Akzeptieren Sie Vor-Ort-Zahlungen als Einzelhandelsgeschäft

Erfahren Sie, wie Sie Kartenzahlungen für Ihr persönliches Unternehmen akzeptieren.

In diesem Leitfaden wird beschrieben, wie Sie Ihre Stripe-Integration so einrichten, dass Zahlungen akzeptiert werden, wenn Sie ein persönliches Point of Sale (POS)-System nutzen.

Für allgemeine Vor-Ort-Zahlungen empfehlen wir den Stripe Reader S700 mit einer servergestützten Integration. Die Schritte in diesem Leitfaden verwenden diese Kombination aus Lesegerät und Integration.

Bevor Sie beginnen

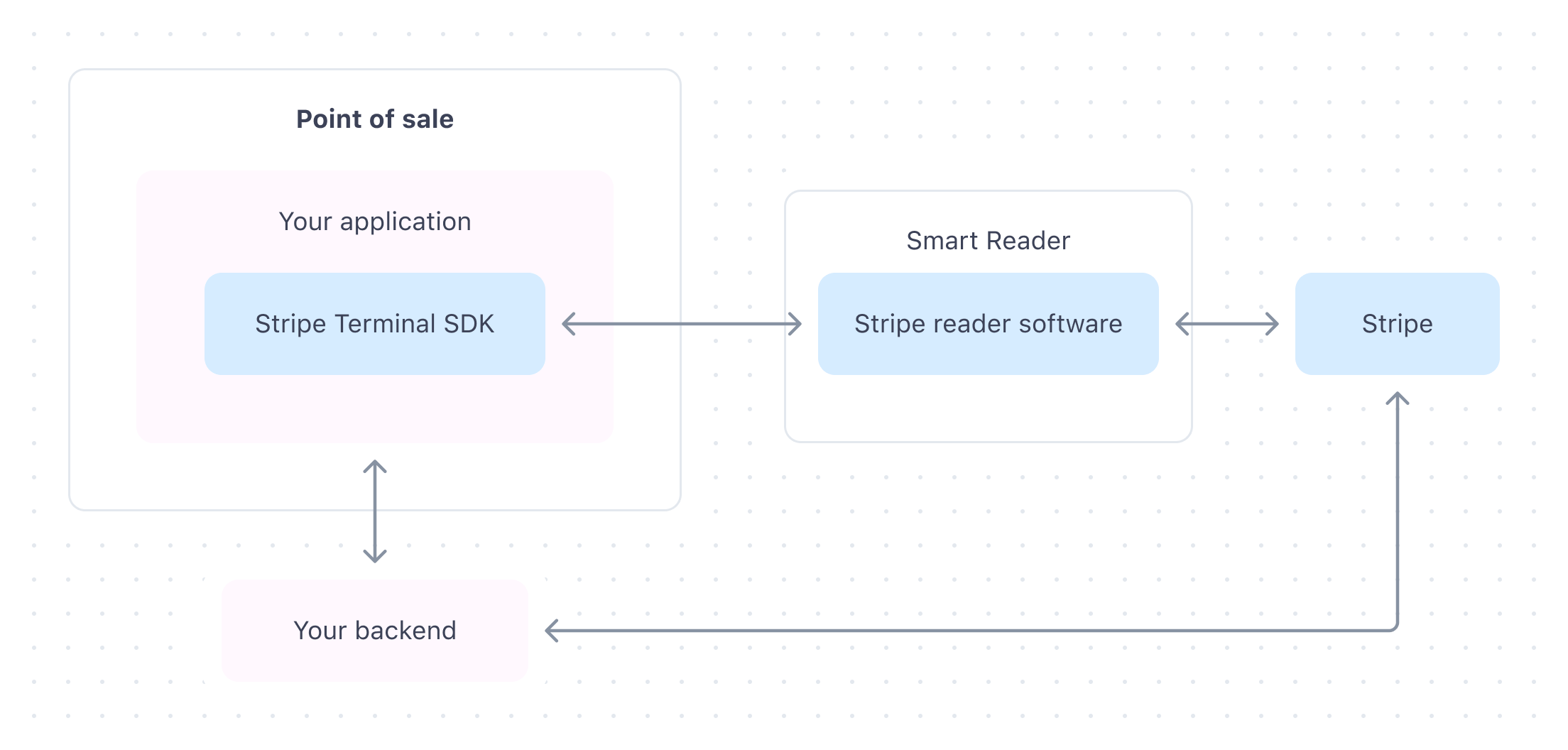

Eine Server-Integration verwendet die Stripe API, um direkt mit intelligenten Lesegeräten zu kommunizieren. Ihr Backend-Server führt API-Aufrufe durch, um Zahlungen zu erstellen und das Lesegerät zu steuern.

Für die Integration benötigen Sie Folgendes:

- Ein Stripe-Konto

- Ein Backend-Server, der Anfragen an die Stripe API stellen kann

- Ein Stripe S700/S710 Reader

- (Optional) Eine Test-Karte zum Ausprobieren

Stripe-Konto erstellen

Vor der Integration mit Stripe müssen Sie ein Stripe-Konto erstellen.

- Erstellen Sie ein Konto, indem Sie Ihre E-Mail-Adresse, Ihren vollständigen Namen und Ihr Land eingeben und ein Passwort erstellen.

- Füllen Sie Ihr Unternehmensprofil aus.

- Klicken Sie im Dashboard auf Ihre E-Mail-Adresse verifizieren. Stripe sendet zur Verifizierung eine E-Mail an Ihre E-Mail-Adresse.

- Ihre E-Mail-Adresse verifizieren.

Nachdem Sie Ihr Konto erstellt haben, rufen Sie Ihre API Schlüssel über das Stripe-Dashboard unter Entwickler > API-Schlüssel auf. Sie benötigen Ihren API-Schlüssel, um Anfragen von Ihrem Backend-Server zu authentifizieren.

Bestellung Ihres Lesegeräts

