticationElement` before the `ShippingAddressElement` (optional if you collect shipping addresses) and the `PaymentElement` for Link to autofill Link-saved details for your customer in the `ShippingAddressElement` and `PaymentElement`. You can also pass in the [appearance option](https://docs.stripe.com/elements/appearance-api.md), customizing the Elements to match the design of your site.

If you have the customer’s email, pass it to the `defaultValues` option of the `linkAuthenticationElement`. This prefills their email address and initiates the Link authentication process.

If you have other customer information, pass it to the `defaultValues.billingDetails` object for the `PaymentElement`. Prefilling as much information as possible simplifies Link account creation and reuse for your customers.

Then, render the `linkAuthenticationElement` and `PaymentElement` components in your payment form:

```jsx

import {loadStripe} from "@stripe/stripe-js";

import {

Elements,

LinkAuthenticationElement,

PaymentElement,

} from "@stripe/react-stripe-js";

const stripe = loadStripe('<>');

// Customize the appearance of Elements using the Appearance API.

const appearance = {/* ... */};

// Enable the skeleton loader UI for the optimal loading experience.

const loader = 'auto';

const CheckoutPage = ({clientSecret}) => (

);

export default function CheckoutForm() {

return (

);

}

```

The `linkAuthenticationElement`, `PaymentElement`, and `ShippingAddressElement` don’t need to be on the same page. If you have a process where customer contact information, shipping details, and payment details display to the customer in separate steps, you can display each Element in the appropriate step or page. Include the `linkAuthenticationElement` as the email input form in the contact info collection step to make sure the customer can take full advantage of the shipping and payment autofill provided by Link.

If you collect your customer’s email with the Link Authentication Element early in the checkout flow, you don’t need to show it again on the shipping or payment pages.

### Retrieve an email address

You can retrieve the email address details using the `onChange` prop on the `linkAuthenticationElement` component. The `onChange` handler fires whenever the user updates the email field, or when a saved customer email is autofilled.

```jsx

{

setEmail(event.value.email);

}} />

```

### Prefill a customer email address

The Link Authentication Element accepts an email address. Providing a customer’s email address triggers the Link authentication flow as soon as the customer lands on the payment page using the `defaultValues` option.

```jsx

```

#### HTML + JS

### Set up Stripe Elements

Include the Stripe.js script on your payment page by adding it to the `head` of your HTML file. Always load Stripe.js directly from js.stripe.com to remain PCI compliant. Don’t include the script in a bundle or host a copy of it yourself.

```html

Checkout

```

Create an instance of the [Stripe object](https://docs.stripe.com/js.md#stripe-function) by providing your publishable [API key](https://docs.stripe.com/keys.md) as the first parameter:

```javascript

// Set your publishable key: remember to change this to your live publishable key in production

// See your keys here: https://dashboard.stripe.com/apikeys

const stripe = Stripe('<>');

```

### Add Link Elements to your payment page

On your payment page, create empty DOM nodes with unique IDs for Elements to render into:

```html

```

When the form you just configured loads, create a new Elements group, passing the [client secret](https://docs.stripe.com/api/payment_intents/object.md#payment_intent_object-client_secret). If you already collect the customer’s email in your payment form, replace your existing input with `linkAuthenticationElement`.

If you don’t collect email, add `linkAuthenticationElement` to your checkout flow before `shippingAddress` (optional if you collect shipping addresses). Add `PaymentElement` for Link to autofill Link-saved details for your customer in the `shippingAddress` and `PaymentElement`. You can also pass in the [appearance object](https://docs.stripe.com/js/elements_object/create#stripe_elements-options-appearance), customizing the Elements to match the design of your site.

If you have the customer’s email, pass it to the `defaultValues` option of `linkAuthenticationElement`. This prefills their email and initiates the Link authentication process. If you have other customer information, pass it to the `defaultValues.billingDetails` object of `PaymentElement`. Prefilling as much information as possible simplifies Link account creation and reuse for your customers.

Finally, create an instance of each Element and mount them to their corresponding DOM node:

```javascript

// Customize the appearance of Elements using the Appearance API.

const appearance = { /* ... */ };

// Enable the skeleton loader UI for the optimal loading experience.

const loader = 'auto';

// Create an elements group from the Stripe instance, passing the clientSecret (obtained in step 2), loader, and appearance (optional).

const elements = stripe.elements({clientSecret, appearance, loader});

// Create Element instances

const linkAuthenticationElement = elements.create("linkAuthentication");

// Passing in defaultValues is optional, but useful if you want to prefill consumer information to

// ease consumer experience.

const paymentElement = elements.create('payment', {

defaultValues: {

billingDetails: {

name: 'John Doe',

phone: '888-888-8888',

},

},

});

// Mount the Elements to their corresponding DOM node

linkAuthenticationElement.mount("#link-authentication-element");

paymentElement.mount("#payment-element");

```

`linkAuthenticationElement` renders an email address input. When Link matches a customer email with an existing Link account, it sends the customer a secure, one-time code to their phone to authenticate. If the customer successfully authenticates, Stripe displays their Link-saved addresses and payment methods automatically so they can use them.

The `PaymentElement` renders a dynamic form that allows your customer to pick a payment method type. The form automatically collects all necessary payment details for the payment method type selected by the customer. The `PaymentElement` also handles the display of Link-saved payment methods for authenticated customers.

The Link Authentication, Payment, and Shipping Address Elements don’t need to be on the same page. If you have a process where customer contact information, shipping information, and payment details display to the customer in separate steps while checking out, you can display each Element in the appropriate step or page. Include the Link Authentication Element as the email input form in the contact information collection step to ensure the customer can take full advantage of the autofill provided by Link.

If you collect your customer’s email with the Link Authentication Element early in the checkout flow, you don’t need to show it again on the shipping or payment pages.

