Funktionsweise von Finanzkonten für Plattformen

Erfahren Sie mehr über verbundene Konten, Finanzkonten für Plattformen und Geldbewegungen.

Finanzkonten für Plattformen ist eine Suite von APIs für Stripe Connect-Plattformen, die es Ihnen ermöglicht, Finanzdienstleistungen in Ihr Produkt einzubetten.

Stripe stellt die Infrastruktur in Partnerschaft mit vertrauenswürdigen Banken zur Verfügung. Sie können Finanzkonten für Plattformen verwenden, um es Ihren verbundenen Konten zu ermöglichen, Geldmittel zu halten, Rechnungen zu bezahlen, Cashback zu verdienen und ihren Cashflow zu verwalten.

Modulare Komponenten für Finanzdienstleistungen

Finanzkonten für Plattformen bietet modulare Komponenten für den Aufbau eines skalierbaren Finanzprodukts mit umfassenden Funktionen.

Use Cases für Finanzkonten für Plattformen

Im Folgenden finden Sie Beispiele für einige gängige Use Cases von Finanzkonten für Plattformen:

| Anwendungsfall | Beschreibung |

|---|---|

| Ausgabenmanagement | Erstellen Sie ein Ausgabenmanagement-Produkt für Ihre Kundinnen/Kunden, mit dem sie Geld auf Ihrer Plattform speichern und Ausgaben mit markeneigenen Karten verwalten können. |

| Konto zum Speichern und ausgeben | Erstellen Sie FDIC-versicherungsfähige Konten, die es Unternehmen ermöglichen, Geld zu verwahren, Cashback zu erzielen, Schecks einzureichen und Auftragnehmer und Lieferanten per ACH und Banküberweisungen zu bezahlen. |

| Programmgesteuerte Geldbewegungen | Erleichtern Sie Geldbewegungen zwischen den verbundenen Konten Ihrer Plattform sowie von verbundenen Konten auf Konten von Drittanbietern. |