Bestellung eines Kartenlesegeräts über das Stripe Dashboard. Sie können auch eine physische Testkarte bestellen, um Ihre Integration zu testen.

- Gehen Sie im Dashboard zu Terminal > Übersicht.

- Klicken Sie dann im Abschnitt „Hardware-Bestellungen“ auf Einkaufen.

- Wählen Sie Ich möchte eine neue Integration mit Stripe-APIs erstellen aus und klicken Sie auf Weiter.

- Wählen Sie Stripe Reader S700 oder Stripe Reader S710 aus und legen Sie es in Ihren Warenkorb.

- Wählen Sie Ihren Warenkorb aus und klicken Sie dann auf Kauf abschließen, um Ihre Bestellung abzuschließen.

Ihr Lesegerät einrichten

Nachdem Sie Ihr Kartenlesegerät erhalten haben, müssen Sie es bei einem Standort registrieren. Wenn Sie ein Lesegerät mit seiner Seriennummer registrieren, können Sie es sofort nach dem Auspacken verwenden. Mit dieser Methode können Sie das Lesegerät auch erneut registrieren, ohne dass das Lesegerät physisch einen Kopplungscode generieren muss.

Nach dem Auspacken Ihres Lesegeräts müssen Sie das Lesegerät entweder über Ethernet (Dockingstation erforderlich) oder WLAN mit dem Internet verbinden. Stellen Sie sicher, dass Sie die Konnektivitätsanforderungen erfüllen.

Ihr Lesegerät registrieren

Nachdem Sie die Seriennummer gefunden haben, registrieren Sie das Lesegerät im Dashboard.

- Rufen Sie im Dashboard die Seite Hardware-Bestellungen auf und wählen Sie Ihr Lesegerät aus, um die Seriennummer des Lesegeräts zu finden.

- Klicken Sie auf der Seite Lesegeräte auf Lesegerät registrieren.

- Geben Sie die Seriennummer ein und klicken Sie auf Weiter. Um mehrere Geräte gleichzeitig zu registrieren, können Sie mehrere Seriennummern eingeben, getrennt durch Kommas.