### Retrieve the email address

You can retrieve the email address details using the `onChange` prop on the `linkAuthenticationElement` component. The `onChange` handler fires whenever the user updates the email field, or when a saved customer email is autofilled.

```javascript

linkAuthenticationElement.on('change', (event) => {

const email = event.value.email;

});

```

### Prefill a customer email address

The Link Authentication Element accepts an email address. Providing a customer’s email address starts the Link authentication flow as soon as the customer lands on the payment page using the `defaultValues` option.

```javascript

// Create linkAuthentication element with the defaultValues option

const linkAuthenticationElement = elements.create("linkAuthentication", {defaultValues: {email: "foo@bar.com"}});

// Mount the Element to its corresponding DOM node

linkAuthenticationElement.mount("#link-authentication-element");

```

## Optional: Prefill additional customer data [Client-side]

If you have it, prefilling customer information further streamlines the checkout process and reduces manual data entry.

#### Pass in an email

The Payment Element accepts a `defaultValues.billingDetails` object which lets you prefill a customer’s name and phone number as well as their email and shipping addresses. By prefilling as much of your customer’s information as possible, you simplify Link account creation and reuse.

Prefill your customer’s email address, phone number, and name to simplify the Link sign-up process

You can provide the following values to the `defaultValues.billingDetails` object:

| Value | Required | Format |

| --------- | -------- | --------------------------------------------------------------------------------- |

| `email` | Required | string |

| `name` | Optional | string |

| `phone` | Optional | string |

| `address` | Optional | JSON object with the fields `postal_code`, and `country`. All fields are strings. |

Passing `defaultValues.billingDetails` to the Payment Element depends on whether you collect information on a separate page before the Payment Element or on the same page.

#### Before the Payment Element

If you collect information on a separate page before the Payment Element, you can prefill values by passing `defaultValues.billingDetails` when you create the Payment Element:

#### React

```jsx

;

```

#### HTML + JS

```javascript

const paymentElement = elements.create('payment', {

defaultValues: {

billingDetails: {

email: 'johnd@domain.com',

name: 'John Doe',

phone: '888-888-8888',

address: {

postal_code: '10001',

country: 'US',

},

},

},

});

// Mount the Element to its corresponding DOM node

paymentElement.mount("#payment-element");

```

#### Same page as the Payment Element

If you collect information on the same page as the Payment Element, you can prefill values by updating the Payment Element with `defaultValues.billingDetails`.

```javascript

const paymentElement = elements.create('payment')

// Mount the Element to its corresponding DOM node

paymentElement.mount("#payment-element");

function updateValues() {

paymentElement.update({

defaultValues: {

billingDetails: {

email: document.getElementById('email').value, // Or whichever ID used for your fields

name: document.getElementById('name').value,

phone: document.getElementById('phone').value,

address: {

postal_code: document.getElementById('postal_code').value,

country: document.getElementById('country').value,

},

},

},

});

}

const yourCollectionFieldIds = [

'name',

'email',

'phone',

'country',

'postal_code',

];

// We recommend updating defaultValues only onBlur

yourCollectionFields.forEach((key) => {

document.getElementById(key).onblur = function() {updateValues()};

});

```

#### Pass in an email to the Link Authentication Element

If you’re using the Link Authentication Element, add the `defaultValues.billingDetails` object to the Payment Element to prefill a customer’s name and phone number as well as their shipping addresses. By prefilling as much of your customer’s information as possible, you simplify Link account creation and reuse.

Prefill your customer’s email address, phone number, and name to simplify the Link sign-up process

You can provide the following values to the `defaultValues.billingDetails` object:

| Value | Required | Format |

| --------- | -------- | --------------------------------------------------------------------------------- |

| `name` | Optional | string |

| `phone` | Optional | string |

| `address` | Optional | JSON object with the fields `postal_code`, and `country`. All fields are strings. |

A Payment Element with all of its values prefilled looks similar to the following examples:

#### React

```jsx

;

```

#### HTML + JS

```javascript

const paymentElement = elements.create('payment', {

defaultValues: {

billingDetails: {

name: 'John Doe',

phone: '888-888-8888',

address: {

postal_code: '10001',

country: 'US',

},

},

},

});

// Mount the Element to its corresponding DOM node

paymentElement.mount("#payment-element");

```

## Optional: Collect shipping addresses [Client-side]

#### Pass in an email

This integration option doesn’t collect the customer’s shipping address. If you need to collect a shipping address, integrate Link by using the Link Authentication Element, Address Element, and Payment Element in the [Use the Link Authentication Element](https://docs.stripe.com/payments/link/add-link-elements-integration.md#collect-shipping) steps.

#### Use the Link Authentication Element

#### React

To collect addresses, create an empty DOM node for the [Address Element](https://docs.stripe.com/elements/address-element.md) to render into. The Address Element must be displayed after the Link Authentication Element for Link to autofill a customer’s saved address details:

```jsx

import {loadStripe} from "@stripe/stripe-js";

import {

Elements,

LinkAuthenticationElement,AddressElement,

PaymentElement,

} from "@stripe/react-stripe-js";

const stripe = loadStripe('<>');

// Customize the appearance of Elements using the Appearance API.

const appearance = {/* ... */};

// Enable the skeleton loader UI for the optimal loading experience.

const loader = 'auto';

const CheckoutPage = ({clientSecret}) => (

);

export default function CheckoutForm() {

return (

);

}

```

Display the `AddressElement` before the `PaymentElement`. The `PaymentElement` dynamically detects address data collected by the `AddressElement`, hiding unnecessary fields and collecting additional billing address details as necessary.