Finanzkonten für Plattformen – Kontoarchitektur

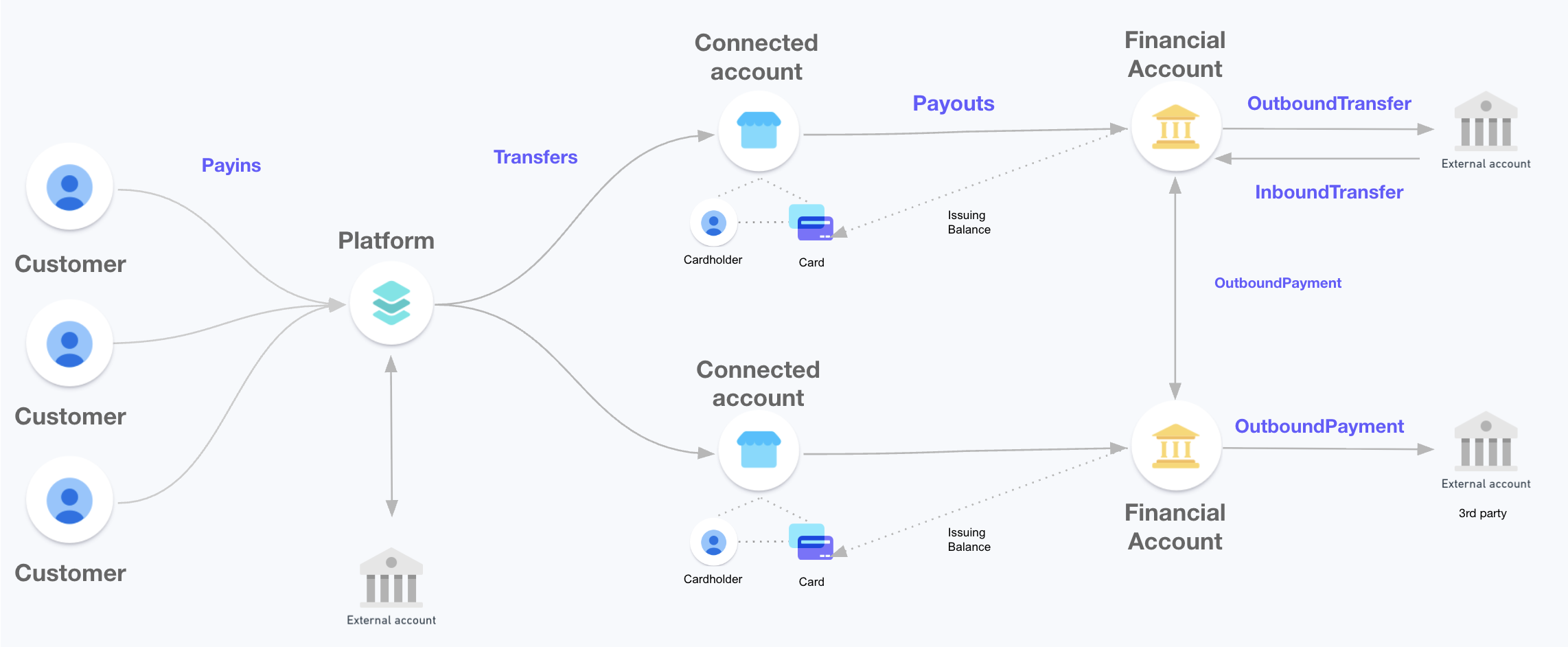

Verwenden Sie Connect, um Kundinnen und Kunden das Onboarding bei Ihrer Plattform als verbundene Konten durchlaufen zu lassen. Sie können für jedes verbundene Konto ein Finanzkonto erstellen, um auf Ihre Finanzprodukte zuzugreifen. Das folgende Diagramm zeigt einen Überblick über eine Plattformintegration mit Finanzkonten für Plattformen.

Finanzkonten für Plattformarchitektur

Finanzkonten für PlattformarchitekturVerbundene Konten

Bei verbundenen Konten handelt es sich um Verkäufer/innen oder Dienstleister/innen, die eine Plattform nutzen. Beispiel: Als Inhaber/in einer digitalen Storefront-Plattform stellen Sie ein E-Commerce-Framework bereit, mit dem Unternehmen Online-Shops einrichten und Zahlungen einziehen. Jedes Unternehmen, das Ihre Storefront-Plattform nutzt, ist ein verbundenes Konto.

Finanzkonten für Plattformen unterstützen nur verbundene Konten, die kein von Stripe gehostetes Dashboard verwenden und bei denen Ihre Plattform für die Erfassung von Anforderungen und die Verlusthaftung verantwortlich ist, einschließlich verbundener Custom-Konten. Erfahren Sie, wie Sie verbundene Konten erstellen die mit Finanzkonten für Plattformen arbeiten.

Als Plattform mit verbundenen Konten sind Sie dafür verantwortlich, eine Mindest-API-Version zu pflegen, Aktualisierungen der Nutzungsbedingungen an Ihre verbundenen Konten zu kommunizieren, Informationsanfragen von ihnen zu bearbeiten und ihnen Support zu bieten. Da Ihre Plattform letztendlich für die Verluste verantwortlich ist, die Ihre verbundenen Konten erleiden, sind Sie auch dafür verantwortlich, sie auf Betrug zu überprüfen. Um mehr zu erfahren, lesen Sie den Leitfaden Finanzkonten für Plattformen – Betrug.

Finanzkonten

Sie können die Finanzkonten für Plattform-Endpoints der Stripe API verwenden, um Finanzkonten zu erstellen, und sie mit verbundenen Konten in einer Eins-zu-Eins-Beziehung zu verknüpfen (es sei denn, Sie sind bei der Vorschau für Multi-Finanzkonten angemeldet).

Sie können Geldmittel auf die Finanzkonten der verbundenen Konten Ihrer Plattform überweisen und zwischen diesen Konten auch Gelder bewegen. Ihre verbundenen Konten können Ihre Finanzkonten außerdem über eine Bank außerhalb von Stripe aufstocken. Wenn Sie Stripe Issuing auf Ihrer Plattform verwenden, können Sie Zahlungskarten bereitstellen, die mit dem Guthaben der Finanzkonten Ihrer verbundenen Konten verknüpft sind.

Finanzkonten haben Routingnummern, da sie von US-Bankpartnern abgesichert sind, und Guthaben sind für die FDIC-Pass-Through-Versicherung berechtigt.

Beispielintegration

Folgen Sie unserer zweiteiligen Beispielintegration, um zu sehen, wie die Lösung Finanzkonten für Plattformen funktioniert:

- Richten Sie Finanzkonten für Plattformen ein und erstellen Sie Karten mit Issuing

- Verwenden Sie Finanzkonten für Plattformen mit SetupIntents und PaymentMethods, um Geld zu bewegen

Finanzkonten für Plattformen wird in den USA von der Stripe Payments Company bereitgestellt, einem lizenzierten Geldübermittler, mit Geldmitteln, die bei den Bankpartnern von Stripe, den Mitgliedern der FDIC, gehalten werden. Karten- und andere Kreditprodukte werden von der Celtic Bank bereitgestellt und von Stripe, Inc. und seiner Tochtergesellschaft Stripe Servicing, Inc. betreut.