- Wählen Sie optional einen Namen für das Lesegerät aus.

- Wenn Sie bereits einen Standort erstellt haben, wählen Sie den neuen Standort des Lesegeräts aus. Andernfalls erstellen Sie einen Standort, der ihrem physischen Betriebsstandort entspricht, indem Sie auf + Neu hinzufügen klicken.

- Klicken Sie auf Registrieren, um die Registrierung Ihres Lesegeräts abzuschließen.

Nachdem Sie Ihr Lesegerät registriert haben, kann es mit der servergestützten Integration verwendet werden. Sie können Lesegerät-IDs später über den Endpoint Lesegeräte auflisten abrufen und dann nach dem Standort oder der Seriennummer des Lesegeräts filtern. So wissen Sie, an welches Lesegerät Transaktionen von Ihrem Point of Sale gesendet werden sollen.

Zahlungsablauf erstellen

Zum Einziehen von Zahlungen mit dem Stripe Datenterminal müssen Sie einen Zahlungsablauf in Ihrer Anwendung erstellen. Verwenden Sie das Stripe-Datenterminal-SDK, um einen PaymentIntent zu erstellen und zu aktualisieren. Bei einem PaymentIntent handelt es sich um ein Objekt, das eine einzelne Zahlungssitzung darstellt.

PaymentIntent erstellen. Sie können festlegen, ob Ihre Zahlungen automatisch oder manuell erfasst werden sollen.

Abwickeln der Zahlung. Die Autorisierung der Karte der Kundin/des Kunden erfolgt, wenn das Lesegerät die Zahlung abwickelt.

Bestätigen Sie, dass die Zahlung eingezogen und autorisiert wurde, indem Sie die Webhook-Ereignisse

terminal.undreader. action_ succeeded terminal.überprüfen.reader. action_ failed (Optional) PaymentIntent erfassen.

Ihre Integration testen

Physische Testkarten

Testen Sie Zahlungen mit Ihrem Stripe-Datenterminal- Lesegerät mit einer physischen Testkarte. Sie können Lesegeräte und physische Testkarten über die Registerkarte Datenterminal im Stripe Dashboard kaufen. Wir unterstützen auch physische Testkarten von Anbietern, wie z.B. B2.

Diese physische Testkarte unterstützt sowohl Zahlungen per Karteneingabe als auch kontaktlose Zahlungen. Sie funktioniert nur mit vorzertifizierten Lesegeräten von Stripe und auch nur mit der Stripe API in einer Sandbox. Wenn Sie Ihre physische Testkarte im Live-Modus verwenden, gibt die Stripe API einen Fehler zurück. Sofern es nicht anders angegeben ist, verwenden Sie bei entsprechender Aufforderung die PIN 1234 .

Beim Erstellen von Zahlungen mit einer physischen Testkarte sollten Sie Beträge verwenden, die auf die folgenden Dezimalwerte enden, um bestimmte Antworten zu erzeugen:

| Dezimal | Ergebnis |

|---|---|

| 00 | Die Zahlung wird genehmigt. |

| 01 | Die Zahlung wird mit dem Code call_ abgelehnt. |

| 02 | Wenn Sie Lesegeräte mit einem Bildschirm verwenden, den die Karteninhaber/innen sehen, legen Sie die Testkarte ein (oder tippen Sie darauf, falls dies unterstützt wird). Wenn für die Karte eine PIN erforderlich ist, wird die Zahlung mit offline_ abgelehnt und es wird eine PIN-Eingabe angefordert, wenn das Lesegerät die Eingabe per Chip unterstützt. Geben Sie 1234 ein, um die Testzahlung abzuschließen. |

| 03 | Wenn Sie Lesegeräte mit einem Bildschirm verwenden, den die Karteninhaber/innen sehen, legen Sie die Testkarte ein (oder tippen Sie darauf, falls dies unterstützt wird). Wenn für die Karte eine PIN erforderlich ist, wird die Zahlung mit online_ abgelehnt und es wird eine PIN-Eingabe angefordert. Geben Sie eine beliebige 4-stellige PIN ein, um die Testzahlung abzuschließen. |