### Retrieve address information

The `AddressElement` automatically passes the shipping address when a customer submits the payment, but you can also retrieve the address details on the frontend using the `onChange` property. The `onChange` handler sends an event whenever the user updates any field in the Address Element or selects a saved address:

```jsx

{

setAddressState(event.value);

}} />

```

### Prefill a shipping address

Use [defaultValues](https://docs.stripe.com/js/elements_object/create_address_element#address_element_create-options-defaultValues) to prefill address information, speeding checkout for your customers.

```jsx

```

#### HTML + JS

The [Address Element](https://docs.stripe.com/elements/address-element.md) lets you collect shipping or billing addresses. Create an empty DOM node for the Address Element. Display it after the Link Authentication Element:

```html

```

Then, create an instance of the Address Element, and mount it to the DOM node:

```javascript

// Customize the appearance of Elements using the Appearance API.

const appearance = { /* ... */ };

// Enable the skeleton loader UI for the optimal loading experience.

const loader = 'auto';

const stripe = Stripe('<>');

// Create an elements group from the Stripe instance passing in the clientSecret and, optionally, appearance.

const elements = stripe.elements({clientSecret, appearance, loader});

// Create Element instances

const linkAuthenticationElement = elements.create("linkAuthentication");const addressElement = elements.create("address", {

mode: 'shipping',

allowedCountries: ['US']

});

const paymentElement = elements.create("payment");

// Mount the Elements to their corresponding DOM node

linkAuthenticationElement.mount("#link-authentication-element");addressElement.mount("#address-element");

paymentElement.mount("#payment-element");

```

Display the Address Element before the Payment Element. The Payment Element dynamically detects address data collected by the Address Element, hiding unnecessary fields and collecting additional billing address details as necessary.

### Retrieve address information

The Address Element automatically passes the shipping address when a customer submits payment, but you can also retrieve the address details on the frontend using the `change` event. The `change` event sends whenever the user updates any field in the Address Element, or after selecting saved addresses:

```javascript

addressElement.on('change', (event: AddressChangeEvent) => {

const address = event.value;

})

```

### Prefill a shipping address

Use [defaultValues](https://docs.stripe.com/js/elements_object/create_address_element#address_element_create-options-defaultValues) to prefill address information, speeding checkout for your customers.

```javascript

// Create addressElement with the defaultValues option

const addressElement = elements.create("address", {

mode: 'shipping',

defaultValues: {

name: 'Jane Doe',

address: {

line1: '354 Oyster Point Blvd',

line2: '',

city: 'South San Francisco',

state: 'CA',

postal_code: '94080',

country: 'US',

}

}

});

// Mount the Element to its corresponding DOM node

addressElement.mount("#address-element");

```

## Optional: Customize the appearance [Client-side]

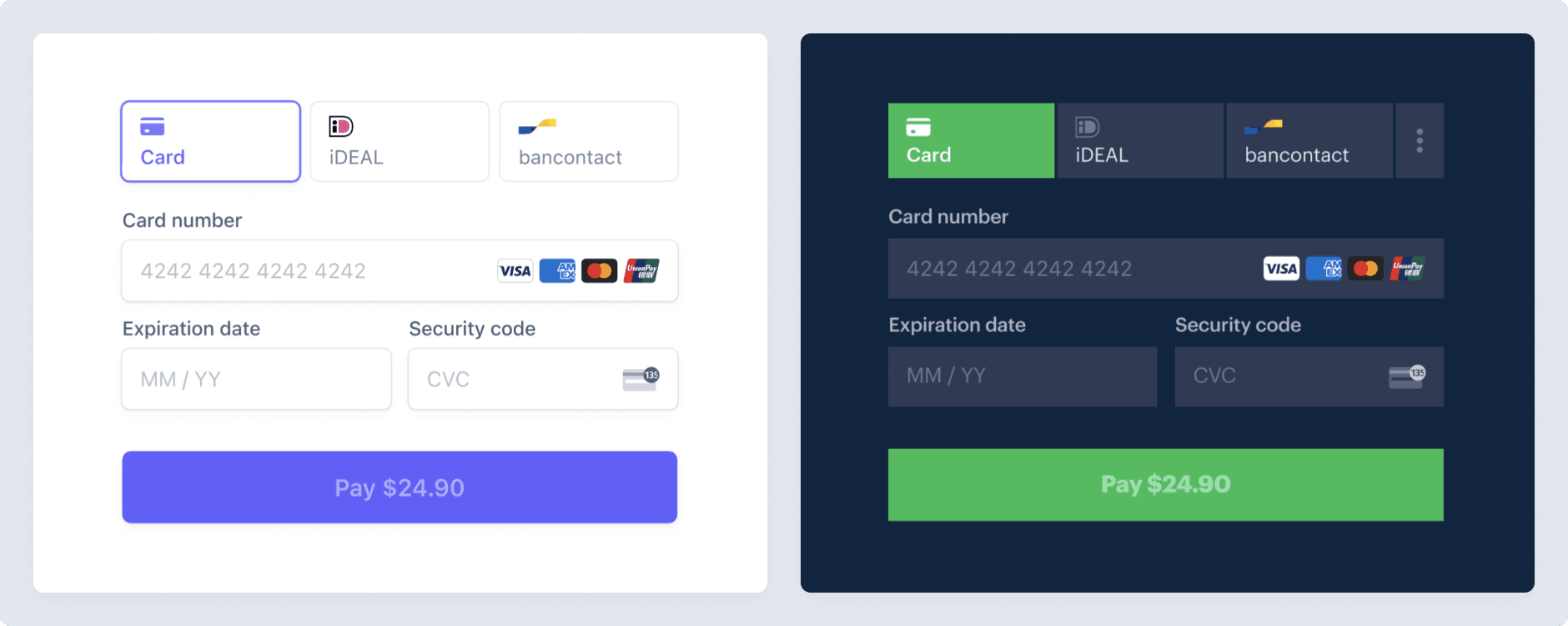

After you add these Elements to your page, you can customize their [appearance](https://docs.stripe.com/elements/appearance-api.md#theme) to make them fit with the rest of your design:

Customize the appearance of your Elements

## Submit the payment to Stripe [Client-side]

Use [stripe.confirmPayment](https://docs.stripe.com/js/payment_intents/confirm_payment) to complete the payment with details collected from your customer in the different Elements forms. Provide a [return_url](https://docs.stripe.com/api/payment_intents/create.md#create_payment_intent-return_url) to this function to indicate where Stripe redirects the user after they complete the payment.

Your user might be first redirected to an intermediate site, like a bank authorization page, before Stripe redirects them to the `return_url`.

By default, card and bank payments immediately redirect to the `return_url` when a payment is successful. If you don’t want to redirect to the `return_url`, you can use [if_required](https://docs.stripe.com/js/payment_intents/confirm_payment#confirm_payment_intent-options-redirect) to change the behavior.

#### React

```jsx

import {loadStripe} from "@stripe/stripe-js";

import {useStripe,

useElements,

Elements,

LinkAuthenticationElement,

PaymentElement,

// If collecting shipping

AddressElement,

} from "@stripe/react-stripe-js";

const stripe = loadStripe('<>');

const appearance = {/* ... */};

// Enable the skeleton loader UI for the optimal loading experience.

const loader = 'auto';

const CheckoutPage =({clientSecret}) => (

);

export default function CheckoutForm() {const stripe = useStripe();

const elements = useElements();

const handleSubmit = async (event) => {

event.preventDefault();

const {error} = await stripe.confirmPayment({

elements,

confirmParams: {

return_url: "https://example.com/order/123/complete",

},

});

if (error) {

// handle error

}

};

return (

);

}

```

#### HTML + JS

```javascript

const stripe = Stripe('<>');

const form = document.getElementById('payment-form');

form.addEventListener('submit', async (event) => {

event.preventDefault();

const {error} = await stripe.confirmPayment({

elements,

confirmParams: {

return_url: "https://example.com/order/123/complete",

}

});

if (error) {

// Show error to your customer (for example, payment details incomplete)

console.log(error.message);

} else {

// Your customer will be redirected to your `return_url`. For some payment

// methods like iDEAL, your customer will be redirected to an intermediate

// site first to authorize the payment, then redirected to the `return_url`.

}

});

```

The `return_url` corresponds to a page on your website that provides [the payment status](https://docs.stripe.com/payments/payment-intents/verifying-status.md) of the `PaymentIntent` when you render the return page. When Stripe redirects the customer to the `return_url`, you can use the following URL query parameters to verify payment status. You can also append your own query parameters when providing the `return_url`. These query parameters persist through the redirect process.

| Parameter | Description |

| ------------------------------ | --------------------------------------------------------------------------------------------------------------------------------------------- |

| `payment_intent` | The unique identifier for the `PaymentIntent` |

| `payment_intent_client_secret` | The [client secret](https://docs.stripe.com/api/payment_intents/object.md#payment_intent_object-client_secret) of the `PaymentIntent` object. |

## Optional: Separate authorization and capture [Server-side]

Link supports [separate authorization and capture](https://docs.stripe.com/payments/place-a-hold-on-a-payment-method.md). You must capture an authorized Link payment within 7 days of the authorization. Otherwise, the authorization is automatically canceled and you can’t capture that payment.

### Tell Stripe to authorize only

To indicate that you want separate authorization and capture, set [capture_method](https://docs.stripe.com/api/payment_intents/create.md#create_payment_intent-capture_method) to `manual` when creating the PaymentIntent. This parameter instructs Stripe to only authorize the amount on the customer’s payment method.

```curl

curl https://api.stripe.com/v1/payment_intents \

-u "<>:" \

-d "payment_method_types[]"=link \

-d "payment_method_types[]"=card \

-d amount=1099 \

-d currency=usd \

-d capture_method=manual

```

```cli

stripe payment_intents create \

-d "payment_method_types[0]"=link \

-d "payment_method_types[1]"=card \

--amount=1099 \

--currency=usd \

--capture-method=manual

```

```ruby

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = Stripe::StripeClient.new("<>")

payment_intent = client.v1.payment_intents.create({

payment_method_types: ['link', 'card'],

amount: 1099,

currency: 'usd',

capture_method: 'manual',

})

```

```python

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = StripeClient("<>")

# For SDK versions 12.4.0 or lower, remove '.v1' from the following line.

payment_intent = client.v1.payment_intents.create({

"payment_method_types": ["link", "card"],

"amount": 1099,

"currency": "usd",

"capture_method": "manual",

})

```

```php

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

$stripe = new \Stripe\StripeClient('<>');

$paymentIntent = $stripe->paymentIntents->create([

'payment_method_types' => ['link', 'card'],

'amount' => 1099,

'currency' => 'usd',

'capture_method' => 'manual',

]);

```

```java

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

StripeClient client = new StripeClient("<>");

PaymentIntentCreateParams params =

PaymentIntentCreateParams.builder()

.addPaymentMethodType("link")

.addPaymentMethodType("card")

.setAmount(1099L)

.setCurrency("usd")

.setCaptureMethod(PaymentIntentCreateParams.CaptureMethod.MANUAL)

.build();

// For SDK versions 29.4.0 or lower, remove '.v1()' from the following line.

PaymentIntent paymentIntent = client.v1().paymentIntents().create(params);

```

```node

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

const stripe = require('stripe')('<>');

const paymentIntent = await stripe.paymentIntents.create({

payment_method_types: ['link', 'card'],

amount: 1099,

currency: 'usd',

capture_method: 'manual',

});

```

```go

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

sc := stripe.NewClient("<>")

params := &stripe.PaymentIntentCreateParams{

PaymentMethodTypes: []*string{stripe.String("link"), stripe.String("card")},

Amount: stripe.Int64(1099),

Currency: stripe.String(stripe.CurrencyUSD),

CaptureMethod: stripe.String(stripe.PaymentIntentCaptureMethodManual),

}

result, err := sc.V1PaymentIntents.Create(context.TODO(), params)

```

```dotnet

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

var options = new PaymentIntentCreateOptions

{

PaymentMethodTypes = new List { "link", "card" },

Amount = 1099,

Currency = "usd",

CaptureMethod = "manual",

};

var client = new StripeClient("<>");

var service = client.V1.PaymentIntents;

PaymentIntent paymentIntent = service.Create(options);