| 05 | Die Zahlung wird mit dem Code generic_ abgelehnt. |

| 55 | Die Zahlung wird mit dem Code incorrect_ abgelehnt. |

| 65 | Die Zahlung wird mit dem Code withdrawal_ abgelehnt. |

| 75 | Die Zahlung wird mit dem Code pin_ abgelehnt. |

Zum Beispiel ist eine Zahlung mit einer physischen Testkarte über den Betrag 25,00 USD erfolgreich; Eine Zahlung in Höhe von 10,05 USD wird abgelehnt.

Interac-Testkarten Nur Kanada

Um Ihre Interac-Integration zu testen, können Sie die simulierte interac-Testkarte oder eine physische Interac-Testkarte verwenden. Diese kann im Terminal-Hardware-Shop im Dashboard bestellt werden. Die physische Testkarte mit Stripe-Marke kann nicht als Interac-Karte verwendet werden.

Die Interac-Testkarte funktioniert bei Zahlungen mit interac_ wie auch bei Rückerstattungen mit interac_. Sie können die gleichen Testbeträge verwenden, die Sie auch beim Testen von Zahlungen mit card_ verwenden. Sofern es nicht anders angegeben ist, verwenden Sie bei entsprechender Aufforderung die PIN 1234. Um eine abgelehnte Rückerstattung zu testen, erstellen Sie eine anteilige Rückerstattung mit einem Betrag, der mit einem der folgenden Dezimalwerte endet: 01, 05, 55, 65 oder 75.

Hinweis

Die Interac-Testkarte unterstützt keine kontaktlosen Zahlungen.

eftpos-Testkarten Nur Australien

Um Ihre eftpos-Integration zu testen, können Sie die simulierte eftpos-Testkarte oder eine physische eftpos-Testkarte verwenden. Diese kann im Terminal-Hardware-Shop im Dashboard bestellt werden. Die physische Testkarte mit Stripe-Marke kann nicht als eftpos-Karte verwendet werden.

Sie können die gleichen Testbeträge verwenden, die Sie auch beim Testen von Zahlungen mit card_ verwenden. Sofern es nicht anders angegeben ist, verwenden Sie bei entsprechender Aufforderung die PIN 1234.

Live gehen

- Öffnen Sie im Dashboard Ihre Kontoeinstellungen.

- Geben Sie Ihren Unternehmenstyp, Ihre Steuerangaben, Ihre Unternehmensdaten, Ihre persönlichen Verifizierungsinformationen und Ihre Informationen für die Kundschaft (z. B. eine Zahlungsbeschreibung in der Abrechnung) ein.

- Fügen Sie Bankdaten hinzu, um zu bestätigen, wo Ihr Geld ausgezahlt werden soll.

- Richten Sie die Zwei-Schritte-Authentifizierung zum Schutz Ihres Kontos ein.

- Optional können Sie automatischem Steuereinzug oder umsatzbasierte Klimaspenden hinzufügen.

- Prüfen Sie die eingegebenen Informationen und klicken Sie auf Zustimmen und absenden.

- Nachdem Sie Ihr Profil aktiviert haben, aktualisiert Stripe Sie vom Sandbox-Modus in den Live-Modus.

Erfahren Sie mehr über die Aktivierung Ihres Stripe-Kontos.

Bevor Sie echte Zahlungen akzeptieren, müssen Sie noch Folgendes tun:

- Erstellen Sie einen Standort im Live-Modus.

- Registrieren Sie Ihr Lesegerät erneut mit dem Live-Modus-Standort.

Nächste Schritte

Nach der Einrichtung Ihrer Integration empfehlen wir Ihnen, die folgenden Funktionen zu implementieren:

- Erstellen Sie physische oder digitale Belege für Ihre Kundinnen und Kunden.

- Auf dem Lesegerät oder einem Zahlungsbeleg Trinkgelder einziehen.