```

### Capture the funds

After the authorization succeeds, the PaymentIntent [status](https://docs.stripe.com/api/payment_intents/object.md#payment_intent_object-status) transitions to `requires_capture`. To capture the authorized funds, make a PaymentIntent [capture](https://docs.stripe.com/api/payment_intents/capture.md) request. The total authorized amount is captured by default—you can’t capture more than this, but you can capture less.

```curl

curl https://api.stripe.com/v1/payment_intents/{{PAYMENTINTENT_ID}}/capture \

-u "<>:" \

-d amount_to_capture=750

```

```cli

stripe payment_intents capture {{PAYMENTINTENT_ID}} \

--amount-to-capture=750

```

```ruby

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = Stripe::StripeClient.new("<>")

payment_intent = client.v1.payment_intents.capture(

'{{PAYMENTINTENT_ID}}',

{amount_to_capture: 750},

)

```

```python

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = StripeClient("<>")

# For SDK versions 12.4.0 or lower, remove '.v1' from the following line.

payment_intent = client.v1.payment_intents.capture(

"{{PAYMENTINTENT_ID}}",

{"amount_to_capture": 750},

)

```

```php

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

$stripe = new \Stripe\StripeClient('<>');

$paymentIntent = $stripe->paymentIntents->capture(

'{{PAYMENTINTENT_ID}}',

['amount_to_capture' => 750]

);

```

```java

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

StripeClient client = new StripeClient("<>");

PaymentIntentCaptureParams params =

PaymentIntentCaptureParams.builder().setAmountToCapture(750L).build();

// For SDK versions 29.4.0 or lower, remove '.v1()' from the following line.

PaymentIntent paymentIntent =

client.v1().paymentIntents().capture("{{PAYMENTINTENT_ID}}", params);

```

```node

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

const stripe = require('stripe')('<>');

const paymentIntent = await stripe.paymentIntents.capture(

'{{PAYMENTINTENT_ID}}',

{

amount_to_capture: 750,

}

);

```

```go

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

sc := stripe.NewClient("<>")

params := &stripe.PaymentIntentCaptureParams{AmountToCapture: stripe.Int64(750)}

result, err := sc.V1PaymentIntents.Capture(

context.TODO(), "{{PAYMENTINTENT_ID}}", params)

```

```dotnet

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

var options = new PaymentIntentCaptureOptions { AmountToCapture = 750 };

var client = new StripeClient("<>");

var service = client.V1.PaymentIntents;

PaymentIntent paymentIntent = service.Capture("{{PAYMENTINTENT_ID}}", options);

```

### (Optional) Cancel the authorization

If you need to cancel an authorization, you can [cancel the PaymentIntent](https://docs.stripe.com/refunds.md#cancel-payment).

## Handle post-payment events [Server-side]

Stripe sends a [payment_intent.succeeded](https://docs.stripe.com/api/events/types.md#event_types-payment_intent.succeeded) event when the payment completes. [Use a webhook to receive these events](https://docs.stripe.com/webhooks/quickstart.md) and run actions, like sending an order confirmation email to your customer, logging the sale in a database, or starting a shipping workflow.

Configure your integration to listen for these events rather than waiting on a callback from the client. When you wait on a callback from the client, the customer can close the browser window or quit the app before the callback executes. Setting up your integration to listen for asynchronous events enables you to accept [different types of payment methods](https://stripe.com/payments/payment-methods-guide) with a single integration.

In addition to handling the `payment_intent.succeeded` event, you can also handle two other important events when collecting payments with the Payment Element:

| Event | Description | Action |

| ------------------------------------------------------------------------------------------------------------------------------- | ------------------------------------------------------------------------------------- | ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ |

| [payment_intent.succeeded](https://docs.stripe.com/api/events/types.md?lang=php#event_types-payment_intent.succeeded) | Sent from Stripe when a customer has successfully completed a payment. | Send the customer an order confirmation and *fulfill* (Fulfillment is the process of providing the goods or services purchased by a customer, typically after payment is collected) their order. |

| [payment_intent.payment_failed](https://docs.stripe.com/api/events/types.md?lang=php#event_types-payment_intent.payment_failed) | Sent from Stripe when a customer attempted a payment, but the payment didn’t succeed. | If a payment transitioned from `processing` to `payment_failed`, offer the customer another attempt to pay. |

## Test the integration

> Don’t store real user data in *sandbox* (A sandbox is an isolated test environment that allows you to test Stripe functionality in your account without affecting your live integration. Use sandboxes to safely experiment with new features and changes) Link accounts. Treat them as if they’re publicly available, because these test accounts are associated with your publishable key.

Currently, Link only works with credit cards, debit cards, and qualified US bank account purchases. Link requires [domain registration](https://docs.stripe.com/payments/payment-methods/pmd-registration.md).

You can create sandbox accounts for Link using any valid email address. The following table shows the fixed one-time passcode values that Stripe accepts for authenticating sandbox accounts:

| Value | Outcome |

| ----------------------------------- | ---------------------------- |

| Any other 6 digits not listed below | Success |

| 000001 | Error, code invalid |

| 000002 | Error, code expired |

| 000003 | Error, max attempts exceeded |

For testing specific payment methods, refer to the [Payment Element testing examples](https://docs.stripe.com/payments/accept-a-payment.md?platform=web#additional-testing-resources).

### Multiple funding sources

As Stripe adds additional funding source support, you don’t need to update your integration. Stripe automatically supports them with the same transaction settlement time and guarantees as card and bank account payments.

### Card authentication and 3D Secure

Link supports *3D Secure 2 (3DS2)* (3D Secure 2 (3DS2) removes friction from the authentication process and improves the purchase experience compared to 3D Secure 1. It's the main card authentication method used to meet Strong Customer Authentication (SCA) requirements in Europe and is a key mechanism for businesses to request exemptions to SCA) authentication for card payments. 3DS2 requires customers to complete an additional verification step with the card issuer when paying. Payments that have been successfully authenticated using 3D Secure are covered by a *liability shift* (With some 3D Secure transactions, the liability for fraudulent chargebacks (stolen or counterfeit cards) shifts from you to the card issuer).

To trigger 3DS2 authentication challenge flows with Link in a sandbox, use the following test card with any CVC, postal code, and future expiration date: 4000000000003220.

In a sandbox, the authentication process displays a mock authentication page. On that page, you can either authorize or cancel the payment. Authorizing the payment simulates successful authentication and redirects you to the specified return URL. Clicking the **Failure** button simulates an unsuccessful attempt at authentication.

For more details, refer to the [3D Secure authentication page](https://docs.stripe.com/payments/3d-secure.md).

> When testing 3DS flows, only test cards for 3DS2 will trigger authentication on Link.

## Optional: Display customer-saved data [Server-side] [Client-side]

If your customer is an Accounts v2 entity, use our [guide](https://docs.stripe.com/billing/v1-v2-customer-map.md) to replace `Customer` and event references in your code with the equivalent Accounts v2 API references.

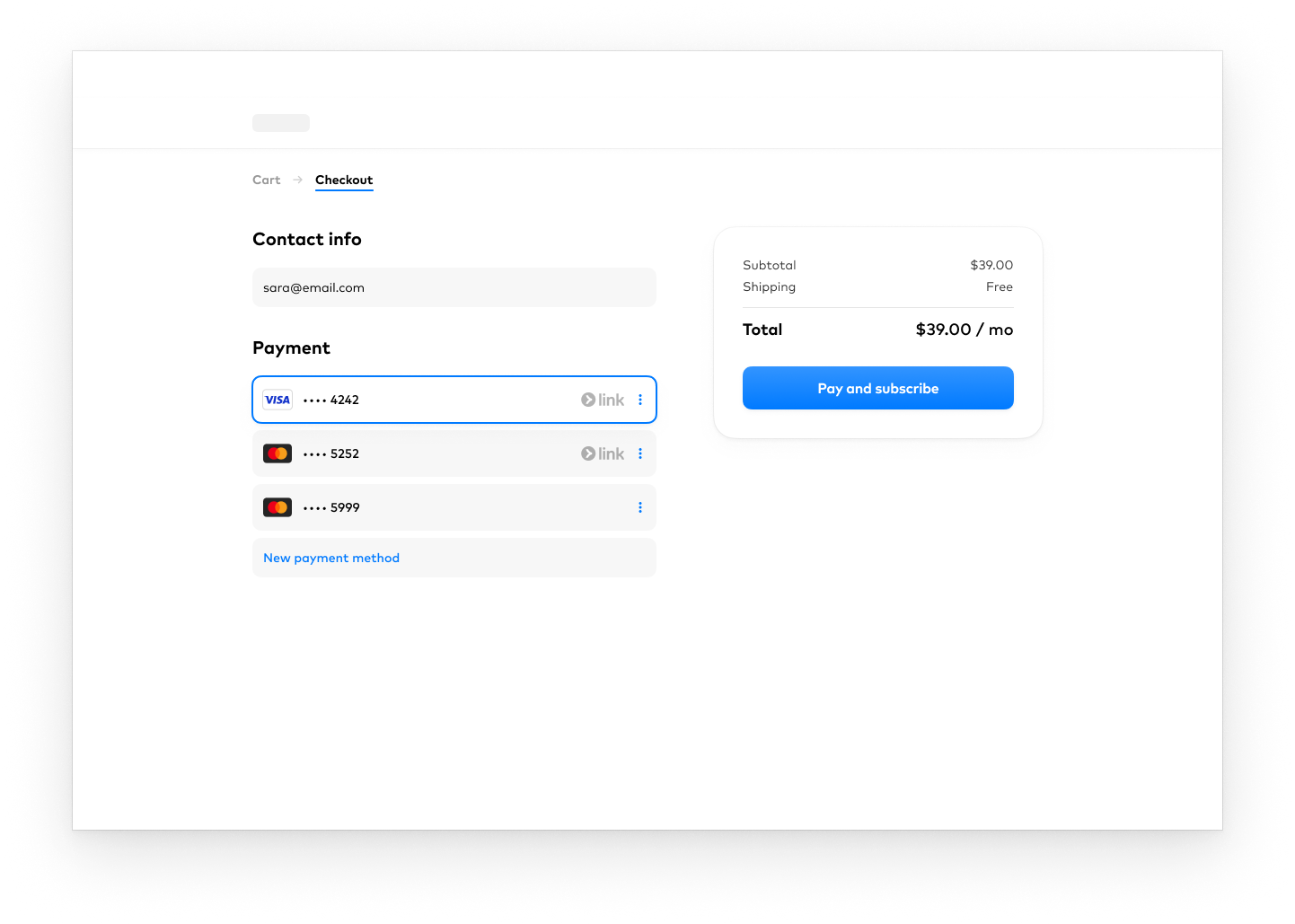

In addition to displaying your own saved addresses and payment methods for a customer, you can display their Link-saved data.

If a customer has more than one saved payment method, Stripe displays the three most recently used cards saved to the *Customer* (Customer objects represent customers of your business. They let you reuse payment methods and give you the ability to track multiple payments) object in addition to any payment methods the customer has saved with Link.

To accomplish this, create an Ephemeral Key and send it to your frontend along with the *Customer* (Customer objects represent customers of your business. They let you reuse payment methods and give you the ability to track multiple payments) ID. Information on the `customer` object is sensitive—you can’t retrieve it directly within Stripe.js. An Ephemeral Key grants temporary access to `customer` data.

#### curl

```bash

curl https://api.stripe.com/v1/ephemeral_keys \

-u<>: \

-H "Stripe-Version:2025-11-17.clover" \

-d "customer"="{{CUSTOMER_ID}}" \

curl https://api.stripe.com/v1/payment_intents \

-u <>: \

-d "amount"=1099 \

-d "currency"="usd" \-d "customer"="{{CUSTOMER_ID}}" \

-d "payment_method_types[]"="link" \

-d "payment_method_types[]"="card"

```

#### Ruby

```ruby

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

Stripe.api_key = '<>'

post '/secret' doephemeralKey = Stripe::EphemeralKey.create(

{customer: '{{CUSTOMER_ID}}'},

{stripe_version: '2025-11-17.clover'}

)

intent = Stripe::PaymentIntent.create({

amount: 1099,

currency: 'usd',customer: '{{CUSTOMER_ID}}',

payment_method_types: ['link', 'card'],

})

{

clientSecret: payment_intent['client_secret'],customerOptions: {

customer: '{{CUSTOMER_ID}}',

ephemeralKey: ephemeralKey.secret,

}

}.to_json

end

```

#### Python

```python

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

stripe.api_key = '<>'

from flask import jsonify

@app.route('/secret', methods=['POST'])

def create_payment():ephemeralKey = stripe.EphemeralKey.create(

customer='{{CUSTOMER_ID}}',

stripe_version='2025-11-17.clover',

)

intent = stripe.PaymentIntent.create(

amount=1099,

currency='usd',customer='{{CUSTOMER_ID}}',

payment_method_types=["link", "card"],

)

return jsonify({

'clientSecret': intent['client_secret'],'customerOptions': {

'customer': '{{CUSTOMER_ID}}',

'ephemeralKey': ephemeralKey.secret

},

})

```

#### PHP

```php

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

\Stripe\Stripe::setApiKey('<>');$ephemeralKey = \Stripe\EphemeralKey::create(

['customer' => '{{CUSTOMER_ID}}'],

['stripe_version' => '2025-11-17.clover']

);

$intent = \Stripe\PaymentIntent::create([

'amount' => 1099,

'currency' => 'usd','customer' => '{{CUSTOMER_ID}}',

'payment_method_types' => ['link', 'card'],

]);

$output = [

'clientSecret' => $paymentIntent->client_secret,'customerOptions' => [

'customer' => '{{CUSTOMER_ID}}',

'ephemeralKey' => $ephemeralKey->secret,

],

];

echo json_encode($output);

```

#### Node.js

```javascript

const stripe = require('stripe')('<>');

app.post("/secret", async (req, res) => {const ephemeralKey = await stripe.ephemeralKeys.create(

{customer: '{{CUSTOMER_ID}}'},

{apiVersion: '2025-11-17.clover'}

);

const paymentIntent = await stripe.paymentIntents.create({

amount: 1099,

currency: 'usd',customer: '{{CUSTOMER_ID}}',

payment_method_types: ['link', 'card'],

});

res.send({

clientSecret: paymentIntent.client_secret,customerOptions: {

customer: '{{CUSTOMER_ID}}',

ephemeralKey: ephemeralKey.secret,

},

});

});

```

On the client-side, fetch the `customerOptions` with `clientSecret`.

```jsx

(async () => {

const response = await fetch('/secret');const {clientSecret, customerOptions} = await response.json();

})

```

Then, pass the `customerOptions.ephemeralKey` and `customerOptions.customer` values to the `customerOptions` option on the [Elements group](https://docs.stripe.com/js/elements_object/create). You must also pass the `elements_customers_beta_1` beta flag when loading the Stripe instance.

#### React

```jsx

import {loadStripe} from "@stripe/stripe-js";

import {

useStripe,

useElements,

Elements,

LinkAuthenticationElement,

PaymentElement,

} from "@stripe/react-stripe-js";

const stripe = loadStripe('<>', {apiVersion: '2025-11-17.clover',

betas: ['elements_customers_beta_1'],

});

const appearance = {/* ... */};

const loader = 'auto';

const CheckoutPage =({

clientSecret,customerOptions,

}) => (

);

```

#### HTML + JS

```javascript

// Customize the appearance of Elements using the Appearance API.

const appearance = { /* ... */ };

// Enable the skeleton loader UI for the optimal loading experience.

const loader = 'auto';

const stripe = Stripe('<>', {betas: ['elements_customers_beta_1'],

});

// Create an elements group from the Stripe instance, passing the clientSecret (obtained in step 2) and appearance (optional).

const elements = stripe.elements({

clientSecret,

appearance,

loader,customerOptions,

});

```

## Optional: Save Link payment methods [Server-side] [Client-side]

You can save Link payment methods for future *off-session payments* (A payment is described as off-session if it occurs without the direct involvement of the customer, using previously-collected payment information) or *subscriptions* (A Subscription represents the product details associated with the plan that your customer subscribes to. Allows you to charge the customer on a recurring basis), but not for future *on-session payments* (A payment is described as on-session if it occurs while the customer is actively in your checkout flow and able to authenticate the payment method). To do so, you must attach it to a *Customer* (Customer objects represent customers of your business. They let you reuse payment methods and give you the ability to track multiple payments). Create a `customer` object when your customer creates an account with your business. Then, specify the `customer` when creating your PaymentIntent.

When a new customer has their first transaction with your business, create a `customer` object in Stripe to store their data for future use.

```curl

curl https://api.stripe.com/v1/payment_intents \

-u "<>:" \

-d amount=1099 \

-d currency=usd \

-d "automatic_payment_methods[enabled]"=true \

-d customer="{{CUSTOMER_ID}}" \

-d setup_future_usage=off_session

```

```cli

stripe payment_intents create \

--amount=1099 \

--currency=usd \

-d "automatic_payment_methods[enabled]"=true \

--customer="{{CUSTOMER_ID}}" \

--setup-future-usage=off_session

```

```ruby

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = Stripe::StripeClient.new("<>")

payment_intent = client.v1.payment_intents.create({

amount: 1099,

currency: 'usd',

automatic_payment_methods: {enabled: true},

customer: '{{CUSTOMER_ID}}',

setup_future_usage: 'off_session',

})

```

```python

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = StripeClient("<>")

# For SDK versions 12.4.0 or lower, remove '.v1' from the following line.

payment_intent = client.v1.payment_intents.create({

"amount": 1099,

"currency": "usd",

"automatic_payment_methods": {"enabled": True},

"customer": "{{CUSTOMER_ID}}",

"setup_future_usage": "off_session",

})

```

```php

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

$stripe = new \Stripe\StripeClient('<>');

$paymentIntent = $stripe->paymentIntents->create([

'amount' => 1099,

'currency' => 'usd',

'automatic_payment_methods' => ['enabled' => true],

'customer' => '{{CUSTOMER_ID}}',

'setup_future_usage' => 'off_session',

]);

```

```java

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

StripeClient client = new StripeClient("<>");

PaymentIntentCreateParams params =

PaymentIntentCreateParams.builder()

.setAmount(1099L)

.setCurrency("usd")

.setAutomaticPaymentMethods(

PaymentIntentCreateParams.AutomaticPaymentMethods.builder().setEnabled(true).build()

)

.setCustomer("{{CUSTOMER_ID}}")

.setSetupFutureUsage(PaymentIntentCreateParams.SetupFutureUsage.OFF_SESSION)

.build();

// For SDK versions 29.4.0 or lower, remove '.v1()' from the following line.

PaymentIntent paymentIntent = client.v1().paymentIntents().create(params);

```

```node

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

const stripe = require('stripe')('<>');

const paymentIntent = await stripe.paymentIntents.create({

amount: 1099,

currency: 'usd',

automatic_payment_methods: {

enabled: true,

},

customer: '{{CUSTOMER_ID}}',

setup_future_usage: 'off_session',

});

```

```go

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

sc := stripe.NewClient("<>")

params := &stripe.PaymentIntentCreateParams{

Amount: stripe.Int64(1099),

Currency: stripe.String(stripe.CurrencyUSD),

AutomaticPaymentMethods: &stripe.PaymentIntentCreateAutomaticPaymentMethodsParams{

Enabled: stripe.Bool(true),

},

Customer: stripe.String("{{CUSTOMER_ID}}"),

SetupFutureUsage: stripe.String(stripe.PaymentIntentSetupFutureUsageOffSession),

}

result, err := sc.V1PaymentIntents.Create(context.TODO(), params)

```

```dotnet

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

var options = new PaymentIntentCreateOptions

{

Amount = 1099,

Currency = "usd",

AutomaticPaymentMethods = new PaymentIntentAutomaticPaymentMethodsOptions

{

Enabled = true,

},

Customer = "{{CUSTOMER_ID}}",

SetupFutureUsage = "off_session",

};

var client = new StripeClient("<>");

var service = client.V1.PaymentIntents;

PaymentIntent paymentIntent = service.Create(options);

```

In the latest version of the API, specifying the `automatic_payment_methods` parameter is optional because Stripe enables its functionality by default.

When you’re ready to charge your customer again, use the `customer` and resulting *PaymentMethod* (PaymentMethods represent your customer's payment instruments, used with the Payment Intents or Setup Intents APIs) ID to create a new PaymentIntent. Set [off_session](https://docs.stripe.com/api/payment_intents/confirm.md#confirm_payment_intent-off_session) to `true`. This causes the PaymentIntent to send an error if authentication is required when your customer isn’t actively using your site or app.

#### curl

```bash

curl https://api.stripe.com/v1/payment_intents \

-u <>: \

-d amount=1099 \

-d currency=usd \

# In the latest version of the API, specifying the `automatic_payment_methods` parameter is optional because Stripe enables its functionality by default.

-d "automatic_payment_methods[enabled]"=true \-d customer="{{CUSTOMER_ID}}" \

-d payment_method="{{PAYMENT_METHOD_ID}}" \

-d return_url="https://example.com/order/123/complete" \

-d off_session=true \

-d confirm=true

```

#### Stripe CLI

```bash

stripe payment_intents create \

--amount=1099 \

--currency=usd \

-d "automatic_payment_methods[enabled]"=true \

# In the latest version of the API, specifying the `automatic_payment_methods` parameter is optional because Stripe enables its functionality by default.--customer={{CUSTOMER_ID}} \

--payment-method={{PAYMENT_METHOD_ID}} \

--return-url="https://example.com/order/123/complete" \

--off-session=true \

--confirm=true

```

#### Ruby

```ruby

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

Stripe.api_key = '<>'

begin

intent = Stripe::PaymentIntent.create({

amount: 1099,

currency: 'usd',

# In the latest version of the API, specifying the `automatic_payment_methods` parameter is optional because Stripe enables its functionality by default.

automatic_payment_methods: {enabled: true},customer: '{{CUSTOMER_ID}}',

payment_method: '{{PAYMENT_METHOD_ID}}',

return_url: 'https://example.com/order/123/complete',

off_session: true,

confirm: true,

})

rescue Stripe::CardError => e

# Error code will be authentication_required if authentication is needed

puts "Error is: \#{e.error.code}"

payment_intent_id = e.error.payment_intent.id

payment_intent = Stripe::PaymentIntent.retrieve(payment_intent_id)

puts payment_intent.id

end

```

#### Python

```python

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

stripe.api_key = '<>'

try:

stripe.PaymentIntent.create(

amount=1099,

currency='usd',

# In the latest version of the API, specifying the `automatic_payment_methods` parameter is optional because Stripe enables its functionality by default.

automatic_payment_methods={"enabled": True},customer='{{CUSTOMER_ID}}',

payment_method='{{PAYMENT_METHOD_ID}}',

return_url='https://example.com/order/123/complete',

off_session=True,

confirm=True,

)

except stripe.error.CardError as e:

err = e.error

# Error code will be authentication_required if authentication is needed

print("Code is: %s" % err.code)